June 2014, Vol. 241, No. 6

Features

Global M&A Markets Appear Poised For Rebound

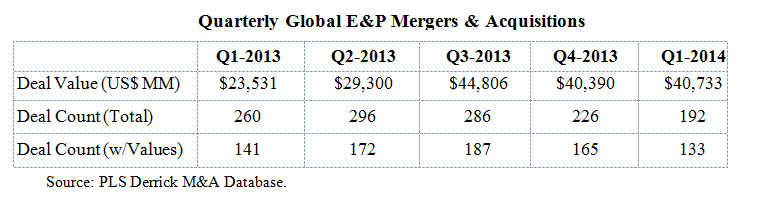

PLS Inc., a leading Houston-based research, transaction and advisory firm, in conjunction with its international partner Derrick Petroleum Services, reports global upstream oil and gas M&A activity for Q1 2014 of $40.7 billion spread across 192 transactions (including 133 with deal value disclosed).

This brings aggregate deal value up 1% from Q4 2013 total of $40.4 billion, achieved through closing 226 deals, and up 65% year-over-year from Q1 2013 total of $23.5 billion across 260 deals. The vigorous year-over-year growth in Q1 is moving closer to the average quarterly deal value of $43.4 billion recorded since 2007.

Brian Lidsky, PLS Managing Director, said, “In Q1, the global M&A markets for upstream oil and gas assets remained at a consistent and healthy level on trend with the second half of 2013, after a very slow start earlier in 2013. Another positive signal during Q1 was that the average deal size eclipsed $300 million, up 25% over Q4 2013 and up 80% year-over-year. Contributing factors include stable to upward trending oil and gas prices, strong capital flows from the private equity sector and continued activity among U.S. resource players in the A&D markets to focus corporate activity on stable, large and executable long-term drilling inventories. Critical to the success for these mega-projects is the emphasis on execution and cost control.”

Examples of these contributing factors in the M&A markets are exemplified by some of the largest transactions of the quarter. The largest deal in Q1 is the proposed $7.1 billion sale of Germany’s RWE oil and gas subsidiary, RWE Dea, to an opportunistic newly formed Russian company, LetterOne Group headed by Russian billionaire Mikhail Fridman. This transaction allows RWE to de-lever the balance sheet and focus on core businesses while LetterOne strikes its first large deal to take advantage of an optimistic viewpoint on oil and gas pricing going forward, particularly in Europe. Though timing of the LetterOne deal is not optimal given deteriorating relations between Russia and the West, the fact that LetterOne is not a state company should lessen opposition to finalizing the deal.

Private equity coffers remain large and oil and gas presents a compelling investment in today’s capital market environment. A case in point in Q1 is private-equity firm TPG Capital, with $59 billion of capital under management, which backed Maverick American Natural Gas’ $1.8 billion purchase of a premier long-lived legacy natural gas asset from Encana. The assets consist of 351 MMcfed (92% gas) and 1.5 Tcfe of proved reserves in Wyoming’s famous Jonah field.

Maverick is a newly established company managed by Dan Allen Hughes Jr, Thomas Hart III and Craig Manaugh. TPG Capital initially committed up to $1 billion in November 2011 to target onshore North America conventional natural gas and remained patient for the right set of assets and market conditions. For Encana, the transaction unlocks value to provide capital to pursue five identified core focus areas.

Global Activity By Region

Regionally, North America’s $23.2 billion in oil and gas M&A activity (Table 2) continued to lead the global M&A market with a 56% share. Europe (18%) and Australia (8%) follow as the globe’s most active regions for deals. Rebounds this quarter occurred in Europe and Canada. In Europe (including North Sea), based almost entirely on the strength of the $7.1 billion RWE/LetterOne transaction, deal activity rebounded to $7.3 billion from just $0.9 billion in Q4 2013, and compares historical quarterly average of $2.4 billion.

Canada also rebounded to $8.4 billion, more than double the $4.1 billion reported in Q4, and surpassed its average $7.6 billion in deals announced quarterly since 2007. The largest Canadian deal was Canadian Natural Resources $2.8 billion purchase of Devon’s western Canada conventional gas portfolio.

The Australia region took 8% of global deal value, or $3.3 billion, a 50% increase over its full year 2013 value of $1.9 billion, which was a record low. This region has not accounted for over 5% of global deals since 2009. LNG projects are driving the increased activity as Shell sold an interest in the Wheatstone LNG project to Kufpec for $1.1 billion and Pacific LNG sold an interest in the Elk/Antelope fields in Papua New Guinea to Oil Search for $0.9 billion.

South and Central America kept steady pace with 7% of global deals, an average the region has consistently held since 2011. In contrast, African activity slowed to $1.1 billion in Q1 or 3% of the market, after tapering off to $2.4 billion (6%) in Q4 but showing a historic high of 16% for the full year 2013.

