October 2017, Vol. 244, No. 10

Features

Piped Gas vs. LNG: Competition May Be Heating UP

Historically, the world trade of gas has been dominated by piped gas with first-ever commercial LNG cargo being delivered to the UK from Algeria in 1964. The growth of the fuel was steady, but accelerated when Qatar entered the supply market with huge LNG trains almost 10 years ago.

Recent developments in U.S. shale gas and Australian reserves will unleash another surge in LNG exports. This transformation in the market has given rise to speculation of increased competition between LNG and pipeline gas.

Demand Centers

The Nexant base case projects that global natural gas consumption will continue to grow at an average annual rate of about 1.6% until 2030 after which it slows down slightly to about 1.4%, due in part to increased energy efficiency, reduced energy intensity and environmental drives.

Demand is forecast to increase by 1,650 Bcm from 2015 to about 5,220 Bcm by 2040 – broadly similar to the International Energy Agency (IEA) projection in its new policies scenario.

Key demand growth regions are Middle East, Asia/Asia Pacific and North America. However, the indigenous demand is satisfied by the local production in North America, FSU and Middle East. While European gas demand shows little growth, its requirement for imported gas is driven by the pronounced decline in local production.

Nearly half of current global gas production can be found in North America and the FSU. Both shale and coal-bed-methane (CBM) production will increase over twofold and threefold, respectively, over the next two decades, but it is still conventional gas output that will make up the bulk of future production.

Most intermarket trade flows are via pipeline gas in the world; however, LNG is gaining importance with time, given the ease of transporting the gas in liquid form. In 2016, LNG accounted for 32% of the trade compared, while averaging 25% for the period 2005-10. The key markets where LNG and pipeline gas compete for market share are Europe and China, with Pakistan expected to be a possible third battleground.

Key Pipeline Projects

Russia is the key supplier of pipeline gas to Europe with existing routes via Belarus (Yamal at 33 Bcm capacity), Nord Stream (55 Bcm capacity), and Ukraine. Russia is aiming to reduce reliance on the Ukraine route as is shown by just 37% of total Russian gas imports came via Ukraine in 2014 compared to 75% in 2005, with Nord Stream (from 2011), and Yamal gaining importance.

