February 2016, Vol. 243, No. 2

Features

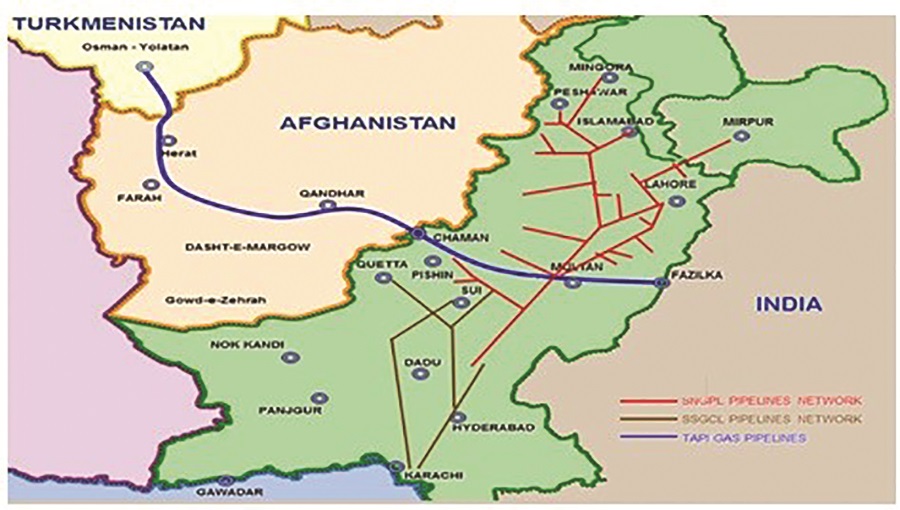

World News: Asian Leaders Laud TAPI Pipeline

Leaders from Afghanistan, Pakistan and India joined the president of Turkmenistan to discuss construction of a natural gas pipeline that could help ease energy deficits in South Asia: The 1,814-km Turkmenistan-Afghanistan-Pakistan-India (TAPI) natural gas pipeline is expected to be operational by 2019 at an estimated cost of $10 billion.

“TAPI is designed to become a new effective step toward formation of the modern architecture of global energy security, a powerful driver of economic and social stability in the Asian region,” Gurbanguly Berdymukhamedov, Turkmenistan’s president, said during the ceremony.

Industry experts say the project faces several risks, including the deteriorating security situation in Afghanistan and lack of clarity about its financing. Although TAPI’s construction is led by state gas firm Turkmengas, no other global energy major has committed to the project.

Ukraine Challenges Russian Gas Project

Ukrainian energy company Naftogaz has filed an official complaint in Europe, arguing Russian gas pipeline expansion plans would limit competition. Gazprom in September signed a shareholder agreement on the development of the second phase of the twin Nord Stream pipeline system with his counterparts at German energy companies BASF and E.ON, as well as those from French company ENGIE, Austria’s OMV and Royal Dutch Shell.

Under the proposed expansion, two more lines would be added to the existing network running through the Baltic Sea to the German coast, roughly doubling the pipeline’s net capacity. Naftogaz said its complaint against the project was transferred to the European Commission. The company said the project would not align with European measures aimed at distance gas suppliers from transit networks.

“The project would not enhance competition in the relevant gas market, would worsen the security of supply and would be detrimental to the efficient functioning of the Energy Community gas market,” it added. Naftogaz has been pressured from Gazprom to honor its contractual obligations regarding gas sent through Ukraine. Russia meets 25% of European gas needs, though most of those reserves head through the Soviet-era pipeline network in Ukraine.

Gazprom said last year the expansion would not meet the regulatory conditions to be considered a new project. The second phase of Nord Stream would be developed by a company named New European Pipeline, and Gazprom would hold a 51% share.

BOST to Develop Ghana’s First National Gas Transmission Network

Bulk Oil Storage and Transportation Company Ltd. (BOST), the holder of Ghana’s Natural Gas Transmission Utility license, has a mandate to operate, maintain and further develop the first country-wide gas transmission network, as part of Ghana’s agenda to exploit gas as an efficient means of augmenting power supply. The first phase of the buildout will be the addition of 750 km of pipeline. Penspen will to conduct a Front End Engineering Design (FEED) study for the project.

Russian Oil Companies Look to Americas to Boost Positions

Key Russian oil companies are refocused on strengthening their international positions through the acquisition of exploration and production assets in geographies outside Russia, with countries in the Americas providing potential partnerships in the long term, reported research and consulting firm GlobalData.

