January 2015, Vol. 242, No. 1

Features

Constitution Gains Key Permit; Northeast Braces For Cold

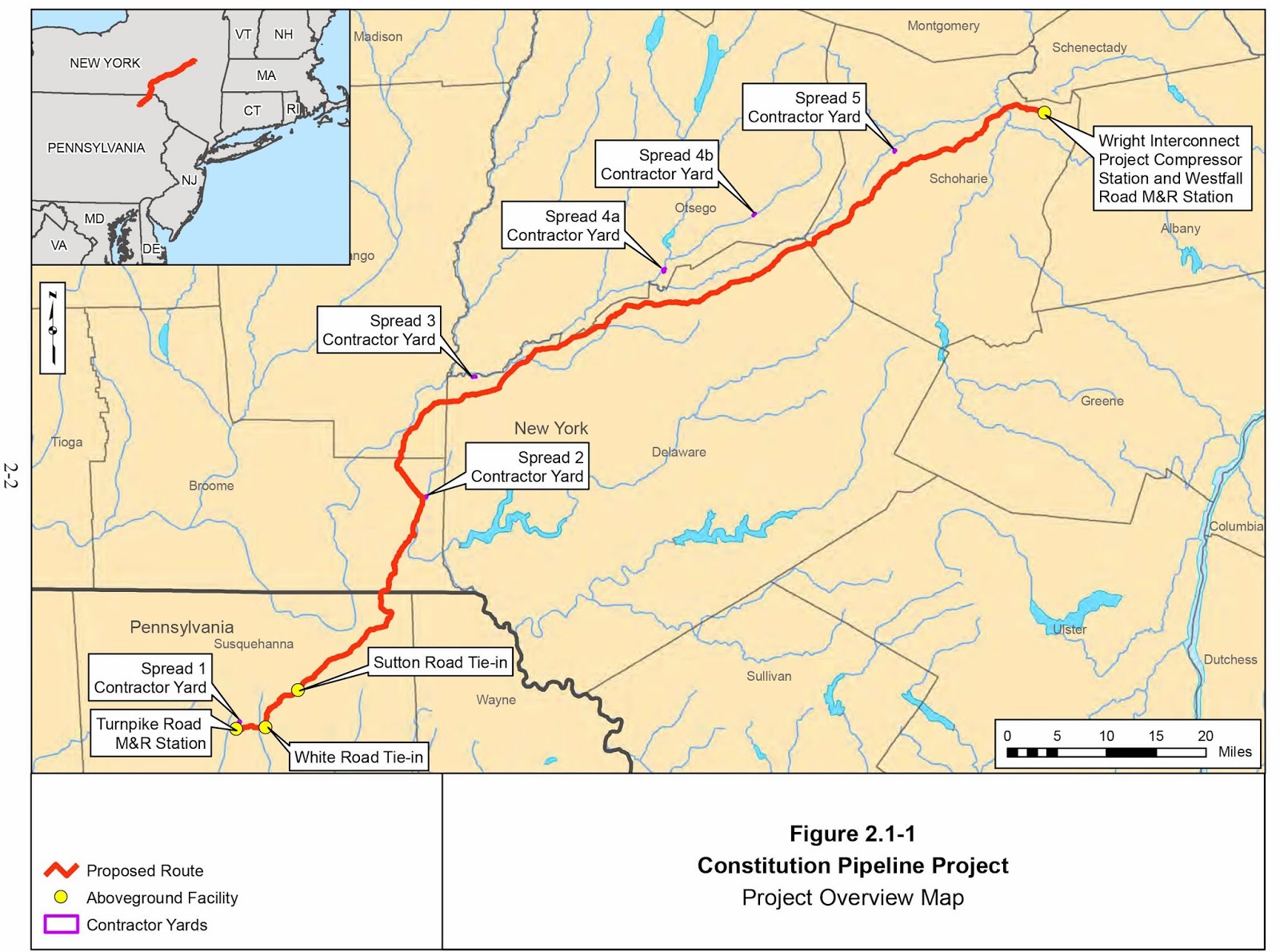

A federal approval for construction of a major natural gas pipeline that will ship supplies from the Marcellus to underserved New England and the Northeast markets closed out 2014 with a reminder to the industry of good things to come.

The Federal Energy Regulatory Commission (FERC) on Dec. 2 gave the go-ahead to the 124-mile Constitution Pipeline, which is expected to be online by the winter of 2015 or 2016. The pipeline will interconnect with the Iroquois Pipeline to serve New York and with the Tennessee Gas Pipeline to supply New England markets.

Construction on the 30-inch pipeline, which will have the capacity to service 3 million homes, is expected to begin in early 2015 if all goes according to plan. The pipeline is owned by subsidiaries of Williams Partners, Cabot Oil & Gas, Piedmont Natural Gas Company and WGL Holdings.

FERC published its final environment impact statement on Oct. 24, concluding the Constitution Pipeline posed “less than significant levels” of influence on the environment with proposed mitigation measures in place to protect wildlife and sensitive areas.

However, the project is experiencing some resistance, particularly in Pennsylvania, where unlike in New York, there is no tax on pipelines. Pro-pipeline groups within the state counter there are significant taxes paid by those developing wells, however. The state also elected a new governor who has promised to review the amount of taxes energy companies are paying to the state.

The Constitution Pipeline still requires final permits from Pennsylvania’s Department of Environmental Protection, the U.S. Army Corps of Engineers and the New York Department of Environmental Conservation.

Bidirectional Modifications

In the Northeast, midstream companies that find themselves scrambling to reduce the number of underused lines are opting to transport natural gas in both directions, according to a report from the federal Energy Information Administration (EIA).