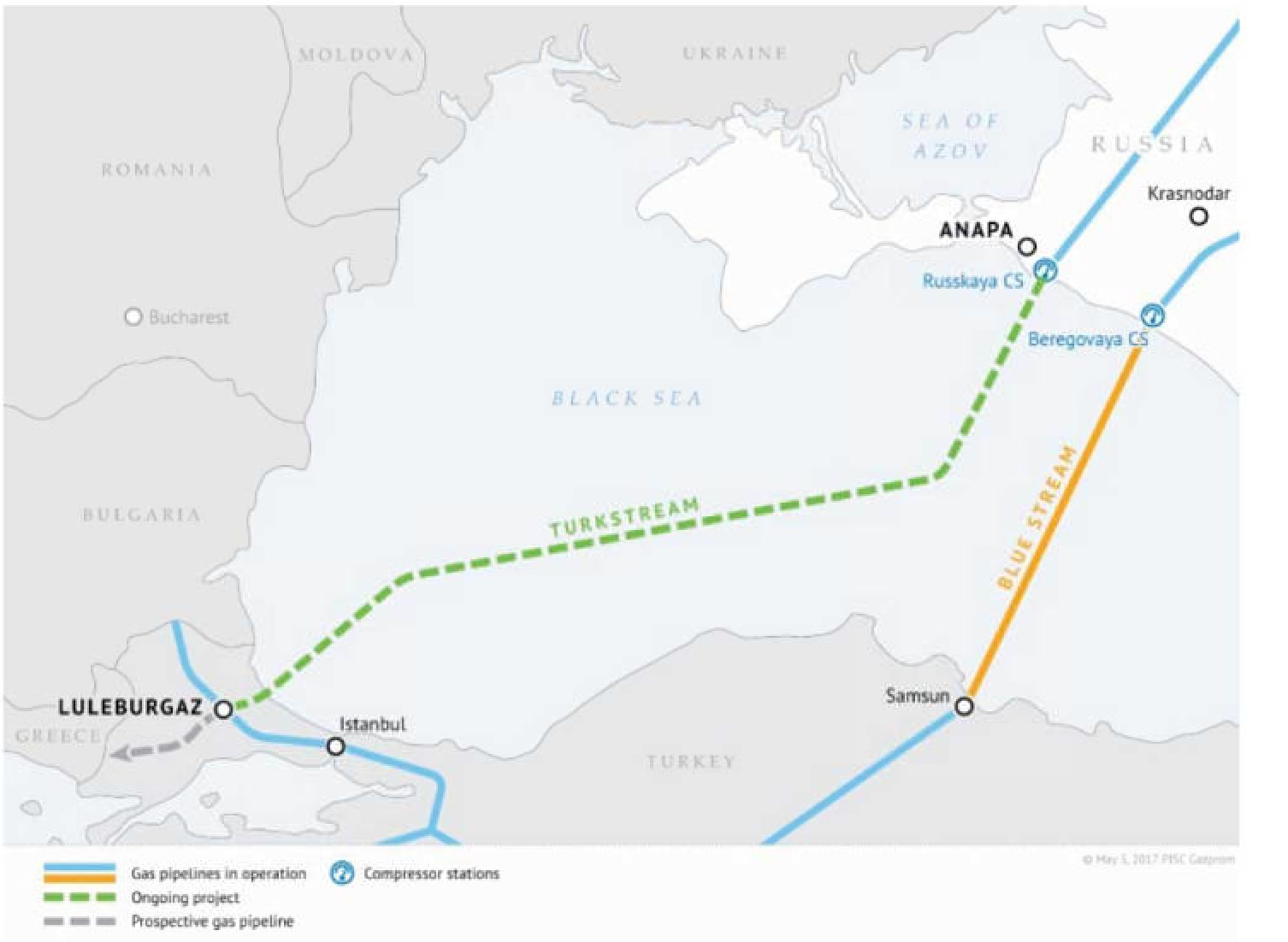

Russia plans to expand a southern route of TurkStream to Europe. Initially, South Stream was expected to be the project fulfilling this aspiration, but the tense political situation between Russia and Europe led this project to be canceled and replaced by 63 Bcm pipeline capacity delivered to Turkey via the Black Sea, rather than to Bulgaria with onward capacity to central Europe.

Recent developments indicate only half of that capacity will be realized with by a start date in 2017-18. The pipeline would run to the Turkish borders with Greece and Bulgaria where new European infrastructure would be needed to take the gas forward

PAO Gazprom, Wintershall Holding GmbH (a BASF subsidiary), PEG Infrastruktur AG (PEGI/E.ON subsidiary), N.V. Nederlandse Gasunie and ENGIE consortium is planning on building another Nord Stream (Nord Stream 2), with the same capacity of 55 Bcm as the original pipeline.

Russia is also planning to target China for gas exports. The Base Case assumes the so-called Eastern Route from Siberia to China North West (Power of Siberia) starts flowing gas in 2020 at the capacity of 10 Bcm and ramps up to 38 Bcm by 2025.

The proposed Altai project is assumed to start up in 2030, with a capacity of 30 Bcm as another pipeline route to China.

Central Asia

The Central Asia to China pipeline supplies gas from Turkmenistan, Kazakhstan and Uzbekistan to China with Turkmenistan the key supplier. The pipeline enters China from bordering Kazakhstan and is expected to reach 80 Bcm capacity by 2025, up from the existing infrastructure of 55 Bcm. The gas received at North West of China from Central Asia then travels to the coastal provinces like Shanghai in competition with LNG.

