July 2013, Vol. 240 No. 7

Features

Exxon Outlook To 2040 Predicts Little Impact For Renewables, Cost On Carbon To Benefit Natural Gas

ExxonMobil’s report “The Outlook for Energy: A View to 2040,” released at a press conference with executives last spring, predicts world energy demand rising by 35% over the next 30 years, mostly due to increasing demand in Asia and population growth worldwide.

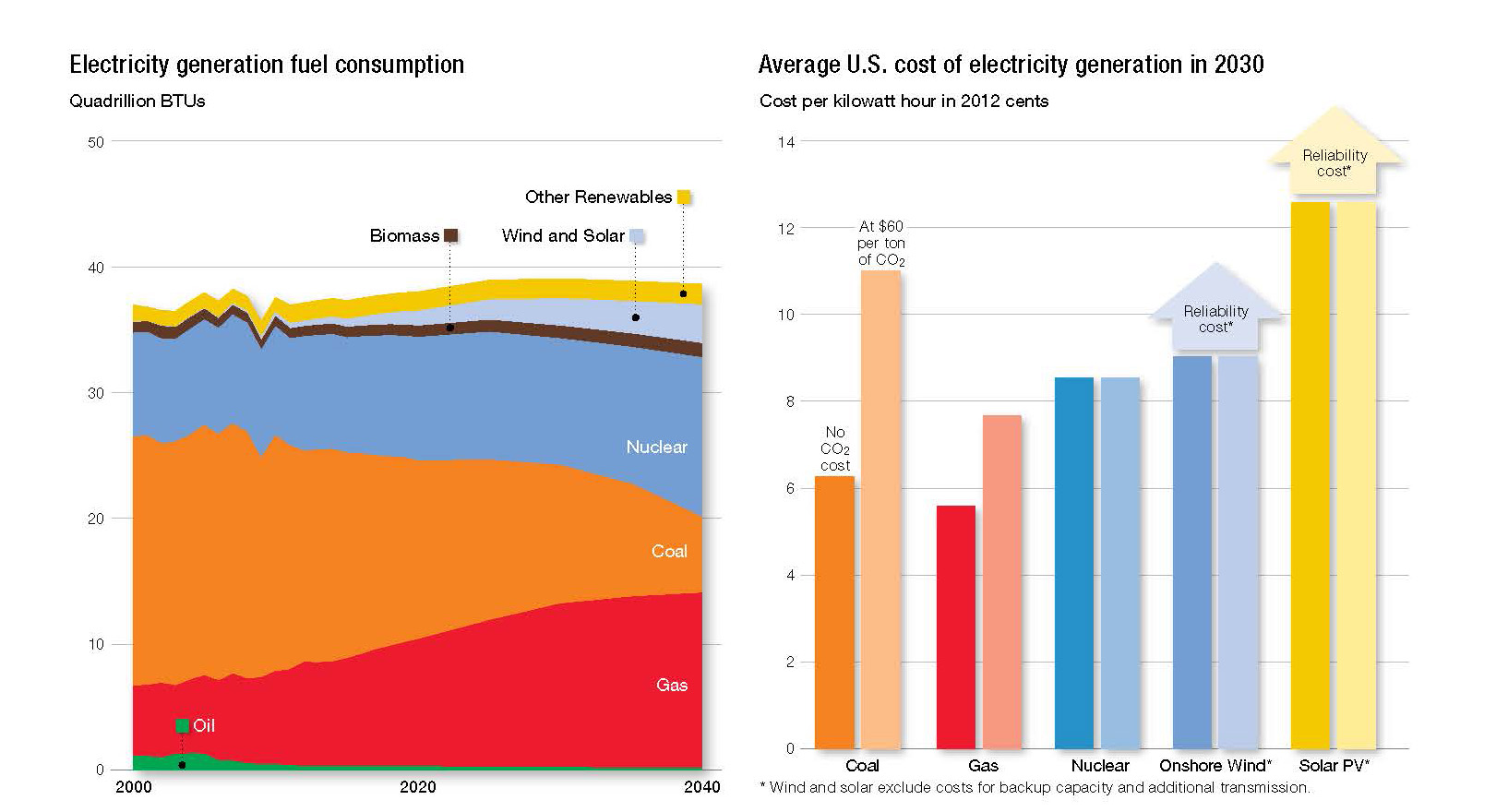

With global electricity generation demand up 85% over 2010 to 117 quadrillion Btus in 2040, the company forecast that a cost on carbon emissions in the United States, at minimum, would make natural gas the most economical fuel for electricity for much of the period, beating out both coal and nuclear energy.

Bill Colton, vice president of strategic planning at ExxonMobil, laid out forecasts in efficiency gains for the U.S. population that would take emissions per capita down by half, despite population growth leading to roughly equal energy use on a nationwide level between now and 2040. Transportation fuel was a big source of efficiency gains due to rising national standards.

“Around the world most of this is actually being driven by government policy. Consumers naturally do seek more efficiency when they buy cars, but they do not seek this level of efficiency. Consumers might not make those same choices,” Colton explained.

The anticipated additional costs of carbon dioxide emissions, placed at $60 per ton for one sample projection, were not enough to boost ExxonMobil’s expectations for renewable energy sources, which the company expected to make up 10% of power generation feedstock in 2040. Instead, the costs of nuclear power generation and natural gas would be comparable, while coal was rendered much more expensive as a feedstock. No details about the timing, structure or nature of the carbon costs used in the estimate were available.

“You could put a transparent tax on the front end or you can put in what Europe has gone to, a cap and trade system. If policy discussions get to that point, we have been rather clear that in our opinion and based on the work we’ve done with many economists, the more effective way to [limit emissions] would be through a revenue-neutral carbon tax,” said Kenneth P. Cohen, vice president of public affairs.

Worldwide demand growth came from expected increases in electricity generation and transportation fuel needs, both heaviest in currently developing countries in Asia. Global electricity generation needs were projected at 54 quadrillion Btus higher than today’s overall, with natural gas a major source of fuel.

Renewables, particularly wind and solar, were the fastest-growing sources of power, but the rate of growth did not overshadow their current tiny fraction of the generation market share. Coal was expected to give way to natural gas in the United States, while the share of nuclear power held steady.

“If engineers ran the world you would probably see a lot more nuclear power, because when you look at the straight economics it looks pretty attractive, and of course it doesn’t have any CO-2 emissions,” Colton commented, but the growth prospects seemed grim due to the difficulty of siting additional plants.

The report also predicts continued energy production growth in the United States, with liquids and natural gas production projected to go up 45% between 2010-2030. Deepwater oil drilling earned particular attention.

“The volumes we’re talking about globally, the amount that’s available in deep water is the equivalent of the production of Saudi Arabia,” said Cohen.

Comments