August 2016, Vol. 243, No. 8

Features

Ghana’s Sankofa Gas Project a Game Changer

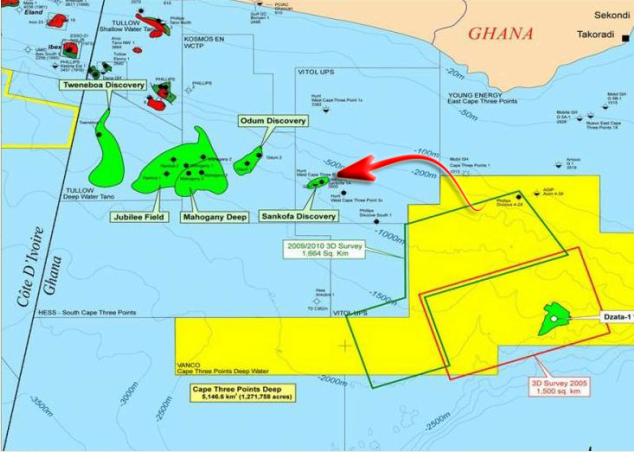

Ghana’s Sankofa Gas Project (SGP) is focused on the development and subsequent production of two offshore natural gas fields within the OCTP (Offshore Cape Three Points) bloc. OCTP is comprised of the Sankofa and Gye Nyame non-associated gas fields, and the separate Sankofa East oil field (estimated total reserves exceeding 100 million barrels of oil). This field is located 60 km offshore in western Ghana in water depths of 500-1,000 meters.

OCTP is being developed by two private investors, Eni S.p.A. of Italy and Vitol Group of the Netherlands – together with the state-owned Ghana National Petroleum Corp. (GNPC). The total development cost for the OCTP block is estimated at US$7.9 billion over the life of the project.

Sankofa is the only significant accumulation of non-associated gas in Ghana. Since this resource can be produced as baseload supply without any linkage to oil production, it represents an important alternative fuel resource for Ghana’s thermal power generation sector, which is dependent on imported light crude oil. SGP’s expected production of 180 MMcf/d over the nearly 14-year “plateau period” would be sufficient to supply close to 1,000 MW of gas fired power generation.

Production from the Sankofa gas field and the Sankofa East oil field will come from separate reservoirs developed according to different schedules. Oil and gas will both flow through a shared FPSO. Phase 1 oil development is expected to begin commercial operation in mid-2017, Phase 2 gas development in the first half of 2018. Separate commercial arrangements are being entered into for oil field and natural gas production. The World Bank’s new scheme provides guarantees to support the commercial arrangements of the natural gas field development.

The petroleum agreement covering the OCTP block was signed by Vitol and GNPC in June 2006. From 2004-08, GNPC negotiated Petroleum Agreements covering 12 deepwater blocks in the Western (Tano) Basin, including the blocks where the Jubilee and TEN fields were subsequently discovered. In 2009, Eni acquired a majority participating interest in the OCTP Block and assumed operatorship. The petroleum agreement expires in 2036. Per normal practice in the oil and gas industry, the partners conduct business via an unincorporated JV governed by a joint operating agreement (JOA).

The first exploration well on the block was drilled in 2009 and resulted in discovery of the Sankofa gas field. In 2011, both the Sankofa East oil field and Gye Nyame gas fields were discovered. In total, eight exploration and appraisal wells were drilled between 2009-13. As in the case of Jubilee and the other Tano Basin discoveries, the OCTP block discoveries are Cretaceous-age channel sand deposits accumulating light oil and gas/condensate in stratigraphic traps.

In 2013, the exploration phase under the petroleum agreement ended and Eni/Vitol submitted declarations of commerciality on Sankofa, Sankofa East, and Gye Nyame. The partners also submitted a proposed a plan of development (PoD) under which the oil accumulations and gas accumulations would be developed separately. The Minister for Energy and Petroleum rejected this concept, insisting on an integrated oil and gas development.

During 2013-14, commercial and technical discussions took place, an integrated (oil and gas) PoD was resubmitted, and on Dec. 30, 2014, the revised integrated PoD was approved by the minister for Energy and Petroleum.

Eni is the designated operator of all the fields in the OCTP block and holds a 44.4% participating interest. Vitol holds a 35.6% participating interest, and GNPC holds 20%. GNPC’s participating interest of 15% is fully carried by Eni and Vitol through the exploration and development phases. In January 2015, GNPC exercised its option to take an additional 5% fully paid (but financed by the private sponsors) participating interest.

Oil and gas will be produced via a floating production and storage unit (FPSO). The OCTP FPSO will be a new-converted double-hull oil tanker (VLCC) anchored using spread mooring in around 1,000 meters water depth and connected via double riser balconies to the subsea wells through wellheads, manifolds, pipelines and riser systems. The FPSO will have a minimum storage capacity of 1.4 million barrels.

The development of the OCTP will be carried out in two parallel phases. The PoD calls for field development to be conducted in two phases. Phase 1 oil development will consist of 14 subsea wells (eight oil producers, three water injection wells, and three gas injection wells) drilled to a depth of up to 4,000 meters below sea level and tied back to the FPSO via flexible risers. First production for Phase 1 is projected for August 2017, and peak production will be 45,000 bpd.

The Phase 2 non-associated gas (NAG) development will consist of five gas-producing wells tied back to the FPSO. The NAG production is expected to begin in the first half of 2018. After reaching plateau production rates in 2019, the project is expected to produce 180 MMcfd for nearly 14 years before entering the decline phase.

The associated gas from the Phase 1 oil wells will be re-injected to maintain pressure in the oil reservoirs, but will also be used to generate power on the FPSO and to supplement NAG production in the event of short-term production problems. The installations are being designed to meet zero gas flaring standards as well as zero discharge of produced water.

The NAG production will be processed on the FPSO for condensate recovery and dew- point control. Then a 63-km, 22-inch subsea pipeline will carry dry sales gas from the FPSO to an onshore receiving facility (ORF) to be built at Sanzule, 10 km east of GNGC’s gas-processing facility located at Atuabo. At Sanzule, ORF will interconnect with GNGC’s 20-inch pipeline connecting the Atuabo processing plant with thermal generation plants at Aboadze, near Takoradi. The GNGC pipeline carries gas from the Jubilee field and will also carry gas from the TEN development once gas production begins (expected in 2018).

ORF will house two stages of compressors. A first-stage compressor will compress the OCTP gas up to 50 bars, after which OCTP gas will be commingled with the Jubilee/TEN gas arriving from Atuabo. A second stage of compressor will have the capacity to take the combined gas stream up to 100 bars, the maximum operating pressure of the GNGC pipeline.

Under the POD‘s base case, total recovery over the life of the project is estimated at 1,071 Bcf of gas as well as commercially viable amounts of condensate and crude oil.

The development of the OCTP will require an investment of US$3.9 billion up to the end of 2017 (for both the oil field development and the Sankofa NAG). The private sponsors envisage financing the total project costs for the OCTP development through a mix of equity, shareholder loans, and commercial debt. The sponsors took their final investment decision in December 2014. Vitol plans to replace its equity financing with project finance debt, subject to approval of World Bank guarantees.

The total cost of the Phase 1 and 2 developments over the lifetime of the project is US$7.9 billion, including the 20-year lease cost of the FPSO. Because oil production is expected to start in Q3 2017, part of the investment will be self-financed by oil revenues.

Vitol is likely to structure its financing share within a mix of equity, shareholder loans, and a limited recourse commercial debt financing, which may also be sourced partly from IFIs including IFC. GNPC is expected to finance its funding share through equity proceeds only.

Comments