August 2013, Vol. 240 No. 8

Features

P&GJs Midyear International Pipeline Report

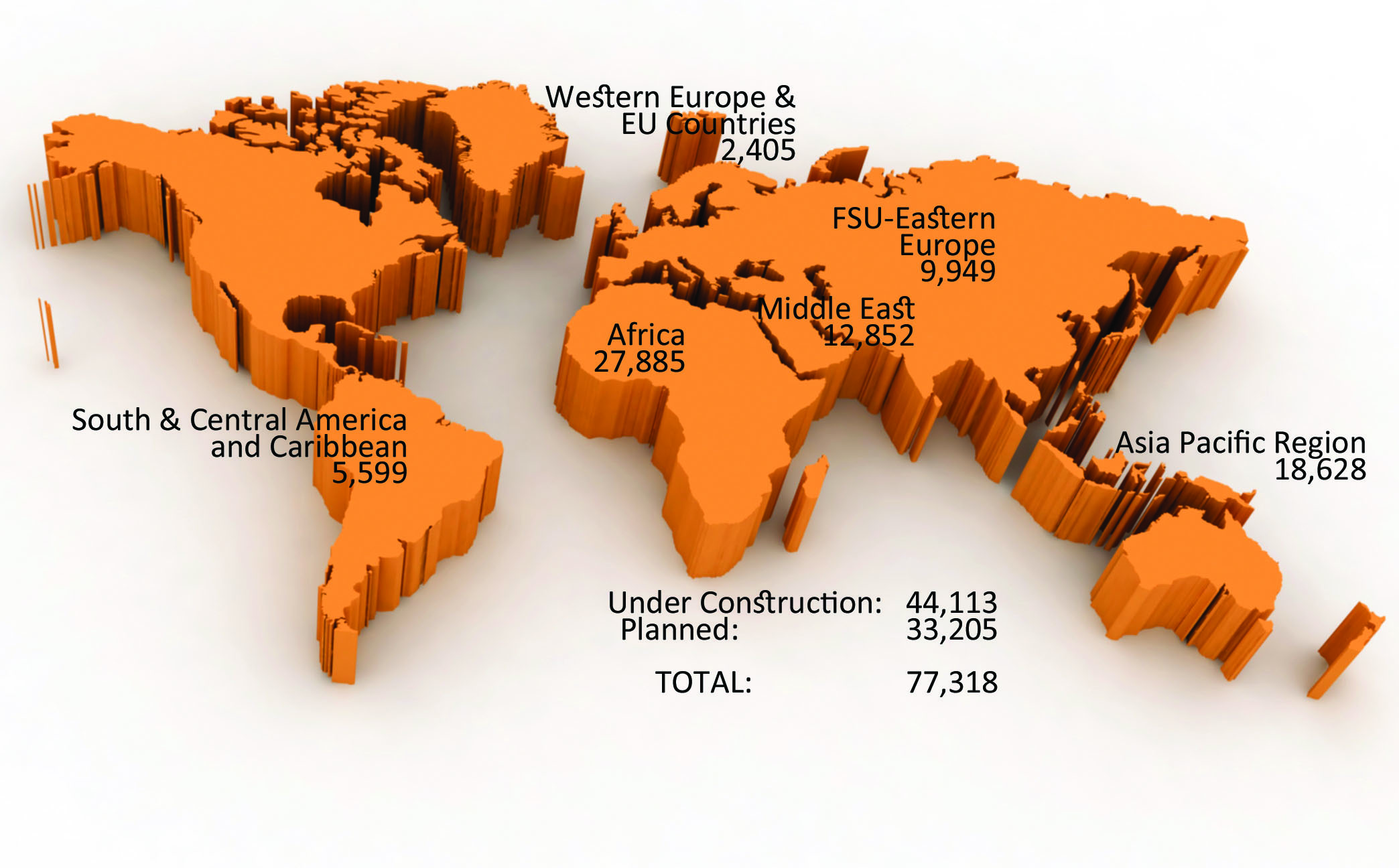

P&GJ’s 2013 international pipeline survey indicates 77,318 miles of pipelines are in various stages of construction and planned. Of these, 33,205 represent projects in the planning and engineering phase and 44,113 are in various stages of construction.

