May 2012, Vol. 239 No. 5

Features

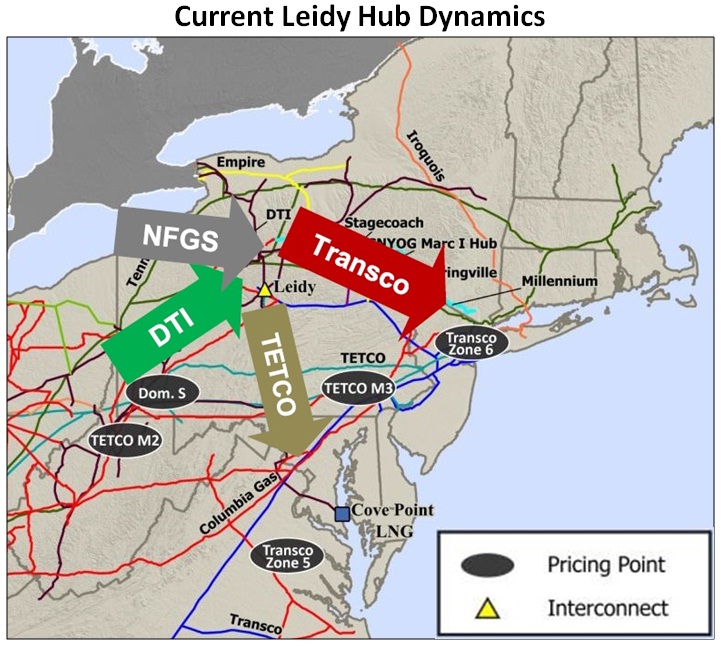

Expansions May Transform Leidy Into Major Natural Gas Supply Hub

BENTEK’s Northeast Observer reported that on April 16 Transco proposed three pipeline expansions to transport approximately 700 MMcf/d of natural gas production out of the Leidy Hub in southern Potter County, PA, by 2016.

The proposed Leidy West Path would flow up to 200 MMcf/d of gas west toward the northern Midcontinent markets. The Station 520 and Station 517 expansions would enable 500 MMcf/d of gas to flow southeast on the Leidy Line to the Atlantic Seaboard.

The Leidy West Path could face competition with growing production from the Marcellus in southwestern Pennsylvania. The Stations 520 and 517 expansions would enable northern Marcellus producers to access a market with higher demand growth potential.

Transco’s proposed projects respond to a significant increase in natural gas supply anticipated to hit the Leidy Hub by fall, which the Northeast Observer attributes to the William’s Springville Gathering Phase II and Inergy’s Marc I Hub pipeline expansions.

These expansions are expected to come online this summer and add 875 MMcf/d of new capacity for production to access Transco’s Leidy Line. The increased supply will largely impact the Leidy Hub by reversing this historically supply-short market and shifting it to a supply distribution center.

USGS Raises Estimate Of World’s Natural Gas

The U.S. Geological Survey released on April 18 a new global estimate for conventional oil and gas resources. The USGS estimates that the undiscovered, conventional resources in the world total 565 billion barrels of oil (bbo), 5,606 Tcf of natural gas, and 167 billion barrels of natural gas liquids.

All of these numbers represent technically recoverable resources, which are those quantities of oil and gas producible using currently available technology and industry practices, regardless of economic or accessibility considerations.

“In the twelve years since the last assessment, the steady progress in technology now allows additional resources to be regarded as technically recoverable,” said USGS Director Marcia McNutt. “By placing this information in the public domain, government leaders, investors, public and private corporations, and citizens have a common information base for planning and decisions that affect the global environment and market place.”

Vertical limestone beds forming cliffs along Three Pagodas-Fault Zone near Hua Hin, Thailand. This area was included in the USGS report, “An Estimate of Undiscovered Conventional Oil and Gas Resources of the World, 2012.” Photograph by Chris Schenk, U.S. Geological Survey.

This new assessment is complete reassessment of the world since the last World Petroleum Assessment in 2000 by the USGS.

The report includes mean estimates of resources in 171 geologic provinces of the world. These estimates include resources beneath both onshore and offshore areas.

This assessment does not include undiscovered, conventional resources in the United States, which the USGS estimates holds 27 bbo and 388 Tcf of natural gas onshore and in state waters. Additionally, there are an estimated 81 bbo and 398 Tcf of natural gas in the U.S. Outer Continental Shelf (OCS), according to the Bureau of Ocean Energy Management.

