September 2011, Vol. 238 No. 9

Features

Pennsylvania The New Hub Of Pipeline Work

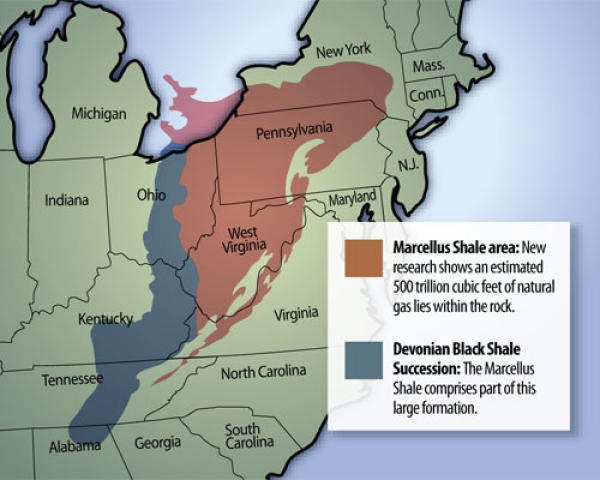

Pennsylvania and the Marcellus Shale natural gas reservoir are emerging as a key focus of natural gas pipeline operators, as the increasing gas flow spurs projects to bring it to customers in the northeastern U.S. and possibly Canada.

More than half of the interstate natural-gas pipeline projects proposed to federal energy regulators since early 2010 involve Pennsylvania — at a cost estimated at more than $2 billion, the Associated Press reported on Aug. 15. That means hundreds of new miles of transmission and gathering lines as part of the network that extends through Pennsylvania and neighboring states, as well as dozens of new or upgraded compression stations.

The projects employ thousands of contract workers and are creating work for steel mills, welders, gravel quarries and landscapers. Combined, more than a dozen projects proposed or already under construction would have the capacity to move an additional 4 Bcf/d — one-third of what analysts for Colorado-based Bentek Energy say is the average daily demand in the northeastern U.S.

“A lot of those projects are really designed to move the new volumes out of the Marcellus to your more traditional, historic pipelines that have served the Northeast markets for the last 30 or 40 years,” said Bentek’s manager of energy analysis, Anthony Scott.

He said about 3 Bcf/d is flowing from the Marcellus Shale. Production is rising quickly as crews busily drill more wells, and the flow should easily reach 7-8 Bcf/d in the next five years, Scott said. The exploration companies need to find takers for the gas, and analysts say more pipeline capacity is needed if the Marcellus Shale gas is going to ease winter price spikes at New York City and Boston-area hubs.

Where gas is flowing into interstate pipelines, largely in southwestern and northeastern Pennsylvania, it is displacing costlier gas from more distant sources including Canada, the Gulf Coast, Rocky Mountains or terminals that accept LNG, Bentek analysts said.

Similar pipeline construction followed earlier growth in shale gas production in Texas, Louisiana and Arkansas, said Jeffrey Wright, director of the Office of Energy Projects at the Federal Energy Regulatory Commission.

“You test it, you produce it and you develop it, and when things look promising, you have to have a way to get the gas to market, and that’s when the pipeline proposals start coming in,” Wright said.

Cathy Landry, spokeswoman for the Interstate Natural Gas Association of America, said pipeline construction historically has been driven by demand from gas utilities or power plant owners. With the growth in gas production, partly from the Marcellus Shale and other shale regions now being explored, it’s the exploration companies that are pressing for pipelines.

The $700 million expansion of Tennessee Gas Pipeline Co.’s 300 pipeline is under construction, employing 2,100 surveyors, inspectors and construction workers, according to the company. It is laying 127 miles of 30-inch pipeline — along the existing 300 pipeline where possible — through northern Pennsylvania and northern New Jersey, as well as installing two new compressor stations and upgrading seven others.

U.S. Shale Gas Weakening Russian, Iranian Petro-Power

Rising U.S. natural gas production from shale formations has already played a critical role in weakening Russia’s ability to wield an “energy weapon” over its European customers, and this trend will accelerate in the coming decades, according to a new Baker Institute study, “Shale Gas and U.S. National Security.” The study, funded by the U.S. Department of Energy, projects that Russia’s natural gas market share in Western Europe will decline to as little as 13% by 2040, down from 27% in 2009.

“The geopolitical repercussions of expanding U.S. shale gas production are going to be enormous,” said Amy Myers Jaffe, the Wallace S. Wilson Fellow for Energy Studies and one of the authors of the study. “By increasing alternative supplies to Europe in the form of liquefied natural gas (LNG) displaced from the U.S. market, the petro-power of Russia, Venezuela and Iran is faltering on the back of plentiful American natural gas supply.”

