October 2014, Vol. 241, No. 10

Features

Study Estimates Economic Benefits To State From Texas Oil And Gas Pipeline Industry

The economic benefits of the Texas oil and gas pipeline industry are resulting in substantial highly compensated employment, investment and economic growth for the state of Texas, according to a joint development study conducted by Texas Tech University and commissioned by the Texas Pipeline Association (TPA).

The focus of the 140-page Current and Future Economic Impacts of the Texas Oil and Gas Pipeline Industry study is on the value creation and the economic sustainability that lies in the economic contribution of Texas pipelines. The study specifically estimates economic impact for the year ending 2013 and provides projections for the year 2024.

The study found that through ongoing operations and construction in 2013 alone, Texas’ oil and gas pipeline industry provided $33 billion in economic impact, supported more than 165,000 high-paying jobs, contributed an additional $18.7 billion in gross state product and injected $1.6 billion in state and local government revenues.

Between the current year and 2024, the study projections indicate that the total economic impact from Texas pipeline operations and construction will generate between $30-41.4 billion in economic output ; $150,000-206,000 jobs; $17-23.4 billion in additional gross state products; and $1.5-2 billion in state and government revenues (all figures are in today’s dollars).

“Texas’ pipeline industry is a key component of our energy infrastructure and our nation’s ever-growing energy needs,” said Thure Cannon, president of TPA. “And due to a dramatic increase in the state’s oil and gas production, the demand for additional pipelines is expected to continually increase in the coming years. The communities that are home to pipeline projects are perfectly poised to see economic benefit from the industry in terms of more jobs and increased tax revenue.”

In an interview with P&GJ, Cannon said he could not provide a specific figure on what the pipeline mileage needs would be in the future. However, he noted that statistics from the Railroad Commission of Texas indicate the state has constructed over 59,000 miles of pipe the past three years.

“Since production statistics are not going down and refineries and plants continue to expand, a conservative estimate is that we will need, at the very least, the same amount of new pipe over the next three years to meet the growing demand,” he said.

When queried about pipeline cost per mile, he said, “A general figure regarding the average cost to build a pipeline is typically about $750,000 to $1 million per mile.”

Drilling, Development And Production Activity

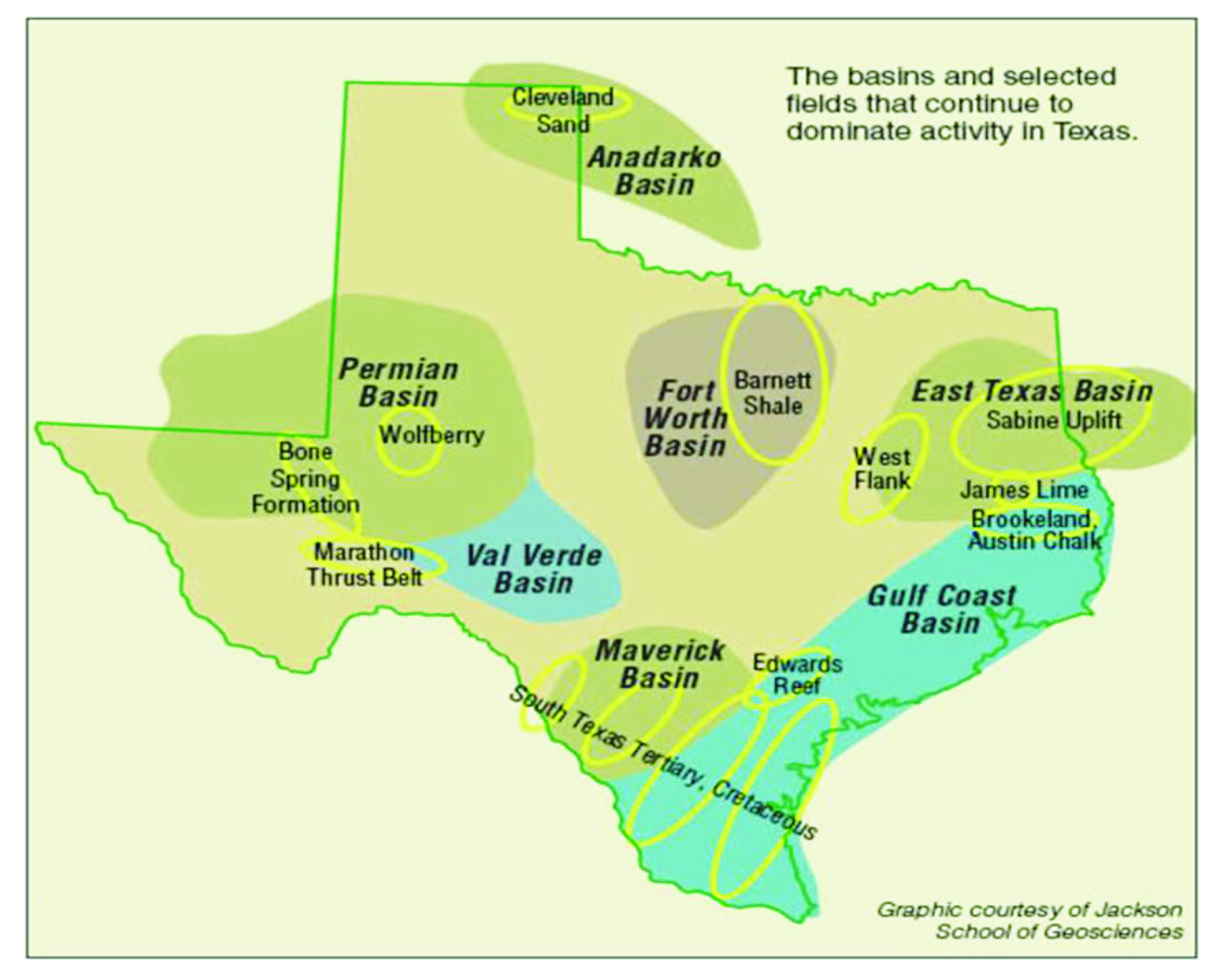

A unique feature of the study is an assessment of the following five major Texas basins and their respective major plays:

