March 2016, Vol. 243, No. 3

Features

AOPL-API Report Finds Pipeline System Growing

During the past five years U.S. crude oil pipeline mileage has grown by 22% for an increase of 12,000 miles – or to think of it another way, about the distance covered in two round-trips between Seattle, WA and Tampa, FL.

“In the time the Keystone XL pipeline was under review, we built the equivalent length of 12 Keystone XL pipelines across the United States,” Andrew Black, Association of Oil Pipe Lines (AOPL) president and CEO, said recently.

Black was commenting on a joint report from AOPL and the American Petroleum Institute (API) that found, among other things, liquid pipelines stretched across 199,243 miles of the United States at the end of 2014, based on information submitted by operators to PHMSA as recently as October.

That represented a 3.5% increase over 2013 as crude pipeline mileage increased 5,000 miles, a 9.1% increase over the previous year.

According to the U.S. Liquids Pipeline Usage & Mileage Report, 66,649 miles of U.S. liquids pipeline was devoted to crude oil, while 61,681 miles delivered refined products, including gasoline diesel and jet fuel, and 65,595 miles moved natural gas liquids, including propane, ethane and butane.

“We have, of course, seen remarkable growth in mileage over the past several years based on the demand to take away products from new production,” said John Stoody, AOPL vice president of Government. “What we don’t know is what portends for the future.”

Stoody pointed out that while large pipeline infrastructure projects are on a longer time frame than most other construction projects, such undertakings only get off the ground because of the commitment of shippers, whose involvement is the linchpin on which the financing can be based. With that in mind, he said, projects will continue to be built based on supply and demand. The short-term picture, however, is not so clear.

“We’re waiting to see what the short-term outlook is,” Stoody said. “Certainly, over the medium and long term, the fundamentals are there.”

With supply always a key consideration in putting forward projects, areas where there is already a large supply may not get as much attention as projects going into other parts of the country.

“It also depends on the refineries in a particular region and what the competing sources are, such as rail,” Stoody said. “Some of the refineries in the Midwest switched over to heavier crude a couple of years back in anticipation of production, and now we have greater light production from the Bakken.”

While the report found falling crude prices during 2014 and 2015 led to a downturn in production growth, it also said, “Operators are optimistic about maintaining existing throughput and constructing new pipelines. Over the long term, there will still be a need for pipeline growth to connect supply areas to demand locations.”

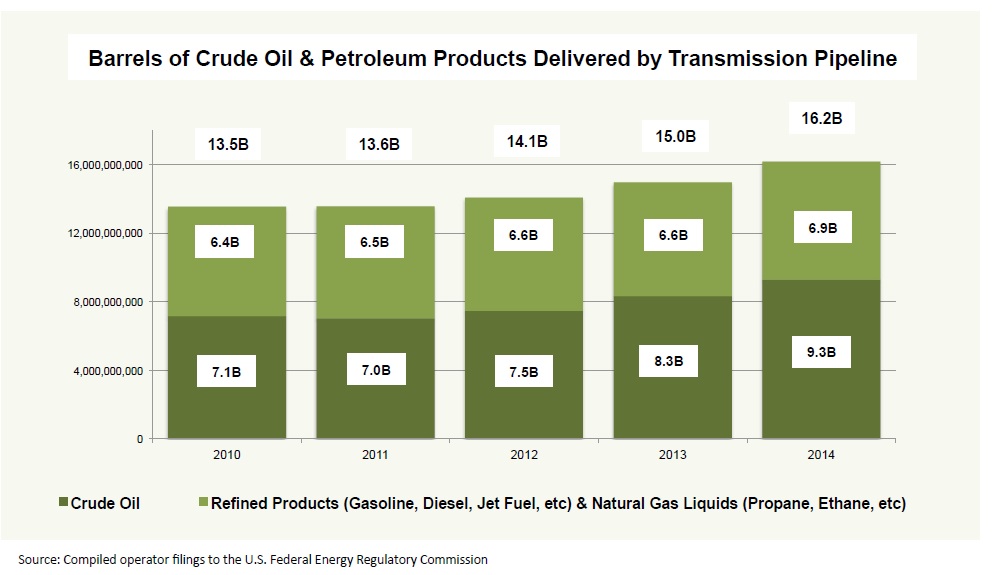

Pipeline deliveries in the United States during 2014 stood at 9.3 Bbbls of crude, which was an 11.6% increase over the previous year, accounting for an almost 1 Bbbl increase. Annual crude oil deliveries by pipeline grew 2.1 Bbls from 2010-14, a 30.8% increase.

Other petroleum products deliveries increased by about 500 MMbbls from 2010-14, or 7.6%. Total liquids pipeline deliveries of crude, refined products and natural gas liquids totaled 16.2 Bbbls in 2014, an 8.1% increase from 2013, data from Form 6 filings made by operators to FERC showed.

Additionally, transmission liquids pipelines, including interstate pipelines or other large intrastate, main or trunklines, delivered 6.89 Bbbls of petroleum products, and natural gas liquids, an increase of 3.7% year-over-year.

Beyond Keystone XL

Stoody said that while the AOPL has a keen interest in Washington legislative affairs, the organization does not see new problems arising in the wake of the Keystone XL rejection by President Obama.

“Luckily, Keystone was the only example of a project where permitting depended on the White House because of the international border crossing,” he said. “Other projects have gone forward. The process in the U.S. can work if it is allowed to work, and we are seeing projects go forward and get built.”

While AOPL is supportive of pipeline safety issues that come before various committees on topics ranging from leak protection to improving smart technology and maintains “an active slate of industrywide efforts” in this regard, Stoody said the organization’s top legislative priority is the reauthorization of the federal pipeline safety law.