The study concludes that timely development of U.S. shale gas resources will limit the need for the United States to import LNG for at least two to three decades, thereby reducing negative energy-related stress on the U.S. trade deficit and economy. By creating greater competition among gas suppliers in global markets, shale gas will also lower the cost to average Americans of reducing greenhouse gases as the country moves to lower carbon fuels.

The Baker Institute study dismisses the notion, recently debated in the U.S. media, that the shale gas revolution is a transitory occurrence. The study projects that U.S. shale production will more than quadruple by 2040 from 2010 levels of more than 10 Bcf/d, reaching more than 50% of total U.S. natural gas production by the 2030s.

The study incorporates independent scientific and economic literature on shale costs and resources, including assessments by organizations such as the U.S. Geological Survey, the Potential Gas Committee and scholarly peer-reviewed papers of the American Association of Petroleum Geologists, “The idea that shale gas is a flash-in-the-pan is simply incorrect,” said Kenneth Medlock III, the James A. Baker III and Susan G. Baker Fellow for Energy and Resources Economics and co-author of the study. “The geologic data on the shale resource is hard science and the innovations that have occurred in the field to make this resource accessible are nothing short of game-changing. In fact, we continue to learn as we progress in this play, and it is vital we understand and embrace the opportune circumstances that shale resources provide. U.S. policymakers should not get diverted from the real opportunities that responsible development of our domestic shale resources present.”

Other findings of the study include that U.S. shale gas will:

* Reduce competition for LNG supplies from the Middle East and thereby moderate prices and spur greater use of natural gas, an outcome with significant implications for global environmental objectives.

* Combat the long-term potential monopoly power of a “gas OPEC.”

* Reduce U.S. and Chinese dependence on Middle East natural gas supplies, lowering the incentives for geopolitical and commercial competition between the two largest consuming countries and providing both countries with new opportunities to diversify their energy supply.

* Reduce Iran’s ability to tap energy diplomacy as a means to strengthen its regional power or to buttress its nuclear aspirations.

The study is available on line at http://www.bakerinstitute.org/publications/EF-pub-DOEShaleGas-07192011.pdf/view

Advisory Board Panel Releases Shale Gas Recommendations

A panel of high-profile advisers to Energy Secretary Steven Chu released a series of consensus-based recommendations last month, calling for increased measurement, public disclosure and a commitment to continuous improvement in the development and environmental management of shale gas, which is now nearly 30% of natural gas production in the U.S.

Increased transparency and a focus on best practices “benefits all parties in shale gas production: regulators will have more complete and accurate information, industry will achieve more efficient operations and the public will see continuous, measurable, improvement in shale gas activities,” the report says.

The report calls for industry leadership in improving environmental performance, underpinned by strong regulations and rigorous enforcement, evolving to meet the identified challenges.

“As shale gas grows and becomes an increasingly important part of our nation’s energy supply, it is crucial to bring a better understanding of the environmental impacts — both current and potential — and ensure that they are properly addressed,” Subcommittee Chairman John Deutch said.

“The current output of shale gas and its potential for future growth emphasize the need to assure that this supply is produced in an environmentally sound fashion, and in a way that meets the needs of public trust.

“Better data will help the industry focus its investments, give the public the information it needs to effectively engage, and help regulators identify and address the most important problems,” Deutch

continued. “We’re issuing a call for industry action, but we are not leaving it to industry alone.”

The Energy Advisory Board Shale Gas Production Subcommittee was convened by Secretary Chu at the direction of President Obama who observed that “recent innovations have given us the opportunity to tap large reserves —perhaps a century’s worth” of shale gas.

The subcommittee was assigned to produce a report on the immediate steps that can be taken to improve the safety and environmental performance of shale gas development. The report includes recommendations in four key areas:

1. Making information about shale gas production operations more accessible to the public.

2. Immediate and longer-term actions to reduce environmental and safety risks of shale gas operations, with a particular focus on protecting air and water quality.

3. Creation of a Shale Gas Industry Operation organization committed to continuous improvement of best operating practices.

4. Research and development (R&D) to improve safety and environmental performance. The report finds that, while the majority of shale gas R&D will be performed by the oil and gas industry, there is a role for the federal government.

“We are mindful of the nation’s financial constraints,” Deutch said. “But we do see a key role that can be played by modest government support for R&D around environmental questions.”

The report is available at: http://www.shalegas.energy.gov/index.html

Shale Plays, Midstream Assets, Foreign Investments Drive Oil & Gas

Ongoing interest in shale acreage, deals for midstream assets and increased investments from foreign buyers in the U.S. oil and gas industry helped drive U.S. oil and gas mergers and acquisitions value to $39 billion in the second quarter of 2011, according to PwC US.

In the second quarter, there were 51 deals with values greater than $50 million, compared to 61 announced deals totaling $41 billion in the same period last year. While the volume and value of transactions dipped when compared to the same period last year, average deal value for deals over $50 million jumped to $765 million in the quarter, a 14% increase over the same period last year when average deal value was $672 million.

