May 2016, Vol. 243, No. 5

Features

EIA Says New Projects Could Make Australia No. 1 LNG Exporter

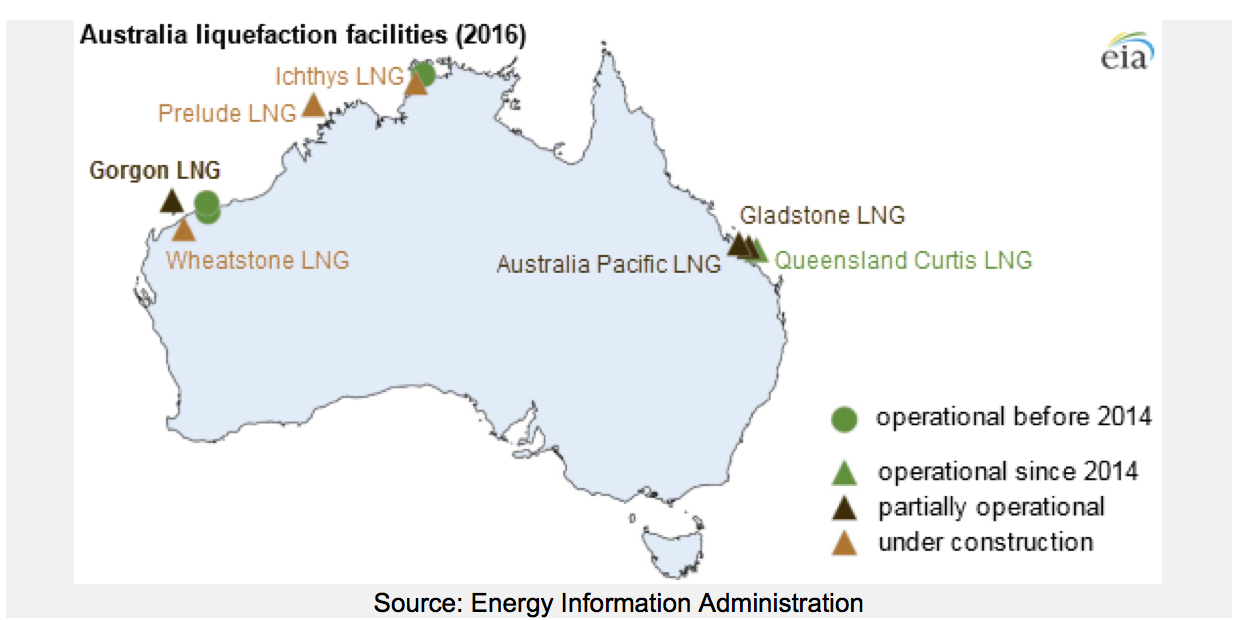

A report released March 30 by the U.S. Energy Information Administration (EIA) suggests that Australia could become the largest LNG bas exporter within three years. The EIA said the massive Gorgon project shipped its first cargo to Japan earlier in the month and that three more projects in eastern Australia have been fully or partially commissioned since 2014.

Australia has LNG export capacity of 6.2 Bcf/d and if more comes online, it would hold 11.5 Bcf of natural gas export capacity. That amounts to about one-third of the total market in 2014, according to the EIA.

The most recently commissioned project is the Gorgon LNG, on Barrow Island off the northwest coast and includes a gas plant, a carbon dioxide injection project and a liquefaction and export facility. The project had been budgeted at $37 billion but grew to $54 billion by 2013. Chevron is the operator, owning 47.3% in the liquefaction plant and associated projects, which include a carbon dioxide injection plant and a gas plant in Western Australia. ExxonMobil and Royal Dutch Shell each own 25% stakes. Osaka Gas, Tokyo Gas and Chubu Electric Power own the remaining 3% interest.

Three projects in eastern Australia have also been working since 2014, the EIA noted. The Queensland Curtis commissioned two trains in 2014-15, Gladstone commissioned one train last October and Australia Pacific shipped its first cargo in January. The three projects have capacity of 2.3 Bcf/d and a planned capacity of 3.4 Bcf/d when completed, the EIA said.

Three other projects are following Gorgon on the western coast. They are the Prelude, Wheatstone and Ichthys LNG plants, which have combined capacity of 2.8 Bcf/d and are expected online in by 2018, EIA said. Most of the gas is headed for Asia. Japanese customers have contracted for 79% of output from operating liquefaction and 35% of new projects. China is the second-largest destination, with about 15% of existing capacity and 23% from new projects, the EIA said. About 2 Bcf/d of new capacity is expected to be sold to short-term spot buyers.

Partners Shelve Floating LNG Project

Woodside Petroleum, Australia’s second-largest oil and gas producer, said March 23 it will not go ahead with near-term development of the $30 billion Browse floating LNG development off Western Australia, as low oil prices bite into project economics and access to development funds. Woodside, along with its partners in the massive offshore floating LNG production and storage project, said the “extremely challenging” energy market environment had stalled progress.

Woodside had been targeting a final investment decision this year. The announcement represents the shelving of Australia’s last chance to continue a run of resources mega-project approvals that have seen $200 billion of LNG investments approved in the past decade.

“The Browse joint venture participants have decided not to progress with the development at this time considering the current economic and market environment,” Woodside said. Shell, BP, PetroChina, Mitsubishi and Mitsui are also partners.

“Woodside remains committed to the earliest commercial development of the world-class Browse resources and to FLNG as the preferred solution, but the economic environment is not supportive of a major LNG investment at this time,” Woodside CEO Peter Coleman said.

The Browse project sits on an estimated resource of 15.4 Tcf of dry gas, plus 453 MMbbls of condensate, in a basin about 260 miles north of Broome in Western Australia.

Comments