September 2012, Vol. 239 No. 9

Features

Electric Power Industry Stands Ready To Strengthen Regional Electric-Gas Partnerships

(Editor’s Note: One of the most important energy issues now under discussion involves the ongoing integration of electric generation with natural gas. P&GJ will provide a continuing forum for the dialogue in coming months.)

Electric utilities are constantly evaluating and re-evaluating the best ways of serving their customers. New technologies, new opportunities with fuel sources, new cleaner, more efficient generation are all things we are looking at all the time. The new supplies of natural gas are now opening opportunities for the industry to benefit the consumer even more, while keeping the supply of electricity affordable, reliable and increasingly clean.

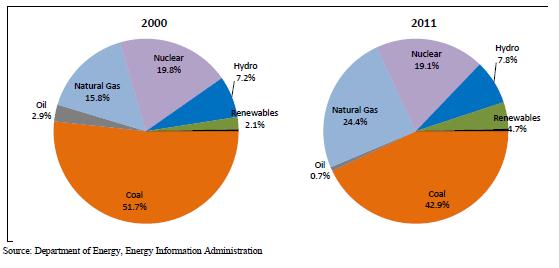

In 2008, natural gas generated 21.3% of all electricity produced in the United States. In 2011, it produced 24.4%, and its share of electric generation continues to grow. In April 2012, natural gas accounted for 32% of electric generation, equaling the percentage of electricity generated by coal for the first time since the U.S. Energy Information Administration (EIA) began collecting the data.

Last year natural gas power plants also accounted for the majority of the new electric generating capacity added — 9,764 megawatts (MW), or 47%. A number of factors are behind this rise in the use of natural gas for generating electricity.

Perhaps the most compelling factor has been the growth in domestic shale gas production. The impact of the recent increase in production can be clearly seen in the steady drop in the price of natural gas over the past four years: In early July 2008, the average Henry Hub spot price for natural gas peaked at $13.32 MMBtu. In 2010, the average price was $4.39/MMBtu, and in 2011, it was down to $4/MMBtu. In April 2012 it had fallen further, to $2.22/MMBtu.

This drop in natural gas prices has reduced the average cost to produce electricity. In 2008, the average cost to produce electricity from natural gas was $78.43 per megawatt-hour (MWh). In 2010 it was $48.94/MWh, and in 2011, the average cost was $46.43/MWh. And with the EIA predicting that natural gas production will exceed consumption during the next decade, the cost to generate electricity from natural gas is likely to remain low.

Another factor that has increased the power industry’s use of natural gas has been the growing number of renewable energy resources, such as wind and solar, now coming on line. Electric system operators have increasingly turned to natural gas-based generation facilities and their quick start-and-stop capability to balance out these variable power sources and keep the grid balanced. And with a number of state renewable portfolio requirements expected to take effect within the next 10 to 15 years, the use of natural gas-based power plants for this purpose is likely to increase.

The recent rules promulgated by the Environmental Protection Agency (EPA) also have had an effect on the industry’s fuel choices for generating electricity. The electric power industry is now facing a number of new and planned regulations from EPA, including the Utility Mercury and Air Toxics Standards (MATS) rule.

Although the electric power industry is committed to reducing its impact on the environment — electric utilities have cut their emissions of sulfur dioxide (SO-2) and nitrogen oxides (NOx) by nearly 70% since the last revision to the Clean Air Act in 1990, even while electricity demand rose 38% over the same period — the utility MATS rule presents major challenges for the power industry’s predominate energy source – coal power plants.

The rule will require hundreds of coal plants to design, obtain approval for, and install complex controls or replacements — all in a very short timeframe. In response, a number of coal plants have been designated for retirement.

Based on public announcements, more than 12,000 MW of coal-based generation is expected to be retired in 2012, and more than 24,000 MW in 2013. Looking ahead over the next decade, it is anticipated that an estimated 53,000 MW of coal-based generation will be retired.

Other reasons behind the growing use of gas include the relative ease of siting a gas-based plant, its lower construction costs, and its shorter construction times compared to other generation technologies such coal or nuclear.

The rising use of natural gas for power generation does not come without challenges, of course, and discussions on how the electric power and natural gas industries can work together more effectively and efficiently have moved to the forefront. Compounding the challenge is that different parts of the country rely on natural gas to different extents in generating electricity.

For example, in the north-central section of the country, natural gas is used to generate less than 5% of the region’s electricity needs. But in New England and the Pacific Coast states, gas-based generation facilities are used to meet about 40% of the region’s electricity needs.

These regional differences in the use of natural gas create regional differences in how interstate pipeline companies, power plant operators, and transmission owners and operators interact. Among the elements that vary are the:

* Use of firm and interruptible pipeline capacity.