More than five years in the making, its guidelines will determine, in part, if extra safety measures that are required in environmentally sensitive and populated areas should be expanded to new locations. The Senate committee with pipeline jurisdiction approved such a bill on Dec. 9, and House committees are expected to review separate versions of the bill soon.

Known as the Securing America’s Future Energy: Protecting Infrastructure of Pipelines and Enhancing Safety (Safe Pipes) Act, it would reauthorize PHMSA from fiscal years 2016 through 2019. Key provisions of the bill include:

- Requiring PHMSA to complete outstanding mandates from the 2011 reauthorization bill.

- Requiring PHMSA to prioritize statutory requirements for rulemaking over new rulemaking.

- Requesting that PHMSA conduct an assessment of inspections process and integrity management programs for natural gas and liquid pipelines.

- Providing direct hiring authority to the agency so PHMSA can address its staffing challenges.

“We expect action this spring,” Stoody said.

Other significant findings from the U.S. Liquids Pipeline Usage & Mileage Report include:

- Total U.S. pipeline mileage has increased 32,483 miles or 19.5% over the last 10 years.

- Crude oil pipelines have grown 17,917 mile or 36.8% over the last 10 years.

- Refined petroleum product pipeline mileage has decreased 1,670 miles or 2.6% from 2013, 3,119 mile or 4.8% over the past five years, and a 1,218 mile or 1.9% from 10 years ago.

- Pipelines carrying natural gas liquids increased by 7,615 miles or 13.1% over 2010 levels, and 14,311 miles or 27.9% over 2005.

With the exception of a small decline in refined petroleum product pipeline mileage, all other areas reported growth. But should AOPL and its members expecting such good news in next year’s report following the further drop in prices that greeted them in the New Year?

“We’ll report the data that we get,” Stoody said. “I can say pipelines remain the safest way to transport liquid energy. When you mix that with the per barrel cost benefits, the future for pipeline over the medium- and long-term is great.”

Liquids Pipelines Still in the Works

Despite falling oil prices, spending cuts, environmental constraints and the aftershock following the Keystone XL decision, liquids pipelines are still being built, albeit some of the projects now face delays. Listed are several liquids pipelines already in progress or expected to have made major strides before the year ends.

Dakota Access Pipeline: In January, the North Dakota PSC joined the South Dakota and Illinois PSCs in approving the $3.8 billion Dakota Access pipeline, which would carry nearly half the Bakken production. The 1,134-mile, 30-inch pipeline is projected to be in service by the fourth quarter but still requires approval in Iowa.

Mariner East Pipeline: Sunoco Logistics Partners plans to build an additional pipeline to deliver Marcellus Shale products to the Philadelphia-area Marcus Hook refinery, reflecting a growing market for liquid fuels derived from the region’s shale drilling. While Mariner East pipeline will deliver 70,000 bpd of NGLs when it is fully operating later this year, the 20-inch Mariner East 2 would deliver 275,000 bpd. The second 16-inch pipeline would deliver 225,000 bpd.

Dos Aguilas Pipeline: Howard Midstream Energy Partners’ subsidiary, Dos Águilas, plans to permit, construct and operate the Dos Águilas project, an open-access system of refined products terminals and pipelines spanning from Corpus Christi, TX to northern Mexico. The project is expected to be in-service in early 2018.

Aegis Pipeline: In January, Enterprise Products Partners completed construction, commissioned and initiated operation of the remaining 162-mile portion of the Aegis ethane pipeline from Lake Charles, LA to the Napoleonville, LA area. The 270-mile, 20-inch system originates at Mont Belvieu, TX. The company said the project received strong interest, as indicated by the success of four open seasons, including the most recent one, Nov. 1-30. Customers have executed contracts totaling 360,000 bpd, ramping up over the next four years. With additional pumps, the pipeline will have the capacity to transport about 400,000 bpd of ethane.

Thunder Creek NGL Pipeline: Meritage subsidiary Thunder Creek NGL Pipeline is developing a new interstate, common-carrier pipeline system to provide options for delivering product from Wyoming’s liquids-rich Powder River Basin to NGL markets at Mont Belvieu and Conway, KS. The pipeline has a preliminary design capacity of 15,000 bpd, expandable to 30,000 bpd. The first 108-mile leg came into service in April. Meritage will begin construction of a 140-mile extension to the NGL pipeline when market conditions and demand warrant.

Lone Star NGL Express Pipeline: Lone Star NGL is building a pipeline from the Permian Basin to Mont Belvieu and converting its West Texas 12-inch NGL pipeline into crude oil condensate service. The system will include 533 miles of 24- and 30-inch pipe and should be operational by the third quarter. The conversion project could begin operation by the first quarter of 2017. The estimated cost is $1.5 billion.

Cornerstone Pipeline: Marathon Pipe Line and Ohio River Pipe Line, subsidiaries of MPLX LP, plan to extend the binding open season to assess interest in the Cornerstone Pipeline and associated Utica Shale buildout projects. The proposed 16-inch pipeline will originate in Harrison County, OH and deliver to Marathon Petroleum’s Canton refinery and to ORPL’s East Sparta tank farm. The estimated in-service date is late 2016.

BridgeTex Pipeline: BridgeTex Pipeline Co. recently extended its open season to gauge interest in a new origin that would accept Eaglebine crude oil and condensate shipments in Grimes County, TX. Depending on demand, BridgeTex may expand system capacity by 35,000 bpd to accommodate volumes from Grimes to the Houston Gulf Coast area. The 50/50 owned Magellan Midstream Partners and Plains All American Pipeline project is scheduled to begin operations by mid-2017.

By Michael Reed, Managing Editor

Comments