December 2014, Vol. 241, No. 12

Features

Take-Off For Gas Pipelines In Mexico, Brazil

Latin America is home to vast quantities of natural gas and oil. Pipeline construction in this region is driven by the need to transport, process and distribute newly discovered oil and gas to market, or to build dedicated pipelines in anticipation of a large increase in gas-fired power generation.

Latin America has more than 9,108 km of oil and gas pipelines under construction. Energy giants Mexico and Brazil, the two largest economies in Latin America, have 3,416 km and 836 km, respectively, of gas pipelines under construction, or imminent commissioning and account for 40% of the continent’s pipeline construction.

Mexico

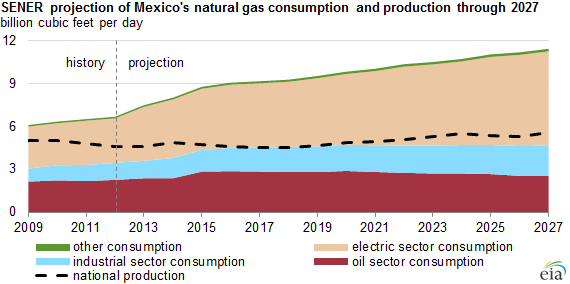

The prospect of U.S. and Canadian gas exports to Europe and Asia has diverted attention from the huge expansion of U.S. shale gas exports to Mexico – up by 92% since 2008. The Mexican energy ministry, SENER, forecasts domestic demand for gas will nearly double from 3 Bcf/d in 2013 to almost 6 Bcf/d by 2027; gas imports from the US are expected to increase from 1.8 Bcf/d to 3.8 Bcf/d by 2018 (Figure 1).

Mexico’s state-owned utility company, Commission Federal de Electricidad (CFE) announced plans to expand gas-fired generation capacity by 24.5 GW between 2010-25, which could boost demand for natural gas by 3.9 Bcf/d.

To meet anticipated demand and steal a march on foreign companies entering Mexico, CFE and PEMEX, the state-owned energy company, account for almost all pipelines under construction.

This take-off in gas-power generation will boost a per capita electricity consumption use rate, which is only 16% the size of that in the United States. There is also the prospect of exporting U.S. gas to Asian markets via Mexico’s Pacific ports in preference to the Panama Canal route, an opportunity that underpins PEMEX’s tender invitation for $4-5 billion worth of pipelines and port development.

PEMEX’s $4 billion Los Ramones Pipeline, a 1,000-km landmark project, will carry Texas shale gas to Mexico City. With a capacity of nearly 60 MMcm/d, it will allow Mexico to triple its imports from the United States, enabling the industrialization of central Mexico while boosting electricity generation and also making viable usage of Mexican shale gas located in the Sabinas Basin’s La Casita.

CFE is investing in pipeline capacity to satisfy the forecasted increase in demand for gas by households and industry. In April, it invited bids from the private sector to build five natural gas pipelines to transport U.S. gas into northern Mexico for local industry that has missed out on the benefits of the U.S. shale gas revolution.

The five pipelines, costing an estimated $2.25 billion, should reduce natural gas shortages, transform transmission infrastructure and increase Mexico’s attractiveness for contract manufacturing as compared with Asia.

Figure 2: Mexico’s gas pipelines in 2020

Source: Geo-mexico.com

Eye Toward The Future

The opening up of the energy sector to private and foreign companies is expected to boost investment. According to a recent Financial Times report, quoting Ernesto Marcos, a former chief financial officer of PEMEX, total private investment in the energy sector between 2014-20 could reach $161 billion. Of this, about $12 billion will go toward development of shale plays. Mexico’s 2014-18 plans require an investment of $34 billion with $13 billion allocated for natural gas pipelines, $7 billion for electricity lines and $14 billion for power plants. Mexico is thus critically poised for a major expansion in exploration, production and pipeline construction.

Energy giant Brazil is the eighth-largest total energy consumer and tenth-largest energy producer in the world. Total domestic oil consumption in 2013 was almost 3 MMbpd and gas consumption was 1.07 Tcf/d. Brazil has experienced a 16% increase in natural gas consumption since 2011 to over 21.3 Bcm/d in 2014. Nevertheless, gas still accounts for a small percentage of Brazil’s total energy consumption, according to the U.S. Energy Information Administration (EIA).

Unlike Mexico, which has opened up its energy sector to private and foreign investment, Brazil’s Petrobras, the state-owned energy company, operates a virtual pipeline monopoly and is the major customer for private gas production. However, as is the case in Mexico, demand for gas from the power sector, growing population and urbanization is expected to rise by 5% annually. This is especially true since droughts exposed the uncertainty of supply from hydropower, the major source of Brazil’s electricity.

Much of Brazil’s pipeline network is focused on major cities such as Sao Paulo and Rio de Janeiro. In addition, a pipeline built in 2009 connects the gas fields of Urucu to Manaus, the capital of Amazonas state. There is also the strategic import pipeline from Bolivia to Sao Paulo, which delivers 30 MMcf/d of gas or 75% of Brazil’s gas imports.

Figure 3: Gas pipeline network

Source: gs-press.com

However, it is the prospect of the strategically important and lengthy cross-border main gas pipeline project, connecting Venezuela to Argentina via Brazil, that promises pipeline builders a bright future.

Future

Petrobras plans to invest $5 billion on infrastructure to transport and process gas from its pre-salt fields to the country’s southeast coast and the main network. In addition, gas-related infrastructure projects between 2014-18 include delivery gates along the 3,150-km GASBOL pipeline, which connects Bolivian gas fields to Brazil’s coastal region cities. However, political and economic conditions might jeopardize these plans.

Author: Nicholas Newman is an Oxford-based energy journalist with experience in the technology, geopolitics, markets and policies involved in the global energy industry business.

Comments