May 2010 Vol. 237 No. 5

Features

From Drake To The Marcellus Shale Gas Play-- Midstream Developments

Editor’s note: This is part 3 of a series on the Marcellus Shale Play by Derek Weber. See part 1 on Marcellus transmission and part 2 on distribution.

The major drivers of midstream infrastructure buildout in the region are learning to read the Marcellus. Just what makes the Marcellus play different aside from its scale? Recognizing the indigenous challenges that are unique to this play and developing the solutions to overcome them are going to be paramount.

Existing gas pipelines in the region currently include those built and operated by NiSource/Columbia Gas Transmission, Spectra/Texas Eastern Transmission, Tennessee Gas Pipeline 300 Line, Dominion Transmission pipelines and Transcontinental Gas Pipeline’s assets. It is widely understood that this existing network of pipelines will prove inadequate to the challenge of bringing Marcellus gas to market as production levels continue to increase. In recognition of this fact a broad array of new pipelines, as well as expansion projects are currently in the planning phases or are already under way with at least 6+ Bcf/d of new pipeline capacity planned.

The challenges of building pipeline systems are varied. Each location comes with its own distinctive set of challenges; differences in costs boil down to mixed-bag equations of geography, weather, regulations and manpower to name just a few. Across North America, a quick tale of the tape reveals some the challenges and struggles associated with completing these complex buildouts: in the Rockies – weather, environmental issues, terrain and seasonal disruptions; in the Haynesville – a powerful rainy season, hurricane season and Louisiana Law (not in order of calamity); in the Barnett – highly populated areas, rights-of-way, city councils, homeowner associations, noise abatement and light pollution. Beyond all else one thing is clear, unconventional resource plays across North America have one important factor in common–they all are associated with the use of massive amounts of water. Operators in the Marcellus Shale play are faced with a gamut of restrictions on the availability of water for use in hydraulic fracturing (hydro-fracing) and the lack of treatment and disposal facilities to deal with flow-back water. The issues involving the disposition of water and natural gas liquids (NGLs) are going to be at the front and center of this buildout.

Midstream Gathering

Natural gas industry experts recognize that critical midstream gathering buildouts, forecast at $10B in spending through 2013; with the construction of complex systems and processing facilities will be essential to success in the aggregate. Finding cost effective solutions to challenges such as frac water use and disposal, facility access and regional manpower shortages are going to be of huge import as the region connects key producer wells to major transmission points and LDC networks.

In terms of a comparison with the Barnett, or better yet a lesson from Barnett to be considered by those entering the Marcellus, according to many insiders, is that in the end there was not enough capacity built in Texas, that in the final assessment not many facilities were too big, but many were too small and that planning will prove critical in the Marcellus.

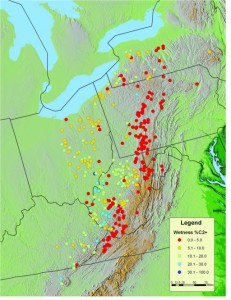

The Marcellus region, although by no means homogenous in regards to geographic considerations, is comparable even across a play that stretches nearly from Buffalo to Nashville. Of particular note, what is required in the key two-fold heart of the play–Southwest Pennsylvania and West Virginia; and Northwest Pennsylvania and Southern New York – where most of the major drilling activity and midstream gathering development is taking place or planned. Regional actors are finding that processing Marcellus gas sometimes requires no processing at all depending on geography with the bulk of the supply being dry gas. Marcellus and conventional Appalachia gas located in West Virginia and Kentucky are coming in richer and therefore some processing has been added recently to accommodate increased drilling activity.

On the Southwest side of the Southern part of the play and on the East side of the Northern play, dry gas of pipeline quality between 1030 -1040 Btu (within the 985 – 1085 range for pipeline gas) flourishes. Although some Marcellus gas and conventional Appalachia gas is in the 1300-1400 Btu range.