The following reflect new and planned pipelines miles in the six basic geopolitical regions used in this report (see accompanying map). Asia Pacific – 18,628; former Soviet Union and Eastern European countries – 9,949; South-Central America and the Caribbean – 5,599; Middle East – 12,852; Africa – 27,885; and Western Europe and European Union countries – 2,405. For information on these and other pipeline projects, see P&GJ’s sister publication, Pipeline News.

Energy Outlook

According to ExxonMobil’s Energy Outlook 2013, global demand for energy is expected to rise by about 35% from 2010-2040, a significant increase that will require trillions of dollars in investment and ongoing advances in energy technology.

The report credits the increase to both population growth and rising prosperity and economic growth around the world, which will create new demands for energy. Moreover, global GDP is projected to expand by about 130% from 2010-2040.

The report notes that energy demand trends will vary greatly by country type. Among members of the Organization for Economic Cooperation and Development (OECD), which includes the United States, energy demand will be essentially flat through 2040. In non-OECD countries, such as China and India, demand is seen rising by 65% as rapid increases in economic output and prosperity levels outpace gains in efficiency.

Other findings include:

?The need for energy to make electricity will remain the single biggest driver of demand. By 2040, electricity generation will account for more than 40% of global energy consumption.

?Oil, gas and coal continue to be the most widely used fuels, and have the scale needed to meet global demand, making up about 80% of total energy consumption in 2040.

?Natural gas will grow fast enough to overtake coal for the number-two position behind oil. Demand for natural gas will rise by more than 60% through 2040. For both oil and natural gas, an increasing share of global supply will come from unconventional sources such as those produced from shale formations.

Asia Pacific

Growing energy demand in China, India and other non-OECD countries continues to drive demand for new and planned pipelines. Of the region’s 18,628 miles, 12,382 miles are in various stages of construction and 6,246 represent pipelines in the design engineering phase.

China, India and Australia remain the most active in terms of construction, while Japan and South Korea continue to work to solve growing energy needs. As to regional activity, China is investing in major international pipeline projects, to secure oil and gas imports from Russia, Central Asia and Myanmar.

China National Petroleum Corp. (CNPC) is constructing the third West-to-East natural gas pipeline that will span 3,107 miles and have a design capacity of 40 Bcm/a. The pipeline, which will be supplied with gas from Central Asian countries, will originate at Horgos in Xinjiang and terminate at Fuzhou, in the capital city of Fujian. The construction the project will cost about $19.7 billion and is expected to be commissioned in 2015.

In the southwest Sichuan province, CNPC is also building its first pipeline dedicated to shale-gas which will have a transport capacity of 4.5 MMcm/d.

The U.S. Energy Information Administration has estimated China’s shale-gas reserves at 1,115 Tcf, with a significant portion inside the Sichuan Basin, which extends across Sichuan province into Chongqing in the southwest.No operational date for CNPC’s pipeline in Sichuan province has been announced.

In Mumbai, Punj Lloyd is involved in construction of the B-127 Cluster pipeline project for the Oil & Natural Gas Corporation Ltd. The 72-mile subsea pipeline is scheduled to be completed in May 2014.

A Global Data report, Global Planned LNG Industry, 2013, indicates the Asia Pacific region will play a pivotal role in the global LNG industry from 2013-2017 in terms of planned additions of both liquefaction and regasification capacities. Also noted is the report is that the region accounts for some key natural gas rich countries, such as Australia, Papua New Guinea and Malaysia, which have planned significant liquefaction additions by 2017.

The Australian energy industry is working to bring eight new LNG facilities on stream and six more are planned.

