December 2012, Vol. 239 No. 12

Features

Recognizing Benefits Of Pipeline Alarm Management

Whenever new regulations are introduced into any industry, they can be challenging as companies work to understand them, put together compliance plans, find technical solutions and identify the right processes and resources to help implement solutions.

Pipeline companies experienced this when the Pipeline and Hazardous Materials Safety Administration (PHMSA) 49 CFR Parts 192 and 195 requirements were issued addressing control room management and human factors. The broad nature of the rule, encompassing everything from fatigue mitigation to controller training, required companies to review and in many cases significantly change their operating philosophies. A key component of the PHMSA requirement is alarm management.

Few pipeline companies undertook the required alarm management improvement projects with return-on-investment (ROI) as a primary objective but instead were focused on compliance. It isn’t that companies didn’t acknowledge the intuitive business benefits of improved alarm management, but like many automation-related projects, the difficulty was in quantifying the benefits.

As the rollout of alarm management solutions in response to the PHMSA rules has occurred, many pipeline companies have been surprised by their ability to see significant and measurable improvements in a number of operational and business areas.

The results have proven that the motivation for alarm management need not be an either/or but instead a combination of regulatory compliance and ROI benefits that result from good alarm management practices such as risk reduction and incident avoidance, reduced maintenance costs and more efficient pipeline operations. Accurate and timely alarm management information available for analysis and sharing enables more informed operational decisions and can positively impact pipeline profitability.

