February 2014, Vol. 241 No. 2

Features

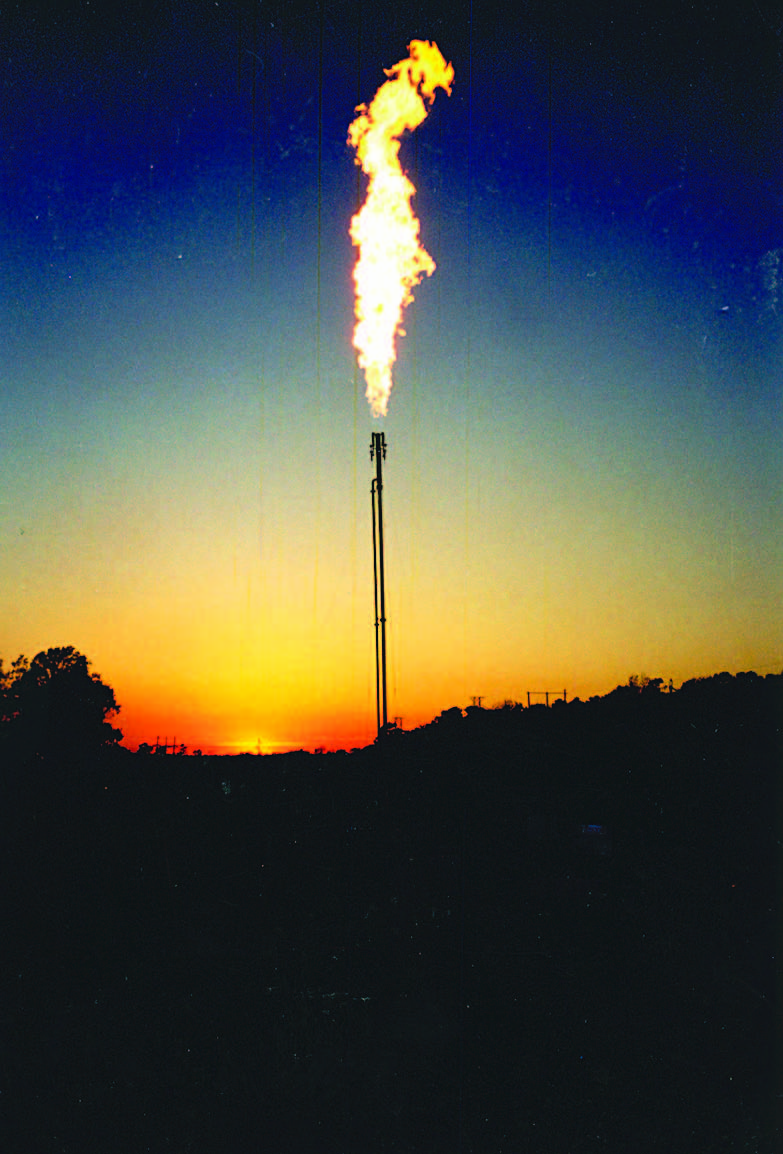

North Dakota Gas Flaring is Creating Firestorm of Controversy

Recently filed class-action lawsuits by North Dakota landowners have brought renewed attention to the controversial practice of gas flaring in that state. In their suits, the landowners claim that major producers in the region, including Continental Resources, XTO and Marathon are costing those owners their share of royalties on as much as $100 million per month of value in natural gas that has gone up in flames in order to keep oil production flowing.

The issue of gas flaring in North Dakota is primarily due to lack of infrastructure. As drilling in the Bakken and Three Forks continues to expand into regions never served by gathering systems, operators are left with few options in dealing with associated gas production. While the volumes of gas are not insignificant either operationally or commercially, the lack of gathering and transport capacity in new production areas means that many wells are brought on line without pipe connections for either oil or gas. While oil can be easily and economically trucked to various market outlets, the associated gas doesn’t have an alternative route.

Faced with the prospect of shutting-in valuable oil production required to pay back their huge investment in completing these wells, producers that have not been able to establish a gathering connection have requested permission from the state to continue flaring gas beyond the one year initially allowed by the North Dakota Industrial Commission. The state, realizing the value of both taxes and industrial development associated with the production boom, has taken a liberal approach in approving almost all permits that they receive.

Despite the breakneck speed at which new wells are being drilled and completed, progress in reducing flared gas volumes is being made. Producers are not indifferent to the loss of potential revenues and midstream companies are cooperating with those producers to develop new natural gas liquids (NGL) processing plants and pipeline connections for residue gas. Tulsa-based ONEOK has completed three new processing plants since 2011 and has two more under construction, providing a total of 500 MMcf/d of processing capacity. Additionally, Hess Corporation is working to more than double the capacity of the company’s Tioga Gas Plant, which will provide an additional 135 MMcf/d of processing and takeaway capacity for both Hess and the other producers in the region.

As the new plants have been brought online and with the expansion of gathering systems in the area, the amount of gas flared has declined from about 36% of production in September 2011 to about 29% in August 2013. Nonetheless, with gas production forecast to rise from a current 1 Bcf/d to more than 2 Bcf/d in the next three years, additional facilities will clearly be required.

Unfortunately, even with the addition of processing to extract commercially valuable NGLs and bring the produced gas to pipeline spec, the takeaway capacity from the Williston Basin is constrained. The two primary pipelines in the region, Williston Basin Interstate and Alliance, are operating very near their combined capacity of 4.5 Bcf/d with most of that gas moving down from Canada. Although there is some opportunity to displace the Canadian volumes with Williston Basin gas, the volumes available are projected to be well below the forecast increases in production.

Given that limited capacity and despite the gathering and processing improvements made to date, new production being brought online in the coming year will almost certainly see the volumes of flared gas increasing once again. Though the operators have joined forces to in order to seek alternative uses for the otherwise wasted gas, such a fuel for trucks, rigs and small-scale power generators, technical limitations and operational constraints limit the volumes that can be utilized and the value captured.

While new processing plants and alternative uses of associated gas are capturing some incremental value from previously wasted production, without substantial investments in interstate pipeline capacity, the gas-fueled fires may just be shifting from individual well sites to the flare towers of the NGL plants. For the aggrieved landowners the incremental revenues provided by NGL sales should be of some consolation even if, at least for the near term, the value of the residue gas remains uncaptured.

Comments