January 2018, Vol. 245, No. 1

Features

U.S. to Dominate Oil Markets After Biggest Boom in World History

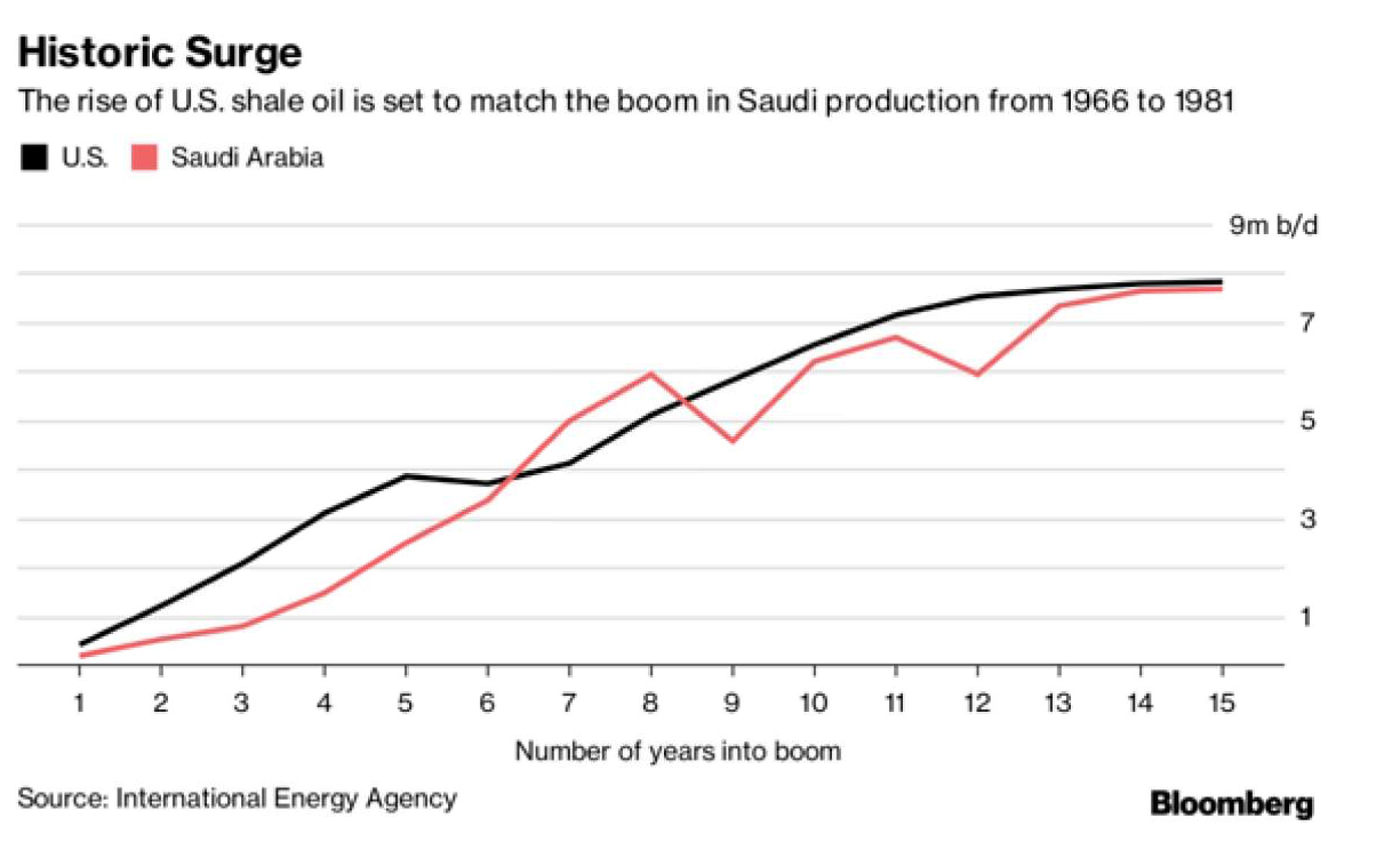

The U.S. will be a dominant force in global oil and gas markets for many years to come as the shale boom ushers in the biggest supply surge in history, the International Energy Agency predicted.

