April 2010 Vol. 237 No. 4

Features

Study Finds Nations Natural Gas Supply Will Last Well Into Next Century

The American Gas Association’s recently released analysis on the nation’s natural gas supply details the robust supply picture and quells any doubts about the ability of natural gas to supply the country well into the next century. The analysis, U.S. Natural Gas Supply: Then There Was Abundance, provides critical information on conventional and unconventional natural gas supply sources.

As noted in the analysis, AGA believes that the strength of gas supply in the U.S. is not only founded on the abundance of the methane in North America but the diversity of those supplies as well.

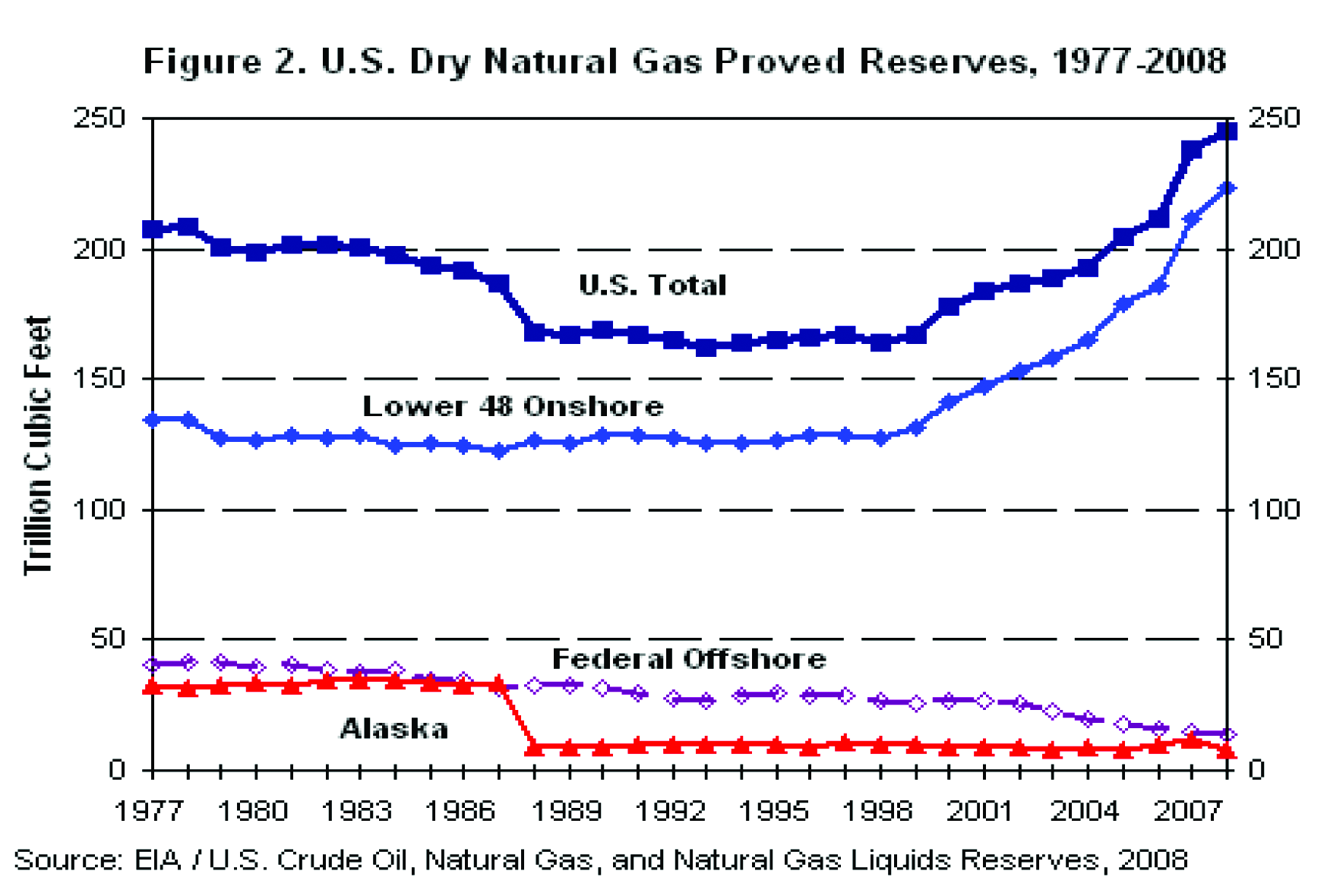

Certainly a strong point of the analysis is the nation’s reserve picture. The analysis indicates natural gas reserves have grown from 169 Tcf in 1990 to more than 245 Tcf (a 45% increase) at year-end 2008 because new discoveries, extensions and revisions of prior reserves data have outgained the pace of production. Moreover, much of the most recent reserve growth has come in the form of less conventional sources of natural gas such as coal seams and gas shales.

The analysis also provides concise answers to commonly asked questions about natural gas supply, such as Canada’s ability to send natural gas to the U.S. and the implications of recent shale discoveries.

