July 2011, Vol. 238 No. 7

Features

Changing Natural Gas Midstream Capital Forecasted for 25 Years

New areas of hydrocarbon production in the U.S. and Canada are supplying more and more natural gas, crude oil and natural gas liquids (NGLs) as production comes from shale deposits and other unconventional resources.

At the same time, new consumption centers are developing, especially for natural gas and NGLs. Both of these, supply and demand, are making significant changes to the fossil fuel infrastructure and making the need for additional capital.

A subsidiary of the natural gas trade group, INGAA (Interstate Natural Gas Association of America), the INGAA Foundation, commissioned the energy research group, ICF International, to do a study of the capital requirements for the midstream section of the natural gas industry for the next 25 years – 2010 through 2035. The report, North American Natural Gas Midstream Infrastructure through 2035; A Secure Energy Future, issued in June, provides significant information not only for the expected capital requirements of the industry’s midstream sector but a good forecast of the natural gas industry’s demand and pricing through the report period.

The report updates a 2009 study done for the Foundation on the infrastructure because of the changes in the natural gas industry from the develop- ment of extracting oil and gas from shale deposits and other non-conventional formations in recent years and the outlook for expanded use of natural gas in electric generation.

The natural gas midstream infrastructure consists of gathering systems, processing plants, transmission pipelines, storage fields, and liquefied natural gas (LNG) terminals. Sufficient infrastructure is needed for efficient delivery and well-functioning natural gas markets. A poor infrastructure leads to price volatility, shrinking markets, and the possibility of stranded supplies or resource production.

According to the ICF study, United States and Canada natural gas infrastructure will require an investment of $205.2 billion (real $2010$) over the 25-year period from 2011-2035 or about $8.2 billion per year. To get some perspective of this amount, the natural gas industry generates about $93 billion per year at current gas consumption and current wellhead pricing, not including income from natural gas liquids.

According to history of the industry, this amount can be met to keep the industry strong and vibrant. Don Santa, president of INGAA, noted that “interstate pipeline expenditures alone met or exceeded $8 billion per year in three of the years between 2006 and 2010.”

The report goes into detail where and how the expenditures will be used. Major regions of the country receiving funds will the supply-rich Southwest (21%), followed closely by Central (19%) and the Southeast (19%). Major areas of the midstream infrastructure receiving funds will be Gas Transmission Mainline (48%), Gathering Line (21%), and Laterals to/from Power Plants, Gas Storage (15%).

Equally as interesting as the forecast of the capital expenditures are the energy and economic considerations used in making the forecast. The report is an excellent source for the supply/demand and pricing outlook for the natural gas industry through 2035.

The report used the ICF April 2011 reference case for developing the report and supplying the industry outlook on supply/demand and pricing. For pricing, the authors projected real gas prices (Henry Hub) rising from $4 to between $6 and $7 per MMBtu (2010$) by 2021 and through the end of the study period. According to the authors, this price level is “sufficiently high to encourage substantial gas supply and development, but not high enough to limit market growth significantly.” Prices used are shown in Figure 1.

Other significant economic parameters used in the forecast include a population growth at an average rate of 1% per year, Growth National Product (GDP) was assumed to grow at an average 2.8% per year, electric load will grow at an average 1.3% per year and crude oil prices average about $80/B in real terms. Temperatures were consistent with average conditions for the past 30 years.