Said Derrick Petroleum Services director Mangesh Hirve, “North America’s market share jumped to 57% from 46% quarter-to-quarter. While Asian companies continue to be active buyers, striking $4.8 billion of deals in Q1 or 12% of the market, the pace is down from Q4’s $14.5 billion or 36% of the market. The largest Asian deal this past quarter is Indian Oil Corporation partnering with China’s Sinopec to pay $2.3 billion for a 25% interest in Canadian Montney gas assets from Malaysian NOC Petronas subsidiary Progress Energy. We certainly view this slower pace as a pause as Asia’s share of the global deals markets rose to 23% last year from 14% in 2011. Since 2007, Chinese and Asian NOCs have bought $184 billion in assets, accounting for 15% of the overall market.

“There were 12 deals which topped $1 billion during Q1, tied with Q4 2013 but up from six deals a year ago in Q1 2013. Noteworthy this quarter is the global diversity of these large deals, which occurred in eight countries,” added Hirve.

Mirroring the global trend, U.S. deal value remained flat in Q1 2014 at $14.8 billion vs. Q4 2013 and up 6% from a year ago. Total deal count slipped 16% quarter-to-quarter and 30% year-over-year. The Q1 deal value is down 10% from the quarterly average since 2007 while the total deal count is down 20%.

According to Lidsky, “For the last three quarters, the stability of the U.S. M&A markets is remarkable at roughly $15 billion per quarter. This level of activity is expected to continue as indicated by the Deals in Play inventory, which now stands at $42 billion, in conjunction with flat to upward rising commodity prices and a healthy reshuffling of assets. All eyes are on execution, efficiencies and cost control as the M&A markets serve to place the right assets with the right capital structure – be it public or private.”

Lidsky added, “The top U.S. deals in Q1 highlight these themes. In the Gulf of Mexico, Energy XX1 paid $2.3 billion to buy fellow shelf producer EPL Oil and Gas which is immediately accretive and expands scale and efficiencies. Baytex Energy also paid $2.3 billion to acquire Aurora Oil & Gas in a transaction that provides Baytex another world class oil resource play in the Eagle Ford. In other U.S. deals during the quarter which highlight the shuffling of onshore conventional gas, Occidental Petroleum sold its interest in the Hugoton field in Kansas to Merit Energy for $1.4 billion and Encana sold Wyoming’s Jonah field to Maverick American Natural Gas for $1.8 billion.”

Regarding upstream valuations in the U.S., current flowing production benchmark multiples for PDP-weighted conventional assets are down slightly for both oil and gas. Oil-weighted assets multiples today are $100,000 per boepd or $25 per proved boe with an average R/P of 11 years (vs. last quarter’s $110,000 per boepd or $18.75 per proved boe and average R/P of 16 years). For gas, the multiples are $5,300 per Mcfed and $1.60 per proved Mcfe with an average R/P of 10 years (vs. last quarter’s $5,900 per Mcfed and $1.50 per proved Mcfe with an average R/P of 11 years).

Looking Forward

As of March 31 the rapid growth of the inventory of Deals in Play is stable and now totals $132 billion, marginally higher than $127 billion on Jan.1, and slightly lower than the recent peak of $135 billion on Sept.1, 2013. However, year-over-year, the inventory is up a substantial 55% from $85 billion on Jan. 1, 2013, following the record level of quarterly activity of $139 billion struck in Q4 2012. This level of Deals in Play is a leading indicator suggesting a continued stable level of deal activity in the coming months.

The U.S. has the largest inventory of deals in play with an estimated $42 billion (up from last quarter’s $38 billion), followed by Canada with $23 billion (same as the prior quarter), Russia with $14 billion (down from last quarter’s $16 billion) and Australia with $10 billion (down from

$11 billion).

New deals in play include French super-major Total in talks to sell a 10% interest in the Shah Deniz oilfield, offshore Azerbaijan. Also in Shah Deniz, Statoil is reportedly selling down a partial interest. Punctuating a key driver in today’s markets, large U.S. independents Linn Energy, Devon and Murphy all announced asset sale plans (each over $1 billion) in order to re-deploy capital towards focus areas. After its $4.9 billion acquisition of Berry Petroleum, Linn Energy is looking at alternatives to maximize its Midland Basin portion of its Permian position. Devon is looking to sell non-core conventional U.S. assets of which the Rockies (35,000 boepd) is the most substantial portion. Murphy is also tightening its exploration focus with what it calls “New Rules of Road” which include lowering working interests in wildcat wells. In line with this new strategy, Murphy is reportedly considering the sale of certain assets in Malaysia, Indonesia, Brunei and Vietnam.

Finally, super-major Shell plans to halve its number of North America onshore operating theaters and is prepared for potential write-downs. In what can be viewed as an expanding industry-wide theme among the super-majors, Shell will be more selective on growth opportunities as it strives to reduce costs.

Comments