July 2020, Vol. 247, No. 7

Features

Carbon Dioxide Pipelines Seen as Cost-Saving Measure in Troubled Times

By Richard Nemec, Contributing Editor

It was difficult to find a silver lining in the outlook of Occidental Petroleum Corp.’s CEO Vicki Hollub and her senior executive colleagues in early May when they prepared for the Houston-based mid-major’s first-quarter 2020 earnings conference call.

The oil and natural gas industry was watching the wheels fall off worldwide while an unprecedented global pandemic was savaging the U.S. economy. In this bleak context, Hollub wrestled with a debt-inflating $38 billion purchase of Anadarko Petroleum Corp. and eventually would report more than $2 billion of first-quarter losses for Oxy and draconian cutbacks in everything from capital expenditures to production.

In the midst of the human and financial carnage, Hollub and her colleagues nevertheless jumped at the opportunity to address an analyst’s question about the feasibility of Oxy’s carbon capture and storage (CCS) projects and its increasing partnerships on low-carbon ventures. Oxy is not going to put out a lot of its own capital in carbon capture; instead, it is seeking funding from joint venture (JV) partners.

After all, Oxy has the reservoirs for carbon dioxide (CO2) sequestration and the land and expertise to build the facilities in CCS. Oxy’s experience with its existing assets makes a good marriage with a partner’s funds to launch the project. And, during an oil/gas investments conference in Chicago in September 2019, Hollub said Oxy planned to shift toward a “carbon-neutral production model,” and she urged U.S. political leaders to fund technologies that fight global warming.

Hollub stressed that CCS is a lot more than sequestration of the CO2.

“It’s also about lowering our costs so that we can take or make our current CO2 business better,” she told the analyst. “By making it better and less expensive, we can also expand that out into our shale play, giving us an option to grow that a lot more and over the expanse of the shale play.”

The model in the Permian Basin also is transferable to other basins in Wyoming and Colorado, for example, Hollub said in early May. About the same time, the International Energy Agency was calling CCS “one of the only technology solutions that can significantly reduce emissions from power generation and deliver deep emissions reductions.”

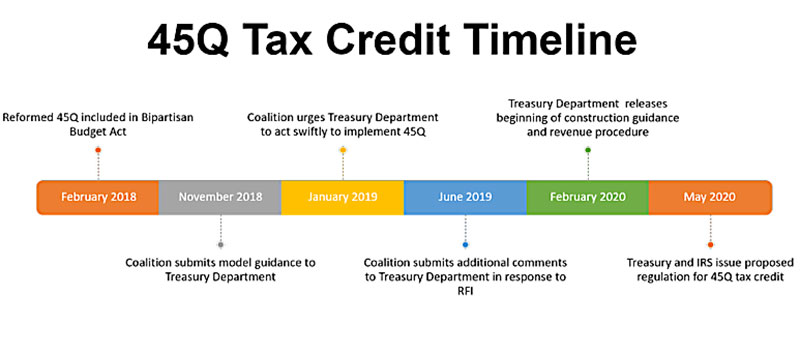

Oxy’s optimism for CCS in early May received a further boost in late May when the Internal Revenue Service (IRS) released some long-awaited guidance for implementation of CCS 45Q tax credits created by Congress in 2018.

A leading advocate for the sector and the tax credit, Carbon Capture Coalition (CCC) Director Brad Crabtree noted the IRS guidance will allow as many as 30 identified commercial-scale CCS projects under development nationwide to push forward. At the same time, the coalition of more than 75 CCS-related companies will provide feedback to the IRS during a 60-day public comment period.

“The tax credit has been around for a long time, but it has never functioned as intended,” Crabtree said. “Finally, in 2018, Congress reformed and expanded the 45Q tax credit. Under the IRS guidelines, there are two credits for carbon capture – $50/metric ton (mt) of qualified CO2 for permanent sequestration and $35/mt for enhanced oil recovery (EOR) purposes. Unlike earlier laws that had limitations, the 2018 law has no limit on the number of metric tons of “qualified carbon oxide,” a broader distinction than just qualified CO2. With the latest IRS guidelines, project operators can:

- Determine adequate security measures for geological storage of qualified carbon oxide;

- Make exceptions to whom the credit is attributable;

- Give procedures for a taxpayer to make an election to allow third-party taxpayers (investors) to claim the credit;

- Have standards for measuring use of qualified carbon oxide and rules for credit recapture.