QGC’s Queensland Curtis LNG facility will be the world’s first project to turn coal seam gas into LNG. Coal seam gas will be transported from QGC’s processing facilities in southern Queensland to a liquefaction plant on Curtis Island, near Gladstone, via a 335-mile, 42-inch pipeline.

The project, which has been under construction since 2010, is on track to begin serving export markets in 2014.

Shell celebrated the cutting of first steel last year for the Prelude Floating Liquefied Natural Gas (FLNG) facility’s substructure with joint venture participants, Inpex and KOGAS, and lead contractor, the Technip Samsung Consortium, at Samsung Heavy Industries’ Geoje shipyard in South Korea.

When completed, the Prelude FLNG facility will be 1,600 feet long and 243 feet wide, making it the largest offshore floating facility ever built. It will be deployed in Australian waters more than 125 miles from shore. It will produce at least 5.3 mtpa of liquids: 3.6 mtpa of LNG – enough to easily satisfy Hong Kong’s annual natural gas needs – 0.4 mtpa of LPG and 1.3 mtpa of condensate.

Africa

Since December 2005, Nigeria has experienced significant pipeline vandalism, kidnappings and militant takeovers at oil facilities in the Niger Delta. Kidnappings of oil workers for ransom are common and the Gulf of Guinea has seen incidents of piracy. While the instability has shut in large volumes of Nigerian production, exports to the U.S. have remained relatively stable and development activity continues in Nigeria and in several other regions.

Following an explosion and fire at a crude theft point on the Trans Niger Pipeline that forced Shell Nigeria to shutdown the pipeline, the company announced plans to invest $3.9 billion in new oil and gas projects to maintain the country’s domestic energy supplies and export capability.

Plans include a $1.5 billion investment in a new Trans Niger Pipeline Loop-line. A $2.4 billion investment in five gas projects, collectively called Gbaran-Ubie Phase 2, will provide natural gas to run power stations in Nigeria and to feed the Nigeria LNG export project.

In Angola, Chevron Corporation’s subsidiary, Cabinda Gulf Oil Company Ltd., confirmed initial production of LNG at the Angola LNG project. The $10 billion project is one of the largest energy projects on the continent and the first LNG project in Angola. It collects and transports natural gas from offshore Angola to an onshore liquefaction plant on the coast near the Congo River. The project has capacity to produce 5.2 mtpa of LNG, 63,000 bpd of natural gas liquids for export and 125 MMcf/d of natural gas for domestic consumption.

AECOM Technology Corporation was awarded a US$15.6 million, first-year contract for the Western Corridor Gas Infrastructure Development Project (WCGIDP) by the Ghana National Gas Co. The project consists of a 27-mile shallow-water section of the offshore pipeline from Ghana’s Jubilee field to Atuabo; a gas-processing plant at Atuabo, a 68-mile onshore pipeline from Atuabo to Aboadze; a 46-mile onshore lateral pipeline from Essiama to Prestea, an NGL export system in Domunli, and other infrastructure, such as storage facilities and an office complex.

Nigerian and Algerian leaders continue to discuss construction of the 2,500-mile Trans-Saharan Gas Pipeline to carry natural gas from oil fields in Nigeria’s Delta region to Algeria’s Beni Saf export terminal on the Mediterranean to supply gas to Europe. Several national and international companies have shown interest, including Total and Gazprom, but security concerns, increasing costs, and ongoing regulatory and political uncertainty in Nigeria continue to delay this project.

FSU & Eastern Europe

One of the most significant events in the FSU and Eastern Europe involves the Southern Gas Corridor, an initiative of the European Commission for gas supply from Caspian and Middle Eastern regions to Europe via either the proposed Trans Adriatic Pipeline (TAP) or the Nabucco-West pipeline. This EU initiative took a major step forward when the Shah Deniz Consortium (SDC) selected the TAP to transport gas from the Shah Deniz II field in Azerbaijan to Europe over its rival Nabucco-West pipeline.