The assessment results indicate that about 75% of the undiscovered and technically recoverable conventional oil of the world is in four regions: South America and the Caribbean (126 bbo); sub-Saharan Africa (115 bbo); the Middle East and North Africa (111 bbo); and the Arctic provinces portion of North America (61 bbo). Significant undiscovered, conventional gas resources remain in all of the world’s regions.

These new estimates are for conventional oil and gas resources only. Unconventional oil and gas resources, such as shale gas, tight oil, tight gas, coalbed gas, heavy oil, oil sands, may be significant around the world, but are not included in these numbers.

Barnett Shale Exceeding Expectations

Eagle Ford Shale task force noted that the vast oil and gas play has surpassed forecast. The industry paid $508 million in state franchise taxes in fiscal 2011, or almost 13% of total franchise taxes paid, said Robert Wood, director of local government assistance and economic development at the Texas comptroller’s office. Also, severance taxes paid by the industry sent $1.1 billion to the state’s rainy day fund in November, he said. Deposits in the fund are made annually in that month.

Railroad Commissioner David Porter, who founded the 24-member task force last year, said at a meeting in Gonzalez on April 18 the numbers reinforce his view that the Eagle Ford might be the state’s biggest economic engine ever while helping boost employment in the state’s oil and gas industry.

“We’re above where we were at the peak in 2008,” Wood said.

Statewide, employment in all industries in Texas rose 2% in 2011, compared with 2010. Employment in the oil and gas industry jumped 18%t in the same period, and the average annual salary was $117,000, Wood said.

Thomas Tunstall, director of the Institute for Economic Development at the University of Texas at San Antonio’s Center for Community and Business Research, said the shale development has far surpassed the institute’s estimates. The institute estimated that the shale would produce 2.1 million barrels of oil in 2010. Instead, the shale produced 4.4 million in the first 11 months of that year.

For 2011, production of 8.7 million barrels of oil was forecast. Almost 22 million were pumped out in 2011’s January-November period.

The institute made no forecast for how much condensate — a valuable product similar to light crude oils — would be produced in 2010, but it estimated that production would reach 5.6 million barrels in 2011. Actual production was almost 19 million.

In Carrizo Springs, the sales tax returned in March alone totaled more than $500,000. Paula Seydel, manager of the Dimmit County Chamber of Commerce, said it’s a thrill that new small business are opening or expanding in once-dying downtowns. She recently interviewed several Dimmit County students who are applying for scholarships.

“For the first time in years, we have smart kids looking at becoming petroleum engineers, with the possibility that they can get jobs right in their hometowns. They’re interested in becoming diesel mechanics, electricians and welders. And thinking they can stay near their family.”

A new report by London-based GlobalData said the major role played by the strategically developed Barnett Shale is likely to provide a model for the development of other shale plays.

The report states that the Barnett Shale has historically attracted substantial investments from oil and gas companies. High crude oil prices are anticipated to encourage oil and gas companies to explore and develop Barnett shale combo projects in the future.

Gas wells in the Barnett shale reached a total of 15,731 in March. Drilling and exploration activities have continued to improve due to advanced fracturing technology that allows oil and gas companies to operate at substantially high recovery rates in the initial production phase. This means that fewer rigs are needed to drill a higher number of wells, improving the productivity of the wells drilled. Operators have also improved their techniques to reduce drilling times, leaving many wells to be drilled from one multi-well pad, which has led to growing efficiency in production rates.

As a result, oil and gas companies are busy acquiring new resources in the liquid-rich area of the Barnett Shale. EV Energy Partners and Enervest have expanded their acreage position in the Barnett Shale combo by acquiring natural gas assets worth $1.083 billion in November 2011. Pioneer Resources also plans to invest around $170 million.

The total number of permits issued in Barnett shale reached 3,642 in 2011. With 1,231 new gas permits issued in 2011 alone, interest is increasing in development and drilling activities in the shale play. It is anticipated that the total number of permits will continue to grow, with more drilling locations popping up not only in this shale play, but in other plays that can mimic its success.

During 2003-2011, the cumulative gross gas production of the Barnett Shale was 10.8 Tcf. It is expected that future gross production will reach 2,068.6 bcfe in 2012, later stabilizing at 2,562.5 bcfe in 2020.

Comments