Geography and weather are playing a major role in the development of the Marcellus, the tests of difficult terrain and the trials of harsh weather are demanding masters. The strong potential for cost increases and time delays due to terrain and weather extremes are requiring painstaking routing reviews, planning and topographical studies. In Pennsylvania, the sheer number of river crossings is proving to be a serious challenge, with this state home to the most miles of stream of any of the lower 48. The expansion of producer wells, compressor stations, gathering systems and pipelines have a host of inherent and significant impediments associated in regards to access in many rural areas.

Many of these sites are serviced by, at best, narrow windy roads which have to be used in order to facilitate the movement of critical personnel, equipment and water. The use, storage and in some cases re-use of water for hydro-fracing, as well as, transporting condensate in wet gas regions is a major issue considering the sheer volume of traffic. The burden of trucks hauling water have necessitated the development of dedicated water transmission lines, usually by the E&P firms themselves. These are often built next to gathering and midstream pipelines for the transportation of waste water from production wells to tanks or pits destined for treatment and/or storage. Most storage tanks simply cannot pump enough water to be directly utilized for hydrofracing and E&P and midstreamers are still obliged to truck these commodities in and out.

Dealing with NGLs is another major issue and while there is an existing market for propane, the absence of any regional ethane market will certainly require solutions that must include an expansion of current take-away capacity. Recently, Enbridge Inc. announced plans to build and operate the first major NGL pipeline in the Marcellus; planned to connect the Southwest fairway to NGL processing assets in the Midwest. The proposed pipeline could connect to Aux Sable (which has spare fractionation capacity) or other existing systems in Chicago area.

In addition, Buckeye Partners, LP and NOVA Chemicals signed a memorandum of understanding to develop a Marcellus, mixed NGL pipeline linking Pennsylvania to Corunna, Ontario.

One trend that is starting to accelerate among the E&P companies is the divesting of their own homegrown midstream and gathering assets to primarily midstream and gathering entities; sometimes in a cooperative framework, relying on burden sharing and redundancy elimination, away from the single use private systems that individual producers have been forced to take ownership of in the last three years.

Ernst and Young’s Jon McCarter has predicted that private equity capital should initially gravitate toward midstream-oriented transactions and other oil and gas businesses less impacted by commodity price exposure as the M and A pace increases. “We have seen more interest from a private equity standpoint, and the master limited partnerships will continue to be ‘serial transactors,'” he observed. “Midstream has been more active recently and I don’t see it slowing down.”

Caiman Energy

Caiman Energy–a high-profile, Texas-based midstream energy service provider, backed by EnCap Energy Infrastructure Fund L.P.–has emerged as one of the most effective dedicated Marcellus midstream companies active in the region after inking a series of recent agreements with Trans Energy, a St. Mary’s, WV based E&P; AB Resources LLC, a Brecksville, OH based exploration and development company and Chief Oil & Gas, LLC.

Jack Lafield, President of Caiman Energy has spoken at great length to both industry leaders as well as government officials about the pulse of the natural gas industry. Lafield also brings just a small helping of the “vision thing,” a must for any chief executive with 25 years of experience, including frontline leadership roles in the Barnett. He has articulated better than most some of the most pressing challenges facing midstreamers in the Marcellus, along with a number of practical and economical solutions.

Reflecting on his experiences in the Barnett, Lafield states, “What we found in 2003 was that it was going to be a huge deal at 1 Bcf/d. A year later it was 3 Bcf and the year after that 6 Bcf.”

In terms of what lies ahead in the Marcellus, Lafield says, “Marcellus is a real play and a great deal larger (than Barnett). The first well will be the worst well – and with the flow rates we are seeing that represents an amazing baseline to start with. The fact is that the market is going to Marcellus because it just has better economics; it is closer to the market. You start checking boxes on the Marcellus and not many boxes remain unchecked in the end.”

Of all the challenges and solutions that face Midstream companies operating in the Marcellus, Lafield is unequivocal, “The right people are the critical asset requirements. You can deal with terrain and things like NGL issues or coal, but the right team that understands how to plan and execute in the midstream space is going to be the key to unlocking the Marcellus.”

