April 2015, Vol. 242, No. 4

Features

Good Labor Hard to Find Especially if Price Slump Continues

Despite a recent bump in oil prices, the industry remains largely in retreat as large companies such as Marathon Oil, Apache and ConocoPhillips continue to announce plans to slash capital budgets.

With the oil and gas industry already feeling the drain of skilled workers and executives leaving due to retirements, there is some fear a prolonged decline will hasten further departures of valued personnel. Layoffs throughout the oil patch have already surpassed the 100,000 mark worldwide, according to Bloomberg.

“One concern I have is that as you look at this market – whether the downturn lasts six months, a year or three years – the longer it lasts, the more the labor force goes into other markets to find work,” said Scott Duncan, a vice president with FMI Capital Advisors in Houston. “If that happens, when the market bounces back, the challenge of hiring project managers and other key professional roles becomes even more acute.”

Especially hard hit has been the service segment on the industry with its big three announcing significant workforce cuts not long after the downturn began. Houston-based Schlumberger laid off 9,000 workers in mid-January, representing 7% of its worldwide workforce; Baker Hughes followed suit days later cutting 7,000 employees (11% of its workforce). Halliburton, on Feb. 10, announced it would layoff 6,400 workers (8% of its workforce).

“We value every employee we have, but unfortunately we are faced with the difficult reality that reductions are necessary to work through this challenging market environment,” a Halliburton spokesman said at the time.

One silver lining concerning the jobs picture is that pipeline and related construction work should remain steady for at least the next couple of years because of the number of projects either underway or scheduled to break ground soon.

Duncan sees what happened in the U.S. construction market a few years ago as a good point of comparison with the oil and gas industry. In 2006, construction peaked with $1.2 trillion in projects and a labor force of 8 million. However, when the market faltered in 2009, about 30% of that labor force left. Now, according to a poll by the Association of General Contractors of America, even though contractors have added 308,000 jobs during 2014, they are worried by the lack of qualified workers available for further projects. This comes a full five years after the big building slump.

The Fluor Exception

Unlike many oil and gas companies, Irving, TX-based Fluor doesn’t expect to reduce its workforce significantly in the coming year, citing emerging engineering and construction projects in North American midstream and refining sectors that allow it to shift workers to other segments of its business.

Fluor recently won a five-year integrated services supplier contract from Pacific Gas and Electric Co. for an undisclosed value to provide engineering, site and facility maintenance at the Diablo Canyon facility in Avila Beach, CA. Additionally, in December, Fluor announced it began construction of a delayed coker unit for ExxonMobil at its Antwerp, Belgium refinery, as well as signing a memorandum of understanding with the China National Nuclear Corporation (CNNC) to develop nuclear and renewable energy projects in Europe and China.

“You end up with a market that changes how services are delivered and companies like Fluor have a real advantage,” Duncan said. “They can go into an office and say, ‘We can do the engineering, we can do the procurement, we can do the construction, and we have access to the labor. We have been doing these types of major projects for decades and can really take a lot of the burden off the owner market.’”

FMI expects this type of structuring will become more prominent, especially on larger projects. In this way, key employees will all but be guaranteed continued employment.

Labor Drain

FMI’s 2015 labor survey indicates that skilled workers such as welders, project managers and superintendents will be more difficult to find as the downturn continues.

Duncan said when the market bounces back, exploration and production companies, particularly in the upstream market, will be trying to drill wells at $70-80/bbl – a level at which most shale wells are economical. Those companies will be under great pressure from the market perspective, and “pressing on their supply chain” for better terms.

“Meanwhile, you are going to have labor that left the market, and to pull them back you are going to have to pay more money,” he said. “This makes the margins of all these companies that are serving the oil and gas sector, particularly on the upstream side, increasingly challenging because they are going to be pushed from sides.”

Bob Leeper, whose recruiting firm Leeper Resources works with companies to find candidates for engineering, operations and oilfield services positions, said the uncertainty in the industry has certainly affected his business.

“It’s slowed down a bunch as you can imagine. We’ve seen many of our job orders put on hold,” Leeper said. “Companies are more cautious certainly now than they were six months or a year ago.”

