February 2016, Vol. 243, No. 2

Features

Canada’s Energy Industry, Part I: Changing Times, Shifting Opportunities

To feel the winds of change from the global crash of crude oil prices in 2015, go no farther away than Canada, the world’s fifth-largest energy-producing nation.

On the verge of a transformation before the commodity price nosedive, the U.S. northern neighbor is even more unsettled as global and North American markets unravel. As a result, in late 2015 it was hard to see a clear pattern for Canada’s future energy infrastructure needs. Different pundits envision varying futures.

As the first freezing temperatures were sweeping through the nation, political, as well as economic, winds were blowing hard, hitting at some major infrastructure projects, such as Enbridge’s $6.5 billion, 650-mile Northern Gateway oil pipeline project from Alberta to the west coast of British Columbia. Initial reports indicated that it was presumably snuffed out near the end of 2015 when newly elected Prime Minister Justin Trudeau declared his intention to declare a moratorium on tankers operating along the northern B.C. coast.

However, Enbridge has not given up, noting the project, which gained regulatory approvals in 2014, is alive and well. Enbridge and its supporters see the project as “essential infrastructure” and company officials remain hopeful the national government will rethink any limitations on tankers, said Ivan Giesbrecht, communications manager with Northern Gateway.

Nevertheless, a day before the new prime minister’s statements, TransCanada Corp. announced a slowing of its natural gas supply network in the provinces of Alberta and British Columbia, after completing its latest infrastructure additions.

Analysts in the industry, regulatory bodies and think tanks were busy recalculating their metrics and rewording forecasts, some with dour adjectives. For example, the Conference Board of Canada last fall was predicting Canada’s oil industry would lose over $2 billion for the year. It is decidedly more bullish on 2016 for both oil and gas projects, according to Carlos Murillo, an economist for the Conference Board tracking industrial trends.

While Canada’s natural gas exports to the United States have slowed to a trickle in the east, oil exports to the south continued unabated in 2015. In August, Canada provided 45% of all crude oil imports into the United States, which has been the primary target for Canadian oil exports since the turn of the 21st century, according to the U.S. Energy Information Administration’s (EIA) analysis. Citing Canada’s National Energy Board (NEB) data, EIA said in the first half of 2015 99% of Canada’s oil exports came into the United States, mostly headed for Midwest refineries.

In 2014, 3.4 MMbpd of Canadian crude and related products crossed the border into the U.S. As oil imports from other areas of the world decrease, Canada’s oil supplies are becoming a bigger factor. According to the EIA, U.S. imports of crude oil and other liquids have increased 58% during the past 10 years. Four companies operate the export pipelines used in this trade – Enbridge Energy Partners, Kinder Morgan, Spectra Energy and TransCanada. Collectively, they used over 25,000 miles of pipelines in doing so.

Forecasting an average crude oil price in the $55/bbl range and gas at $3.40/MMBtu, Murillo said he sees the prospects for a number of investment decisions on big-ticket projects coming in 2016 for oil and gas, including what he considers the “largest and leading” LNG projects, Pacific Northwest LNG and LNG Canada. In late 2015, he also noted that “various land-based and barge-based small-scale LNG projects continue to advance along the regulatory process, and various gas extraction as well as natural gas and NGL transportation projects are in the works in Western Canada.”

In 2015, analysts like Murillo on both sides of the border were reviewing prospects for some of Canada’s largest producers in 2016, many of which are both oil and gas producers. The reviews are somber, given that depressed commodity prices have forced the producers to slash costs through layoffs, reductions in salaries and benefits, large deferrals, and cancellations in capital projects, as well as renegotiate contracts with suppliers and increase operating efficiencies. They see leaner, more tightly focused players in the oil and gas patch.

“Activity [in natural gas] continues to be focused on the Deep Basin area of northwest Alberta and northeast B.C., as the area has good access to infrastructure, wells have high productivity rates and high NGL content, and operators in the area continue to drive efficiencies,” said Murillo, calling the area “very competitive” with plays across North America.

At the same time, other parts of the Canadian energy industry had a more negative view of the near term, pointing in late 2015 to prospects for continued shrinkage in estimated new wells anticipated in 2016. The Canadian Association of Oilwell Drilling Contracts (CAODC) forecast less than 5,000 new wells for the new year (4,728), a 58% decline from the 11,226 wells drilled throughout Canada just two years earlier.

“Canadian gas and oil drilling will continue to retreat [in 2016] unless energy prices stage a surprise comeback,” a spokesman for the field equipment operators group predicted in late November.

CAODC President Mark Scholz placed the 2015-16 active rig count in Western Canada at the same level as 1983, which he called “one of the worst periods in our history.” Besides the commodity price fallout, Scholz told trade news media in his country last fall that Canada has been plagued with political uncertainty from the October election defeats of conservative governments in Alberta and nationally. This tended to put what he called a “left-leaning and unpredictable” spin on future energy policy and development prospects.

Reflecting the same sourness in its sector, the Petroleum Services Association of Canada (PSAC) envisioned a continuing slump in 2016 with a forecast of 5,150 wells being drilled. The association’s small “silver lining” is a perceived bottoming out of the downturn since it expected only a few more wells drilled in all of 2015, forecasting last fall that the final total would hit 5,340.

“Low commodity prices, oversupply and low cash flows obviously impacted us significantly in 2015, resulting in a more than 50% loss of activity from previous year averages,” said Mark Salkeld, PSAC CEO, adding that actual and projections combined are running over 50% below Canada’s previous five-year averages of more than 11,000 new wells each year. “With those same factors continuing we can’t expect anything better for 2016.”