Trans Energy, a rapidly growing oil and gas exploration and development company, and Caiman announced the details of an agreement in late November 2009 for Caiman to design, construct, and operate midstream pipelines and processing facilities in West Virginia; ultimately connecting to interstate pipelines, with Trans Energy also selling Caiman its Wetzel County, WV pipeline system which will be used as part of a proposed 30 mile gathering system.

In that same month, AB Resources announced a similar agreement for Caiman to design, construct, and install midstream gathering and processing facilities; with AB having rights up to 60,000 MMBtu/d of firm capacity with the capability to move significantly larger overall volumes on the legacy gathering system. A 120 MMcf/d cryogenic processing plant is currently under construction and expected to be operational by the fourth quarter in 2010.

In early 2010, Caiman again signed definitive agreements with Chief Oil & Gas, LLC and its partners to provide midstream gathering services for over 250,000 of Chief’s lease acreage position in Pennsylvania, West Virginia, and Maryland.

Laurel Mountain Midstream

Williams, as a long standing and active midstream sector actor with assets throughout North America, in 2009 formed Laurel Mountain Midstream LLC, a Marcellus midstream JV with Atlas Pipeline Partners, LP. The agreement saw Williams operating the gathering system and holding a 51% ownership stake. In the deal Williams also agreed to contribute $102 million and issue a $25.5-million note payable to the new joint venture.

On the new venture, Daryl Grieger, regional vice president and general manager, Laurel Mountain Midstream, from his office in Coraopolis, PA explains, “What we have is a smaller diameter system; it is not made for Marcellus wells. LMM is building a new larger diameter pipeline system layered on top of the legacy system in Fayette, Greene, Washington and Westmoreland Counties (PA) that will ultimately be capable of transporting over 500 MMcf/d of shale gas.”

Currently, LMM provides gathering service for producers on 6,900 existing conventional wells; delivering natural gas into its system with an average throughput of more than 100 MMcf/d. LMM also owns and operates approximately 1,800 miles of intrastate gathering lines in western Pennsylvania, western New York and eastern Ohio. The existing southwestern Pennsylvania gathering system, where most of the Marcellus activity is planned to take place, is well positioned to connect with a number of major interstate pipelines and expansion projects currently under way.

To better address pressure-related issues on the legacy gathering system in southwestern Pennsylvania, LMM initiated three major looping projects in Greene and Fayette counties, which are expected to add approximately 30 MMcf/d of incremental capacity in Q2. In addition, “Williams employs a large scale model on compression; planning a single centralized Shamrock Station, in Germantown, PA, Fayette County,” Grieger adds.

![]()

“Laurel Mountain Midstream and Williams,” Geiger continues, “Are continually focused on best practices; operating a safe system that meets regulation guidelines and working within the community. These Midstream assets will be in place for 50 years – that is what is truly unique about the midstream side of the business; assets and the long term jobs that go hand in hand with this kind of development.”

Outside of the Marcellus, Williams also has gas gathering and processing assets in Colorado, Kansas, New Mexico, Pennsylvania, West Virginia, the Gulf Coast and Canada; 18 natural gas processing, treating and or production handling facilities and over 8,000 miles of natural gas gathering lines with a combined 8 Bcf/d capacity.

Dresser Inc.

Dresser, Inc., a highly diversified multi-billion dollar global oil and gas products and services company with a presence in over 100 countries, has a long history and wide regional footprint, charting over 129 years of technology innovation in the natural gas industry from its roots and foundational home in Bradford, McKean County, PA to its present-day scale. Dresser Inc. holds a well earned position as a global solutions provider, with brands: Wayne, Roots, Masoneilan, Consolidated, Waukesha and Dresser products.

The company supplies pressure regulators and flow control valves for the natural gas industry. This includes the Mooney, Becker and RedQ. All are known and proven throughout the distribution, transmission and midstream segments of the industry for unparalleled performance, positive shut off, ease of maintenance, low minimum operating differential, reliability and versatility. Coupled with no bleed pilots and control instrumentation, the result is a highly accurate pressure or flow control device that maximizes operations and uptime.