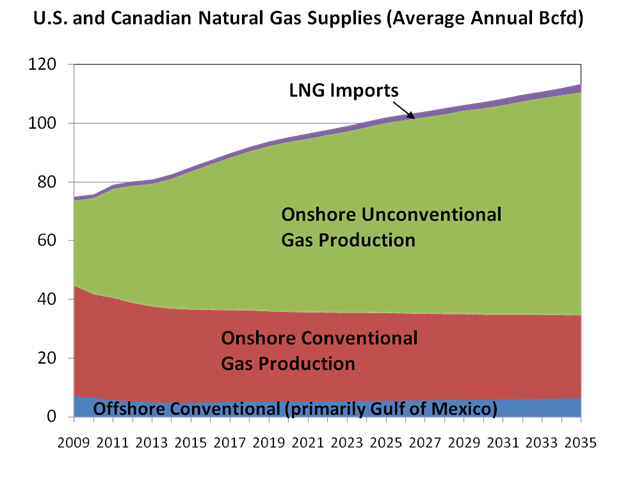

Natural gas consumption in the U.S. and Canada is projected to increase by an average 1.6% per year through 2035. Total natural gas use across all sectors is projected to rise to about 109 Bcf/d in 2035. Incremental demand growth between 2010 and 2035 is 35 Bcfd, of which 26 Bcf/d or 75% occurs in the power sector. From a newly projected natural gas resource base of almost 4,000 Tcf, U.S. and Canadian natural gas supplies are projected to grow by 38 Bcf/d from about 75 Bcf/d in 2010 to about 113 Bcf/d in 2035, adequate to meet expanded demand projections in 2035. Unconventional natural gas supplies account for all of the incremental supply as production from conventional areas declines.

Since a major force in the need for an update was because of the rather recent development of shale and other unconventional sources of natural gas, crude oil, and NGL supplies, the report discusses these changes.

According the report, current gas supplies are about 27.4 Tcf in 2010 and will go to 41 Tcf to meet demand of 40 Tcf in 2035. (Their current estimate is a little high according to the Energy Information Agency which shows 22 Tcf for dry gas produced but does not include gas used for field use, etc.)

The report assumes unconventional supplies (shale, coal bed methane, and tight gas plays) will account for two-thirds of the gas supply in 2035. Net LNG and other imports (Canada) will be approximately 2.5% of supply compared with 1.7% in 2010.

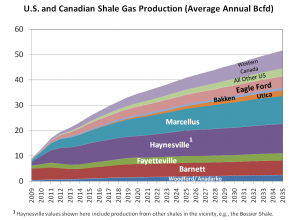

Shale plays in the U.S. and Canada have become some of the fastest growing production areas in the world. The report estimates that current production of about 13 Bcf/d in 2010 will go to 52 Bcf/d by 2035. The Barnett shale was started over 10 years ago and newer ones have started more recently. Some of the plays are in distinct new areas and open the need for additional infrastructure because of this.

The potential for large hydrocarbon production include the gas-rich Marcellus and Haynesville fields and the Bakken and Niobrara more liquids-prone (crude and NGLs) fields. Another important field is the Eagle Ford which will also be high in liquids. Figure 3 shows the production and forecast for the various shale plays.

The report acknowledges the specific considerations for NGLs. Since liquids either as crude oil or NGLs are commanding higher prices, the importance of potential plays in liquid rich areas is considered. Natural gas liquids production in the report increases by 2% annually. Ethane, propane, butane, and pentanes are projected to increase by 2.3%, 2.1%, 1.7% and 1.6% per year, respectively.

According to the report, several gas and oil plays have high liquids contents which include Eagle Ford in South Texas, parts of the Marcellus, and the Utica shale play in West Virginia, Ohio, and Pennsylvania, the Bakken oil play in North Dakota, and the Niobrara and Green Rivers plays located in Wyoming and Colorado.

In building the forecast, ICF used what it believed the “most likely scenario” for natural gas market development. It acknowledges that there are some “big market movers” and some “smaller market movers” that could have a significant affect on the gas market development. The report includes this analysis listing the different potential market changers.

The report surmises that gas supply development is permitted to continue at recently observed activity levels – no significant restrictions on permitting and fracturing beyond current restrictions. There would be no significant hurricane disruptions to natural gas supply (20-year average).

The study does not foresee Arctic projects (specifically no Alaska and Mackenzie Valley gas pipelines). Net LNG exports occur only at the Kitimat facility in the Northwest (no net LNG exports from elsewhere in the U.S. and Canada). CNG vehicles are assumed to be limited to commercial fleets and buses.

The report and a separate Executive Summary are available from INGAA through its website, INGAA.org.

Editor’s Note: Carol Freedenthal has been a consultant in the energy industry for more than 40 years and his “Burnertip” column appears every other month in P&GJ. Look for his point of view on midstream issues at www.pgjonline.com/midstream. He can be reached at cbfreedenthal@oildom.com.

Comments