Alarm Management Lifecycle

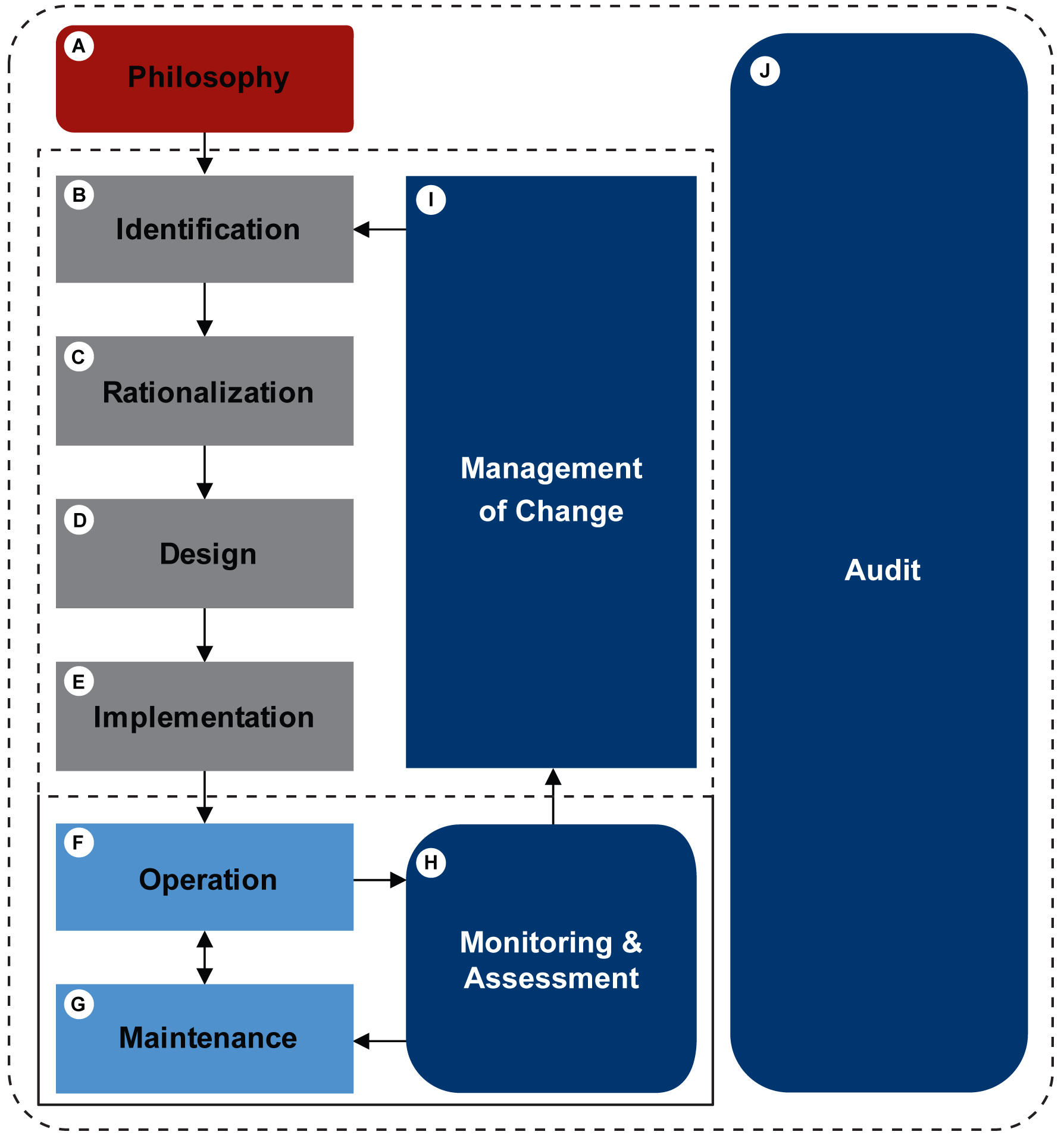

The Alarm Management Lifecycle model outlined in ANSI/ISA 18.2 is one of the best ways to quickly visualize and understand the key components of alarm management (Figure 1).

To better understand the 10 Alarm Management Lifecycle components, see the standard at www. isa.org which defines each step in detail. The first question for many pipeline companies in response to PHMSA 49 CFR Parts 192 and 195 was how to accurately assess their current status and determine where and how to begin adopting the alarm management lifecycle model.

For most pipeline companies, the natural starting point was to begin with new alarm management philosophies. An alarm management philosophy document defines the basic definitions and plans for how alarms are categorized, handled, measured and reported. If an alarm philosophy already existed then a gap analysis to determine the distance between the actual alarm strategy in practice and the abstract alarm philosophy became a secondary entry point that quickly provided an indication of the magnitude of the alarm management challenge.

Many pipeline companies found that the most daunting task was execution because it requires a significant resource commitment and can be very labor-intensive. A key consideration for companies was how much of the effort they were willing and — more importantly — able to take on themselves vs. using subject-matter experts. There are many decision factors on how to best execute a rationalization such as 1) the availability of organization resources, 2) technical understanding of alarm management, and 3) the project costs.

A good alarm management software package that facilitates identification of alarm issues, rationalization, monitoring and assessment, and management of change (MOC) is a critical component in alarm management success. The software needs to be flexible and able to reliably communicate with whatever control system or combination of control systems a company has in place. This integration should not be a time-consuming part of the process because it shifts focus away from the real priority which is the alarms. The alarm management solution does not have to be complex but should provide access to and easy configuration of analysis reports.

Management of change (MOC) is another complex issue because it generally uses a combination of software and business processes to track, review and approve changes that impact the alarms. Companies can often spend money on some of the upfront activities and software only to struggle on the back end with effectively managing change within the organization. MOC is a particular challenge because it requires an ongoing organizational resource commitment to capture proposed changes, evaluate them against the established alarm management strategy and approve or reject the changes using a documented process.

Other activities such as operation, maintenance and auditing are part of the on-going lifecycle and their importance should not be minimized as drop-offs in these areas over time can undermine the work done in the other areas of the lifecycle.

Management support is an essential element of success for alarm management initiatives. Alarm management does not necessarily require a large financial investment, but to maximize ROI it does need to be a well-thought-out investment. From the development of the alarm philosophy document to the installation of monitoring, analysis and reporting software, companies must understand where their biggest challenges exist with alarm management and then create a plan that best addresses these problem areas.