The 540-mile TAP selected will connect with the Trans Anatolian Pipeline near the Turkish-Greek border at Kipoi, cross Greece, Albania and the Adriatic Sea before coming ashore in Southern Italy. Designed to expand the capacity from 10-20 Bcm a year, TAP will open up the so-called Southern Gas Corridor, enhancing Europe’s energy security by providing a new source of gas.

TAP’s shareholders are Axpo of Switzerland (42.5%), Norway’s Statoil (42.5%) and E.ON of Germany (15%). Shah Deniz Consortium members are BP, SOCAR and Total.

The North Caspian Operating Company (NCOC) recently celebrated completion of facilities required for initial production from the giant Kashagan field. Over the course of 2013-2014, production will be progressively ramped up from 180,000 bpd in the first stage to 370,000 bpd in the second.

This production capacity reflects only the first phase of development; Kashagan and the neighboring fields in the North Caspian hold estimated reserves of about 35 bbl of oil and future development projects have the potential to significantly increase production volumes and position Kashagan as an important contributor to the world energy market.

To diversify its natural gas export routes, Gazprom is constructing the South Stream project – a gas pipeline across the Black Sea to South and Central Europe. The offshore section will run under the Black Sea from the Russkaya compressor station on the Russian coast to the Bulgarian coast. The total length of the Black Sea section will exceed 560 miles. The annual design capacity is 63 Bcm. The first leg of the pipeline is to be commissioned in late 2015.

Plans are underway to extend the Nord Stream pipeline system into the Netherlands and potentially to the UK. The CEOs of Gazprom and of Nederlandse Gasunie, Aleksei Miller and Paul van Gelder, reportedly signed the required documents.

The proposed expansion of Nord Stream would add a third and fourth line to its Baltic seabed from Russia to Germany. It would reach the Netherlands with those new lines, using the fourth line to deliver gas to Britain through an existing pipeline on the seabed of the North Sea. The third and fourth lines are planned for annual capacities of 27.5 Bcm each, equal to the existing capacities of Nord Stream 1 and 2. Thus, the system’s overall capacity would double to 110 Bcm per year.

While Nord Stream 1 and 2 are owned and operated by the Gazprom-controlled consortium along the entire route on the Baltic seabed, the proposed new lines would be governed by a Gazprom-led joint ventures or consortiums for each distinct segment along the route. Gazprom’s goal is to increase deliveries to Britain; however, it wants long-term contracts as opposed to spot market deals.

Middle East

Political disputes and civil unrest continue in the Middle East. The civil war in Syria shows no signs of abating, and there is the added potential of spill-over to neighboring countries. Despite these and other challenges, pipeline activity remains relatively high in some areas.

According to a study published by the International Energy Agency, Iraq has the potential to reshape the global energy industry in the near future. The study said an increase in oil exports could add a cumulative US$5 trillion to Iraq’s economy over the next two decades, a number that would increase its gross domestic product fivefold. Progress has been slow because of political disputes between factions within Iraq and disagreements regarding shared oil fields with Kuwait and Iran.

As to planned activity, Iraq has a technical evaluation underway on the proposed 1,044-mile crude oil pipeline that will run from Basra to the port of Aqaba in Jordan, bypassing the Strait of Hormuz. The first phase of the pipeline is scheduled to export 1 MMbopd from Basra, which pumps 70% of Iraq’s total oil production. The second phase will export 125 MMbopd to the Syrian Banias port in the Mediterranean. From the 1 MMbpd of oil exports, about 150,000 bpd would go to Jordan for domestic use.

A gas pipeline is also planned parallel to the oil pipeline to supply power stations that will be constructed along the route.

While historically Israel has been an importer of natural gas – discoveries of the Tamar and Leviathan fields (among several others) should allow the country to become a significant exporter of natural gas in the next decade. Assessments of the Leviathan field indicate there could be as much as 17 Tcf of recoverable gas.

