April 2015, Vol. 242, No. 4

Features

Mixed Fortunes for Australias Gas Pipelines

Australia, with much of the country yet to be explored, has the largest proven gas reserves in the Asia-Pacific region, about 43 Tcf, according to a U.S. Energy Information Administration (EIA)? country analysis from August 2014.

Most of the traditional gas reserves, about 92%, are located in the North West Shelf in the Carnarvon and Browse basins in North West Australia and the Bonaparte Basin shared between Australia and East Timor, the Gippsland and Otway basins in South East Victoria Province, and the Cooper-Eromanga basin in central Australia (Figure 2).

In addition to natural gas, Australia had an estimated 33 Tcf of commercially viable reserves of coal seam gas (CSG) in 2012, principally located in North East Queensland Province in the Bowen and Surat basin, which attracted a huge (Australian) $31 billion investment in 2010.

Gas Production, Demand

Natural gas production approached 2.2 Tcf in 2013, compared to less than 1.2 Tcf in 2000, as a result of many new discoveries. According to the EIA, Australian natural gas production was about 2.18 Tcf in 2014. Of that, exports in the form of LNG accounted for 919.9 Bcf.

In addition, CSG production was about 232 Bcf and is currently confined to New South Wales and Queensland, according to the Australian Petroleum Production & Exploration Association’s (APPEA) annual report.

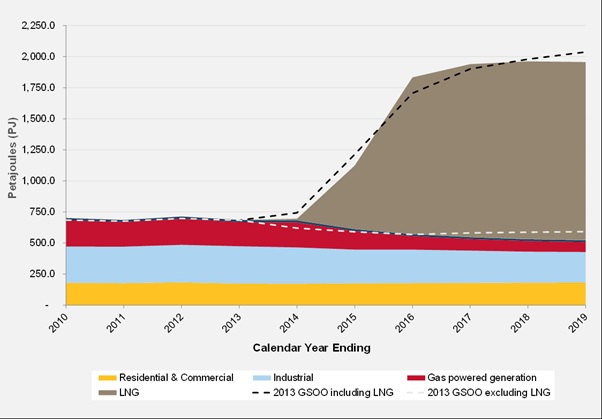

In 2012, gas accounted for 21% of Australian energy consumption. Australia’s Bureau of Resources and Energy Economics (BREE) 2014 expects gas demand to remain flat until 2020 (Figure 1), due to greater use of renewables and the continued shift from manufacturing toward services, which lowers energy intensity.

In the last decade, energy companies have invested about $200 billion in Australian LNG projects. Australia is the world’s fourth-largest LNG exporter with four fully operational LNG plants. In 2013-14, Australia exported 24 million tons of LNG with Japan and China taking 80% and 16%, respectively. Principal customers included Japan’s Tokyo Gas, Osaka Gas, Chubu Electric Power and Toho Gas, each under long-term contracts.

Six new LNG plants are scheduled to come online from now through 2020 (Table 1), although there may be some slippage. Nevertheless, APPEA forecasts a tripling of LNG production to 85 million tons by 2018 and an exponential increase in LNG shipments.

In total, Australia has over $190 billion worth of LNG projects under construction, which will require additional pipeline capacity.

Pipeline Networks

Australia has over 33,000 km of high-pressure steel pipelines – over 25,000 km of which are gas pipelines. Two leading companies, Australian Gas Networks Ltd. and AOA Group, dominate the pipeline networks.

Of the gas pipelines about half are dedicated to deliver gas to Australia’s domestic consumers organized as three separate regional gas pipeline networks: Western Australia, the Northern Territories (NT) and a network linking the states along the eastern third of the country where most of the country’s economic activity and population are located.

The remaining gas pipelines directly link gas fields to LNG processing and exporting plants. As CEO Graeme Bethune of EnergyQuest energy consultancy pointed out, “They’ve just finished three huge pipelines for the Queensland LNG projects as well as linkages from Gorgon and Wheatstone to the DBP.”

Australia’s energy policy aims to balance secure domestic energy at affordable prices with increased exports to Asia. Both approaches require more energy infrastructure.

“The network would benefit from developing into a gas grid, allowing West Coast and Northern Territories gas to feed the newly developed East Coast LNG export terminals,” said As Olivier Royet, head of Section Pipelines, DNV GL Oil & Gas, Australia. “This would help alleviate the stress on the local domestic gas market in Queensland and connect the plentiful gas resources in other states in Australia.”

Export opportunities and the need to link new sources of supply to domestic markets, especially in Victoria and New South Wales, are driving Australia’s pipeline investments (Table 2).

New LNG plants in the northwest of the country have driven recent pipeline capacity expansion in the west coast market while the Gladstone LNG export plant on the east coast has generated 530 km of pipeline to bring CSG from the gas fields of Surat and Bowen.

The proposed 1,100-km Northern Territories Pipeline Link is designed to access stranded gas finds and bolster gas supplies to energy-hungry New South Wales. However, Bethune predicts such a mega-project is “unlikely to happen.”

Instead, Royet predicted, “New pipeline projects are likely to be of much smaller size, with subsea tiebacks feeding existing installation, to reach the full liquefaction capacity.”

Conclusion

The era for mega-long pipeline construction is over for the time being. Australia will not escape the reduction of 15-20% in global exploration and production spending, which “will percolate down the value chain,” according to Jason Waldie, associate director of energy forecasting company Douglas-Westwood Pte. Ltd.

Falling LNG prices alongside huge cost overruns and a slowdown in new contracts have led investors to put over $100 billion worth of LNG projects on hold. Nevertheless, investment in short-distance pipelines and capacity enhancements are likely to continue helping Australia to become the world’s leading LNG exporter by 2020.

Figure 2: Australian gas main transmission pipeline networks.

Table 1: Australian LNG projects.

[inline:table2.jpg]

Table 2: New and recent pipeline projects investments.

Comments