August 2013, Vol. 240 No. 8

Features

E&P Companies Cite Insufficient Pipeline Capacity Among Fastest-Growing Potential Threats

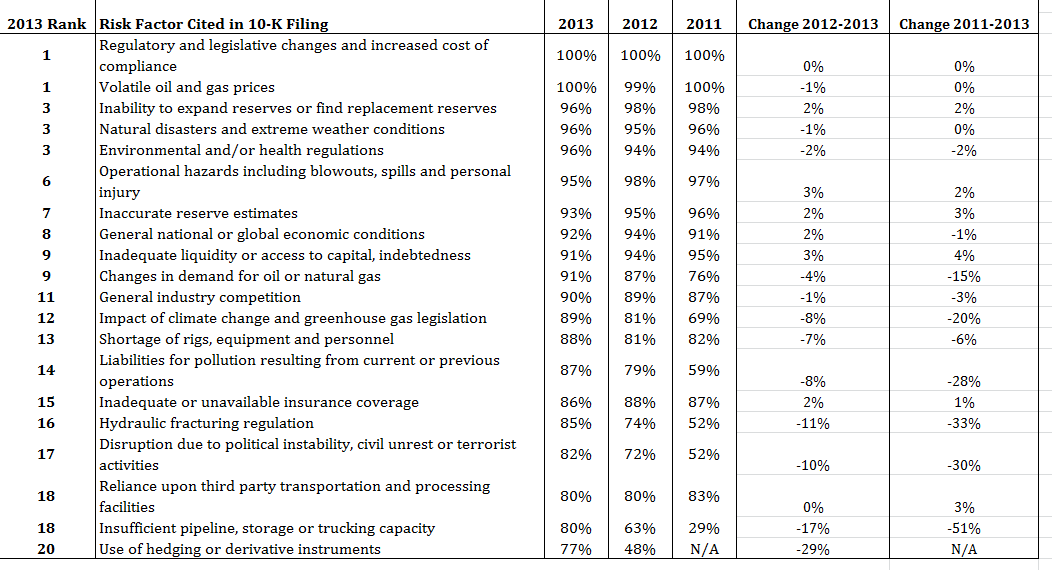

According to a study released by BDO USA, LLP, 80% of the 100 biggest publicly traded exploration and production companies by revenue listed insufficient pipeline, storage or trucking capacity as among the potential risks to their business for 2013. The study was conducted on the companies’ SEC 10-K filings, which list possible threats to their financial performance.

Although many listed issues were more widespread, including some 100% ratings, these did not move much year over year, indicating that they are likely viewed as part of the normal business risks in the industry. Pipeline capacity concerns, however, were up 17% since 2012 and 51% since 2011, the largest two-year jump in prevalence of any issue.

Concern about changes in demand for oil and natural gas was up as well, to 91% from 76% in 2011. Clark Sackschewsky, a partner with Natural Resources practice at BDO, said he thought the two trends were related.

“The change in demand for natural gas and the ability to pipe it and store it really plays into the price aspects. With prices being suppressed because we have so much supply of natural gas -for really the first time in our nation’s history – now we have so much that it’s ‘How do I get it to market?’ and ‘How can I get it to market and still make money?’”

Therefore, pipeline availability becomes a major issue when projecting the profitability of a natural gas enterprise. With the supply of natural gas virtually assured, drillers believe prices will be determined by demand. “If I have more demand, either domestically or internationally with the ability to export, that will raise the price for natural gas,” Sackschewsky explained.

In the meantime, with prices low, transportation costs matter a great deal. “Now that I have [natural gas], how do I get it to market? There’s a limited amount of trucks out there, a limited amount of storage, and limited pipelines. You can’t build pipelines and storage just overnight. The transportation aspect has to meet the supply and the demand, otherwise there’s no reason to drill anymore.”

Sackschewsky suggested that some of the current situation might be the result not just of the shale gale directly, but also the 2010 Macondo disaster in the Gulf of Mexico. When the region was closed due to the spill and the offshore rigs put out of production, much of the investment they represented was displaced into the shale plays. “There’s a limited amount of capital available to do drilling. If I can’t drill in the Gulf, well, I’m going to drill onshore. I have to drill to be able to meet my revenue projections, not necessarily for this year, but for next year and the next year and the year after that. The spill in the Gulf caused a shift of those rigs to the domestic leaseholds. For the bigger companies the question became, do I drill onshore U.S., or do I go internationally, where there are greater risks, less political stability, and all those other factors?”

Causes and results of the situation aside, the insufficiency of the pipeline mileage available is now overwhelmingly a consensus among the studied companies, and will likely remain an issue as pipelines struggle to keep up. “The pipeline and the storage haven’t met the supply side yet. But it takes a considerable time to build a pipeline.”

Other risks listed in the study may also affect pipeliners. All the companies listed potential regulatory changes as a possible source of trouble all three years the filings were reviewed. Volatile commodity prices were almost as universal a concern. However, there were other big moves aside from transportation. Potential new fracking regulations were seen as a risk by 85% of the companies, for instance, up from 52% in 2011.

The largest single-year increase in prevalence was use of hedging or derivative instruments, with a 29% jump to 77%. International unrest presented a threat to companies operating globally, with disruption due to political instability, civil unrest or terrorist activities making the list for 82% of firms in 2013.

One interesting change in prevalence, though, was a decrease in concern from 2012 to 2013: tax uncertainty, now marked by only 63% of filing companies. Sackschewsky attributed the adjustment to a more stable political climate and a shift in policy since early 2012, especially from the president and executive branch. “There’s been a change in tone from a political standpoint. It was fun to see that happen.”

Comments