Challenge

For many pipeline companies that were lacking in good alarm management analysis information, just determining where to start to clean up their current SCADA alarming was a significant challenge. A lack of in-house expertise on alarm management combined with limited resources available to drive alarm management programs exacerbated this problem. As a result, many pipeline companies relied on third-party alarm management companies with dedicated subject matter expertise to guide them through the process from development of alarm philosophy documents to alarm rationalization and eventually to implementation of alarm management software solutions for monitoring and analysis.

Another challenge for many pipeline operating companies was finding an alarm management solution that easily communicated with multiple SCADA platforms all with unique integration requirements. This was a particular area of concern for pipeline companies who have grown through acquisition of existing assets and left legacy control systems in place. Flexible and broad connectivity became one of the primary alarm management software selection requirements for many of these companies.

Once alarm management data collection was in place, pipeline companies then had to determine how to make use of the new wealth of information. While this would seemingly be an easy part of the process, it is not necessarily the case. Good alarm management software provides contextualized information that helps to facilitate easy analysis. However, that analysis must be followed up with specific actions to help resolve the issues as they are identified. Many pipeline organizations are not set up with clearly established ownership of the alarm issues or the resolution of these issues. It generally requires a team of controllers, maintenance technicians, SCADA engineers and alarm management resources working together to resolve identified alarm issues.

Solution

Pipeline companies discovered that to fully address alarm management they needed a combination of comprehensive alarm management software solutions with flexible service options. Each pipeline company started from a different point with unique challenges. For some, it made perfect sense to develop the alarm philosophy with in-house personnel and then execute the alarm rationalization as an internal team. For other companies, they needed consulting resources to guide the process.

The ultimate goal of alarm management implementations is to help identify alarm issues that contribute to distracting pipeline controllers from operating effectively. When nuisance alarms occur with high frequencies, they render all alarms less impactful. When events occur and controllers are flooded with alarms, the controller is limited in what they can effectively process, which often leads to incidents. Good alarm management is about being able to identify bad actor alarms, resolve root cause issues and optimize alarms so that when they occur they are meaningful and the controller has a clear action to take to resolve the alarm.

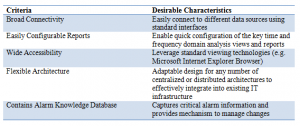

Pipeline companies quickly learned in evaluating solutions that the most effective alarm management software met several key criteria (Table 1).

Table 1: The most effective alarm management software meets several key criteria.

While the initial focus for most companies after the alarm management software installation is on taking advantage of analysis reports to identify nuisance alarms, bad actors and alarm interactions that is only the first step. Many pipeline customers are leveraging the alarm management information to capture alarm distributions across consoles and subsequently perform workload studies to help redistribute and better balance work tasks among controllers.

Benefits

Beyond the expectations of meeting the PHMSA regulatory compliance goals, many pipeline customers are also realizing many other significant benefits from their alarm management implementations. The rationalization process alone has helped many companies re-prioritize alarms and change philosophies so that alarms are now more meaningful to controllers. This process also leads to better clarity among controllers so that they understand the meaning when an alarm activates and are clear on the appropriate actions to take in response to the alarm. This is a significant improvement for many companies and — although difficult to quantify — has a positive impact on reducing risks and avoiding incident.

The quantifiable benefits for each pipeline company vary based on where they started from combined with how they implemented alarm management, but it is not uncommon to see reductions of pipeline control room alarms by as much as 50%. These reductions are significant and improve performance because controllers can shift their attention from dealing with distracting alarms to optimizing pipeline operations.

Another area where alarm management information is adding value is in workload studies. Pipeline operators are utilizing the alarm analysis data to help identify better ways of distributing work evenly across the control room. Some companies have even added consoles and controllers based on resource loading results generated from these studies.

By embracing the alarm and control room management initiatives, companies are making pipeline operations safer while also optimizing operational philosophies. Alarm management software is a cornerstone in these efforts, capturing vital alarm information and providing valuable analysis tools that have improved overall insight into pipeline operations.

Author

Daniel Roessler is the marketing director for TiPS Inc. in Georgetown, TX. He has an electrical engineering degree from the University of Texas at Austin and has been in the process automation business for more than 20 years.

Comments