March 2014, Vol. 241 No. 3

Features

Pipeline Industry Growth Fueled By Increasing Global Energy Demand, Shale Gas Exploration

Increasing oil and natural gas consumption in Asia-Pacific has made a significant contribution to the need for increased pipeline construction investment worldwide. The region is expected to surpass Europe to become a major growth gas market by 2015. Developing economies in the Asia-Pacific region, such as India and China, have been importing substantial quantities of crude oil and natural gas for domestic consumption and industrial use.

The Middle East, China and India are also improving the domestic production of petroleum products by introducing new refineries and increasing the capacity of existing ones. Developments of this kind have necessitated the establishment of new pipeline transmission infrastructure, which is expected to be developed between 2013-17.

The development of shale gas in the U.S. has been stimulating pipeline expansion in North America. Burgeoning crude oil prices have been encouraging continued shale gas production in the U.S. Substantial shale gas discoveries in North America are expected to require the transportation of natural gas to different regions, which will support the North American pipeline industry. The surplus supply of gas from these shale plays has provided the U.S. with energy security, which has opened up new opportunities for the export of natural gas to lucrative markets in the Asia-Pacific region, where gas prices are higher.

Phasing out nuclear power in Europe is expected to result in increased natural gas consumption in European countries. For instance, until recently, the majority of power demand in Germany has been met by thermal and nuclear generation. Following the nuclear phase-out, Germany is expected to become increasingly dependent upon Russian gas imports, the Netherlands and other European countries. This is expected to provide support for the pipeline industry in the country.

There are plans for the construction of intra-country pipelines. Switzerland plans to rely upon gas power plants in order to compensate for the deficit that will be created by the phase-out of nuclear power. This would require an increased amount of gas imports in the country, which would create a need for new gas pipelines. There is also an opportunity for the development of the pipeline industry in Belgium, since in 2003 a law was approved by the federal government regarding the closure of the country’s nuclear power plants. The country has been increasingly focusing on gas-fired power plants, primarily combined-cycle gas turbine (CCGT) plants, as they are efficient and result in lower greenhouse gas emissions. Belgium possesses meager natural gas reserves and is wholly dependent upon imports for gas consumption.

The advancement of offshore technologies, which has resulted in lower unit costs, has made deepwater projects a viable option in the global scenario. The installation of offshore pipelines in such projects has also been driving the global pipeline industry market. It should be noted that new pipe-laying technologies are expected to make the laying of offshore pipelines at water depths of around 9,840 feet a possibility.

Key Statistics

Active crude oil pipelines, petroleum product pipelines, and natural gas pipelines have total global lengths of 183,190 miles, 155,290 miles, and 677,560 miles, respectively, operating both onshore and offshore. There are 3,500 active pipeline/pipeline systems worldwide, and around 172 planned projects.

In terms of a geographic analysis of pipelines worldwide, North America has the longest length of natural gas pipeline, accounting for a 43.9% share of the total natural gas pipelines in the world, followed by Europe and Asia-Pacific with respective 35.7% and 11.7% shares. North America leads in terms of petroleum product pipeline, accounting for a 49.8% share of the global pipeline length, followed by Europe and the Asia-Pacific with respective 16.1% and 14.7% shares. The North American region also has the longest crude oil pipeline network in the world, accounting for a 36.8% share, followed by Europe and the Middle East with respective 27.9% and 16.6% shares.

