July 2015, Vol. 242, No. 7

Web Exclusive

Indonesia Banking On Big Return to Oil, Gas

Indonesia, the most populous country in South East Asia, is trying hard to reshape its ailing energy industry as it seeks new investors in both its exploration and refining sectors to dramatically upgrade its energy capabilities.

At a time when most new global investments in oil and gas projects have either been cancelled or postponed due to low oil prices, this latest move by Indonesia is a bold one. However, Indonesia’s poor infrastructure and difficult domestic regulatory environment have affected investment in the past, with only seven oil and gas contracts signed in 2014.

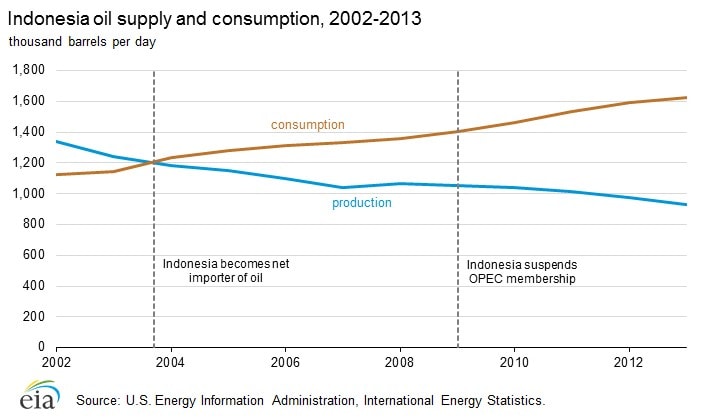

Being the fourth most populous country in the world, Indonesia has a significant and growing need for energy supplies, as its middle class continues to expand. Indonesia’s energy consumption increased by 44% from 2002 to 2012. Petroleum accounted for the highest proportion of this increase and Indonesia went from being a net exporter of oil to a net importer of oil in 2003. Originally a member of OPEC, Indonesia left the oil cartel six years ago as its exports were dwarfed by growing domestic needs.

Indonesia’s Ministry of Energy and Mineral Resources (MEMR) recently completed awarding 12 oil and gas blocks which consisted of four unconventional and eight conventional blocks. ConocoPhillips Kalimantan Exploration Ltd- PC Kualakurun Ltd., Shell Pulao Mua Pte. Ltd and Statoil Indonesia Aru Trough IBV were three of the eight companies that won conventional blocks.

Indonesia is set to offer an additional twelve oil and gas blocks this year. Out of these, four conventional oil blocks: West Asri, Manakarra Mamuju, Oti and Kasuri would be available for open bidding. Another four conventional blocks: West Berau, North Jabung, Southwest Bengara and Rupat Labuhan would be offered through negotiations with the government.

The two shale blocks to be offered would be MNK Blora and MNK Batu Ampar.

Whether or not these companies can succeed in reviving Indonesia’s oil production through these offerings remains to be seen, but a lot hinges on Indonesia’s efforts at meeting domestic consumption, which is growing quickly.

“We are in the preparation stage and will start the new bidding round soon,” said Wiratmaja Puja who is Director General for Oil and Gas in MEMR. Although Indonesia is a net importer of oil, it still exports its crude oil. The recent plunge in oil prices adversely affected the Southeast Asian nation as its exports and imports declined by twice as much as expected.

Indonesia’s oil and gas sector is led by Total, Chevron, ConocoPhillips, BP and Exxon Mobil. Chevron is the largest producer of oil in Indonesia having a share of around 39% as of 2013. The country’s state owned Pertamina had the second highest share followed by Total and ConocoPhillips.

Apart from these players, China’s national oil company CNOOC and South Korean KNOC are other prominent players in Indonesia’s upstream sector. Under the current economic scenario, and with declining investments in oil exploration, it seems highly unlikely that big players would be interested in acquiring new blocks, especially as many oil majors like ExxonMobil and BP have given up their exploration assets in Indonesia. The total investments from the upcoming ten

In a surprise move, Indonesia announced its intention to try and rejoin OPEC. The motivation is not necessarily to achieve a boost in exports, which is the defining characteristic of OPEC membership, but to secure new supplies. Indonesia is hoping to ink new supply agreements with OPEC so that it can import more oil in order to feed its planned refinery expansion.

“We will discuss purchasing crude from them. We have a plan to build refineries, so we need crude supplies,” said Wiratmaja Puja of MEMR. Indonesia considering a major build out of new refineries in the coming few years. Pertamina has plans to increase its refining capacity from 1 million barrels per day to 2.3 million barrels per day through some modifications in existing plants and adding newer ones. Refining capacity will be critical for the country to produce a supply of petroleum products for rapidly expanding internal use.

With growing domestic demands and flagging production, Indonesia is no longer the oil exporter it once was. But it is becoming more and more important as a global energy consumer.

Comments