October 2013, Vol. 240 No. 10

Features

Prices, Transportation Determine Future For Canadian Oil And Gas

Recent reports on the state of crude oil and natural gas production in Canada suggest that the transportation bottleneck at the border will have long-ranging effects on Canada’s energy markets.

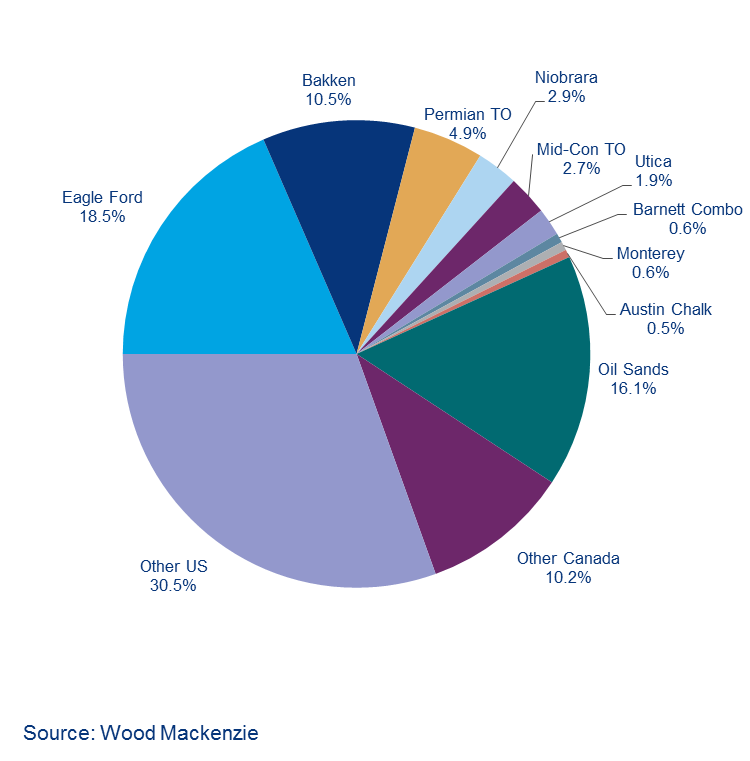

With some in the industry voicing the opinion that the Keystone XL has become irrelevant to the energy picture as the question of approval drags on (see “U.S. Refiners Don’t Care if Keystone Gets Built,” Wall Street Journal, Sept. 5), Wood Mackenzie put forth projections showing all Canadian resources attracting just over a quarter of total North American onshore capital expenditures for oil in 2013.

“While Canadian tight oil plays can offer attractive returns to the right operator, they generally lack the scalability of the larger U.S. counterparts,” the firm said in a July 26 release.

Geography was singled out as a key determinant in a market where supply growth was expected to continue to outpace pipeline capacity for the foreseeable future. Rail transport, while alleviating transit pressure, offers begrudging relief in many areas. For comparison, although rail now carries more than half of all oil from the North Dakota Bakken play, Wood Mackenzie estimated that this could cost 60% more than pipeline service when all expenses were factored in. Gathering and loading costs in particular were often high due to a lack of connecting infrastructure.

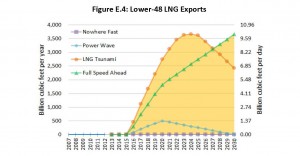

A Canadian Energy Research Institute report released in August, “North American Natural Gas Pathways,” lays out expected outcomes for natural gas production based on whether major LNG exports are approved or not, and how much natural gas is used for power generation in North America.

“First, the narratives based on significant LNG exports (LNG Tsunami, Full Speed Ahead) combined with a healthy economic recovery saw substantial short-term increases in Henry Hub gas prices supporting upstream production. However, increased LNG exports did not support the Western Canadian upstream industry with the exception of British Columbia, which was able to increase production dramatically in isolation to the rest of the country,” the report said.

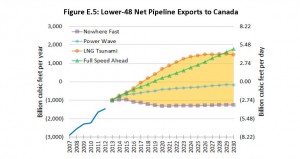

In all scenarios, CERI found Canadian gas faces limited growth potential in the United States, crowded out by the Marcellus in the northeastern and Chicago markets where existing pipeline connectivity directs Canadian gas.

“Although Canadian shale resources are equally impressive in size and potential [compared to American deposits], the geographical location and associated differential to Henry Hub is a negative factor. In fact, Canadian drilling activity will remain weak as a result of the Marcellus Shale’s proximity to the premium New York/Boston markets and thus, improvement will only occur if LNG export terminals can be developed on the west coast of British Columbia.”

Should large-scale LNG exports become a reality, the study predicts, Canada’s natural gas production would increase 30% at maximum and it would become a net pipeline importer from the United States. But with new pipelines under construction to supply Korea and China over land and many competitors in the Asian arena, the study suggests that new LNG facilities in North America would have to come online by 2020 to be economic.

Wood Mackenzie predicts that the Western Canadian Sediment Basin shale production will increase to just over 16 Bcf/d by 2020, with the growth coming from the Montney and Duvernay plays. Despite the high drilling costs in those plays, CERI also sees potential for the areas as Alberta and British Columbia’s resources compete.

While British Columbia has the advantage of access to the coast and any future LNG export terminals, Alberta’s existing infrastructure includes pipeline access to California, Illinois and Canadian markets.

In a separate report, “Conventional Oil Supply Costs in Western Canada,” CERI found that new oil wells in the Western Canadian Sedimentary Basin were economic for the most part, with costs averaging $40/bbl for horizontal wells and $64/bbl for vertical wells. Alberta’s oil wells were even lower in supply costs, ranging from $15/bbl to $31/bbl.

Comments