February 2016, Vol. 243, No. 2

Features

Where There Is Oil, There Will Be Pipelines

“An Industry in Transition: Where There is Oil & Gas There Will Be Pipelines” was presented Monday night by Pipeline & Gas Journal Editor Jeff Share to members of the Pipelines Association Association.

Is this a crazy world or what?

Would anyone disagree that it takes a strong stomach and nerves of steel to be in the oil and gas industry today? This has always been an unpredictable business, never more so than now. All that’s ever been predictable is that we know that we’re going to have up-and-down cycles but now they happen more frequently and with volatility.

What we didn’t see coming was China’s slowdown; a series of deadly incidents that has many questioning the safety of our industry; Iran returning to the market; a social media targeting all new infrastructure projects, and a seemingly innocuous pipeline project that created a life of its own. Then there’s that 800-pound gorilla: climate change. What we should have expected was the Saudis’ decision to fight a war of attrition to cripple our domestic industry.

There has never been as much distrust between any administration and the oil industry. API and Big Oil have been relentless opponents of the administration since Day 1; I said years ago that even if President Obama approved Keystone, the industry’s only response would have been “what took so long?”

Early on, Obama made moves to open up portions of restricted offshore areas to the industry, but that died with Macondo. He also promised to speed up the permitting process, but it doesn’t seem that’s had much effect. At last count there were over $15 billion worth of pipeline projects still awaiting FERC approval.

And then climate change comes along. This handed Obama his legacy issue with Keystone the perfect sacrificial lamb. The public never had the slightest interest in Keystone. The industry oversold the jobs issue just like the opposition oversold the threat of environmental risks or that the oil would be shipped overseas.

With Keystone I thought there was no way we would offend our closest allies with a rejection. Even though Obama couldn’t wait to kill the project, Prime Minister Justin Trudeau’s election last fall made it even easier because Trudeau apparently is no fan of oil and gas. Now he plans to require that environmental reviews of oil pipelines and LNG export projects consider greenhouse gas effects as well as the impact of oil and gas production. This will affect existing projects already under review, pushing back Kinder Morgan’s Trans Mountain pipeline expansion by four months and TransCanada’s Energy East by nine months.

Is it a shrewd effort to win public support for the projects? Maybe. But then Peter Watson, CEO of the National Energy Board, insists Canada’s oil production will rise in coming decades even without new pipelines. “Our analysis shows that if prices are sufficient, crude oil production will grow and rail transportation will provide the takeaway capacity.”

Despite advances in wind and solar power, renewables will only supply a small percentage of our energy needs for years to come unless some technological breakthroughs are made. One reason I’m so strong on natural gas is that the industry continues to reduce emissions. Just look at the partnerships with top universities and research centers.

So, until we find a fuel with the same density, gasoline will be the primary fuel for motor vehicles. The question is whether investors are willing to invest billions for new infrastructure if they’re worried about the future for petroleum products.

But, and this is a big but, projects are being built with more on the way, though when is another big but. Rob Riess commented last month on a study where they expect large-diameter construction spreads to fall from 120 to 100 in 2016 and rise from 80 to 100 for 2017, which was already expected to be a banner year for pipeline construction. But will more projects be delayed or canceled, and if not, will there be enough equipment and manpower to handle all of the work?

We’re seeing unprecedented cutbacks in spending on new supply – a 16% investment reduction this year and 20% last year, which is setting the stage for a recovery, but it probably won’t be until the second half of 2017 when we see an actual rebound and prices likely to be around $50 a barrel. EIA Administrator Adam Sieminski is predicting an average of $40 Brent and $38 for WTI for 2016.

For natural gas he predicts an average of $2.65 this year and $3.22 next year. In December it sold for $1.93, the lowest since 1999. Since 2005 the Henry Hub benchmark price has averaged $5.18.

The gas surge is tapering off with production is only expected to grow by 0.6%, compared to 7% last year. EIA predicts by next summer we’ll be a net exporter of natural gas, which has not happened since 1955. They expect demand for gas to rise because of high consumption in the power sector. Great Britain is seeing a huge increase in demand as it shifts from coal with 25 new gas-fired power plants. Cheap gas had led to increased demand from the industrial sector which uses it as a feedstock.

