March 2010 Vol. 237 No. 3

Features

From Colonel Drake To The Marcellus Shale Gas Play - Transmission Developments

(Author’s note: This is the first part of a three-part series on the Marcellus Shale Play. Part two will cover distribution, and part three focuses on production and midstream).

Gamechanger is just one of the compelling terms being used to describe emerging shale gas plays across North America. In light of the red-hot intensity surrounding the largest of these, the Marcellus Shale Gas play, now recognized as the largest unconventional natural gas reserve in the world – with estimated recoverable reserves of at least 489 Tcf – it seems particularly relevant to remember the Greek philosopher Heraklietos and his axiom, that change is the only constant in the universe.

The scale of the Marcellus, at 22.4 million acres, coupled with the region’s historical relevancy in the development of the modern oil and gas industry, might also lend credit to another complementary point of view – the more things change the more they seem to stay the same and, on occasion, even repeat themselves.

Both sentiments ring freshly true as 150 years of history come full circle, bridging the past to the present and connecting the start of “Colonel” Edwin Laurentine Drake’s original boom in 1859 to today’s Marcellus play. The Marcellus Shale formation had been well-known by operators in the Appalachian Basin – having been historically viewed as a drilling hindrance to tapping conventional gas reserves. It now is widely seen as the quintessential American energy solution in a carbon-constrained world. The change was precipitated through widely reported advances in horizontal-drilling technologies and hydro-fracturing processes, twin catalysts which have turned this proverbial separation of wheat from chaff directly on its ear.

The Marcellus Shale gas play is part of the Devonian Black Shale Succession that spans seven states in the northeastern U.S., covering an estimated 54,000 square miles stretching across New York, Ohio, Pennsylvania and West Virginia, as well as extending through parts of Tennessee, Virginia and Kentucky (see Marcellus map, above). Final estimates of the resources located in the Marcellus had been on a slow burn since the 2002 publication of the U.S. Geological Survey, “Assessment of Undiscovered Oil and Gas Resources of the Appalachian Basin Province,” which calculated the Marcellus Shale as containing about 2 Tcf of natural gas. By 2007, studies produced by researchers Gary Lash at Fredonia State College and Terry Engelder of Pennsylvania State University predicted that 500 Tcf to 1.3 quadrillion cubic feet (Qcf) of recoverable reserves lay within the shale. This increase of many orders of magnitude tracks closely with the compound successes that have broken through in the Barnett play in Texas.

The momentum being created by the size of the Marcellus play in close proximity to mature markets, coupled with investor confidence in emerging shale gas plays, has only accelerated development plans. On the ground, producers have been impressing industry observers with the publication of Marcellus well flow rates that often transcend the substantial and approach the celestial. Transmission companies have followed suit by announcing a staggering assemblage of new and expanded pipeline projects – a count hovering around 24 projects destined for in-service dates over the next 36 months.

Marcellus Well Flow Rates

The unique challenges of developing the Marcellus are going to be front and center as interest in this play continues to snowball and infrastructure buildout plans accelerate among producers, pipeline companies and midstreamers, all anticipating a very busy 2010 and beyond.

The industry has seen the search for unconventional gas reserves return to many a well-known locale; certainly the Barnett Shale area of north-central Texas had been regarded as being tapped out after a half century of extensive oil and gas drilling. However, in less than 10 years, the Barnett Shale play became one of the largest in the country, with 15 Bcf/d built or under construction. The Barnett Shale gas play experienced more than a 3,000% rate of growth between 1998-2007.

The Barnett of the Fort Worth Basin remains the most common and consistent comparator used to model future activity and results in plays such as Marcellus. Highly productive to this day, it will continue to serve as an example of what may yet come to pass in Marcellus. Many anticipate that, in time, Marcellus will simply eclipse Barnett in production; but getting there will require infrastructure buildouts even the most imaginative would be hard-pressed to envision.

Existing gas pipelines in the region include those built and operated by NiSource/Columbia Gas Transmission, Spectra/Texas Eastern Transmission, Tennessee Gas Pipeline, Dominion Transmission and Transcontinental Gas Pipeline.