According to Anna Belova, senior upstream analyst covering the Former Soviet Union (FSU), Lukoil, Zarubezhneft, Bashneft, Rosneft, and Gazprom are all pushing international diversification in light of the sanctions placed on Russian companies after its involvement in Crimea.

Adrian Lara, senior upstream analyst covering the Americas, noted, “With governmental support, countries not originally prioritized for international expansion are being identified as potentially strong political, trade and investment partners for Russian oil companies. They have their sights firmly on the Americas, expressing interest in future gas projects in Mexico, Argentina, Venezuela, and Bolivia, among others.”

GlobalData believes these countries could benefit from external help, as they are in need of financial aid and/or expertise in developing and exploring their resources. However, as Lara stated: “Following the recent outcomes of elections in Argentina and Venezuela, which saw a shift toward more conservative governments, Russian companies might lose political and economic privileges, as relationships with these nations will be subject to stricter limitations.

“Involvement with Mexico would also incur obstacles, as Russian companies would have to compete with other key oil companies as shown in the second phase of Round One, where Lukoil’s high bid was outperformed by ENI’s.”

Belova concluded: “Russian upstream companies are now an established presence in the Americas and, given their focus on exploration and early stage projects, are instituting long-term objectives. Even if limited benefits are to be gained from Americas-based projects in the near future, they do offer a foundation that should reap benefits over the coming decade, if consistently matured.”

ExxonMobil Starts Operating Processing Facility in Indonesia

ExxonMobil has brought the onshore central processing plant at the Banyu Urip field in Indonesia into service, increasing production to over 130,000 bopd. Once full field production is reached, Banyu Urip will represent 20% of Indonesia’s 2016 oil production target.

Banyu Urip is expected to produce 450 MMbbls of oil over its lifetime. The project consists of 45 wells, an onshore central processing facility, a 60-mile onshore and offshore pipeline and a floating storage and offloading vessel and tanker-loading facilities in the Java Sea.

Study Show Shale Gas Fracking in UK Should be Pursued

A report from the Task Force on Shale Gas, which is funded by the UK’s shale gas industry but operates independently, says fracking for shale gas in the UK should be pursued as an alternative to the use of coal in order to provide a bridge to a low-carbon future.

The report found that climate change targets could still be met even with an increase in the use of gas. When technologies known as “green completion” are used, which means stopping the leaks of methane from shale wells, the fuel is no more carbon-intensive than conventional gas, and less so than imports of LNG, said the report.

The report noted that if gas is to be used for another four decades, as envisaged by the group, much more effort must be put into carbon capture and storage technologies. These have been problematic, as repeated attempts to set up UK pilot projects over the past decade have yet to produce a result.

Former Labor Cabinet Minister Lord Smith said: “I don’t think the reason for the slowness lies in problems with the technology. It is a lack of political will.”

He indicated that shale gas should not receive public subsidy or tax breaks, and the tax revenues arising from its exploitation should be redeployed to develop renewable energy and other low-carbon innovations.

“I can’t see any reason why the shale industry needs tax breaks. If the gas is there and is recoverable – and that’s still a big ‘if’ – the industry can derive revenue from extracting it,” he said. “Shale gas is not the answer to climate change.”

The report also cast doubt on the ability of renewable sources to be increased sufficiently to avoid an increasing dependence on importing gas into the U.K.

Russian Gas Exports to France Grow 32% in 11 Months

Russian gas export to France grew rapidly in 2015, according to Gazprom Chairman Alexey Miller. In 11 months, Gazprom exported 8.7 Bcm of gas to the country, a 32% increase vs. the same period of 2014 when exports totaled 6.6 Bcm.

Chevron, China Huadian Sign HOA for Long-Term LNG Supply

Chevron Corporation’s wholly owned subsidiary, Chevron U.S.A. Inc., has a non-binding LNG supply Heads of Agreement (HOA) with China Huadian Green Energy Co., Ltd. When the agreement is finalized, China Huadian Green Energy is expected to receive up to 1 million metric tons per annum (mtpa) of LNG over 10 years, starting in 2020.

The LNG will be supplied from the Gorgon Project, a joint venture of the Australian subsidiaries of Chevron (47.3%), ExxonMobil (25%), Shell (25%), Osaka Gas (1.25%), Tokyo Gas (1%) and Chubu Electric Power (0.417%).

The Gorgon Project combines the development of the Gorgon Field and the nearby Jansz-Io Field. Facilities being built on Barrow Island include an LNG facility with three processing units capable of producing 15.6 MTPA of LNG, a carbon dioxide injection project and a domestic gas plant.

Comments