We need to watch how LNG exports go; Cheniere Energy’s Sabine Pass terminal should start operation soon. One of the biggest opportunities we’re seeing, and will for years to come, is the flow of gas through pipelines into Mexico. The numbers are growing fast: In October more than 98 Bcf was exported to Mexico, a fourfold increase from 2010.

How will this affect renewables? Usually when oil and gas prices are sky high, the talk turns toward alternatives. But is it a wise investment in a low-price environment?

Though we’re seeing a slowdown in construction of large-diameter pipelines, there is plenty of business, driven by FERC’s Modernization Policy Statement. Expansion is also being driven by demands in new marketplaces and from producers needing to get their supplies to market. We’ll see continued development from the Bakken to the Gulf Coast and the Northeast and from the Northeast to the Southeast as gas pipelines reverse direction to meet LNG demand and new markets in the South, especially Florida.

One example is the decision by Columbia Pipeline Group to extend its Gas Transmission System modernization program with another $1.1 billion for work expected to last through 2020. Columbia has already spent $1 billion the last three years and placed over 100 projects into service.

What they’ve done is replace over 130 miles of bare steel and iron pipelines; installed or upgraded 116,000 HP of compression, and added a state-of-the art real-time preventive maintenance monitoring system to the compression fleet. Columbia is a good example because it represents the transmission and distribution sides of our business; and is a company we’ve heard relatively little about in years.

Let’s look at what some other major gas utilities are planning to do this year:

Integrys

Integrys Energy Group has 2,000 miles of cast iron mains to replace within its Peoples Gas distribution system in Chicago. That’s going to involve replacing about 300,000 service pipes and related meters as part of a long-term job that will also include water and sewer replacement. They plan to remove all the cast iron in the next 20 years, at a cost of $2.5 billion.

UGI

UGI serves eastern and central Pennsylvania and needs to replace about 1,200 miles of bare steel and 350 miles of cast-iron. All the cast iron will be replaced by 2027 and the bare steel by 2041. It’s a $1.2 billion project that’s updating 65 miles of pipeline a year. UGI has been adding 10,000 customers a year for the past five years because of the availability and price of gas for heating.

PECO

PECO in southeastern Pennsylvania is replacing 1,700 miles of iron and bare steel pipe. In the last two years, it’s increased its replacement of mains from 14 to 30 miles per year and bare steel service replacement from 1,800 to 4,000 services. They’re on track to replace all of the aging mains within 33 years and all bare steel service lines within 10 years, accelerating the work by about 50 years. PECO increased its spending from $34 million a year to $61 million by 2018. Through 2022, they’ll spend $534 million, up from $371 million in the original plan.

Avista

In the Northwest, Avista Utilities has an ongoing 20-year program to replace 700 miles of plastic main piping and install transition tubing at some 16,000 steel tees at a cost of about $10 million a year.

PG&E

Pacific Gas and Electric Company (PG&E) finished replacing all 835 miles of cast-iron pipe ahead of its 2014 goal. They’re validating the maximum allowable operating pressure of the entire transmission system, of which they’ve replaced over 130 miles of pipeline, automated 208 valves and converted over 4 million pages of pipeline records to digital formats.

PSE&G

New Jersey’s Public Service Electric & Gas Co. will replace 400 miles of gas mains over a three-year period at a cost of $650 million. PSE&G will also spend $205 million to install another 110 miles of gas mains. This is part of a $900 million program to replace 38,000 service lines. They’ll remove 500 miles of cast-iron and unprotected steel gas lines, some installed 100 years ago. Because of Superstorm Sandy, their Energy Strong program will replace 250 miles of low-pressure cast-iron mains in flood-prone areas, relocating electrical switching systems and substations.

Southern Reliability Link

Last week the New Jersey Board of Public Utilities approved New Jersey Natural Gas’s construction of a $130 million, 28-mile, 30-inch pipeline that would run through several southern communities and has drawn stiff opposition because part of the pipeline would go through an environmentally sensitive area.

