December 2015 Vol. 242, No. 12

Features

Pipeline Rush in Upper Midwest: Gas to Replace Coal

Nine- and even 12-figure numbers don’t phase Paul Copello, a petroleum engineer and president of IIR Energy, a capital projects tracking company that globally compiles and analyzes information for over 95,000 energy projects worldwide, collectively representing potential capital investment of $13.7 trillion.

Among those projects, the natural gas pipeline sector is one of the surest bets for consistent increased capital spending, Copello told an energy meeting in Chicago last September.

Part of the IIR tracking and analyses takes into consideration that natural gas is what Copello calls a “very complex chemical molecule” compared to coal, and this spurs greater diversity in the use of natural gas. It can be a blend, a feedstock, transportation fuel or electric power burner, Copello told an industry audience as part of a panel at a recent LDC Mid-Continent Gas Forum.

“When you start looking at the ramifications of the supply of natural gas, you have a much more complex environment that can consume gas,” Copello said. “So it is prudent for anyone in the gas industry to take a broad look at all of the sectors where gas is used.”

For Copello, the IIR data shows the electric-generation sector is booming, including natural gas baseload plants, environmental retrofits and various renewable projects.

“Even though demand for power is down and it’s not growing like it used to, we’re still seeing spending in the power sector way outpacing demand.”

What Copello was alluding to was the heavy interest – particularly in the Upper Midwest – in switching or replacing coal-generation plants with gas-fired facilities, and that is keeping the demand for more gas pipeline infrastructure in play. “Pipeline construction remains healthy as there is always a need for more pipe as the shale plays continue to produce more and more supplies.”

A Bentek Energy analyst who follows the Midwest, Thaddeus Walker, sees the region as still a very coal-dominated region but one that experienced a lot of natural gas growth in the power markets in 2015. The regional grid operator’s data through mid-2015 indicated coal generation was averaging 52% of the stack, with gas comprising another 19%.

Bentek estimates natural gas demand for power in the Mid-Continent market averaged nearly 1.5 Bcf/d at that point in the year, nearly double 2014’s level of 883 MMcf/d for the comparable period, Walker noted. New gas-fired power plants are expected to add over 6,600 MW, while over 3,600 MW of coal-fired generation is expected to retire by the end of 2017.

“There have been notable coal retirements in the Midwest in the past year, totaling 2,234 MW of capacity,” he said, adding that some of this has been met with an additional 879 MW of gas-fired power capacity coming online over that timeframe. “We’re tracking nearly 10 GW of coal capacity expected to be retired in the coming years, but this is still a small percentage of the existing coal capacity of 95 GW in the region.”

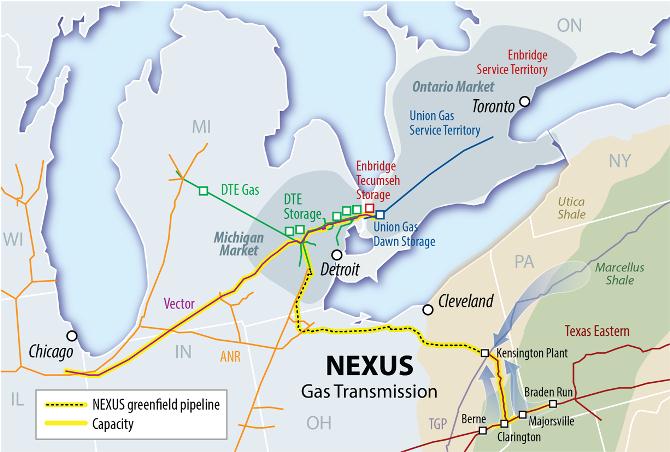

Copello and his fellow panelists painted a picture that cited numerous drivers for more gas demand and markedly greater building in the midstream gas infrastructure space. One of the examples cited is the plans of Spectra Energy Corp.’s DTE Energy Storage & Pipelines and a unit of Enbridge Partners to build the 250-mile NEXUS pipeline, bringing shale gas from the Utica and Marcellus plays to Upper Midwest markets, particularly future gas-fired power plants to replace coal.

David Slater, president of DTE Energy, looks at the Utica shale play in Ohio as the major U.S. shale gas area in the long term, and a basin that has barely scratched the surface of production gains. DTE wants to provide a 1.5 Bcf/d conduit between northeast Ohio and an existing interstate interconnect in Michigan. It is estimated to cost $2 billion and will provide multiple receipt and delivery points and provide potential heavy power sector service.

In Chicago, Slater acknowledged he was talking to a number of existing and prospective customers interested in tapping into the growing supplies from the Utica, which he calls a “very prolific and robust basin by any measure.”

