March 2015, Vol. 242, No. 3

Features

Falling Oil Prices Exert Influence on Utility Construction

The free-falling oil price caught many observers off guard. Historically, crude oil and natural gas prices tend to stay in alignment as the imbedded energy content is the defining characteristic. Since 2010, when the price of these commodities separated, many observers anticipated upward volatility in the price of gas to realign it with the price of oil. Few analysts anticipated oil falling to realign with low-cost natural gas.

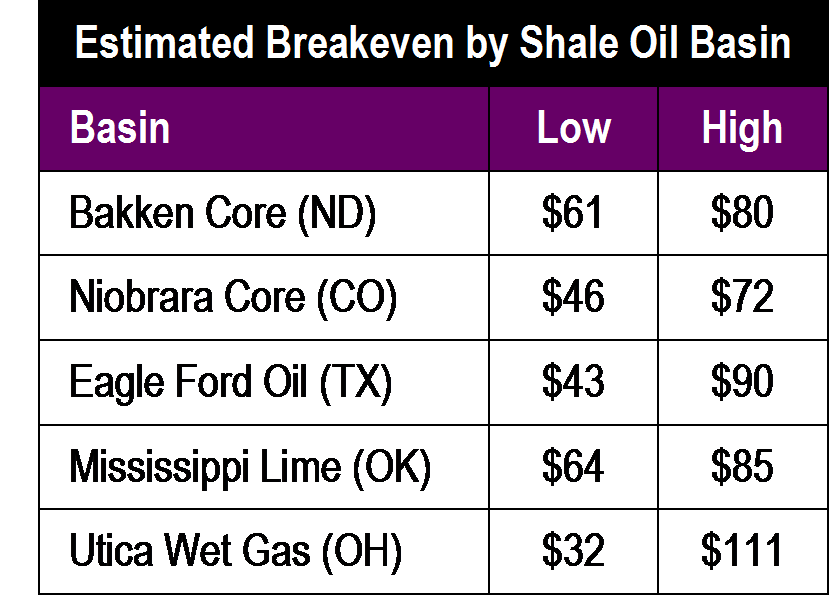

Falling oil prices affect the competitiveness of U.S. shale oil plays. For example, basin breakeven extraction costs demonstrate low competitiveness in the $40-60 range. While the reasons for the freefall of oil are highly complex and frankly not well explained, there is no doubt that it is creating both positive and negative implications.

Drivers for the falling oil price include the following:

Low global demand: The economic slowdown in Asia and Europe has reduced demand.

High supply: Five years of $90-plus oil led to massive investment in exploration and production.

OPEC weakness: OPEC’s share of world supply is declining and its members have grown fat domestic budgets fueled by high-priced oil; these countries want to protect their market share.

Geo-political action: Saudi Arabian opportunity to economically punish Russia, Iran and Syria without directly harming the United States and inflicting moderate and manageable damage to their domestic budget.

Speculation: It is unclear what role speculators play in the crude oil price swing, yet there is general agreement that speculative activity continues and is moving prices.

[inline:BRIDGERS CHART.jpg]

Impacts to shale oil and gas markets along with underground and pipeline contractors.

[inline:OilExhibitA.png]

Comments