April 2017, Vol. 244, No. 4

Features

Decommissioning of Offshore Oil and Gas Facilities Rising Sharply

The decommissioning of aging offshore oil and gas platforms, subsea wells and related assets is increasing dramatically, with over 600 projects expected to be disposed of during the next five years alone. This rapid trend toward decommissioning is causing spending to rise significantly, according to a study.

The IHS Markit Offshore Decommissioning Study suggests spending on decommissioning projects will rise from $2.4 billion in 2015 to $13 billion-per-year by 2040, or an increase of 540%. The report offers a detailed market analysis and assessment of the legal, regulatory and financial requirements for decommissioning in the UK, Norway, U.S. Gulf of Mexico, Indonesia and Australia.

Another 2,000 offshore projects will be decommissioned between 2021-40, the report said, and total expenditures in that period will amount to $210 billion. In the next five years, Europe will absorb about 50% of global decommissioning spending as the industry removes major offshore structures from the North Sea. Each year, the industry decommissions an average of 120 projects on a global basis, IHS Markit said.

“In terms of decommissioning, the global offshore industry is headed for a perfect storm,” said Bjorn Hem, senior manager of IHS Markit upstream costs and technology service and one of the study’s authors.

“We see increasingly stringent decommissioning regulations coming into force at the same time that the inventory of structures nearing end-of-life status is getting larger and more complex,” Hem said. “At the same time, the providers of decommissioning services are very fragmented – there are no dominant players, so this makes it even more difficult for offshore E&P (exploration and production) companies and offshore service companies to accurately predict decommissioning costs and risks.”

The report notes as E&P activity has shifted to deeper waters, harsher environments and increasingly complex projects, some of which comprise hundreds of wells and miles of risers tied back to a few ultra-large platforms, operators face enormous challenges when planning removal of these assets.

Some decommissions can cost billions and take years. Decommissioning delivers no return on investment or revenue, but instead carries significant environmental and regulatory liabilities.

“The effective decommissioning of offshore platforms, subsea wells, and related assets is one of the most important business challenges facing the oil and gas industry today and in the future,” said Bill Redman, senior director of upstream costs at IHS Markit. “Decommissioning represents a considerable shift in terms of sustainable business planning for most operators.”

Environmental issues in decommissioning include dealing with any potential direct effects on the marine ecosystem, ensuring the appropriate use and containment of hazardous substances, and addressing waste management issues, including seabed debris accumulated during the life of the platform.

Items typically involved in decommissioning include surface facilities, called topsides, as well as subsea installations, pipelines and wells. These topsides structures can vary greatly in size and function, from one small well/wellhead to massive deepwater installations, including large processing and storage assets and staff accommodation facilities.

Navigating the myriad environmental and waste-management regulatory requirements that individual countries have regarding decommissioning is a significant challenge for operators and offshore vendors, the report said. That equation is getting even more difficult as decommissioning activity shifts from individual assets to entire fields, and to larger, more complex structures.

Historically, the Gulf of Mexico (GOM) and the North Sea regions, which entered the oil and gas industry first, have dominated decommissioning demand. Older offshore installations also exist in other regions, such as the Middle East, but because of their longer field life, IHS Markit expects these assets to operate for many years to come.

The report said the GOM has had the most platforms decommissioned, about 4,000, and with over 5,000 oil and gas structures in place, the region also has the largest number of platforms yet to be decommissioned.

Since these offshore facilities provide significant habitat for marine life, the GOM is home to the largest artificial reef system in the world. Many global operators participate in Rigs to Reef programs, which allow the repurposing of decommissioned rigs as artificial reef structures.

“While North America is the largest market for decommissioning, the European region has the largest amount of offshore decommissioning spending, based on the size and volume of the structures being decommissioned in the North Sea, including concrete gravity-based structures (GBSs),” said Grigorij Serscikov, senior manager, Upstream Oil Gas at IHS Markit, another author of the report.