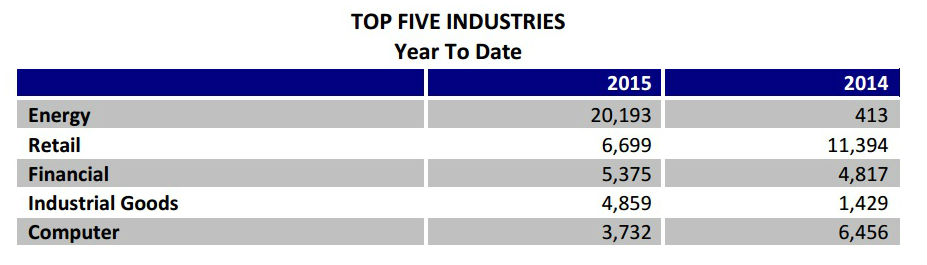

Outplacement firm Challenger, Gray & Christmas (CG&C) reported in February that jobs lost in the energy industry during January had increased to 20,193, compared to 413 for the same month in 2014. Job losses in December 2014 had only reached 2,783.

“We may see oil-related job cuts extend well beyond those industries directly involved with exploration and extraction,” said CEO John Challenger of CG&C. “The economies throughout the northern United States that have been thriving as a result of the oil boom could experience a steep decline in employment across all sectors, including retail, construction, food service and entertainment.”

Of the 53,041 job cuts announced in January, CG&C said 21,322 were directly attributed to the sharp decline in oil prices.

While it is generally accepted that more layoffs will occur in correlation to how long oil prices remain low, there have been relatively few bankruptcies filed since the decline. Duncan said that is in part because many service providers have benefited from “extraordinary” pre-tax exempt margins of 30%. This would make withstanding a downturn easier for companies with conservative balance sheets.

Still, he said, many companies that went into business the last five or six years and experienced growth due to the shale boom are now experiencing their first downturn. “I’d expect a number of those to be weeded out from the pack.”

While ongoing mergers and acquisitions, particularly among explorers and producers (E&Ps), have had some effect on the jobs market, Duncan said the first place that companies look to control costs is people and contracts. However, the larger companies that have done well have had time to think about a strategic response to the downturn.

In the case of E&P companies, they will return to the market when oil prices make it economical to drill wells. It has to do with where they can hedge their oil prices, Duncan said. When hedges can be bought at $70/b for the next year, more companies will return.

“Midstream is affected greatly by drilling activity, but there still is a lot of flaring of gas and a dramatic need for infrastructure,” he said.

Duncan said experienced project managers and superintendents will have “a fairly easy time of keeping or finding positions” throughout the price slump, not in small part, because much of the labor market is driven by loyalty to superintendents.

“We’ve been telling our clients that they need to make a particular effort to retain pipeline superintendents and the key employees needed to meet quality and safety requirements of your work going forward,” he said. “The guys that are really valuable are the ones with 15 years-plus experience that can look at any situation in the field and provide the appropriate response.”

Leeper said he expects engineers to remain in high demand, primarily because those are the most difficult positions to fill with experienced people. He agreed that project managers and supervisors should fare well, but added, “There just won’t be as many projects to work on after companies wind down the projects they are doing now.”

He said “softer internal jobs,” such as those in human resources, accounting and lease records will likely go unfilled until companies feel they are on surer footing going forward.

With the federal Department of Energy projecting oil production to be at its highest level in over 40 years for at least the first six month of 2015, job opportunities will continue for midstream and downstream operations. However, the number of oil drilling rigs in operation nationally fell to 1,223 in late January, representing a three-year low, according to oilfield services company Baker Hughes.

Also on a troubling note, Duncan said, the construction industry as a whole “has a long way to go in attracting young people to trade-specific careers.”

Leeper, too, said he has experienced some skittishness on the part of younger employees already in the industry when it comes time to decide whether to stick around.

“Some candidates we’ve talked with are somewhat hesitant to stay in the [oil and gas] industry, particularly those earlier in their careers,” Leeper said. “The more seasoned folks have seen this cycle before and they know how good the industry can be, so they want to stay, even if the offers are not as promising as last year.”

Still, Duncan added, while the length of the downturn will have an effect on the chances available to young people looking to entering the labor market, the market is going to remain robust over the long haul.

“The idea that shale oil is going to go away is crazy,” he said. “At some point everything is going to settle down and people graduating college now will have reasonable opportunities.”

Comments