The Interstates

Dakota Access Pipeline

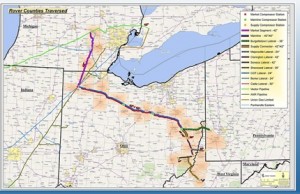

Last month, the North Dakota PSC joined the South Dakota and Illinois PSCs in approving the $3.8 billion Dakota Access pipeline, which would carry nearly half the Bakken production. The 1,100-mile system crosses the Dakotas, Iowa and Illinois to connect the Bakken with the Patoka Hub in southern Illinois. From there, it ties into the Energy Transfer oil pipeline to the Sunoco Logistics terminal in Nederland, TX. The 30-inch line will transport 450,000 bpd is expandable to 570,000 barrels. There is some opposition In Iowa and the state Utilities Board isn’t expected to make a decision until February.

Atlantic Sunrise Pipeline

A major project out of the Marcellus is Williams’ Atlantic Sunrise Project which will start in northeastern Pennsylvania and deliver to markets in the Mid-Atlantic and southeastern states down to Alabama. It would add 1.7 million dekatherms to the Transco system. They plan a lot of work in Pennsylvania, especially around Leidy, to connect the northeastern Marcellus region into the mainline. It’s one of many projects waiting to hear from FERC but plans are to start construction this summer and be in-service by 2017.

Appalachian Connector

Williams is evaluating a project connecting the western Marcellus and Utica in northern West Virginia into Virginia. The Appalachian Connector expands Transco pipeline and would move up to 2 Bcf/d by 2019. This is the only project proposed from the western Marcellus and Utica regions that would directly access Mid-Atlantic, Southeast, and Gulf Coast markets along the Transco system as far south as Louisiana.

Florida Southeast Connector

The plan is that by 2017 Marcellus gas will be moving deep into the Southeast. Thanks to Appalachian Connector it will tie into Atlantic Sunrise and make the Transco mainline bidirectional as far south as southwestern Alabama. From there, Spectra Energy and Sabal Trail pipeline will move Marcellus and other gas into central Florida, where Florida Southeast Connection line will take it still further south.

Constitution Pipeline

Williams and three partners plan to develop the $700 million Constitution Pipeline. This will bring Marcellus gas from northern Pennsylvania into the Southern Tier of New York before terminating in Schoharie County and connects to Iroquois and Tennessee pipelines. The 124-mile, 30-inch pipeline will have capacity of 650,000 MMcf/d into the Northeast and New England. It would create thousands of jobs and bring in millions of sales and tax revenue.

I lived and worked up there back in the late 1970s, and that area needs all the help it can get economically. The local communities want it, FERC gave its final approval on Dec. 3, 2014 and it’s been sitting on New York Gov. Andrew Cuomo’s desk ever since. They had hoped to start construction this spring and be in-service by the end of the year.

Along with that they’ll build the Wright Interconnect Project which will expand Iroquois’ facilities so it can connect with Constitution.

Rover Pipeline

Construction of the $4.2 billion, 3.25 Bcf/d Rover pipeline was planned to begin in the first quarter of 2016 and finish construction up to Defiance, OH by the end of the year. However, in November FERC said it won’t offer the Environmental Impact Statement (EIS) until May. This may have ramifications for other pipeline proposals as well. This would bring Appalachian basin gas throughout much of the country with 32% going into Michigan via Vector pipeline.

Mountain Valley Pipeline

Mountain Valley Pipeline LLC has applied to build a 300-mile pipeline that would bring Marcellus and Utica natural gas to companies, industrial users, and power generation facilities in the Mid-Atlantic, Southeast, and Appalachian regions. It will begin in West Virginia and in Virginia. VA. MVP will have at 2 Bcf/d of firm capacity and construction could start this year with a full in-service targeted for late 2018.

Westcoast Connector Gas Transmission Project

Spectra Energy’s Westcoast Connector Gas Transmission Project would begin in northeast British Columbia and end at Shell’s proposed Prince Rupert LNG export terminal on Ridley Island. This would create a natural gas transportation corridor allowing up to two pipelines with total design capacity of 8.4 Bcf/d in a single right-of-way and enable multiple LNG projects to the Prince Rupert area. Service of the initial 528-mile, 4.2 Bcf/d pipeline is expected to start around the end of decade.

