July 2017, Vol. 244, No. 7

Features

Delivering Gas Off-Grid in North America

Virtual pipelines are scheduled shipments of natural gas between two points – from A to B – by road, rail or sea without a fixed pipeline. Virtual pipeline operations are usually to be found in remote areas where the terrain makes it too costly or too difficult to construct permanent pipelines.

They are also located in regions where the market is too small to justify the capital costs of a pipeline, or as a means to deliver gas to off-grid, large-scale gas customers.

Virtual pipeline operators deliver gas in two main formats: (liquefied natural gas (LNG) or as compressed natural gas(CNG). To make LNG, pipeline gas is converted in a liquefaction plant from where it is distributed by tanker trailers to large energy-intensive customers like power plants and mines where the customer’s gasification unit converts the LNG into ready-for-use gas.

For CNG, a compression station linked to the gas grid, compresses the gas that is then stored in purpose-built trailers for delivery to customers’ decompression plants. CNG is delivered to smaller customers such as hospitals and factories.

Virtual pipeline delivery systems, by rail, road, river or sea, are flexible enough to meet a client’s changing levels of demand. Equally important, virtual pipeline operators offer customers up to five years of price certainty. Obviously, lower long-term energy costs are important for customers, so a five-year, locked-in contract when gas prices are low offers certain and predictable bills.

North America

Customers in remote or mountainous areas of Canada, New England, Pennsylvania and Washington state are routinely supplied with CNG or LNG by virtual pipeline rather than by permanent pipelines.

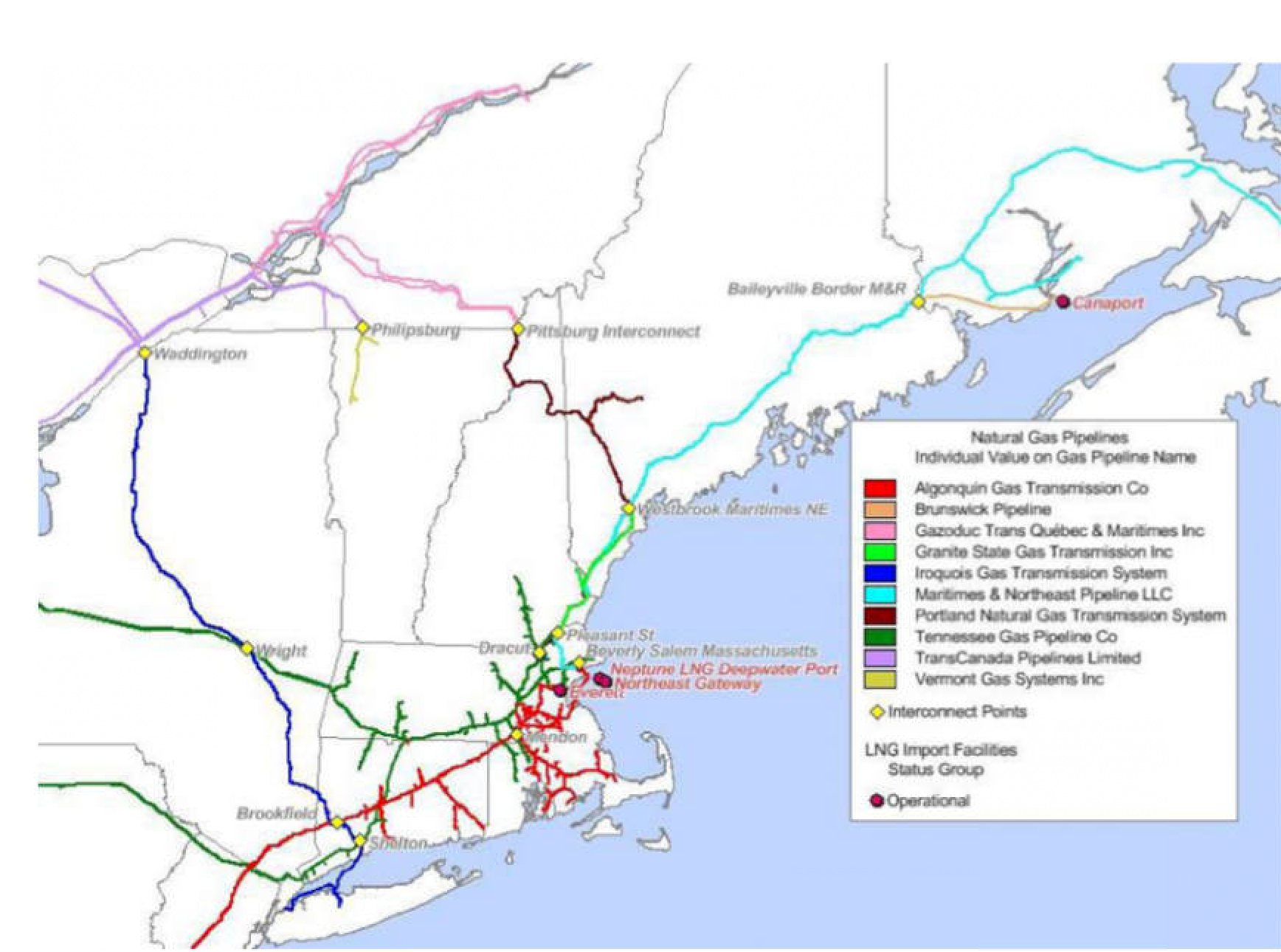

For instance, in New England, the only pipeline of significance is the Maritimes & Northeast Pipeline, which serves coastal communities. The region has many communities without access to piped gas, and it is this gap in the market that has been filled by companies using trailers designed to carry large quantities of natural gas drawn from compression terminals (Figure 1).