As John Schnitzer, manager of marketing for the Mooney and RedQ lines states, “customers that want a proven and rugged device that offers quick response to set point change and opens at minimal differential choose our solutions as their preferred choice. Not only do the Mooney FlowGrid, FlowGrid Slam Shut, FlowMax, FlowTap and FlowMax regulators provide performance that meets the demanding operational needs, they are also the industry’s easiest to maintain which means greater uptime and lower O and M costs.”

Schnitzer continues, “In terms of the Marcellus, Dresser is providing value from wellhead to pipeline within this highly active producer and midstream segment. With most of our customers running lean we are finding the need critical for ‘set it and forget it’ features; especially in the more remote locations. Our customers are looking for products that can operate effectively from very low flows to very high flows, with minimal parts, without having to disassemble; and with no special tools.”

As Greg Giernoth, manager of marketing for the Becker line states, “the Becker family of control valves including the T-Ball and V-Max provides self cleaning/non clogging operation, options for noise abatement trim, a wide range of flow/bidirectional operation and low differential performance.” He goes on to state that Becker instrumentation is, “unmatched in the prevention of fugitive gas emissions. The reduction in bleed gas can provide payback of the equipment costs in a short amount of time while also protecting the environment. Our Marcellus customer base knows our value set, knows our products and knows our people. This is about trust and reliability at the most basic level.”

Dresser, Inc. is also an approved station fabricator to all major gas transmission pipeline companies and one of the largest turnkey solutions providers located directly inside the Marcellus regional hub. Piping Specialties products and FloSystems solutions are designed and manufactured out of Dresser’s 340,000 sq. ft. state-of-the-art facility in Bradford, PA with a focus on an array of measurement and regulation solutions to producers, transmission companies, midstreamers and Utilities.

Conclusion

Col. Drake’s original achievement was a significant milestone on the road to modernity in tapping oil and gas reservoirs. The original 25 bpd that the Drake Well produced grew in 12 years to 5.8 million barrels per year region-wide. The unprecedented growth experienced in the Appalachian Basin after Drake’s persistence in Titusville, PA, brought workers, entrepreneurs and dreamers alike to the rolling hills and steady streams of the area, with the chimera of energy riches from this first rush fueling the creation of boom towns across the region.

Over the course of the intervening years assumptions about natural gas exploration and production have changed in fundamental ways, including exploration in previously bypassed source rock. In the cyclical way of such things, the tracks of opportunity that raced out over the horizon have retraced themselves around the globe and back again. No example is more relevant or timely in North America than the Marcellus Shale play.

The Author

Derek Weber is business development manager – Marcellus Activity, Infrastructure Solutions, Dresser Inc. Contact details: Ph: 518-951-6336, email: Derek.weber@dresser.com.

Bibliography

Airhart, Marc, “The Barnett Shale Gas Boom – Igniting a Hunt for Unconventional Natural Gas Resources”.

Barlas, Stephen, “TGPC Could Be First To Carry Marcellus Shale Gas”, 2010 Budget News.

Considine, Timothy; Robert Watson, Rebecca Entler, Jeffrey Sparks, “An Emerging Giant: Prospects and Economic Impacts of Developing the Marcellus Shale Natural Gas Play”, The Pennsylvania State University College of Earth and Mineral Sciences, Department of Energy and Mineral Engineering, August 5 2009.

Driver, Anna, “U.S. energy companies bullish on Marcellus shale”.

Kell, John, “Spectra Reaches Pact to Expand Two Projects”, WSJ Dec 29 2009.

King, Byron W., “Rocks, rock oil and peak oil”

Payne, Darwin, Initiatives in Energy: The Story of Dresser Industries 1880-1978, Simon & Shuster, New York, 1979.

Tronche, John-Laurent, “Marcellus Shale – Appalachian Basin Natural Gas Play”.

Comments