Statoil, Total, Chevron, ExxonMobil and ConocoPhillips are the top-five operators globally in terms of spending by operator.

Beyond North America and Europe, Angola and Nigeria will drive decommissioning spending in Africa, while shallow-water Australia will drive demand in the Asia-Pacific region. Mexico and Brazil will be the focus of decommissioning demand in Central and South America, IHS Markit said.

Decommissioning costs also vary across a wide range of platform types, from unmanned production units to large multi-platform complexes. Those costs often differ even for similar facilities, as many projects have their own level of specialized decommissioning requirements.

In general, historical decommissioning costs for rigs in the Gulf of Mexico have been in the $500,000 to $4 million range for shallow-water structures. Platforms included in this category can vary from single-pile, one-well platforms that are located in several feet of water, to larger, four-pile structures in water depths up to 120 meters.

Costs naturally increase with water depth and size, as well by type, complexity and size, IHS Markit said. A four-pile structure in 15 meters of water depth typically costs just under $2 million in decommissioning and removal whereas a structure in 100 meters of water will cost nearly double that to dismantle.

The North Sea involves much larger structures and costs typically are higher. For example, one gravity-based system with a 22,500-ton topsides and an 180,000-ton substructure has an estimated decommissioning cost of $2 billion.

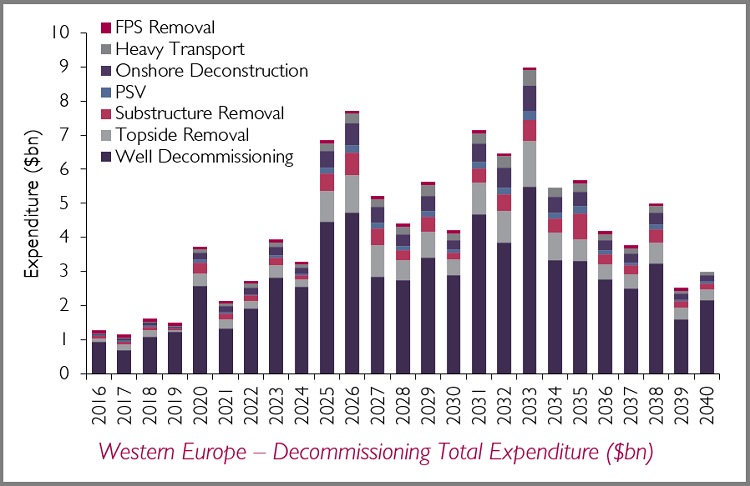

In a related report on March 7, Douglas-Westwood forecast that the expenditure in Western Europe is expected to total $105 billion over 2017-40 as major decommissioning activity begins. Douglas-Westwood said Western Europe will be the first area outside the Gulf of Mexico to see large-scale decommissioning activity.

Countries covered in the study include: Croatia, Denmark, Italy, Germany, Greece, Ireland, The Netherlands, Norway, Spain and the UK.

The rise in decommissioning activity will provide a significant opening for specialist companies aiming to establish themselves within the industry, from vessel contractors and cutting service/equipment providers to shipyards and companies specializing in waste management/disposal.

With the publication of the UK government’s MER UK Strategy in March 2016 being a notable example, the focus within the decommissioning market is expected to remain on maximizing cost-effectiveness, which will involve ensuring that operations are carried out efficiently and without incident. It will also involve taking adequate steps to explore all options for reducing decommissioning costs.

Key report findings:

- Well decommissioning represents 65% of the total market over the period.

- Substructure and topside removal accounts for a combined 20% of expenditure over 2017-40.

- With the largest population of ageing platforms, the UK is expected to account for the largest proportion of decommissioning activity in Western Europe over 2017-40, representing 54% of total expenditure, and 45% of platform removals.

The 2031-35 period is forecast to see particularly high levels of expenditure as activity increases in Norway and the UK.

Comments