* Availability of natural gas storage.

* Communication protocols for scheduling gas-based generation facilities.

The regional differences in the use of natural gas for generating electricity also mean differences in system vulnerabilities and the potential impacts on system reliability. As a result, we are encouraging the use of regional dialogues between the electric power and natural gas industries to ensure that both electricity and natural gas customers continue to receive reliable, affordable service.

EEI’s members, who serve 95% of the ultimate customers in the shareholder-owned segment of the industry and represent approximately 70% of the U.S. electric power industry, are committed to working together more closely with the natural gas industry to increase this coordination.

Discussions should take place among the entities responsible for resource planning and reliability assessments within the various regions — RTOs and ISOs in the organized markets, and utilities in the traditional/bilateral markets. The June 21, 2012 announcement by the Federal Energy Regulatory Commission (FERC) that it will hold regional technical conferences on these issues and the July 5, 2012 Notice establishing five regional technical conferences in August is welcomed and will hopefully facilitate discussions between the two industries where needed.

The FERC, as the regulator of both wholesale electric utility industries and the interstate natural gas pipelines, has an important role to play in these discussions between the industries. And in conjunction with the regional stakeholders, the Commission can help to identify the issues that need to be addressed.

In comments filed with FERC on March 30, 2012, we suggested that some of the topics that could be addressed at these regional conferences include:

* Coordination and communication protocols needed to maintain reliability during severe weather or outage events as well as in the long term.

* Sufficiency and availability of natural gas pipeline capacity.

* New natural gas pipeline pricing structures and storage services that could be available to meet generator needs.

* Scheduling protocols between natural gas pipelines and electric generation facilities.

We are glad to see that these issues have been teed up for discussion during the regional technical conferences in August.

One area that has received considerable discussion over the past few years is coordinating the “gas-electric day”. Within the gas industry the daily process for nominating gas volumes (i.e., gas supplies and transportation), which is referred to as the ‘gas day’, traditionally has occurred from 9 a.m. of the current day to 9 a.m. of the next day.

For the power industry, the traditional planning day, or ‘electric day’, is from midnight to midnight. Thus, there is a time gap, possibly up to eight or more hours, of incompatibility between the two traditional approaches to planning and scheduling.

Coordinating electric and gas schedules and markets, as with all the other topics listed above, is challenging, and due to regional differences including time zones, peak demand, scheduling processes and market structures, the benefits and costs of coordinating gas and electric schedules should be evaluated at the regional level.

As highlighted in the 2011 Special Reliability Assessment issued by the National Electric Reliability Council (NERC), some regions already have taken steps to coordinate electric and gas schedules better. The stakeholders at the regional technical conferences could discuss whether RTOs, ISO and the traditional/bilateral markets should explore whether there are additional steps that the electric industry can also take to further enhanced coordination and market harmonization taking into account their unique regional circumstances.

We look forward to working on these important gas-electric coordination issues with the commission and stakeholders from both the electric and natural gas industries. Moving forward, we have suggested that the following ideas may help facilitate discussion of the challenging topics to be addressed in the near term and long term.

* Ensuring the continued reliable operation of both the electricity and interstate gas pipeline systems.

* Managing risks and developing strategies to address the operational, planning, and investment needs of gas and electricity systems.

* Ensuring that system costs are fairly — and clearly — allocated and that the potential cost impacts on gas and electric customers receive appropriate consideration.

We are confident that, working together, the electric and gas industries will be able to overcome other challenges that the increased use of natural gas in the power sector will undoubtedly bring. It is of paramount importance to the reliability of the electric system that enough gas transportation capacity exists to accommodate the growing needs of the electric generators. The stability of fuel supply and prices is also of critical importance in order to protect electricity customers from price spikes caused by disruptions in other energy sectors

As the electric power industry’s use of natural gas grows, so too does our commitment to work with the natural gas industry in identifying and addressing electric-gas coordination issues. We are confident that with guidance from the commission a stronger partnership will pay off in more economical, reliable service for our customers.

The Author

Richard F. McMahon, Jr. is vice president, Energy Supply and Finance for the Edison Electric Institute. In this capacity, he leads the two groups within EEI, the Energy Supply Group and the Finance, Tax and Accounting Group. McMahon directs the industry’s finance and Wall Street activities including financial analysis, investor relations, accounting and tax issues including advocacy before the Securities and Exchange Commission, as well as credit and wholesale market issues before the Federal Energy Regulatory Commission. Also, he leads the industry’s advocacy on OTC Derivatives and Financial Reform before the Congress and the Commodities Futures Trading Commission. He directs the Energy Supply staff in advancing public policy issues in fossil and renewable power, hydropower, fuel diversity and rail transportation issues.

Comments