The report found that pipeline companies have planned modifications in the works that will allow 8.3 Bcf/d of gas to leave the Northeast via bidirectional flows. That would mean 32% of natural gas shipped to the region would be “two-way capable” by 2017, EIA said.

This underscores the rapid expansion of pipeline capacity in the Northeast, which in 2013 reached about 25 Bcf/d coming from Canada, the Southeast and the Midwest, EIA data showed. Proposals on various projects to add 35 Bcf/d of additional capacity in the region are underway.

Flows on ANR Pipeline, Texas Eastern Transmission, Transcontinental Pipeline, Iroquois Gas Pipeline, Rockies Express Pipeline, and Tennessee Gas Pipeline accounted for 60% of flows to the Northeast in 2013, EIA data showed. Flows on these pipelines in 2013 were between 21% and 84% below 2008 levels.

The largest percentage of decline from that group took place on the Tennessee Gas Pipeline, which along with and the Texas Eastern Transmission, began flowing gas both ways between states along the Northeast and Southeast region borders in 2014.

Potential For ‘Strain’

Commodities research firm Morningstar, meanwhile, reported New York gas infrastructure this winter will be a bit more robust than last year but still warned a cold blast could strain the system.

The Marcellus and Utica shales are expected to produce 4 Bcf/d more natural gas supply this winter, which should ensure availability in the Northeast. Nonetheless, pipelines shipping gas into the New York City area are still constrained despite incremental expansions such as Spectra’s Team 2014 and Transco’s Northeast Connector, which are moving gas east from the Marcellus.

On high-demand days, New York City utilities and gas generators are still marginal buyers of gas. Peak-shaving liquefied natural gas (LNG) plants lessen constraints on peak days, but that supply will be limited to 10-15 cold days, Morningstar said.

“New York City demand is set to tick up this winter by at least 100 MMcf/d, since more than 1,000 buildings have converted to cleaner-burning fuels in the first six months of 2014 alone under the NYC Clean Heat program,” said Jordan Grimes, Morningstar senior commodities analyst.

The NYC Clean Heat program provides resources to assist with building conversions from heavy forms of heating oil, as required by city regulations beginning in July 2012. The first major conversion deadline is January 2015.

Key Morningstar projections:

• The Northeast Connector will be the only year-over-year improvement moving gas beyond the constraint, according to the research firm, while Transco-Rockaway will distribute Transco-Z6 NY more efficiently but won’t relieve major constraints.

• Peak-shaving LNG capacity in the New York City area stands at less than one-third of New England’s capacity, which may leave the metropolitan area short on supply during sustained cold weather.

• Increased output from the Marcellus and the 300 MMcf/d expansion along Texas Eastern Market Zone 3 will add downside pressure to TETCO-M3 and Transco-Z6 Non-NY hubs.

With the gas scheduling day modified for better alignment with gas generators, Morning Star predicted there to be less “fear-buying” from generators and that there will be more power plants this winter with dual-fuel capability.

Last winter, New York’s gas demand (November-March) was 14% higher than the five-year average because of the extreme cold. Generator demand, on the other hand, was down 5% for the same period vs. winter 2012-13. This reflected dual-fuel generators’ ability to burn oil or kerosene when gas prices spiked, Morning Star added.

Bracing For Winter

Independent System Operator (ISO) New England has moved to address the inadequate pipeline capacity for natural gas and potential fuel-availability issues during the winter months through its Winter Reliability Program (WRP).

For a second straight year, the program will secure bids for energy over the winter with incentives for oil-fired generators to incrementally increase fuel oil inventories and payments to dual-fuel units for testing switching capacity.

Last winter, sustained cold weather increased natural gas demand, leading to severe pipeline constraints that led to record-high natural gas prices. Periods of sustained cold weather boosted demand for natural gas, causing record-high prices that resulted in natural gas at times being more expensive than heating oil.

Due to the difference in price, on some days natural gas pipelines in the region operated at capacity, but few gas-fired generators were producing power; the natural gas was being used to heat homes and businesses, ISO New England said.

Adding to concerns, system operators last year relied on several generators that will not be available for all or part of this winter, due primarily to facility closures. With the retirement of coal, oil and nuclear power plants, dependence on natural gas for electricity production throughout New England and the Northeast is growing. Relying less often on types of generators with on-site fuel storage means gas supply directly affects power grid reliability.

Gas-fired generators generally do not have firm delivery contracts, instead depending on the release of spare capacity from gas utilities. With increased conversions to natural gas by businesses and homeowners that spare capacity is more difficult to come by.

ISO New England expects enough resources will be in place to handle consumer demand for electricity with peak demand of about 21,085 MW at normal winter temperatures of 70 F and about 21,705 MW if extreme winter weather of 20 F takes place.

TGP Submits Alternative Routes

Tennessee Gas Pipeline Company (TGP) adopted two alternative routes for its proposed Northeast Energy Direct project to minimize environmental impact as the company expands natural gas service in New Hampshire.

TGP, a subsidiary of Kinder Morgan, submitted an amended resource report to FERC,, which will use existing utility corridors. The company notified landowners, local officials and regulatory officials of the move as well.

“TGP will be able to construct significantly more of the pipeline adjacent to and parallel with existing utility corridors in portions of New York, Massachusetts and New Hampshire,” Kimberly Watson, East Region pipelines president, said of the amended route from Wright, NY to Dracut, MA.

With the adoption of the New York Powerline Alternative and the New Hampshire Powerline Alternative, the proposed route will include 188 miles of new and co-located mainline pipeline facilities, 64 miles of pipeline generally co-located with an existing power utility corridor in eastern Massachusetts and 71 miles of pipeline generally co-located with an existing power utility corridor in southern New Hampshire. The new configuration, exclusive of laterals, would be adjacent to or co-located with existing rights-of-way for about 90% of the mileage.

Comments