New U.S. Border-Crossing Pipelines Bring Shale Gas to More Regions in Mexico

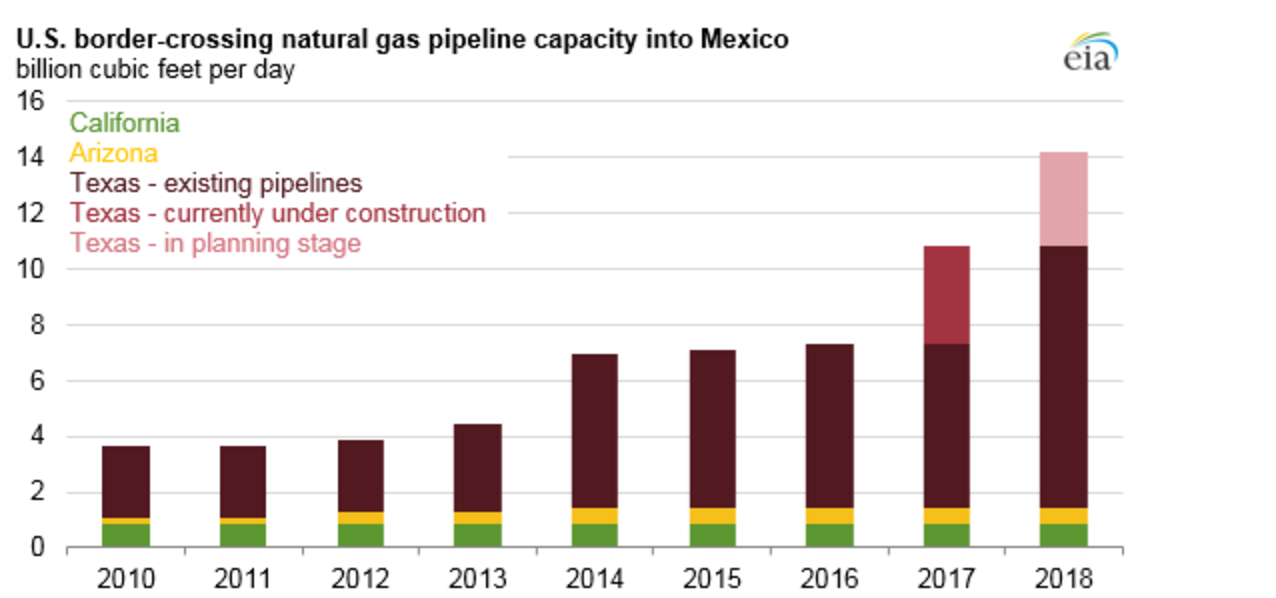

U.S. pipeline capacity for natural gas exports to Mexico has rapidly expanded in the past few years and currently stands at 7.3 billion cubic feet per day (Bcf/d). This existing cross-border capacity primarily supplies the Northeast and Central regions of Mexico. New capacity projected to be completed in the next several years will help to supply Mexico’s Central and Northwestern regions.

The expansion of the U.S. cross-border pipeline network into Mexico has been driven primarily by strong growth in Mexico’s natural gas demand in the power sector, declining domestic production, and the lower prices of U.S. pipeline gas compared with more expensive liquefied natural gas (LNG) imports.

In the next three years, U.S. pipeline capacity into Mexico will nearly double. In 2017, four U.S. pipeline projects under construction—Roadrunner (Phase II), Comanche Trail, Presidio Crossing (also called Trans-Pecos), and Nueva Era—totaling 3.5 Bcf/d, will supply natural gas to new natural gas-fired power plants in the states of Chihuahua, Nuevo Leon, Sonora, and Sinaloa. By the end of 2018, two additional pipelines—KM Mier-Monterrey and Neuces-Brownsville—totaling 3.3 Bcf/d, are projected to begin exporting natural gas to Mexico’s Northeast and Central regions, mainly from the Eagle Ford play in southern Texas.

U.S. pipeline exports to Mexico have increased significantly over the past several years and are beginning to gradually displace Mexico’s LNG imports. The completion of the Los Ramones Phase I pipeline (2.1 Bcf/d capacity), which went into service in 2014, has already mostly displaced LNG imports at the Altamira terminal with natural gas from the Eagle Ford play. LNG imports at Altamira averaged 0.1 Bcf/d through October of this year, more than 50% lower than in 2015.

The completion of Phase II South (1.4 Bcf/d) of Los Ramones pipeline is expected to displace LNG imports at the Manzanillo terminal in the Central region of Mexico, including Mexico City. LNG imports to Manzanillo averaged 0.5 Bcf/d through October. The Central region has been experiencing natural gas shortages and has been required to purchase additional LNG to make up the difference. Once Los Ramones Phase II South begins operation and ramps up to full capacity, more U.S. shale gas is expected to displace LNG imports at the Manzanillo terminal.

Related News

Related News

- Keystone Oil Pipeline Resumes Operations After Temporary Shutdown

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

- Freeport LNG Plant Runs Near Zero Consumption for Fifth Day

- Enbridge to Invest $500 Million in Pipeline Assets, Including Expansion of 850-Mile Gray Oak Pipeline

- Williams Delays Louisiana Pipeline Project Amid Dispute with Competitor Energy Transfer

- Evacuation Technologies to Reduce Methane Releases During Pigging

- Editor’s Notebook: Nord Stream’s $20 Billion Question

- Enbridge Receives Approval to Begin Service on Louisiana Venice Gas Pipeline Project

- Russian LNG Unfazed By U.S. Sanctions

- Biden Administration Buys Oil for Emergency Reserve Above Target Price

Comments