By 2025, the growth in American oil production will equal that achieved by Saudi Arabia at the height of its expansion, and increases in natural gas will surpass those of the former Soviet Union, the agency said in its annual World Energy Outlook. The boom will turn the U.S., still among the biggest oil importers, into a net exporter of fossil fuels.

“The implications of the shale revolution for international markets and energy security have been profound,” said the Paris-based IEA, which advises most of the world’s major economies on energy policy. U.S. drillers have “weathered the turbulent period of lower oil prices since 2014 with remarkable fortitude.”

The IEA raised estimates for the amount of shale oil that can be technically recovered by about 30% to 105 billion barrels. Forecasts for shale-oil output in 2025 were bolstered by 34% to 9 MMbpd.

“The United States will be the undisputed leader of global oil and gas markets for decades to come,” IEA Executive Director Fatih Birol said last month in an interview with Bloomberg television. “There’s big growth coming from shale oil, and as such there’ll be a big difference between the U.S. and other producers.”

The U.S. industry “has emerged from its trial-by-fire as a leaner and hungrier version of its former self, remarkably resilient and reacting to any sign of higher prices caused by OPEC’s return to active market management,” the IEA said.

While oil prices have recovered to a two-year high above $60 a barrel, they’re still about half the level traded earlier this decade, as the global market struggles to absorb the scale of the U.S. bonanza. It’s taken the Organization of Petroleum Exporting Countries and Russia almost 11 months of production cuts to clear up some of the oversupply.

Price Cut

Reflecting the expected flood of supply, the agency cut its forecasts for oil prices to $83 a barrel for 2025 from $101 previously, and to $111 for 2040 from $125 before.

Lower prices are helping to support oil demand, and the IEA raised its projections for global consumption through to 2035, despite the growing popularity of electric vehicles. The world will use just over 100 million barrels of oil a day by 2025.

That will benefit the U.S. as it turns from imports to exports. The country will “see a reduction of these huge import needs,” Birol told a news conference in London. That “will bring a lot of dollars to U.S. business.”

A remarkable ability to unlock new resources cost-effectively pushes combined United States oil and gas output to a level 50% higher than any other country has ever managed; already a net exporter of gas, the U.S. becomes a net exporter of oil in the late 2020s.

Nevertheless, U.S. shale output is expected to decline from the middle of the next decade, and with investment cuts taking their toll on other new supplies, the world will become increasingly reliant once again on OPEC, according to the report. The cartel, led by Middle East producers, will see its share of the market grow to 46% in 2040 from 43% now.

Yet that could still change, the IEA said.

As shale has outperformed expectations so far, the IEA added a scenario in which the industry beats current projections. If shale resources turn out to be double current estimates, and the use of electric vehicles erodes demand more than anticipated, prices could stay in a “lower-for-longer” range of $50-70 a barrel through to 2040.

“There could be further surprises ahead,” the IEA said.

New Order

Natural gas grows to account for a quarter of global energy demand in the New Policies Scenario by 2040, becoming the second-largest fuel in the global mix after oil.

In resource-rich regions, such as the Middle East, the case for expanding gas use is relatively straightforward, especially when it can substitute for oil. In the United States, plentiful supplies maintain a strong share of gas-fired power in electricity generation through to 2040, even without national policies limiting the use of coal.

Yet 80% of the projected growth in gas demand takes place in developing economies, led by China, India and other countries in Asia, where much of the gas needs to be imported (and so transportation costs are significant) and infrastructure is often not yet in place. This reflects the fact that gas looks a good fit for policy priorities in this region, generating heat, power and mobility with fewer CO-2 and pollutant emissions than other fossil fuels, helping to address widespread concerns over air quality.

Still, the competitive landscape is formidable, not just due to coal but also to renewables, which in some countries become a cheaper form of new power generation than gas by the mid-2020s, pushing gas-fired plants towards a balancing rather than a baseload role. Efficiency policies also play a part in constraining gas use: while electricity generated from gas grows by more than half to 2040, related gas use rises by only one-third, due to more reliance on highly efficient plants.