Figure 1: Quebec, New Brunswick, Nova Scotia and New England Gas pipeline network.

Off-pipeline gas deliveries have long been used by the military, but it was not until 2011 that NG Advantage pioneered virtual pipeline deliveries by road from an existing compressor station to customers within 200 miles who require over 100,000 MMBtu of gas a year. For large-scale, energy-intensive concerns – those able to consume over 750,000 MMBtu, lying outside the 200-mile limit of an existing compressor station – NG Advantage will build a new compressor station on the closest transmission pipeline line.

Essentially, a local, low-pressure piping network connects facilities to a decompression station, which receives compressed natural gas via a virtual pipeline of tractor-trailers around the clock. NG Advantage’s customers receive 1 to18 tractor-trailer loads of gas daily.

Major customers include International Paper’s Ticonderoga, New York Mill, and Vermont’s Gas Systems (VGS) gas island at Middlebury, which supplies four customers including energy-intensive Agri-Mark Dairy Cooperative, with piped gas. In addition, NG Advantage, like several of its competitors, supplies LNG to filling stations for natural gas-fueled vehicles.

Other companies offering similar CNG and LNG gas delivery systems in the region include Xpress Natural Gas, based in Boston, and Global Partners in Maine. One of Xpress’s customers is the Aroostook Medical Center in Presque Isle. It was the first facility in the state of Maine to make the transition to 100% CNG. Sylvia Getman, the hospital’s president, and CEO, said “the savings is projected to be between $400,000-500,000 per year.”

Xpress Natural Gas is also trucking CNG to Great Northern Paper’s East Millinocket mill and to Naturally Potatoes processing plant in Mars Hill. Another Xpress Natural Gas customers is the Port Townsend Paper Corp. paper/pulp mill in Washington state, which has switched from oil to natural gas.

To serve this and future customers, Xpress Natural Gas opened a $6 million CNG supply facility southwest of Seattle, within easy reach of the state capital at Olympia and Interstate Highway 5. The company fills portable tubes for trucking CNG on its custom trailers from a connection with the Williams Northwest Pipeline interstate natural gas transmission system, according to NGI Daily.

To date, only the largest consumers of gas in New England have been supplied by virtual pipelines, although Darren Gillis, general manager at Irving Energy, has said, “I think over time, as the technology changes and the cost of infrastructure goes down — which I believe it will — we will be able to offer the option to smaller customers.”

Canada

Two significant virtual pipeline companies serve eastern Canada’s Maritime Provinces and parts of northern New England: Irving Oil, based in New Brunswick and Gaz Métro, based in Quebec.

Irving Oil has a compression plant in Lincoln, New Brunswick, which compresses up to 4 Bcf of natural gas a year, sourced from the Sable Offshore Energy Project of Nova Scotia and delivered onshore by Maritimes & Northeast Pipeline. A major customer for Irving Oil is the McCain food processing plant in Easton, ME, two hours’ drive across the border.

Quebec state-owned Energy Company Gaz Métro operates a similar virtual pipeline delivery system from the Bécancour liquefaction plant, which sits astride the TQM pipeline that serves the cities of Montreal and Quebec. The Bécancour, with an annual capacity of 9 mtpa of LNG, serves many of Quebec’s remote communities including, the Renard diamond mine in the Otish Mountains. LNG fuels the mine’s power plant of seven 2.1-MW LNG gen-sets, reducing greenhouse gas emissions and producing annual operating cost savings of $8-10 million, reported Gaz Métro in June 2016.

Elsewhere in NA

Many shale oilfields in North America offer a huge marketing opportunity for virtual pipelines since the increased oil drilling has led to an increase in associated gas. Two shale plays in particular spring to mind. The first, the Bakken oil fields of North Dakota, where it is uneconomic to build a temporary gas collection pipeline network, a virtual pipeline can take off and monetize the associated gas that would otherwise be flared.

For example, the GE and Ferus Natural Gas Fuels joint venture has created the Last Mile Fueling solution. Previously, uneconomic natural gas is collected directly from an oilfield production site’s flare stack.

High-value liquids are removed for subsequent sale, the remaining methane is compressed and loaded onto Ferus’ specialized tube trailers to deliver gas power to drilling rigs, hydraulic fracturing crews or other oilfield power applications. The second is the Permian shale play, where burgeoning oil production is rapidly increasing associated gas production, which can be delivered by virtual pipeline to LNG export plants along the Gulf Coast.

As these examples illustrate, the virtual pipeline concept can be used in a variety of ways to serve different customer segments ranging from the large energy-intensive business customers located in remote, off-grid or difficult-to-access places to shale oil exploration and development companies, as well as meeting the filling-up needs of a growing number of natural gas-powered vehicles.

Comments