December 2012, Vol. 239 No. 12

Features

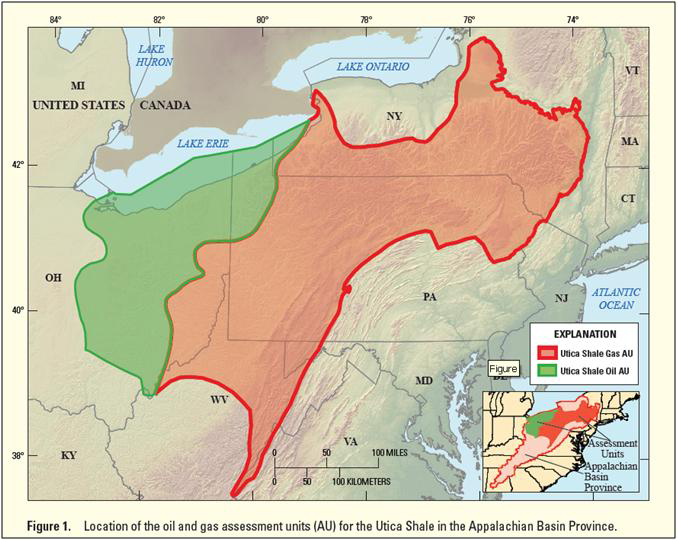

Utica Shale Play Emerging As Important Liquids-Rich Resource

A recent report from analytical firm HIS says that although it is still premature to conclude that the Utica/Point Pleasant Shale play in Ohio and western Pennsylvania will be as productive as the Eagle Ford Shale in Texas, the Utica is in many ways analogous to the Eagle Ford and early drilling results are encouraging.

The similarities between the two plays include an extensive prospective area, vast resource potential, and three hydrocarbon-prone areas (oil, wet gas, and dry gas).

“To date, horizontal drilling results in the Utica have been very encouraging, with activity so far focused on targets within the wet gas window,” said Andrew Byrne, director of energy equity research at IHS, and author of the IHS Herold Utica/Pleasant Point Shale Regional Play Assessment.

“Approximately two-thirds of the horizontal wells drilled on the play have reported 24-hour initial production (IP) rates of 1,000 barrels-of-oil-equivalent per day or more, which supports our opinion that early results are encouraging. However, the Utica is still in the very early stages of exploration; only in late 2010 did the industry start moving from drilling vertical exploratory wells in the play to permitting horizontal wells.”

Byrne cautioned that it is still too early to declare certain areas of the emerging play as “sweet spots,” since few horizontal wells have been drilled to date. The most productive liquids-rich wells so far have been located in Harrison and Carroll counties in Ohio, and are operated by Chesapeake Energy, the most dominant company in the play in terms of total acreage and wells drilled.

According to IHS, more than 135 drilling permits have been granted for Utica horizontal wells, but only 11 having been completed with IP test volumes. Drilling depths for the Utica range from 6,000 feet total vertical depth (TVD) to 9,000 feet TVD as compared to a typical Eagle Ford well with depths ranging from 9,500 feet TVD to 11,500 feet TVD.

Chesapeake’s key Buell-8H (Utica) well in Harrison County, OH, which has delivered the best production to date, has a TVD of 8,564 feet. The 1,350 barrels-of-oil-equivalent per day (BOE) production rate compares favorably with other liquids-rich plays.

Added Byrne, “Initially, we expected the Utica’s proximity to northeastern U.S. would result in premium pricing for natural gas similar to the Marcellus Shale. However, recent prices in the region suggest that this is no longer a safe assumption. The play is somewhat shallower than the Eagle Ford, which means the wells should be less expensive to drill, so there should be some cost advantages.”

According to the IHS report, an assessment of the Utica’s well distribution analysis gives the current productivity advantage to the Eagle Ford play. Since Ohio only reports production on an annual basis, a true peak 30-day rate is not available. IHS derived “an inferred” 30-day peak rate by taking the actual 24-hour IP rate and reducing it by 40%, which the company determined was a reasonable number.

The three best wells in the Utica have calculated production rates greater than 750 BOE/d. However, all three are located in the gas-prone window and are reported to have flowed 100% natural gas. The Utica well distribution performance is encouraging, considering the early stage of the play, with a large percentage of wells coming in at 600 BOE/d or greater.

“Based on our early research, it appears the vast majority of the Utica liquids volumes are lower-value, natural gas liquids (NGLs). Therefore, much of the economic outlook for the play relies upon not only natural gas prices, which remain low, but also prices for natural gas liquids, which have been highly volatile,” said Byrne.

“Successful de-risking of the oil-prone window would greatly enhance the attractiveness of the play. We also believe that additional experience and technological advancements, as well as infrastructure build-out, offer the potential for improved well performance over the early data.”

The initial horizontal drilling results in the oil-prone window are just becoming available, including recent encouraging results reported by Anadarko. The best oil-weighted well drilled to date is the Anadarko Brookfield well in Noble County during the first quarter of 2012, which tested at a 24-hour IP rate of 731 BOE/d (82% oil and condensate).

Anadarko has 390,000 gross acres prospective for the Utica. Devon Energy also has several wells in process in the oil-prone window, which IHS believes will deliver critical insights regarding the relative attractiveness of the area. The largest acreage holders in the play are Chesapeake Energy and EnerVest, which are both seeking partners.

Comments