A new gas order is emerging, with U.S. LNG helping to accelerate a shift toward a more flexible, liquid, global market. Ensuring that gas remains affordable and secure, beyond the current period of ample supply and lower prices, is critical for its long-term prospects. LNG accounts for almost 90% of the projected growth in long-distance gas trade to 2040: with few exceptions, most notably the route that opens up between Russia and China, major new pipelines struggle in a world that prizes the optionality of LNG.

Gas supply also becomes more diverse: the amount of liquefaction sites worldwide doubles to 2040, with the main additions coming from the United States and Australia, followed by Russia, Qatar, Mozambique and Canada. Price formation is based increasingly on competition between various sources of gas, rather than indexation to oil. With destination flexibility, hub-based pricing and spot availability, U.S. LNG acts as a catalyst for many of the anticipated changes in the wider gas market.

The new gas order can bring dividends for gas security, although there is the risk of a hard landing for gas markets in the 2020s if uncertainty over the pace or direction of change deters new investments.

Over the longer term, a larger and more liquid LNG market can compensate for reduced flexibility elsewhere in the energy system (for example, lower fuel-switching capacity in some countries as coal-fired generation is retired). IEA estimates that in 2040, it would take around ten days for major importing regions to raise their import levels by 10%, a week less than it might take today in Europe, Japan and Korea.

Clean Energy Transitions

As oil and coal fall back and renewables ramp up strongly, natural gas becomes the largest single fuel in the global mix in the Sustainable Development Scenario. Securing clear climate benefits from gas use depends on credible action to minimize leaks of methane – a potent greenhouse gas – to the atmosphere.

Consumption of natural gas rises by nearly 20% to 2030 in the Sustainable Development Scenario and remains broadly at this level to 2040. The contribution of gas varies widely across regions, between sectors and over time in this scenario. In energy systems heavily reliant on coal (as in China and India), where renewable alternatives are less readily available (notably in some industrial sectors), or where seasonal flexibility is required to integrate high shares of variable renewables, gas plays an important role.

Stepping up action to tackle methane leaks along the oil and gas value chain is essential to bolster the environmental case for gas: these emissions are not the only anthropogenic emissions of methane, but they are likely to be among the cheapest to abate. The study presents the first global analysis of the costs of abating the estimated 76 million tons of methane emitted worldwide each year in oil and gas operations, which suggest that 40-50% of these emissions can be mitigated at no net cost, because the value of the captured methane could cover the abatement measures.

Oil & Gas Production in U.S.

As noted, IEA’s projections show that the 8 MMbpd rise in US tight oil output from 2010-2025 would match the highest sustained period of oil output growth by a single country in the history of oil markets. A 630 Bcm increase in U.S. shale gas production over the 15 years from 2008 would comfortably exceed the previous record for gas.

Expansion on this scale is having wide-ranging impacts within North America, fueling major investments in petrochemicals and other energy-intensive industries. It is also reordering international trade flows and challenging incumbent suppliers and business models.

By the mid-2020s, the United States becomes the world’s largest LNG exporter and a few years later a net exporter of oil – still a major importer of heavier crudes that suit the configuration of its refineries, but a larger exporter of light crude and refined products.

With the U.S. accounting for 80% of the increase in global oil supply to 2025 and maintaining near-term downward pressure on prices, the world’s consumers are not yet ready to say goodbye to the era of oil. Up until the mid-2020s demand growth remains robust in the New Policies Scenario, but slows markedly thereafter as greater efficiency and fuel switching bring down oil use for passenger vehicles (even though the global car fleet doubles from today to reach 2 billion by 2040).

Powerful impetus from other sectors is enough to keep oil demand on a rising trajectory to 105 MMbpd by 2040: oil use to produce petrochemicals is the largest source of growth, closely followed by rising consumption for trucks (fuel-efficiency policies cover 80% of global car sales today, but only 50% of global truck sales), for aviation and for shipping.

Once U.S. tight oil plateaus in the late 2020s and non-OPEC production as a whole falls back, the market becomes increasingly reliant on the Middle East to balance the market. There is a continued large-scale need for investment to develop a total of 670 billion barrels of new resources to 2040, mostly to make up for declines at existing fields rather than to meet the increase in demand. — By Bloomberg

Comments