October 2014, Vol. 241, No. 10

Features

European Pipeline Outlook 2020 Seeks Diversification

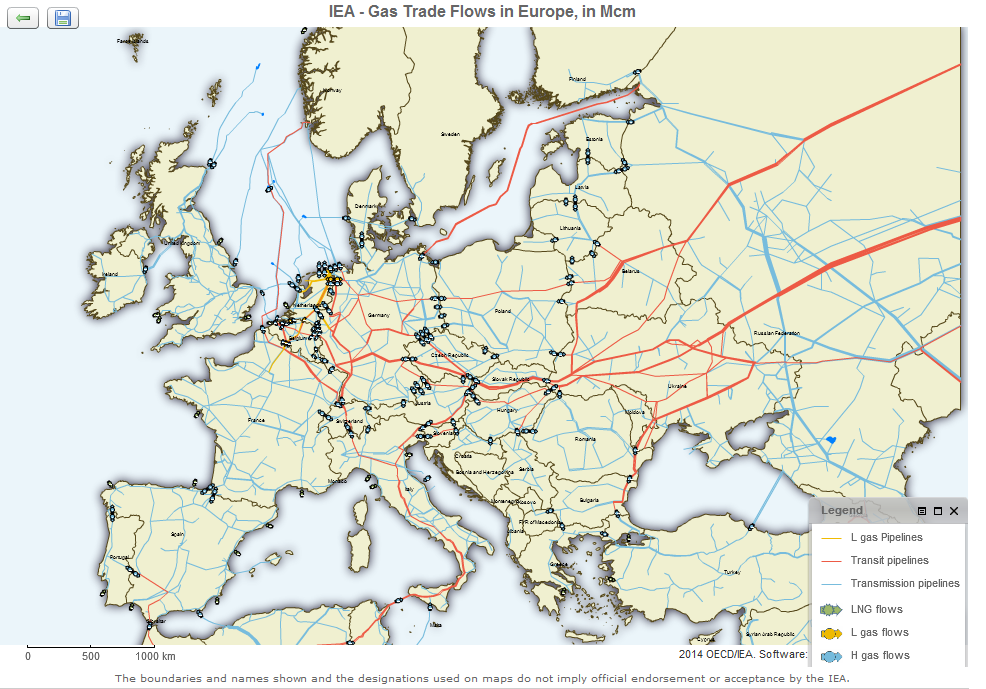

Seen on a map, Europe’s gas pipeline network appears both complex and comprehensive. It would appear to reflect all conceivable supply needs. Yet, in reality, it is an aggregation of a protracted series of regional networks, devised at different times to serve localised needs.

In consequence there are serious shortcomings and illogical deficiencies. For example, in the absence of a single dedicated north-south pipeline, it is not easy to directly deliver gas from the Norwegian North Sea in the north to consumers in Sicily in the south. The network is not as integrated as it appears at first sight.

The Baltic states are not connected to the main European grid and while Eastern Europe’s gas pipelines have good links with Russia, their inter-regional links are poor, which makes it hard to trade gas from Poland to Romania. In addition, some pipelines have insufficient capacity. For example, the existing Larrau interconnector that links Spain and France can only transport 5.2 billion cubic meters (Bcm) per year.

Over and above national gas pipeline networks, recent pipeline construction has been largely determined by two stakeholders. On the one hand, there is the European Commission which has encouraged pipeline development by providing cheap loans as part of its efforts to implement its energy policies as well as complete the creation of a single integrated European Energy Market.

On the other hand, there are those led by Russia’s Gazprom, the leading non-European supplier of gas to the EU. In 2013, Gazprom’s gas exports to Europe reached some 161 Bcm per year, reports Gazprom Export in September 2014. Of this, 127.1 Bcm of gas went to Western Europe, the remainder being delivered to Eastern and Central Europe. Around half of Russia’s gas exports to Europe were delivered via Ukraine’s gas transport pipeline system in 2013, compared with about 80% prior to the 2011 completion of the Nordstream Pipeline which provided a direct link between Russia and Germany under the Baltic Sea.

Demand For Russian Pipelines In Doubt

Table 1 shows in outline the main pipeline projects planned or under construction across Europe by Gazprom and European energy companies including Austria’s OMV and Norway’s Statoil. If Russia’s Nordstream 3 +4, Yamal Europe 2 and Southstream are built, this will double Russian gas pipeline export capacity to Europe to 380 Bcm and bypass Ukraine completely. However, whether Europe can absorb such an increase is open to question, given that total gas consumption in Europe’s 28 member states has decreased for the third year running.

According to the latest estimates from Eurogas, total demand was down 1.4% in 2013, following the 10% and 2% declines in 2011 and 2012, respectively. Overall, in 2013, gas demand remained under pressure predominantly due to reduced usage by the power sector. Whether Europe will be willing to maintain, let alone increase, its dependency on Russian gas is open to question.

Proposed non-Russian pipelines, such as Nabucco serving the Central EU and Balkan states, Trans- Adriatic delivering gas to the Mediterranean EU states and the Polish-Lithuanian interconnector providing a direct link between the Baltic states with the European grid are all primarily designed to reduce reliance on Russian gas in the countries they serve. However, pipeline projects such as MIDCAT facilitating increased Spanish/French cross-border flows and the North-South Pipeline corridor, are designed to increase market flexibility and improve competition in Eastern EU states.

Table 1: Current major pipeline projects

As for the non-Russian pipelines being proposed or constructed in Europe, 60% are in fact cross-border interconnectors, designed to integrate and create a European single-energy market in which it would be easy to purchase and deliver gas across the whole of the European Union, thereby increasing energy security. As Norbolsa energy broker Isabel Mera explained, “It is a fact that Europe needs a lot of gas interconnections to diversify their sources of gas supply.”

One strategically important planned gas interconnector is MIDCAT, designed to link Spain’s gas network with that of France. Spain currently delivers via the Larrau interconnector 5.2 Bcm per year of gas to Europe. MIDCAT increases capacity by an extra 14 Bcm per year which, according to an estimate by Spain’s gas industry association (Spanish Association of Companies in Investigation, Exploration & Production of Hydrocarbons and Underground Storage) would allow Spanish gas exports to Europe to reach 10% of today’s Russian gas exports to Europe.

In 2013, Algeria supplied 39% of Spain’s natural gas via subsea pipelines, according to BP Statistical Review of World Energy 2014; the rest came from non-Russian LNG sources. Algeria could increase gas exports to Europe and at a lower cost than Russian gas if the requisite infrastructure was put in place.

Indeed, all the proposed projects are designed to fill gaps, overcome congestion, or ensure the ability to reverse capacity as required. An example of the latter is the 7.5 Bcm per year North-South corridor pipeline, which is to link LNG terminals on Poland’s Baltic coast with one on Croatia’s Adriatic coast. Once built, it will provide an alternative source of gas for Central and Eastern European countries dependent on Russia for more than 60% of their gas needs.

Essentially, it remains an open question whether all the planned pipelines will be built within the current timeframe, given Europe’s current economic malaise and a strategic imperative to reduce dependence on Russian gas. Indeed, Europe’s pipeline investors and operators face many obstacles, not the least of which are raising sufficient funds and gaining access to affordable gas supplies as well as winning planning approval.

For map of EU gas pipeline network see http://www.entsog.eu/maps/transmission-capacity-map

Comments