Crabtree and his coalition colleagues hope the tax credit will drive the kind of technology deployment that the production tax credits for wind and solar have done in those industries. “We’re hoping for the same sort of dynamic effect in the marketplace.”

Right now, there are multiple challenges for companies generally – destruction of demand, supply chain problems and uncertainty in the future, Crabtree said. “Under the CCS, most companies were going to rely on financing projects on tax equity where investors wanting to offset taxable income will invest for the tax benefits. Today, investors don’t have excess taxable income; they have losses.”

All the projects expecting tax equity financing have been scurrying around and have been more at risk. It has taken two years to get final guidance on the rule covering the 45Q tax credit. Originally it was authorized for six years, but more than two of those years have expired today, so Congress’ help is being sought by Crabtree and the coalition, and there are one-year, five-year and permanent extension proposals pending in Congress. The U.S. House Green Act has the one-year proposal; another bill in the House removes any limits; and a Senate bill has a 5-year extension in its energy bill.

Carbon Capture

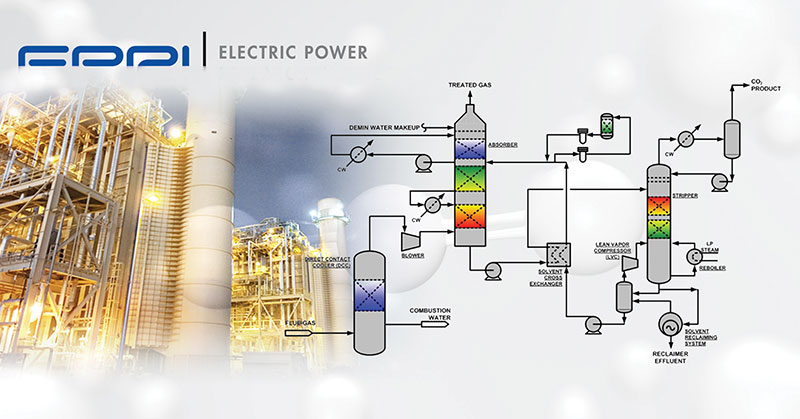

“CCS remains a proven and efficient technology, preventing CO2 from being released into the atmosphere by capturing it where it is produced by large industrial plants, compressing it for transportation and then injecting it deep into a rock formation at a carefully selected and safe site, where it is permanently stored,” according to the Global CCS Institute. “Since the 1930s, carbon capture equipment has been used commercially to purify natural gas, hydrogen and other gas streams in industrial settings; it was first injected underground in commercial-scale operations in 1972.”

More than 260 million tons (mt) of CO2 emissions from human activity have already been captured and stored, and the global capture and storage capacity of projects currently operating or under construction stand at around 40 million tons per annum (mtpa). CCS reduces emissions from industrial processes vital to the global economy, like steel, cement, electric power and chemicals production.

“Paired with bio-energy used for power generation or biofuel production, it is one of few technologies that can deliver negative emissions on a large enough scale to limit temperature rises to 1.5° C,” Global CCS officials noted.

Worldwide there are up to 51 major CCS projects operating, in construction and under development, with 24 in the United States seeking to capture and store CO2 from various industrial processes, including power generation and oilfield operations. Overall, the projects represent 97.5 million tons of CO2 annually that could be captured. Existing CCS technology works well, and operators and researchers are constantly seeking refinements.

One area of expansion involves large gas-fired generation plants. So far, only small-scale gas plants have tried CCS. Of the 27 U.S. CCS projects under development, six involve natural gas and they are scattered in five states, according to the Clean Air Task Force (CATF) tabulation.

“We’re hoping that FEED [front-end engineering and design] studies now being worked on with the addition of 45Q will lead to one or more combined-cycle gas-fired plants using CCS,” said Deepika Nagabhushan, a scientist with CATF. “That would be an early commercial demonstration for the first time of a commercial-scale CCS project on a combined-cycle gas plant.”