On the demand side, he described the Upper Midwest region’s biggest change as being the large numbers of coal-fired power plant conversions or replacement by natural gas. In mid-2015, 75% of the power generation still comes from coal in the region but that will change substantially in the next five to 10 years. The combination DTE utility’s generation fleet is 60% coal-fired.

“Our neighbors throughout the region are going through the same changes,” Slater said.

This is prompting NEXUS to plan for a 36-inch pipeline with four 130,000-hp compressor stations along the route. DTE and its partners are looking for a November 2017 start date for the new pipeline, which should have several interconnections across northern Ohio’s numerous load centers.

Further along, the interconnection by NEXUS in Michigan will take its supplies to the Dawn storage hub in Ontario, Canada, or westerly into the greater Chicago metropolitan area market. The pipeline infrastructure envisions tapping into the large industrial and power-generation markets in the broader region, Slater said. “This is a project designed to reach much broader gas assets throughout the region.”

Slater and the other panelists are fixated on what they see as one of the nation’s fastest growing supply areas – if not the fastest – with growing markets in the Upper Midwest. “We’re blessed in the Midwest to be close to one of the nation’s most active drilling areas” for a growing gas-fired power market and resurgent industrial sector. With both producer and end-user support, NEXUS planned to file with the Federal Energy Regulatory Commission (FERC) before the end of 2015.

Already before FERC, the 711-mile Energy Transfer Partners (ETP) Rover Pipeline Project bids to move 3.25 Bcf/d of Utica/Marcellus gas to similar markets as NEXUS with a Michigan interconnection, along with serving markets throughout the eastern parts of the United States and Canada. In mid-2015 both NEXUS and Rover were running into local opposition along their proposed pipeline routes.

Also vying for a major stake of the east-to-west gas movement into the Upper Midwest is TransCanada’s ANR Pipeline System, which has straws all around the Utica and Marcellus supply basins.

“We have assets in place all across North America,” said Todd Johnson, a Houston-based marketing director for TransCanada who is responsible for marketing many of the company’s pipeline assets and storage capacity on this side of the U.S.-Canadian border.

Like the DTE-Enbridge NEXUS project, ANR emphasizes its ties to the TransCanada flexible service system that is particularly attractive, Johnson said, to prospective power plant customers. Delivering up to 14 Bcf/d, TransCanada’s North American system includes 35,000 miles of big-inch transmission pipelines, 7,000 additional miles of connecting pipelines, and 250 Bcf of regulated gas storage, so it is assumed there is flexibility for major prospective major power plants.

The flexibility mantra was driven home this past fall when a unit of GE unveiled a multi-year deal with Edison International’s Southern California Edison Co. (SCE) utility to upgrade a 10-year-old, gas-fired 1,054-MW power plant in Redlands, CA over the next two years. What GE’s Power Generation Services unit specializes in and what SCE said it wanted is to take existing combined-cycle generation and make it quicker, more efficient and less of a consumer of water or an emitter of greenhouse gases. The goal is to have gas-fired power better balance the future grid that is expecting a continuing influx of intermittent renewable sources of power.

“With natural gas playing a growing role in power generation around the world, we are committed to helping operators squeeze every megawatt they can out of their existing facilities while also reducing their site emissions and water consumption,” said Paul McElhinney, CEO at GE’s Power Generation Services business.

In Chicago, TransCanada’s Johnson focused his attention on ANR and the opportunities it sees from the flowering of the Marcellus and Utica shale plays, and the east-to-west reversals of supply flows. “One critical question for us is where will all this gas want to go, so we’re looking at the Midwest and the Gulf Coast markets,” he said.

Heading west out of the Marcellus, ANR has its own Lebanon Lateral, a 350,000-Dth/d project that came online in 2014, running from ANR’s mainline in Indiana to Lebanon, OH where it has connections with three major interstate pipes (Texas Eastern Transmission, Dominion and Columbia Gas Transmission). But more recently, in 2015, the east-to-west reversal started on the Rockies Express (REX) pipeline with 1.2 Bcf/d capacity out of the Marcellus through Tallgrass Energy Partners, which was also represented on the LDC panel.

So the Midwest and/or Gulf Coast markets are looking at up to 1.7 Bcf/d capacity coming out of the Marcellus/Utica, and ANR is planning for that much-added capacity from interconnections on its system, Johnson said. With these changes, ANR has the growing capability to send up to 600 MMcf/d of Marcellus gas to the Gulf Coast.

More recently, Johnson said ANR has begun to concentrate on what he called “market projects” in the Upper Midwest. One is a capacity expansion in Wisconsin adding compression and metering of nearly 100,000 dth/d principally aimed at signing 15-year supply contracts with big-megawatt, gas-fired electric generation plants, Johnson said. Once the contracts are settled, ANR expects to start construction in mid-2016 with startup in November 2018, he said.

