July 2015, Vol. 242, No. 7

Web Exclusive

Effects of Clean Power Plan on Natural Gas Markets, Pipeline Infrastructure

The Environmental Protection Agency’s proposed Clean Power Plan (CPP) establishes state-by-state carbon emissions rate targets that it projects will reduce U.S. electricity sector carbon emissions 30% below 2005 levels by 2030.

Some stakeholders, including the North American Electric Reliability Corp. (NERC), have raised concerns that states might rely heavily on natural gas generation for CPP compliance, creating stress on gas pipeline capacity and ultimately affecting electric system reliability.

While it is likely that states will pursue a diverse portfolio of emission reductions, examining the infrastructure implications of gas use scenarios helps with risk management.

The AEE Institute contracted with ICF International to perform an assessment of the potential effects of the CPP on required gas pipeline capacity. AEE Institute specified three scenarios in the U.S. electricity and natural gas markets for ICF to analyze. The reference case is a business-as-usual future without the CPP.

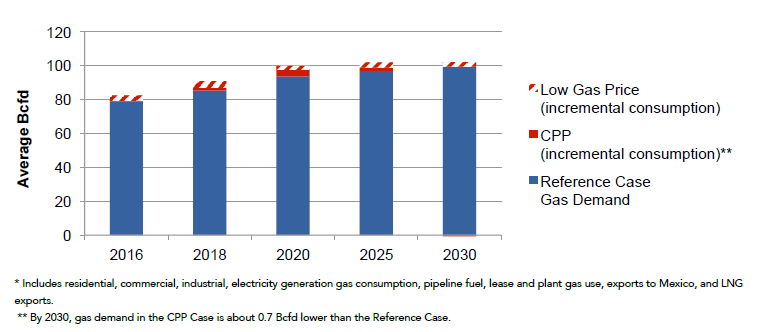

The basic CPP Case assumes each state will reach its rate-based emissions target as proposed in the CPP by 2030 with resources competing in the model to provide the necessary emission reductions. The low gas price CPP case considers the same emissions targets and approach as in the CPP case, but assumes natural gas prices are about 20% lower than expected, leading to increased gas consumption.

Under the reference case, natural gas demand continues to grow through 2030. Under the CPP case, there is a temporary increase in natural gas demand above the reference case due to the incremental shift from coal to gas. Incremental demand then declines over time as additional renewable energy and demand-side resources come online.

Since this incremental demand is small, even if coal to gas switching becomes a more prominent compliance mechanism, as under the low future gas prices scenario, this modeling shows that it would not cause a significant increase in new pipeline requirements.

There is, however, regional variation among these results: Changes in gas consumption and infrastructure are concentrated in the Northeast, but could be greater in the South and Midwest if gas prices are lower.

Consistent with some prior studies from EPA and DOE, this report finds that ongoing changes in the U.S. natural gas market independent of the CPP are driving increases in pipeline gas infrastructure, prompted by dramatic growth in new gas supplies from areas like the Marcellus and Utica shales.

This report further finds that compliance with the CPP, even under an unlikely “stress test” scenario of unexpectedly high gas usage, would only modestly increase the gas infrastructure needs, in the range of 3% to 7%.

Three key factors explain this outcome:

• A large number of pipeline projects are already in the planning stages to expand capacity over the next three to five years. These planned projects are sufficient to meet both the anticipated growth in gas demand in the Reference Case (that is, demand growth not related to the CPP) as well as much of the incremental demand in the CPP cases.

• The assumed increase in energy efficiency in the CPP cases reduces electric load growth relative to the Reference Case. Because electric load growth is lower, power sector gas demand in the Northeast and West regions is actually lower in the CPP Case in 2030 than in the Reference Case, and only slightly higher than the Reference Case in the CPP Low Gas Price Case.

• While Midwest and South power sector gas consumption is projected to increase in both CPP cases, these areas are relatively close to incremental gas supplies (principally the Marcellus and Utica shales). The proximity of the incremental gas demand to the source of the incremental supplies and the reversals of existing pipelines (moving gas from Marcellus/Utica to the Midwest and South on existing pipelines) reduces the amount of new pipeline and capital expenditures required.

The pace of investment in new pipeline capacity over the past decade suggests that these projected future investments, with or without the CPP, are well within the capabilities of the industry.

This conclusion is reinforced by the fact that there are numerous competitive options for emission reduction available in the marketplace that collectively reduce the risk of heavy dependence on natural gas for compliance.

Furthermore, this analysis does not capture the evolution of certain technologies, such as gas demand response, and electricity grid operational techniques, including ISO New England’s Pay for Performance rules), which are changing and will continue to change the relationship between gas demand and infrastructure needs.

For the complete report, visit http://info.aee.net/competitiveness-of-renewable-energy-and-energy-efficiency-in-us.

Comments