Keystone XL Operator Reassessing Interest Of US Producers

BISMARCK, N.D. (AP) — TransCanada Corp. is reassessing whether oil producers in North Dakota and Montana are still interested in shipping crude through its long-delayed Keystone XL pipeline now that they have other new options to ship their product, including the Dakota Access pipeline.

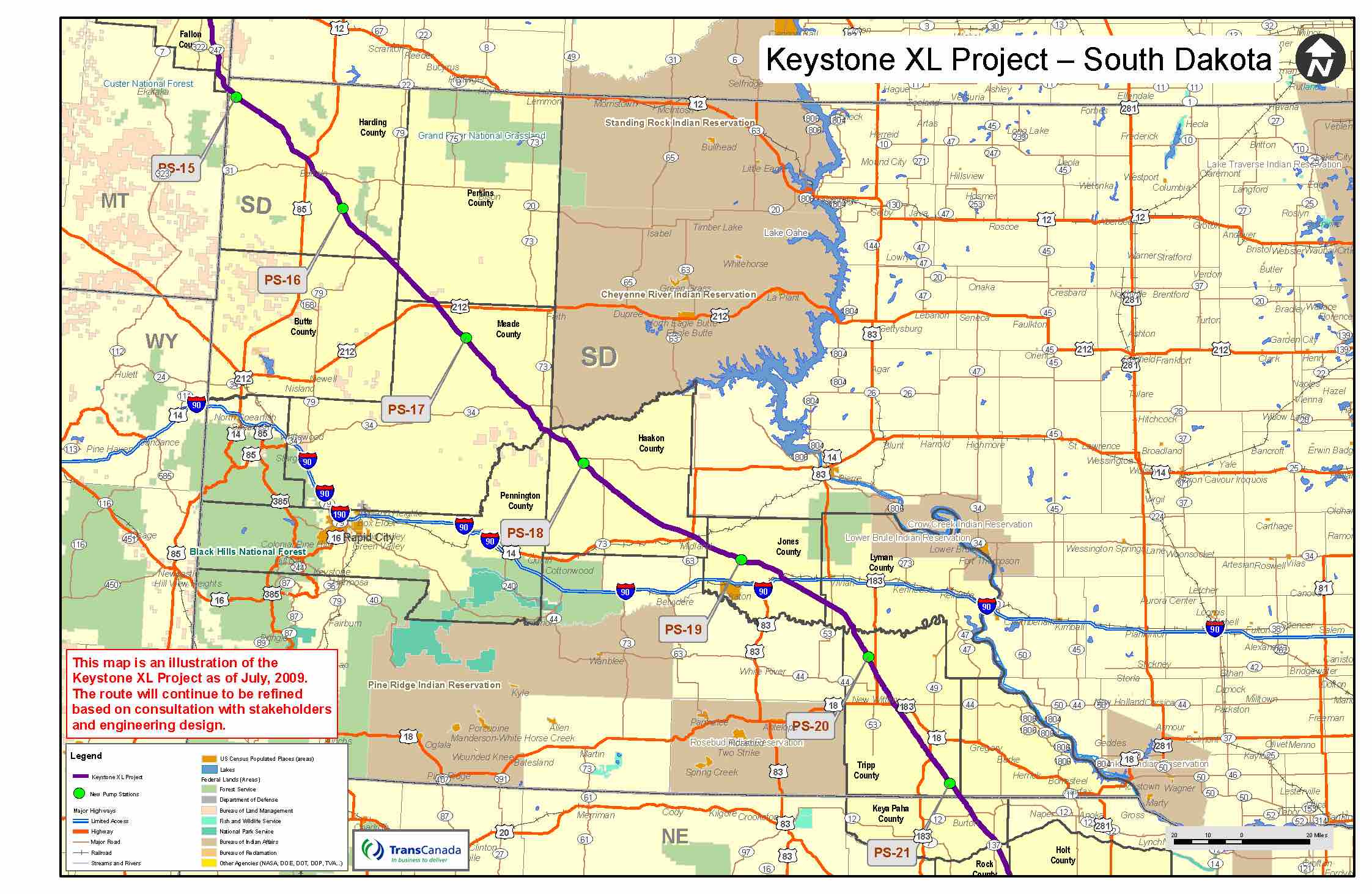

The Calgary-based company’s announcement this month comes with the Keystone XL still needing approval of its proposed route through Nebraska and with the Dakota Access, which was designed to transport about half of North Dakota’s oil production, expected to be fully operational by June.

TransCanada announced in 2011 that it had secured five-year contracts to move crude from the oilfields of North Dakota and Montana via a proposed five-mile-long access pipeline. The $140 million project, designed to carry 100,000 barrels of crude daily from the rich Bakken and Three Forks formations, would meet with the Keystone XL in Baker, Montana.

Work on that access line was never started, and TransCanada spokesman Matthew John said the company plans to re-engage with prospective shippers “because of a lot of changes in the oil market.”

John said the company also would be surveying Canadian shippers to firm up support for the entire Keystone XL.

“We are confident the project still has a need, absolutely,” he said.

TransCanada first submitted its $8 billion Keystone XL project for review in late 2008. The company initially balked at allowing U.S. crude on the pipeline that’s designed mainly to carry Canadian oil south but also passes through rich oil fields along the Montana-North Dakota border.

The company reversed its stance in 2010 under political pressure from officials in the two states. Montana’s then-Gov. Brian Schweitzer had threatened to hold up Keystone XL’s 280-mile route through his state if it did not agree to an “onramp.” North Dakota’s congressional delegation also pushed for access to the pipeline.

Ron Ness, president of the North Dakota Petroleum Council, said the state’s oil producers likely still want the option of utilizing the Keystone XL.

“I don’t think it’s as critical as it once was,” said Ness, whose group whose group represents several hundred companies working in North Dakota’s oil patch. “But I’m never going to say we don’t want every option available.”

When TransCanada first sought shipping commitments for the pipeline spur in 2010, North Dakota was producing about 342,000 barrels of oil daily. The state now puts more than 1 million barrels daily and is the No.2 oil producer behind Texas.

The Keystone XL pipeline gained federal approval in March when President Donald Trump overturned former President Barack Obama’s rejection of the project in 2015. It already had been approved by most of the states along the route.

But the project still lacks approval of a route through Nebraska. State regulators have begun reviewing TransCanada’s proposed route.

Nebraska regulators plan to hold hearings on the proposed route in August and they likely will issue their decision sometime in the fall.

The company said it hopes to start a two-year construction phase of the pipeline in 2018.

Justin Kringstad, director of the North Dakota Pipeline Authority, said getting U.S. oil producers to re-commit to shipping on the Keystone XL “depends on the timing of the project.”

“It’s a completely different environment than what we had five years ago,” he said. “It’s really going to be up to market to decide the need.”

Wyoming-based True Cos. had built a terminal to store oil at the Keystone XL link in southern Montana several years ago though it’s no longer being used for its original purpose.

“We repurposed it because it took such a long time,” spokeswoman Wendy Owen said. “We’ll take a look at it if it comes up again.”

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Mexico Seizes Air Liquide's Hydrogen Plant at Pemex Refinery

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

Comments