Together, the existing pipeline capacity flows throughout Appalachian and Marcellus territories onto the greater Northeast gas markets. It is widely understood and commented upon by the pipeline companies that the existing network of pipelines will prove inadequate to the challenge of bringing Marcellus gas to market as production levels continue to increase. In recognition of this fact, a broad array of new pipelines, as well as expansion projects, are in the planning phases or are already under way with 6+ Bcf/d of new pipeline capacity planned.

Of course, the challenges of building pipeline systems vary from locale to locale. The Marcellus, like all other resource plays of the last 10 years, comes with its own unique set of challenges; differences in overall play costs boiling down to a mixed-bag equation of geography, weather, regulations and manpower, to name just a few. Some, but not all companies, now engaged in the Marcellus have previously worked in the broad infrastructure buildouts that occurred and continue to happen in plays such as Barnett, Haynesville, Eagle Ford and Fayetteville.

Transmission

The list of major pipelines projects planned, representing greater than 6 Bcf/d of new capacity include Tennessee Gas Pipeline’s 300 Line Expansion Project; Spectra Energy’s Texas Eastern Transmission TEMAX and TIME III Projects; NiSource’s Marcellus Pipeline, Columbia Penn, Line 1804 Expansion and 1711 Pipeline Corridor; Dominion’s Appalachian Gateway Project; Williams-Dominion Keystone Connector Pipeline; and National Fuel Gas Supply’s Lamont PA Expansion, Line N Expansion, West-to-East (W2E) Project and Appalachian Lateral Pipeline. These are just some of the new pipeline and expansion pipeline projects in the works. Others are being planned to meet demand from producers across Marcellus.

Tennessee Gas Pipeline’s expansion of its existing 300 Line has a binding Precedent Agreement in place with EQT for a 15-year term, representing 100% of the project’s capacity. It would link EQT production wells in the Appalachian Basin to market. The 300 Line expansion project will contain seven looping segments through New Jersey and Pennsylvania; 128 miles of 30-inch pipeline; two new compressor stations in northwest Pennsylvania and upgrades to seven compressor stations already in use. TGP expects the 300 Line Expansion project will increase delivery capacity in the region by approximately 340 MMcf/d with delivery points along the total 300 Line pathway and thus into a number of interconnections with other significant pipelines in northern New Jersey, as well as a pre-existing delivery point located in White Plains, NY.

Spectra Energy Corp. is also moving ahead to develop pipeline projects in Pennsylvania, New York and New Jersey to take advantage of new shale gas and provide Marcellus producers access to market. The projects include focused Marcellus expansions to Spectra’s Texas Eastern Transmission and Algonquin pipelines, and to a lesser extent, possible tie-ins with TEMAX and TIME III projects as they progress.

Chesapeake Energy Marketing, Inc., a subsidiary of Chesapeake Energy Corporation, the largest acreage holder in the Marcellus, has entered into a binding agreement – along with Statoil ASA and another shipper – with a commitment of up to 425 MMcf/d, to serve the New York metropolitan area with the construction of facilities on the Algonquin Gas Transmission and Texas Eastern Transmission systems, including 16 miles of 30-inch pipeline running from Staten Island to Manhattan. The pipeline, once complete, would provide a new interconnect with Consolidated Edison of New York, capable of delivering up to 800 MMcf/d of additional supply to Con Edison’s greater service area. The expansion is expected to be in-service by year-end 2013. Another proposed expansion plan would see the replacement of five miles of pipeline in New Jersey and New York with larger diameter pipelines and facilities on the existing Algonquin line.

Texas Eastern Transmission’s TEMAX and TIME III projects in Pennsylvania are set to add 8.6 miles of 36-inch pipeline loop and 30 miles of 36-inch pipeline potentially capable of handling Marcellus production as well, with an additional 300 MMcf/d planned and scheduled to be in-service by first quarter 2012.

Dominion’s recently announced Appalachian Gateway Project – a massive 110-mile, $600 million pipeline planned for construction in 2011 and to be in-service in 2012 – is set to transport gas being produced in West Virginia and Pennsylvania onto storage fields and pipelines in Pennsylvania. The project is fully subscribed by regional producers, Marcellus and other Appalachian E&P companies. Dominion has stated that total transportation delivery from the project is anticipated to reach 470 MMcf/d.