Plans are moving forward on a floating LNG project that will draw from the Tamar field – and the nearby Dalit – to produce up to 3 mtpa of LNG as soon as 2017. There are competing proposals to develop pipelines and LNG infrastructure to support natural gas exports, but talks about how Israel will get its natural gas to market are ongoing.

Also off Saudi Arabia, the Punj Lloyd Group is installing a 25-mile subsea crude line for Al-Khafji Joint Operations, an Aramco Gulf Operations Company Ltd. and Kuwaiti Gulf Oil Company joint venture. The project is scheduled for commission in September, 2014.

Western Europe & European Union Countries

Shale gas reserves holds promise for increased pipeline activity in Western European and EU countries as more interest and exploration begins in shale formations.

According to the Energy Information Administration, Poland has significant shale gas reserves in the Baltic Basin, where leases have already been awarded to participating oil companies. Britain, too, clearly has potential. UK shale gas reserves were recently upgraded to more than 1,300 Tcf and development of its shale gas reserves are being promoted.

Poland’s Gaz System S.A. has undertaken engineering design of the 105-mile Lwówek-Odolanów gas transmission pipeline. The schedule calls for completion of construction in 2017. The pipeline is part of a comprehensive investment plan implemented by the company as part of the North-South Gas Corridor that will be progressively developed until 2018. Overall, nearly 600 miles of pipelines will be constructed.

In the western part of Poland, Gaz System’s investment plans call for the construction of eight high-pressure gas pipelines totaling 325 miles. In addition to the Lwówek-Odolanów, those include the Czeszów-Wierzchowice, Czeszów-Kie?czów and Tworóg-Tworze? pipelines.

To ensure future energy security, Gaz System officials want to see the proposed Poland-Slovakian gas transmission project go forward. Operator Eustream AS signed a contract for a feasibility study of the cross-border pipeline, which would have capacity of up to 5 Bcm/y. Gaz-System and Eustream expect to obtain co-financing under the European Union’s Trans-European Energy Network Program.

Development of the Aasta Hansteen in the Norwegian Sea is centered around the first spar platform on the Norwegian continental shelf. The platform will be moored to the seabed in 4,265 feet of water. Once production begins in 2017, processed gas will be transported to the onshore Nyhamna gas plant via the 299-mile Polarled gas pipeline, which will be the deepest 36-inch gas pipeline ever installed.

Eleven oil and gas companies are reportedly financing the $5.7 billion project of which Statoil is development operator. Start-up is planned in 2016.

Also in the Norwegian Sea, Statoil and its partners have made the investment decision for a joint oil export solution for the Edvard Grieg and Ivar Aasen fields. The oil will be transported via a 27-mile oil pipeline from Edvard Grieg to the Grane oil pipeline, and then on to Sture.

The transport solution is a precondition for developing the Edvard Grieg (operated by Lundin) and Ivar Aasen (operated by Det norske oljeselskap) fields. Edvard Grieg is scheduled to start producing in 2015 and Ivar Aasen in 2016. The new pipeline will be called the Edvard Grieg oil pipeline.

Statoil is a partner in both fields and operator for the joint venture for oil transport.

Caribbean/South & Central America

Several countries throughout the Caribbean and South and Central America have pipeline projects in progress.

Work is underway in Brazil on an ethanol pipeline being built by Logum Logistica S.A. as part of the multibillion-dollar multimodal logistical and storage system that will transport ethanol a distance of 810-miles through 45 cities, joining the main ethanol producing regions located in the states of Sao Paulo, Minas Gerais, Goias, Mato Groso and Rio de Janeiro.

Ownership of Logum Logistical is distributed among Petrobras (20%), Copersucar (20%), Raizen – a joint venture between Shell and Cosan – (20%), Odebrecht Transport Participation S.A. (20%), Camargo Correa (10%) and Uniduto Logistica S.A. (10%).

Colombian projects include an oil pipeline to link the Llanos Basin to the Pacific Coast. Planners envision commissioning the 200,000-400,000 bpd line by 2016.

Comments