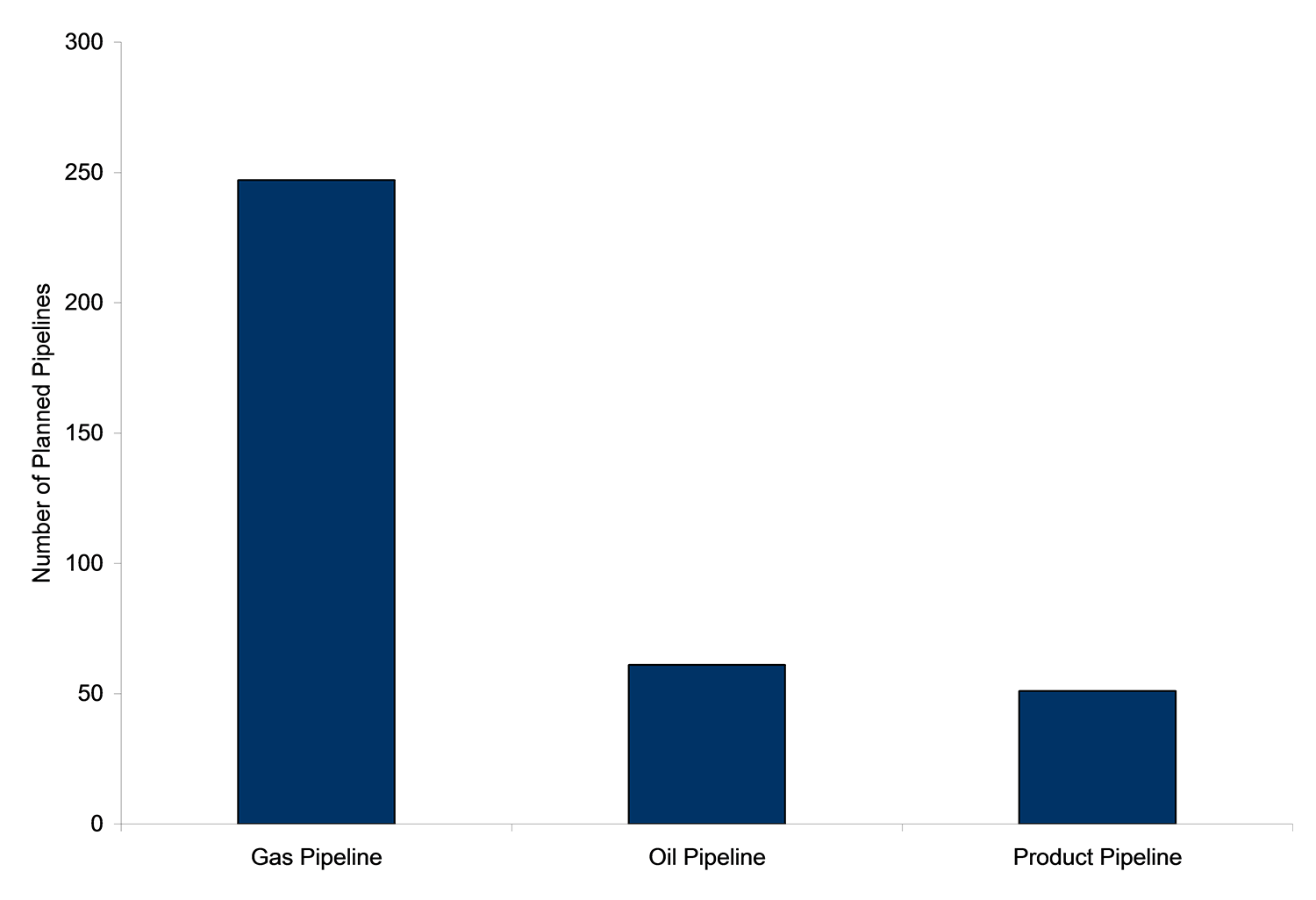

As of 2013, gas pipelines accounted for a 68.8% share of total planned pipelines. Europe has the highest number of planned gas pipelines, followed by the Asia-Pacific region, which is the fastest growing gas market in the world and is expected to become the second-largest market by 2015, with demand for natural gas predicted to amount to a total of 27,887 Bcf/y. The growth of the gas market is primarily driven by China, India and Japan.

The accompanying figure illustrates the statistics of planned pipelines as of 2013.

Key Regional Developments

Europe has been looking to increase its LNG imports and its domestic shale gas production, both of which are expected to reduce Europe’s dependency upon Russian gas imports. Russia has therefore been focusing on Asian markets for its gas exports. Russia’s intention to diversify its gas export market to include Asia-Pacific countries is expected to benefit its pipeline industry.

The rapid economic growth of Asia-Pacific countries such as China, India, Japan and South Korea has attracted Russia’s Gazprom, resulting in the opening of negotiations regarding gas supply. Russia has plans for two major pipelines to transport gas to the Asia-Pacific region: the Atlai gas pipeline, and the Trans Korean gas pipeline. The Atlai gas pipeline project is a planned natural gas pipeline to export natural gas from Russia’s western Siberia to China’s northwestern Xinjiang region, where it will be linked to the West-East Gas Pipeline system. The proposed 1,620-mile pipeline will have an annual design capacity of around 1,059 Bcf. The capital expenditure for this project is about US$10 billion. The pipeline is expected to be operational by 2015.

The Trans Korean gas pipeline is a submarine pipeline from Russia to the Republic of Korea. The pipeline runs from Vladivostok in the Russian Far East through the Democratic People’s Republic of Korea (DPRK) with a final destination of Seoul, the capital city of the Republic of Korea. The planned length of the pipeline will be around 1,990 miles with capacity of 353 Bcf. It is expected to be operational in 2017. Gazprom is in talks with Japan concerning construction of a natural gas pipeline which would cost an estimated $5 billion. Such developments in Russia are expected to strongly drive the pipeline market in the region.

In March 2011, the Fukushima disaster, which led to a nuclear crisis in Japan, resulted in the temporary closure of 50 nuclear reactors, leading to a severe shortage of power in the country. Japan is the world’s third-largest net importer and third-largest importer of crude oil. Following the disaster, the country increased its oil and gas imports for power generation.

Since the future of nuclear energy in Japan is uncertain, this scenario has been driving the need for more pipelines. Three Japanese companies are planning construction of an offshore pipeline in Japan in order to import natural gas from Russia’s Sakhalin Island. The pipeline is expected to cost up to an US$5 billion.

Demand for natural gas has been increasing in Japan as it must compensate for the absence of nuclear energy. Importing gas through pipelines is expected to be less expensive than importing LNG in tankers. In addition, there are plans for the installation of several intra-country pipelines. Overall, these factors are expected to boost pipeline investment in the region.

Natural gas consumption in South and Central America has been rising rapidly in recent years. Natural gas consumption rose from 9.26 Bcf/d on 2011 at a Compound Annual Growth Rate (CAGR) of 4.5%. Since primary energy demand in this region is expected to increase in future, a substantial amount of investment expected for construction of a pipeline transmission infrastructure. For instance, construction of the South Andean natural gas pipeline is planned in Peru. It will have a length of 670 miles and will run from the Camisea gas fields in Cusco to Tacna. Kuntur Transportadora de Gas SAC, an incorporated company in Peru, owns and operates the South Andean Pipeline. The operation of the South Andean Pipeline is expected to attract investment in Peru and have a positive impact upon the energy sector. Five additional pipelines are also planned in Brazil, which is expected to emerge as South and Central America’s largest crude oil producer, surpassing Venezuela and Mexico. These pipelines are the Rondonopolis–Cuaibia Pipeline, the P Eptacio–Campo Grande Pipeline, the Londrina–P Eptacio Pipeline, the Curtibia–Londrina Pipeline, and the Campo Grande–Rondonopolis Pipeline.

Overall, rising global demand for hydrocarbons and the subsequent need to transport them to key markets via pipelines, together with successful hydrocarbon discoveries, are expected to drive the pipeline market in the near future.

Comments