Oxy Spinoff

An Oxy spinoff, California Resources Corp. (CRC), is involved in such a project at its Elk Hills (oilfield) power plant.

A lot of unanswered questions such as cost and production could be answered by one of these demonstration plants, Nagabhushan noted. “We’re going to see technological advances play out just in the first wave of the 45Q tax credit-driven projects.”

An example of what she is talking about can be found in the California central valley CRC project, bidding to run a successful CCS program from its ongoing oilfield-based 550-MW natural gas-fired combined-cycle electric generating plant and its ongoing extensive EOR operation northwest of Bakersfield, Calif., in the oil- and agricultural-rich San Joaquin Valley. This project’s participants are aiming at erecting a new model in size and efficiency for a gas-fired CCS project.

“Our Elk Hills carbon subsidiary is performing the FEED study for our pioneering carbon capture project,” said CRC Spokesperson Richard Venn. He stresses that the ongoing FEED study, funded by the U.S. Department of Energy (DOE) was a third of the way completed (in May) by the Palo Alto, Calif.-based Electric Power Research Institute (EPRI) and global engineering giant Fluor Corp.

Along with DOE, the Oil/Gas Climate Initiative is also supporting the FEED study. This project is one of four CRC strategic 2030 sustainability initiatives, so the virus lockdown and the global oil meltdown are not expected to deter it, Venn said.

Both the scale and the fact that it involves a gas-fired, combined-cycle plant promise to set new standards for CCS globally, according to Abhoyjit Bhown, Ph.D., EPRI’s technical executive on the FEED study for Elk Hills. “For CCS there are many more projects in other industries, such as natural gas processing, and they have been around for decades and certainly other industrial processes.”

Electric generation plants on a large-scale basis have not been involved until now, he noted.

Although they involve coal, Bhown said there have been lessons learned from the Texas and Canadian power plant CCS projects, so he confirms that there have been improvements along the way with a lot of learning-by-doing. “We think the things that have been publicly reported can be incorporated in the Elk Hills project. Water availability is another challenge with the location of Elk Hills. There are some innovative things being pursued there,” Bhown said.

“The other challenges come from the fact that this is a gas combined-cycle plant and the CO2 concentrations are much lower than in a coal-fired plant,” Bhown noted. “Typically, it is around 3% to 4% for gas, compared to coal, which is typically in the 12% to 14% range. The lower concentrations just make the carbon capture harder to do. This is challenging because no CCS project with gas has been done at this scale; otherwise, there are really no hard-core technical challenges.”

CRC’s Venn and Bhown see the Elk Hills project as having potential global implications for CCS. They note that the California Energy Commission earlier identified the Elk Hills Oilfield as “an optimal site for safe and secure sequestration of CO2” and “one of the premier U.S. sequestration sites.” The project bids to be the nation’s largest CCS project, taking CO2 from the 550-MW gas-fired power plant at Elk Hills and injecting it in nearby deep underground structure, cutting greenhouse gas (GHG) emissions in half and displacing remaining oil as it helps extend the life the field, Venn emphasized.

Dismissing any problems with CCS technology, Bhown said, what is needed now are market and regulatory drivers for the projects. “Right now the ones in Texas (Petra Nova at an NRG Energy Inc. power plant in Thompsons, Texas) and Canada (Sask Power’s Boundary Dam station, Estevan, Saskatchewan) are used for EOR, but even for both those projects, government subsidies were needed before those projects could be made viable because the price for CO2 was not enough to offset the project costs.

“But as people get better, and the technology improves with people learning more, presumably the costs will come down; a lot depends on the price of oil, and more importantly, there needs to be incentives on the regulatory side.” In California there are the low-carbon fuel credits. But CCS advancements also depend on how the rest of the world chooses to deal with carbon dioxide.

North Dakota Project

Another U.S.-based project can be found in North Dakota where small electric cooperative Minnkota Power Cooperative has proposed a CCS project at its 455-MW coal-fired generation plant, Milton R. Young Station, in Center, N.D. The proposal is the Tundra Project, and it sparked discussion by North Dakota’s state oil and gas regulator Lynn Helms, director of the Department of Mineral Resources. Minnkota plans to capture up to 90% of the CO2 at the power plant. But, in the Bakken Shale-rich, unconventional drilling state, Tundra CCS will require different drilling and other operations as part of the storage, Helms emphasizes.