“There continues to be steady M&A activity in the oil and gas sector with strong competition for prized assets, which has maintained the deal momentum throughout the first half of the year. The second half has already kicked off with one mega deal announced, and we expect that deal momentum to continue,” said Rick Roberge, principal in PwC’s energy M&A practice. “Foreign and private equity interest in North American oil and gas assets remains very high and will likely be a driver of ongoing activity.”

For deals valued at over $50 million, there were 11 midstream deals that accounted for $19.9 billion, or 51% of total deal value, compared to six deals worth $3.4 billion in the same period last year. Seven of the top 10 deals by value in the second quarter were related to shale plays, including four upstream deals and three transactions in the midstream and oil field services space. For all deals greater than $50 million, there were 10 shale-related transactions totaling $7.5 billion, or 19% of total deal value, including two deals involving the Marcellus Shale totaling $2.3 billion.

“Shale-gas assets continue to be very attractive acquisition targets as multinationals look to gain technical know-how and exploit the long-term value and opportunities from rising energy needs,” said Steve Haffner, a Pittsburgh-based partner with PwC’s energy practice. “At the same time, there is tremendous activity developing around natural gas infrastructure which is necessary to move the extracted gas to market. The U.S. ‘shale gale’ continues to attract the attention of global companies.”

“With oil prices hovering at $100, private equity funds continue to make a very strong push in the oil and gas sector,” added Roberge. “The private equity deal makers, who used to largely play in the midstream space, are now heavily involved in exploration and production, shale plays, and oil field services and equipment sector. However, along with the great opportunities and rewards of investing in oil and gas, there is still risk in this space – and new entrants need to understand the pitfalls before trying to exploit these possible opportunities.”

Another potential driver for M&A activity is the desire from some oil companies to sell assets and break apart key lines of business, according to PwC.

E&P Firms Outside North America To Boost Spending 35%

Fueled in large part by strong oil prices, capital spending on exploration and production by 139 publicly traded oil and gas companies studied is expected to increase by 12% to $406 billion in 2011, building on gains of 19% in 2010, according to a report from IHS.

“Although this modest increase is less than the 19% rise in 2010, oil and gas companies, many of which decreased spending considerably during the economic downturn of two years ago, are continuing to increase their investments in their upstream portfolios, particularly for oil-weighted projects,” said Aliza Fan Dutt, senior analyst at IHS, and author of the IHS Herold Global E&P CAPEX Review.

“Despite recent volatility and a wobbly economic recovery, oil prices remain relatively strong, which supports higher upstream spending. In addition, investments in oil and unconventionals continue at a rapid clip, while conventional gas outlays remain relatively depressed,” she said.

The shift to drilling on oil and liquids-rich properties that began in 2010 accelerated through the year and continues today, said the report. According to Fan Dutt, “those companies that shifted their portfolios earlier will benefit more than those that moved more slowly.”

EOG Resources, for example, an established natural gas producer, shifted to the oil-side much earlier than most of its peers. As a result, oil now contributes 60% of EOG Resources’ revenues and the company is posting strong earnings growth.

”Cost inflation will continue to be a key issue, with more companies competing for oil services and equipment during a time of elevated oil prices,” said Fan Dutt. “Cost containment will be particularly important for natural gas-weighted producers as they struggle to achieve strong margins amid weak natural gas prices.”

“U.S. Pipelines, Power and Diversified”-classified companies should boost upstream spending by 49%, which is largely tied to infrastructure investments needed to support the tremendous influx of gas production in the peer group of “U.S. Companies in the Outside North America E&Ps” will boost spending 35%, with a focus on emerging markets.

“A healthier economy will back attractive upstream opportunities overseas,” said Fan Dutt, “many of which are in areas that are risker both politically and geologically. For example, companies like CNOOC (China National Offshore Oil Corp.) do not plan to slow down their upstream expansion to fuel growing Chinese demand.”

“Mid-Sized U.S. E&Ps” will see a healthy 25% increase in spending, while the “U.S. Integrated Oils” are expected to reduce the rate of increase to 14% this year. Marathon Oil is the most aggressive, ramping up spending by 37% as it drills on expanded U.S. acreage in the Anadarko Woodford play, the Niobrara play in the Denver-Julesburg basin in Colorado and Wyoming and in its Bakken shale position.

On the other hand, the “Largest North American E&Ps” will increase capital outlays by only 3%, which will be buttressed by spending on unconventional resources in shale basins, noted the report. For example, Pioneer is increasing its spending by 53%, with its expansive holdings in the Spraberry field and Eagle Ford shale play, where it was an early entrant.

Petrobras continues to invest heavily on its expansive upstream portfolio, with an expected 24% increase in spending. Lukoil is slated to spend 55% more this year.

Comments