Shah Daniz II is expected to pick up capacity from 2020 onward, adding more flows to Europe by transiting via Georgia. The pipeline would use TANAP/TAP infrastructure to deliver gas to southern Europe – adding another source of pipeline gas into Europe. The country would be delivering close to 30 Bcm to Europe by 2030, compared to nearly 6 Bcm in 2016.

Iran and Iraq have planned pipeline routes to Turkey. Iran wants to expand the existing Persian pipeline and Iraq is looking for brand new pipeline capacity of 20 Bcm which might be required by 2030. However, the region struggles with political stability.

Pakistan and India are LNG-dependent when it comes to imports. Both countries are part of the possible pipelines from Iran and Turkmenistan, with the latter transiting via troubled Afghanistan, and beyond that point, the political situation between India and Pakistan remains a hurdle. Pakistan backed out of the Iranian project, citing political differences.

Key Pipeline Projects

The advent of LNG trade is the game changer for the trade patterns in the industry. Among projects hailed to come through in the next two decades, U.S. LNG leads the way at the back of the shale gas revolution along with Australia, with the traditional suppliers in Asia Pacific trailing. East Africa, in the form of Mozambique and Tanzania, is possible in the mid-2020s, and Qatar, which has been the leading capacity holder supplier historically, plans to debottleneck to increase capacity in addition to developing North Fields further on.

The U.S. Gulf Coast leads in providing the capacity with the projects via Sabine Pass, Freeport, Cameron, Cove Point, Elba Island and Corpus Christi. These projects will account for 58.5 mtpa (or about 80 Bcm) of capacity by 2020 with the volumes destined for Asia Pacific and Europe.

The UK and France are expected to be key importers of U.S. LNG in North West Europe with Japan being the key off-taker in Asia Pacific followed by Korea. India is the key importer of U.S. LNG in Asia – however, at the moment it is working on the deals to swap Sabine Pass LNG with the portfolio players and traders.

Australian LNG is largely destined for Asia Pacific with Japan and Korea the key buyers and China in Asia off-taking a big chunk of flows. The continent is adding 58 mtpa of additional capacity by 2018 with CBM based plants in Queensland – QCLNG, AP LNG and Gladstone having just started up, plus other projects coming on-stream this decade such as Wheatstone LNG, Ichtyhs, Gorgon and the Prelude FLNG, adding to the existing projects of North West Shelf, Pluto and Darwin.

Other projects

East African LNG will be competing for market share in Asia and Asia Pacific in the 2020s. Mozambique and Tanzania lead the way for the region with Mozambique holding the most gas reserves. Mozambique could see close to 63 mtpa of capacity with Tanzania contributing 20 mtpa by the late 2030s

West Africa has Nigeria and Equatorial Guinea as established exporters, with Angola recently restarting after technical issues.

Yamal, 16.5 mtpa, is another project from Russia coming on stream soon and supplying Europe/Asia – this adds to the existing 11 mtpa Sakhalin II project in the far east of Russia.

Conclusion

Among these pipelines, the Russian projects into Europe and east of China are well-supported and appear most likely, compared to projects focused on the Indian sub-continent and those originating from the Middle East destined to Europe.

Central Asian project expansions to China are well-supported with sales and purchase agreements in place. LNG would enjoy a greater share of global trade with the Australian LNG destined for Asia and Asia Pacific with East African LNG seeking markets in the Indian sub-continent and China.

The Qatar debottlenecking and expanding North Field production only adds to global LNG capacity. However, when it comes to competing with pipeline gas, the future of the European gas trade seems set to be dominated by cheap Russian gas, making U.S. LNG marginal into the continent.

While Europe has enjoyed somewhat of a love-hate relationship with Russia, with declining indigenous European production, the low cost and vast reserves of gas in Western Siberia/Yamal, Russia is expected to continue and even enhance its favorable position in the market.

Comments