Of particular note in the report is a discussion on the most often asked questions regarding supply elements and the following straight-forward answers provided:

1. How have the revelations in shale-gas development changed the U.S. gas supply picture?

The Potential Gas Committee now identifies about 600 Tcf of natural gas resource potential attributable to shales alone. It is the success of drilling and completion technologies among other factors that have allowed the inclusion of this significant resource volume in the U.S. undiscovered resource base. This recent recognition of the shale-related resource potential has increased the overall view of domestic gas supply compared to annual production from a 65- to 100-year life. In addition, some analysts who point to 8 Bcf/d of shale-gas production in the U.S. today, believe that the volume could be increased to 13-15 Bcf/d (or higher) in only a matter of years, not decades, and thus become a prominent factor in

meeting future gas requirements or even growing natural gas demand.

2. To what extent will pipeline supplies of natural gas from Canada be sustained in the U.S. market?

Daily natural gas production in Canada has fallen from about 16 Bcf/d to less than 13 Bcf/d in less than five years. About half of current Canadian production is exported to the U.S. Both domestic use and the struggle to sustain production in Canada may limit future exports to the U.S. – in fact, may significantly limit pipeline exports – in the eyes of many energy analysts. With that said, the addition of LNG import capacity and the potential for unconventional resource development in Canada (following the technology path established in the U.S.) may tip the pessimism around future Canadian gas supply to a more favorable view in the future.

3. Will the U.S. become a major importer or exporter of LNG?

The U.S. boasts about 14 Bcf/d of LNG import capacity. It has never been fully utilized. A strong day for vaporized LNG placed in to the domestic pipeline grid (based on history) has been 3-4 Bcf/d. Permission to accept LNG, store it and ultimately re-export it has been granted to some facilities on the U.S. Gulf Coast. The question of whether this critical asset is more fully utilized to meet U.S. customer needs in the future will depend on world market conditions, supply-demand balances in Europe and Asia (not just the U.S.), relative pricing between all corners of the globe and other market conditions well out of the control and influence of the U.S. trading partners. However, the potential for LNG to supply new demand growth in this country is real.

4. When will we see arctic natural gas to the lower 48 states?

Understanding incremental sources of new gas supply for the U.S. is not just a matter of looking at shale-gas or LNG. Known quantities of natural gas exist in the arctic areas of Alaska and significantly more potential exists. Creating the pipeline transportation system to connect those arctic supplies to the North American pipeline grid has been proposed for more than 30 years. The concept seems to have more tangible momentum with key players like TransCanada, ExxonMobil, BP, ConocoPhillips and the state of Alaska moving closer to measurable progress. Competing projects have been proposed. That aside, many analysts believe that a pipeline connecting North Slope gas reserves to the lower-48 states is closer than ever and that by 2020, or soon, as much as 4.5 Bcf/d may be flowing.

5. What are the implications of a growing underground storage capacity?

Operational underground working gas storage capacity in the U.S. increased by about 100 Bcf between spring 2008 to April 2009. In fact, the new total of more than 3.8 Tcf was essentially filled prior to the 2009-2010 winter-heating season, resulting in the largest inventory of working gas ever recorded. A very cold start to winter in December 2009 and January 2010 attested to the value of storage in an overall gas supply mix that draws 15-20% of all gas consumed from November to March from working gas and may account for 30% of all gas supply during the peak month for winter-heating season demand. This flexibility is crucial to meeting heating peak-load demands by local gas utility customers and all customers for that matter.

The analysis also points out that for many years promoting natural gas as a long-term solution within the national energy supply mix was considered to be irrational. Today, that view has changed. Natural gas is abundant in North America. It is found in conventional oil and gas reservoirs offshore and onshore. Reservoir geology includes sandstones, fractured tight sands, carbonate rocks, coal seams and even low-permeability shales. Organic-rich sediments, ancient stream beds and tectonically complex subsurface layers can provide environments conducive to hydrocarbon accumulations.

Discoveries and development plays are found in deepwater or shallow and in present-day arctic or temperate climates. Wells can be remote or drilled next to a farmer’s barn. They come as horizontal, directional or vertical wellbores. In short, they come in all shapes and sizes and it is this diversity that has made the U.S. the largest natural gas-producing country in the world (recently surpassing the Russian Federation).

The 21-page analysis covers a host of other pertinent topics and examines the current view of natural gas supply in and available to the United States, the sources of that supply and comments on future potential. To review the entire document, visit www.aga.org.

Editor’s Note:

A disclaimer from AGA is included in the analysis that indicates the statements in the publication are for general information and represent an unaudited compilation of statistical information that could contain coding or processing errors. AGA makes no warranties, express or implied, nor representations about the accuracy of the information in the publication or its appropriateness for any given purpose or situation. Information on the topics covered by this publication may be available from other sources, which the user may wish to consult for additional views or information not covered by this publication.

Comments