The other power market-oriented project is a revision of an earlier project that has now morphed into what is called the Midwest Market Access Pipeline Project (MAPP) to take the added capacity coming from the Marcellus/Utica onto ANR’s system for delivery to either Michigan- or Chicago-area markets.

“As we look across the Midwest markets and focus on what is happening in the power market, certainly coal-to-gas switching is important, but the big change is in the PJM capacity market rules [as an outgrowth of the winter 2014 supply outages] and the drive those power producers will need in terms of adding new capacity to participate in those markets,” said Johnson, with caveats. “As that [capacity] market develops, access to storage and specific power plant services such as load-shaping are going to be critical, and those are services ANR has readily available.”

The Midwest market also includes some growth among local distribution utilities and growing desires among them to diversify their supply basins so they are not too dependent on Canada and U.S. Rockies supplies, Johnson said. Third-party analysts see the possibility of an oversupply of gas in the Midwest for an interim period, resulting in Rockies and Western Canadian supplies being pushed out of the region.

To accommodate this impending load growth, MAPP intends to add a 122-mile, 30- or 24-inch link between Defiance, OH to Bridgman, MI through an existing ANR corridor. It can make use of existing compression along the way, according to Johnson, who said that if needed by the market, the link could be expanded with additional compression that would bring it to over 90 MMcf/d. There could also be expansions from Bridgman, such as one into the Joliet Hub south of Chicago.

Based on earlier work for the project – ANR East – that preceded MAPP, a certain amount of basic environmental work was completed, so with a relatively modest amount of additional assessments, ANR hopes for a pre-filing with FERC next spring.

“The project is definitely driven by the growing market for coal-to-gas switching among power plants,” Johnson said. “It also will allow PJM power producers to get off of interruptible contracts and add more firm transmission to their portfolios.”

With a number of electric generation plants already attached to ANR’s system in the Midwest, Johnson talked bullishly about the type of services he hopes to provide the added gas-fired facilities that are surely coming.

The key infrastructure operator/developer in line to satisfy future gas demand growth in the Upper Midwest, Tallgrass Energy Partners, the majority owner operator of REX and its east-to-west flow reversal, has its nose under the tent for future contracts with power-generation plants. It sits in an enviable spot for moving increasing dry gas supplies out of the Utica and Marcellus, according to Chicago-based Doug Walker, vice president for business development.

“We didn’t have to go out and get those supplies [with added laterals], they are coming to us,” Walker told the LDC Forum. “So we’re really happy where we stand in the region.”

Noting that the east-to-west reverse flow is now in place for what is called REX Zone 3 across Ohio, allowing 1.8 Bcf/d of supplies from the Appalachian region, in the future Tallgrass plans to expand the Zone 3 pipeline by another 800 MMcf/d through added compression, and almost all of that addition (700 MMcf/d) has been sold as long-term firm capacity, Walker said. “The rest will be sold soon,” he assured his Chicago audience.

In total, when all the additions and laterals are added up, Tallgrass is promising to provide 2.6 Bcf/d of new gas supply capacity headed to the Midwest or the Gulf Coast. That offsets somewhat the Rockies flow of gas, Walker said, while noting that is not the primary offset of the east-to-west shift. “We see a lot of supplies continuing to flow very consistently from the Rockies.”

Walker noted there has been ongoing work to beef up delivery points, but there also has to be corresponding upticks by producers to drive up supplies, even in a low commodity price environment.

On REX Zone 3, Tallgrass is upgrading two existing compressor stations and adding three new stations for which a FERC filing was made earlier in 2015. The upgraded and new compressor units are expected to be in service by late 2016, Walker noted.

Walker said he is bullish about the prospects for more shale production, citing Energy Information Administration (EIA) data such as the fact that 95% of the new gas production in the U.S. comes from shale plays. In mid-year 2015, Utica already hit 3 Bcf/d of production, according to EIA, and Marcellus/Utica combined were projected to hit 18-19 Bcf/d in coming years.

“We’re all very excited about Appalachian supply, and REX, of course, makes us very excited at the Rockies long term; they’re going to be there,” Walker predicted, while noting that the prospects for demand growth (up to 4% in 2016) are what really drives his company’s infrastructure buildout.

Supplies and infrastructure to move them seem more than assured for the Midwest region. All of the remaining questions are mostly focused on demand. There are no quick, or easy answers, but some observers say long-term contracts by generators with the new pipelines, along with more specifics on coal plant retirements, will give some glimpse into the future, and that data should become more available in 2016. In any event, the transition in the Midwest is already underway.

Richard Nemec is P&GJ’s West Coast Correspondent based in Los Angeles. He can be reached at rnemec@ca.rr.com.

[inline:Rover.jpg]

The Rover route through Ohio.

[inline:ANR_Lebanon_Lateral.png]

Comments