Columbia Gas Transmission, an operating company of NiSource, is also working with Marcellus E&P companies to bring gas to market in its Columbia Penn Corridor which runs northeasterly from southwestern Pennsylvania to Corning, NY. The project, currently in Phase II of development, is projected to provide 47 MMcf/d to Williams-Transco at Renovo, PA and an additional 52 MMcf/d to Spectra-Texas Eastern at Delmont, PA.

Based on future producer requirements in further expansion phases along this corridor, Columbia Gas could make available as much as an additional 137 MMcf/d at Delmont and Waynesburg. Future market interest in a high-pressure, larger diameter “New Penn” pipeline project extending from Transco’s Young Woman’s Creek interconnect in Leidy, PA to the Millennium Pipeline outside of Corning capable of 480 MMcf/d is also being studied by NiSource.

National Fuel Gas Supply Corporation (NFGSC) is seeing very strong interest from Marcellus producers across the board, including Seneca Resources, a wholly owned E&P subsidiary of National Fuel Gas Corporation, on its proposed transmission and storage development projects. They are moving ahead with the Lamont compression expansion project known as the “Line-N expansion project.” This is a $22 million pipeline and compression project at the southwestern end of the NFG system that will be moving 150 MMcf/d of Marcellus production into the Texas Eastern system. Environmental and field routing studies are under way. An in-service date of November 2011 is expected.

NFGSC is also moving ahead and looking to place its West to East (W2E) pipeline project in-service as early as 2011 – designated to serve mainly Marcellus producers. In 2007, the expectations were that the primary gas supply was going to be coming from Rockies Express Pipeline (REX-East) at Clarington, OH. Beginning in early 2008, however, interest from Marcellus producers had NFGSC changing focus to an Appalachian supply base, with the Appalachian Lateral project added later that year, complementing the W2E project east of Overbeck, PA.

According to NFGSC, the W2E and Appalachian Lateral projects would run in phases; Phase I set for a 2011 in-service date, comprised of a 32-mile, 30-inch pipe and incremental capacity of 195 MMcf/d and an additional 7,100-hp compressor station; Phase II set for an in-service date of 2012 would consist of a 50-mile, 30-inch pipe with 290 MMcf/d of additional capacity and a new 9,000-hp compressor station.

NFG’s Empire Connector, a 24-inch high-pressure pipeline, running 76 miles south from Rochester, NY to Corning, went into service at the end of 2008 with a rated capacity of 750 MMcf/d. The company now plans to build a Tioga County Extension consisting of 16 miles of 24-inch pipe through Corning to Tioga County, PA, providing for 195 MMcf/d of additional capacity from Marcellus and Trenton Black River (TBR) producers to Millennium Pipeline and TGP. The total project cost is estimated at $43 million with an estimated in-service date of 2011.

Set for in-service in 2013 is the Williams-Dominion plan for a 240-mile Keystone Connector Pipeline project; a Williams and Dominion joint venture to transport up to 1 Bcf/d of natural gas produced both in the Rockies and in the Appalachian Basin/Marcellus Region. According to sources, the Keystone Connector would span the end of the Rockies Express pipeline in Ohio onto the Williams Transco pipeline in southeastern Pennsylvania.

Millennium Pipeline, a New York state-based interstate pipeline which services the Northeast and is anchored by National Grid, Consolidated Edison, Central Hudson Gas and Columbia Gas Transmission (jointly owned by affiliates of NiSource Inc., National Grid and DTE Energy) has announced an open season for transportation of Marcellus gas bound for New York and New Jersey markets also looking at in-service for 2013.

Charles Joyce Jr., president of Otis Eastern Service in Wellsville, NY and located along the Pennsylvania border, is the largest pipeline construction company in the region. With a well- earned national reputation, Otis Eastern, a large-scale, fourth-generation family enterprise specializing in projects with difficult environmental and logistical challenges throughout the Northeast, has a long history of managing projects in the Appalachian Basin region. The Joyce family was part of the original oil and gas development that started in the 1930s, establishing themselves as drillers before beginning their long careers in pipeline construction.

In comparison with the Barnett, Joyce explains, “Just getting in and out of the (Marcellus) region is tough work; these challenges are shaping up to be primarily logistical, with the relative inaccessibility of the Marcellus producer regions to major highways, in contrast to (the Barnett) where one had pipelines crisscrossing major thoroughfares.”

