August 2014, Vol. 241, No. 8

Features

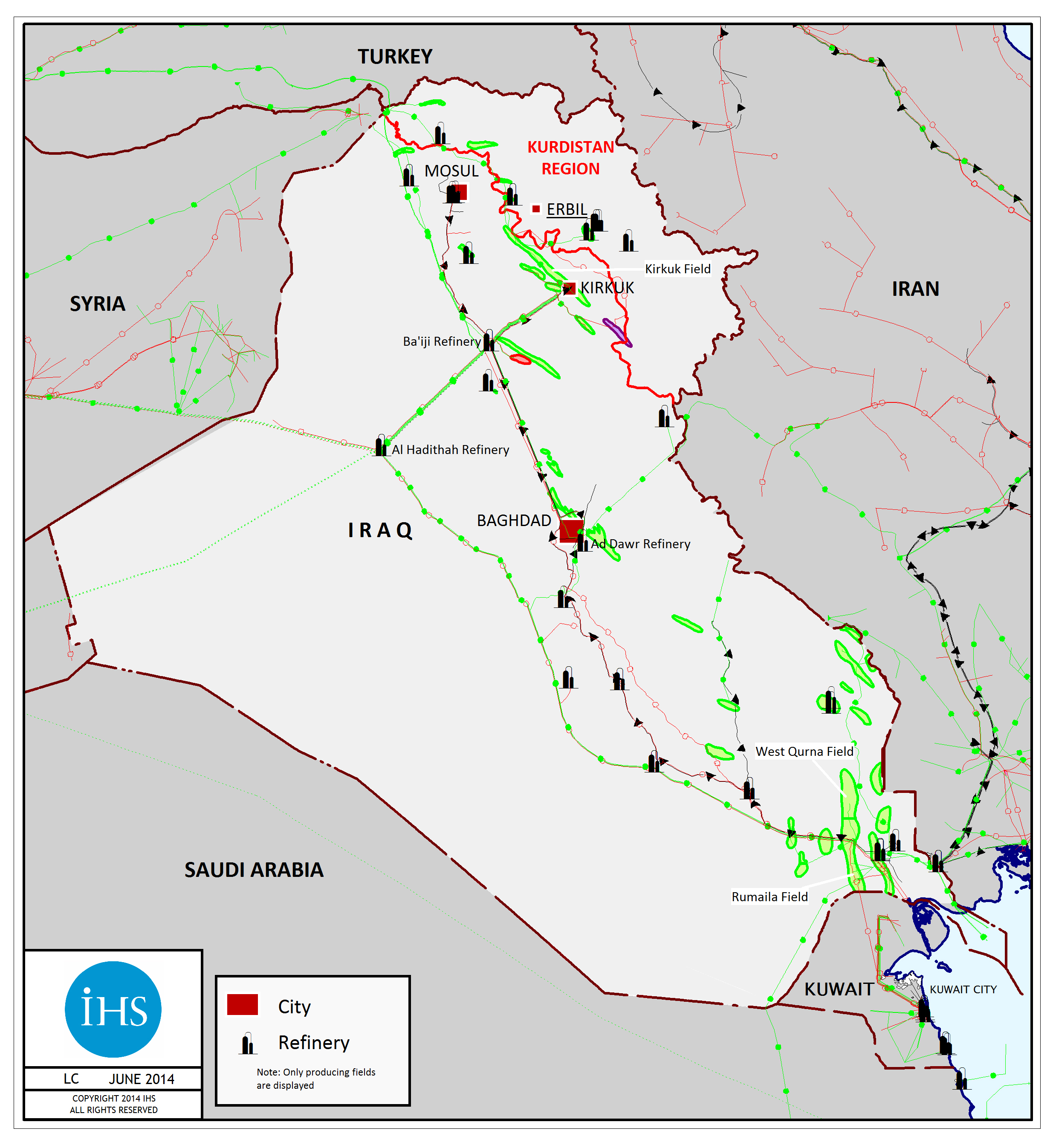

Instability In Iraq: Effect On Production, Infrastructure

Iraq has a long and varied history of oil exploration and development, and its proven reserve base is largely unmatched outside of the Middle East. However, regional conflicts throughout history have disrupted exploration drilling and resulted in extensive damage and neglect to infrastructure, ensuring current oil production is considerably lower than its potential.

The first hydrocarbon discovery in Iraq was made at Chia Surkh in 1905. Oil production commenced in the 1930s from the Naft Khaneh field and gradually increased as successive fields were brought on-stream until reaching a peak in the 1970s.

However, these high production levels were significantly curtailed by the Iran-Iraq war during the 1980s and damaged further by the two subsequent Gulf Wars, accompanied by neglect and mismanagement of key fields and infrastructure. Iraqi oil production stands at about 3 MMbpd, according to Iraq Ministry of Oil figures.

The Iraqi government originally announced production rate targets of 4.5 MMbpd by 2014, 6 MMbpd by 2016 and 9 MMbpd by 2020. Oil production rates have increased slowly over the last five years but have not attained these ambitious levels forecast. The majority, about 80%, of the oil produced in Iraq is exported; most of these exports are transported via tanker through the southern Fao terminal.

Recent installation of several new single-point moorings at the terminal has increased the export capacity and current crude oil exports average about 2.5 MMbpd. There is also a smaller component, usually exported north to the Mediterranean coast of Turkey via the Kirkuk-Ceyhan pipeline. However, that pipeline has been out of operation for several months due to repeated terrorist attacks.