Nexus Pipeline

NEXUS Gas Transmission project is a 255-mile pipeline designed to bring Appalachian Basin gas into Ohio, Michigan and the Dawn Hub in Ontario. They’re looking for FERC approval in the fourth quarter with construction beginning early next year. The 30-36-inch pipeline is a partnership between Spectra, Enbridge, and DTE Energy and will carry up to 2 Bcf/d.

Along with NEXUS, Spectra plans to build the Ohio Pipeline Energy Network. This includes 73 miles of 30-inch pipe and a compressor station to take Utica shale gas into the Texas Eastern market delivery and access the Central and Southeast regions.

PennEast Pipeline

Six companies want to build the PennEast Pipeline to bring Marcellus gas to consumers in eastern Pennsylvania and New Jersey. It’s a $1.2 billion, 118-mile, 36-inch pipeline that would deliver 1 Bcf/d and help eliminate a serious pipeline constraint in an area that already pays some of the highest energy bills in the country. Power generators and manufacturers are pushing for the pipeline but it’s another getting heavy pushback from New Jersey residents and municipalities that it would go through. They had hoped for approval later this year, but some now expect that to be delayed until 2017, probably pushing construction back to 2018.

Pennsylvania could be the hot spot for pipeline development. They expect to have 4,600 miles of interstate pipeline built over the next 3 years, and 30,000 miles of pipelines over the next 10 years, quadrupling of the number of gathering lines by 2030. The governor’s task force will make a final report this month.

New England Direct Access (NED)

Kinder Morgan’s NED Pipeline includes 430 miles of pipeline with capacity from 800 MMcf/d to 2.2 Bcf/d. It takes gas from the Marcellus into New York, Massachusetts, Connecticut and New Hampshire. 90% of construction will be co-located along existing utility corridors and adjacent to Tennessee Gas Pipeline. They’re hoping for approval by the fourth quarter, starting construction in January and being in-service by November 2018. Stiff opposition from state and local officials.

Nearby, Spectra’s Algonquin Incremental Markets expansion project is to add 342 MMcf/d to Algonquin’s pipeline in New England. It’ll start out in Westchester County in New York, moving into Connecticut, RI and end outside of Boston. It’s been approved by FERC but the opposition is trying to block it.

Western Kentucky and Southern Indiana Laterals

Two relatively small market-driven projects are part of Boardwalk Pipeline’s growing portfolio. Southern Indiana Lateral is 30 miles of 10-inch pipeline from Kentucky into Indiana for a new industrial customer. Western Kentucky Lateral is 22 miles of 24-inch pipe from a Texas Gas compressor station to an expanding storage complex.

Dos Águilas Pipeline

Howard Midstream Energy Partners plans a 287-mile, 12-inch Dos Águilas Pipeline for refined products terminals and pipelines from its Corpus Christi refinery into Monterrey, Mexico. The $500 million project should be in-service in 2018. Last year, Howard announced plans to build the Nueva Era gas Pipeline from South Texas to Escobedo and Monterrey in Nuevo León, Mexico. That 200-mile pipeline should be in-service in June 2017.

Houston Link Pipeline

Magellan Midstream and TransCanada plan to connect their Houston terminals through HoustonLink Pipeline. This is a 9-mile, 24-inch crude oil line giving TransCanada’s Keystone and Marketlink customers access to Magellan’s Houston and Texas City oil distribution system. The will cost $50 million. They also plan to develop additional infrastructure at their terminals to accommodate shipments from the new pipeline expected to be operational next year.

Conclusion

We can’t overemphasize how the Keystone rejection re-energized the anti-fossil fuel movement. They’re organizing protests against any new development, especially in regions new to pipelines, and depending on what political party is in office, they are being heard. The opposition numbers aren’t huge but make no mistake: they’re well-funded, well-organized and get way too much attention from the media and from politicians who are also funded by anti-fossil fuel advocates. With climate change as their cause, they would like nothing better than to shut down the fossil fuel industry.

But the fact is that our society will be dependent on oil and gas for many years to come, and gas will still be the preferred fuel for at least the first half of this century. It’s our job to make sure that our products and services are as safe and as environmentally clean as possible. And that means beating the legal requirements.

To view related maps and charts, click here.

Comments