Pipeline companies and contractors are looking ahead to meet the challenges of keeping pace with ever-increasing Marcellus production and the pipelines that will be built to transport shale gas to market. Otis Eastern and Joyce, who served as general contractor on the Empire Connector, a 76-mile pipeline in New York, has learned a few techniques to completing pipelines in the region on time, explaining, “where Otis Eastern was very successful was in cutting up that project (Empire Connector) into smaller pieces, giving (Otis Eastern) the ability to finish larger runs in a season.” Techniques such as this one employed to deal with seasonal weather conditions offers a small window into what one leading company has experienced in the region.

Regarding environmental policies and regulations that are already having major impacts on companies operating in the Marcellus – most notably through the New York State Department of Environmental Conservation, Pennsylvania Department of Environmental Protection and the Susquehanna River Basin Commission (SRBC), Joyce makes the point that these agencies, “are much more detailed about what they want and how they want their resources protected and …contractors are going to have adjust construction techniques to meet those requirements.”

Marcellus Wetness Distribution (image courtesy of GeoMark Research, Ltd. – Marcellus Study)]

The lessons of geography are playing a major role in the development of the Marcellus. The tests of difficult terrain and the trials of harsh weather are demanding masters to wrestle with. The strong potential for cost increases and time delays due to terrain and weather extremes are requiring painstaking routing reviews, planning and topographical studies.

As Marcellus-active companies develop or migrate from other locales, notably from other emerging shale plays in the south and west, regional manpower and matters of local spend, finding the right group of regional vendors and contractors that are able to provide matching levels of expertise and capacity to the equation, become essential.

Dresser, Inc., a highly diversified multibillion-dollar global oil and gas products and services company with a presence in more than 100 countries, has a long history and wide regional footprint, charting nearly 130 years of technology innovation in the natural gas industry from its roots and foundational home in the Pennsylvania town of Bradford, McKean County to its present-day scale.

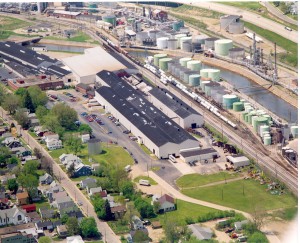

Dresser, Inc., an approved station fabricator to all major gas transmission pipeline companies, is one of the largest turnkey solutions providers located directly inside the Marcellus regional hub. Piping Specialties products and FloSystems solutions are designed and manufactured at Dresser’s 340,000-square-foot, state-of-the-art facility in Bradford, PA with a focus on an array of measurement and regulation solutions to producers, transmission companies, midstreamers and utilities.

Aerial View of Bradford, PA, Dresser Inc. Facility

Daniel J. Manion, Director of Marketing for DPS explained, “We have very strong relationships with the companies which are active in the Appalachian and Marcellus region, from our longstanding relationships with the gas distribution utilities, producers, and transmission pipeline companies, having worked with Dresser in some cases here for upwards of a century. We also look forward to forging new relationships with those entering this region for the first time.”

Author

Derek Weber is Business Development Manager – Marcellus Activity, Infrastructure Solutions, Dresser Inc. He can be reached at 518-951-6336 or Derek.Weber@dresser.com.

Bibliography:

Airhart, Marc, “The Barnett Shale Gas Boom – Igniting a Hunt for Unconventional Natural Gas Resources.”

Barlas, Stephen, “TGPC Could Be First To Carry Marcellus Shale Gas,” 2010 Budget News.

Considine, Timothy; Watson, Robert; Entler, Rebecca; Sparks, Jeffrey, “An Emerging Giant: Prospects and Economic Impacts of Developing the Marcellus Shale Natural Gas Play,” The Pennsylvania State University College of Earth and Mineral Sciences, Department of Energy and Mineral Engineering, Aug. 5, 2009.

Driver, Anna, “U.S. energy companies bullish on Marcellus shale.”

Kell, John, “Spectra Reaches Pact to Expand Two Projects,” WSJ Dec. 29, 2009.

King, Byron W., “Rocks, rock oil and peak oil.”

Payne, Darwin, Initiatives in Energy: The Story of Dresser Industries 1880-1978, Simon & Shuster, New York, 1979.

Tronche, John-Laurent, “Marcellus Shale – Appalachian Basin Natural Gas Play.”

Comments