“The CCS process is quite different,” Helms said. “The wells are all vertical; there is no horizontal drilling, and the rules are a lot more stringent on how the wells are completed or constructed, and how the information is to be collected.”

There is little coring on horizontal wells, but on carbon capture wells there is coring above, below and in the storage zone, he said. A different drill mud system is also deployed on carbon capture wells. A water-based, as opposed to oil-based, mud is used. “There is much, much more coring and information collected,” Helms said. North Dakota’s potential project will be the first one permitted by a state. All the other U.S. ones went through U.S. EPA.

Climate change advocates who strongly believe in renewables are coming around to seeing the value of more storage in the future. One of those advocates is Microsoft’s billionaire founder Bill Gates, who told the Global CCS Institute:

“I often hear that lower cost solar and wind power along with the emerging breakthroughs in energy storage mean that these sources will be enough to get us to a carbon-free power grid. But, because the world must balance the need to eliminate carbon emissions with economic growth, we should also consider what solutions would be most affordable.

“A recent study from researchers at MIT found that supporting renewable energy with a mix of clean energy solutions – including nuclear and carbon capture and storage (CCS) – would make carbon-free electricity up to 62% cheaper than using renewables alone.

“Another way we can get zero-carbon electricity is carbon capture, utilization and storage, which separates and permanently stores CO2 pollution from an energy plant’s exhaust to keep it out of the atmosphere. This technology is especially important in places where there isn’t good renewable energy potential, or where it would be too costly to retire and replace existing power plants.”

In May, the U.S. Bureau of Land Management (BLM) released a draft environmental impact statement on a potential 2,000 miles (3,200 km) of CO2 pipelines in Wyoming. The pipelines, if built, could connect with a number of coal-fired power plants in the state. State officials are very interested in seeing the pipelines built and CCS project developed in this current time for the oil and gas sector that could cost Wyoming alone up to $2.8 billion in lost revenues derived from the oil, gas and coal sectors.

Separately, former U.S. Energy Secretary Ernest Moniz and AFL-CIO union President Richard Trumka announced an initiative to preserve gas and coal industry jobs and at the same time promote climate change mitigation. CCS could be one of the areas to benefit from their proposal as Moniz indicates the goal is to “pull CO2 emissions out of the electricity, transportation and building sectors on a vast scale.”

Among the champions for CCS, Oxy CEO Hollub recognizes the immediate opportunities and challenges for a hurting oil/gas sector as articulated in her first-quarter 2020 earnings conference call this year and her earlier remarks to industry audiences before the ongoing struggles. She promotes the use of technology advances and the newly created 45Q tax break, but also is advocating for help from Congress in support for further development of CCS infrastructure.

‘Push the Envelope’

“We’re going to push the envelope on everything now, and that’s part of the reason we’ve been able to reduce our overall expenses significantly as our teams are leveraging technology and automation as much as we can,” Hollub told analysts in early May. “On the field operations side, our CO2 operations are very highly automated. We can actually manage those from a central control room.”

Technology advances and automation are the keys to creating a low operating expense environment and CCS is similarly driven, she said.

Oxy injects 2.6 Bcf/d of CO2 in the Permian Basin in Texas and New Mexico to support crude oil extraction, and the excess CO2 is recovered and reinjected until it largely becomes trapped under ground, according to the company website. “We actually build models by which the computer can basically do the drilling, but it takes an engineer to help to build those models, and once they’re automated, then it’s a process of just being tweaked to get better,” said Hollub while committing to expanding the company’s carbon capture efforts.

Hollub emphasizes that the only way to cap global warming is to have significant sequestration, and that is part of the Oxy strategy. She sees a serious CCS effort as eventually making Oxy’s global crude output carbon-neutral. She cautions that carbon-neutral oil production won’t happen anytime soon, pointing to her Chicago talk last year:

“As much as some people want oil/gas to go away in the next couple of decades, it cannot. What we can do is make sure all companies have access to these technologies.”

Richard Nemec is PG&J’s correspondent based in Los Angeles. He can be reached at rnemec@ca.rr.com.

Comments