Canada’s defeated prime minister, conservative Stephen Harper, was a strong supporter of tar sands oil development and the Keystone XL pipeline, so the environmental groups and other opponents have characterized the new government nationally and in Alberta as a serious blow to the oil and gas industry, as well as future development.

Within hours of Trudeau’s election, Anthony Swift, Canadian project director for the Natural Resources Defense Council, called the win “an unprecedented opportunity to move Canada away from the dirty fuels of the past and toward a clean energy future that will bring jobs, prosperity and security for all Canadians.” This added to the energy sector’s pessimistic outlooks in late 2015.

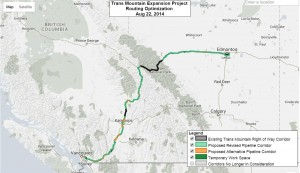

Trudeau said he supports pipelines over rail transport as he favors the Keystone XL oil pipeline and has voiced his support for several other major pipelines, such as TransCanada’s Energy East project, and the Kinder Morgan TransMountain pipeline. Both projects propose to move large amounts of oil to the east and west coasts of Canada, respectively.

“In terms of a possible future crude oil tanker ban along Canada’s west coast, we are confident [Trudeau’s government] will be embarking on the required consultation with First Nations and Metis [native groups] in the region, given the potential impact a crude oil tanker ban would have on those communities and Western Canada as a whole,” Enbridge’s Giesbrecht said. “We have made significant progress building support on the B.C. coast and along the pipeline corridor.”

From a macro-viewpoint, a continuing conundrum for Canada is that although it has the world’s third-largest oil reserves, it has less than 4% of the global market share. Salkeld said that predicament needs to be addressed, and continuing hurdles and limits to resource development need to be tackled. For now, he sees festering market access issues – “an environment of regulatory and policy uncertainty,” meaning Canada’s energy industry has been unable to “make anything better out of a bad situation that began in 2015.”

Nevertheless, it is the global markets that ultimately hold the key to increased production and infrastructure buildout in Canada. The attraction of LNG exports is built on this premise, and organizations such as the Canadian Association of Petroleum Producers (CAPP) have calculated that 7 Bcf/d of exports, which many think is Canada’s maximum realistic capacity, equates to $10 billion of new capital investment.

“Hopefully, it will be 7Bcf/d; we’ll be cheering up here if it is that amount,” said Mark Pinney, CAPP manager of natural gas markets/transportation. “There are a lot of challenges, but there are opportunities as well.”

As an example of this lemons-to-lemonade approach, there is the proposed development of pipeline conversions – gas-to-oil and the reverse. The decrease in gas flowing from the west to east in Canada due to the loss of the U.S. export market has morphed into an oil pipeline project, creating an opportunity for switching one of the six pipelines going west to east.

In late 2015, a Navigant Consulting study done for LNG Canada Development Inc. concluded Canada has enough gas supplies to support widespread LNG exports. Navigant’s conclusion: Canada has a natural gas resource endowment life of over 380 years at current demand levels. The report was aimed at supporting an extended 40-year export license for LNG Canada.

“So, there are opportunities as I would see it,” Pinney said. “Where there are more challenges is where we need to build new facilities to meet the LNG export opportunity. I see less of a challenge for building natural gas pipelines than crude oil, but we are still challenged when you go through B.C.’s terrain.”

Pinney touted the industry’s efforts to complete developments in an environmentally responsible manner and is disappointed companies individually and collectively don’t get more recognition for these efforts. He sees processes and safeguards being applied all the time with little acknowledgement from government or the general public.

“We don’t get the credit from the general public for the degree of scrutiny we have to go through to get these projects built,” Pinney said. “If you look at the applications to the NEB and Canadian Environmental Assessment Agency and others, these are huge documents with input from lots of groups. A lot of people don’t give us credit for what we’re going through.”

The safeguards raise the cost and timetables for projects, he stressed, while conceding that they are “a price you have to pay to do things right.”

Companies and organizations like CAPP know first-hand the extent to which externalities play an increasingly larger role in infrastructure growth. Climate change policies influence plans and outcomes just as much as the Canadian economic and global energy markets. Each of the provincial governments is responding to the climate pressures in different ways. Alberta in 2015 was wrestling with legislation on carbon emissions; British Columbia set a tax on carbon; and Ontario and Quebec have linked into cap-and-trade programs in California.

“Times are tough in the economy, and they are really tough for the oil and gas sector in Alberta, and Canada, generally,” Pinney said. “At a time when we’re grappling to keep our economic heads above water, we’re subject to increased costs related to climate change and have an ongoing review of the royalties we pay for a possible increase. Corporate tax rates are increasing. The industry is in extremely challenging times, so we are looking at technology and global opportunities.

“We definitely need new markets because we have huge resources, including our shale gas potential in Western Canada, but production is only going to grow if we can get off of North America and serve new markets.”

If there is a theme for Canada’s energy sector, it is a shifting focus from a historical North American orientation to one that is worldwide and changing more rapidly. Canada’s largest market traditionally has been the United States where two-thirds of its production ends up. In more recent years, however, that has been 50-50, and the U.S. is becoming increasingly less reliant on Canada. This is a shift that cannot be overlooked, regardless of where global oil and gas prices settle.

Written by Richard Nemec, P&GJ’s West Coast contributing editor in Los Angeles. He can be reached at: rnemec@ca.rr.com.

Comments