May 2014, Vol. 241, No. 5

Features

Top Natural Gas Traders See Massive Spike In 13 Volume

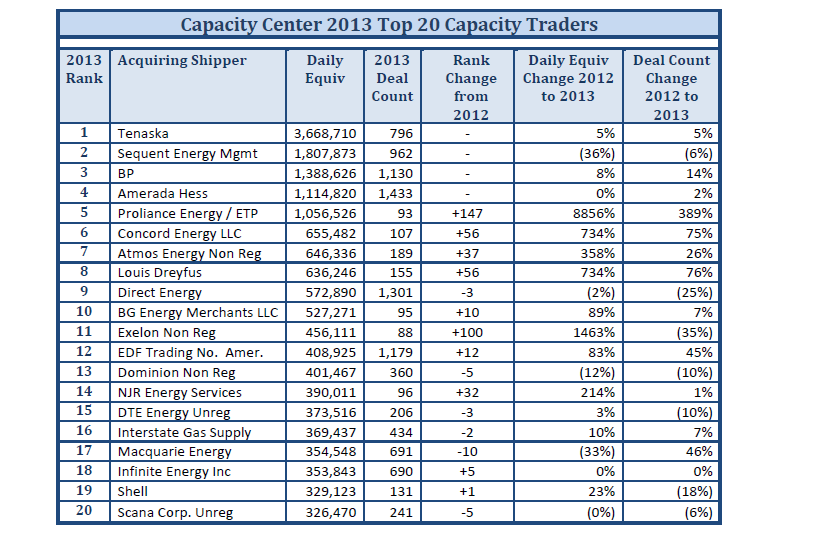

For the fourth year in a row, analysts at Capacity Center reported the total volume of natural gas pipeline capacity traded by the top 20 companies increased over the previous year – this time by a “remarkable” 106%, topping 15.8 Bcf/d.

Although the total number of entities participating in purchasing released capacity fell slightly to from 2012 to 481, the nearly 27 Bcf/d traded on a daily equivalent basis through September 2013 represented nearly a 10% increase over the same period in 2012.

Not surprisingly, for a fifth consecutive year, the West Peabody, MA consultancy firm reported that Omaha, NB-based Tenaska repeated as the number one capacity trading company in the nation, increasing its daily equivalent traded to just under 3.7 Bcf/d, up from 3.45 Bcf/d in 2012.

“Simply put, they (Tenaska) have laser-like focus when it comes to looking for capacity to optimize and control that contract as part of their overall optimization scheme,” said Greg Lander, president of Capacity Center. “They have so much capacity, and they do so much with that capacity that they can do things we don’t see anybody else doing.”

The next three spots on the traders list were held by Sequent Energy, BP and Amerada Hess, all of Houston, repeating their rankings from the previous year, respectively. In the fifth position was Proliance Energy/ETP, of Indianapolis, IN which moved up 147 spots to become the list’s biggest gainer.

Lander pointed out that Proliance, which had been an affiliate of local gas distribution company Vectren, entered into a joint venture with some other distribution companies and now basically manages the group’s capacity.

“Because there is less margin in the business, I think they basically decided there was not enough reason as distribution companies to maintain that business,” Lander said. “They wanted to monetize and still have somebody else perform the capacity management. As a result, Energy Transfer Partners (ETP) really kicked in and expanded that business.”

Aside from the continuing trend toward growth in capacity trading volume levels on a year-over-year basis, which Lander said indicates “an emergence of players who are heavily focused on owning and controlling capacity and doing so by virtue of the secondary market,” he pointed to a “huge change” in what type of firms occupied the fifth through 11th spots this year.

“The banks are basically getting out of the gas trading business, largely because of the lack of volatility and the lack of arbitrage margin,” Lander said.

The list showed eight of the top 10 companies are primary market players, meaning they are physical players that buy and sell the gas to meet demands or manage the demands of other entities, as opposed to those being in the market to trade and profit off of volatility and price difference.

Also trending is the lessened concentration of capacity trading activity by the top 20 firms. In 2013, 57% of all non-affiliate deals were made by the top 20, a decrease from the 63% traded last year – more in line with the 56% level of 2011.

Interestingly, the grouping of trading firms listed from numbers 11 through 20 was extremely tight, with just under 130 MDth (thousand decatherms) of annualized daily equivalent separating those spots, the data showed.

In addition to Proliance/ETP, newcomers to the top 20 were Concord Energy (up 56 places), Louis Dreyfus (up 56), Exelon Non Regulated (up 100), NJR Energy Service (up 32) and Infinite Energy (up 5). Returning to the list after a year’s absence were EDF (up 12) and Atmos Non Regulated (up 37).

Entities dropping off the top 20 were NextEra, GenOn, CenterPoint Non Regulated, Iberdrola Non-Reg, Texla, Gavillon, Atmos Regulated and ConocoPhillips.

Based on its acquisition of Hess assets, Lander expects Houston-based Direct Energy to move into one of the two top spots next year, not by having more trades but by increasing the size of trades.

Northeast Moving Forward

Because the capacity market tends to lag behind the physical market, Lander said he foresees much more trading of Northeast capacity in coming years as the Algonquin and other expansions come online, much like what happened around the Barnett Shale between 2004 and 2006.

“Shale has changed some of the players who were reaching forward from REX (Rockies Express Pipeline) and the Midcontinent, and what we are seeing in both is new capacity and, eventually, in trading of that contracting capacity,” Lander said. “It’ll lag by six months to a year once the new capacity comes on.

“What we saw throughout the Northeast was, while there was some amount of trading, the vast majority of those with capacity in New England and New York were holding onto that capacity because the price of gas was so cheap. By controlling the capacity, they control the price.”

Comments