- Anadarko Basin – Granite Wash and Cleveland Formation;

- East Texas Basin – Cotton Valley, Haynesville and Bossier;

- Permian Basin – Cline, Spraberry, Wolfberry, Wolfcamp, Bone Spring and Avalon;

- Texas Gulf Coast Basin – Eagle Ford; and

- Fort Worth Basin – Barnett.

These basins were selected on the basis of having the most drilling, development and production activity. All five are discussed in detail in the text. One objective was to access each basin’s production and pipeline takeaway capacity as shown in the following table:

Texas Total Gas Production Forecast

Rig Activity

Source: Baker Hughes)

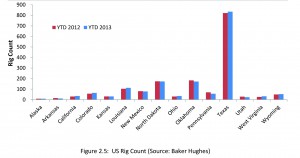

The report shows the U.S. has the highest number of rotary rigs with 1757 or 53% of the world’s total rigs in operation as of December 2013 (Figure 2.1). The state of Texas has the highest number of rigs with 835 as of Dec. 27. This represents 48% of total rigs running in the U.S. and 25% of total world rig count.

Also noted is the increasing percentage of wells in the U.S. that are being drilled horizontally as a result of the advancement of hydraulic fracturing and horizontal drilling technology. This is illustrated in the increasing trend of horizontal rig utilization since the 2008 recession, as shown in Figure 2.2. In fact, over the last year, the number of horizontal and directional rotary rigs increased by 84 rigs (31%) and the number of rigs drilling vertically decreased by 90 (19%).

The historical trend in the U.S. Rig Count (Figure 2.2) is closely mirrored and influenced by the trend in Texas Rig Count (Figure 2.4). Thus, it is fair to conclude that Texas, having the highest number of rigs in operation, as shown in Figure 2.5, has the most drilling activity in the U.S.

The report also notes that the closing gap between total rig count and rigs drilling for oil indicates operator’s preferential drive for hydrocarbon liquid, especially in the post-2008 recessionary period. The reason for this is after 2008 natural gas prices never quite recovered while oil prices quickly recovered back to pre-2008 prices, and then continued to increase thereafter. Oil and gas companies refocused capital budgets to oil (liquids) prone basins. The areas that benefited the most were the Permian Basin, Bakken Play (Williston Basin), and the Eagle Ford (Texas Gulf Coast Basin).

Other highlights of the study include:

- Conservative economic estimates conclude that in the period from 2014-2024, the pipeline industry will contribute over $374 billion in total economic output, sustain 171,000 high-paying jobs annually, contribute over $212 billion in additional gross state product and inject $19.5 billion in state and local government revenues.

- Wells in a confirmed shale play exhibit a repeatable, statistical distribution offering predictable performance in a given geological subset.

In commenting on a potential downside that might hamper future oil and gas pipeline activity in Texas over the near-term, the Texas Pipeline Association president said:

“With heightened oil and gas production, the demand for additional pipelines is expected to increase dramatically and it is the pipeline industry’s job to keep up with the demand. However, in order to construct and maintain the necessary infrastructure, the industry must be able to rely on sound and consistent regulatory policies.

“Inconsistencies or unpredictability in regulations result in unnecessary delays and increases costs for the energy economy. Also, keep in mind that the reliable transportation of the fuels we all rely on today, which include gasoline, diesel fuel and jet fuel as well as crude oil, natural gas and natural gas liquids, depends in large part on Texas’ pipeline system.”

“Additionally, the prevalent misunderstanding regarding eminent domain has the potential to hinder the construction of necessary pipelines. The use of eminent domain is never our preference as it ultimately delays projects and pipeline companies would much prefer to obtain property rights-of-way through fair, market driven negotiations with landowners. In fact, what you don’t often hear is that, in general, negotiations between landowners and pipeline companies are overwhelmingly successful 95% of the time.

“Pipelines are going to be here for a long time so it is imperative to be good neighbors.”

Cannon also provided the following as to what impact natural gas prices could play on future drilling activity: “Of course, if gas prices rise, there will certainly be a significant increase in drilling. In fact, going back to the study results, the numbers they used were conservative and did not take into account $8-10 gas prices. The study noted that the estimated economic benefit to the Texas economy will be greater if gas prices reached this level.”

Readers can review the full study by visiting www.texaspipelines.com.

Thure Cannon serves as president of the Texas Pipeline Association (TPA). Prior to joining TPA in 2010, Thure worked in the Texas Legislature for over 12 years, serving as chief of staff for a state representative. Before his legislative tenure, he consulted on numerous political campaigns and interned for members of the Texas House and Senate.

Thure holds a Master of Public Affairs degree from the Lyndon B. Johnson School of Public Affairs at the University of Texas. He has been a guest lecturer on Texas campaigns at the Lyndon B. Johnson School of Public Affairs and has been a speaker at conferences and service clubs on the Texas Legislature and politics.

Comments