The pipeline had been scheduled for repair, but this appears to have been delayed by the security situation in the country. Construction of a 300-km backup section of pipeline within Iraq, running parallel to the 900-km pipeline, has also been proposed, but is unlikely to proceed until the security situation along the proposed route improves.

The Kirkuk-Ceyhan pipeline had an original capacity of 1.6 MMbpd but repeated sabotage and technical faults have reduced its effective capacity to about 600,000 bpd when operational. Another major 880-km pipeline ran to the Mediterranean port of Banias in Syria, but fell into serious disrepair and has been completely shut-in since 2003. Iraq also has historically supplied oil to Jordan via trucks. In 2012, the two countries agreed to construct a 1,680-km crude oil pipeline with an export capability of about 1 MMbpd from Basra in southern Iraq to the Red Sea port of Aqaba in Jordan.

In addition, a gas pipeline is planned for construction parallel to this oil pipeline, which is intended to supply a series of new gas power stations along the route. Iraqi natural gas production is about 1.9 Bcf/d, but 70% of this natural gas is flared despite an increasing local requirement. In order to fulfill demand, a 500-km gas import pipeline from Iran to Iraq is under construction, and imports of Iranian gas are due to commence in March 2015 after completion of the new pipeline.

The key producing oil fields in Iraq are predominantly located in the south, particularly in Basra Province, where the field with the highest production, Rumaila, is located. The main producing field in the north of Iraq is the Kirkuk Field. However, lately production has been reduced due to the pipeline situation and natural decline.

Most of the large fields in the south are being developed in collaboration with international oil companies (IOCs), under technical service contracts. These were awarded during three licensing rounds for field development contracts held in June 2009, December 2009 and October 2010.

A large number of IOCs pre-qualified and participated in the licensing rounds, and several field development technical service contracts were signed a few months after bidding. Under these service contracts, ownership of the field is retained by the Iraqi state, but the field is developed by an international operator, which is remunerated for increasing and maintaining production at the field.

Examples of IOCs working under service contracts in southern Iraq include BP (Rumaila field), Shell (Majnoon field), ExxonMobil (West Qurna – southern part), Lukoil (West Qurna – northern part), Eni (Zubair), Gazprom (Badrah field) and Petronas (Gharraf field). The initial production plateau targets agreed to by many of the field participants have subsequently been renegotiated; in many cases targets were reduced as unrealistically ambitious.

So far, it appears that the violence has had a limited effect on production, largely because the majority of key producing fields are concentrated in the southern part of Iraq, a significant distance from the worst of the ongoing insurgency and in close proximity to existing export facilities.

IHS Energy is not aware of any production shut-ins so far; however, the threat obviously exists and is hugely dependent upon scope and nature of future violence. It might be argued that refining and pipeline infrastructure remains more vulnerable due to broader geographical dispersion within the country. Also, there is a far greater threat to domestic oil and derivate product supply in the short term than to international oil exports.

Since the current conflict escalated, a number of IOCs have evacuated some non-Iraqi personnel as a precaution, even though operations are still underway at the oil fields they operate. Although work has been progressing to develop these fields, limited progress has been made on development of national infrastructure. In addition to the pipelines under discussion or under construction, there are plans to build new refineries; however, such projects have inevitably been affected by the ongoing unrest in the country.

As an example, a bid round for the Nasiriyah field has been postponed indefinitely due to the deteriorating security situation. This integrated project included development of the field together with a mandatory requirement to build and operate a 300,000-bpd refinery. Other infrastructure projects are expected to be delayed or canceled entirely.

The Kurdistan region, which is in northern Iraq, has awarded its own oil and gas contracts to international companies, some of which, including ExxonMobil, are also operating in southern Iraq. These are production- sharing contracts, so unlike with government contracts, the participating company is also entitled to a share of the field’s production.

Exploration and production in the Kurdistan region is at a much earlier stage than in the south of Iraq, however; several oil and gas discoveries have been made, appraised and are beginning to be brought on-stream. There is an ongoing dispute between the federal Iraqi government and the Kurdistan Regional Government (KRG) over the legality of these contracts and the right of the region to export oil from its fields. Despite this dispute, the region is exporting oil via Turkey by trucks and a newly constructed pipeline.

Exports through this pipeline reportedly commenced at more than 100,000 bpd in January 2014. The oil was initially kept in storage at the Turkish port of Ceyhan while awaiting export approval from the federal Iraqi government; however, it was later loaded onto tankers for export. Exploration and development operations are still underway in the Kurdistan region. Thus far there have not been reports of it being directly affected by the violence.

In summary, while current violence is having little effect on oil production, historically within the region conflicts and terrorist activity have significantly hampered the rate of development. As such, a prolonged period of unrest is far more likely to delay long-term production objectives and significantly obstruct much-needed upgrades to national infrastructure.

Author: Sarah Haggas is regional manager of the Middle East team for the Global E&P Reporting Service (GEPS) at IHS Energy. Her focus areas include Iraq, Syria, Turkey and Eastern Mediterranean upstream hydrocarbon exploration, development and production. Haggas holds a doctorate in geology from the University of Leicester, UK and a master’s degree also in geochemistry from the University of Leeds, UK.

Comments