February 2015, Vol. 242, No. 2

Features

Opportunity Knocks For Natural Gas: Is Anybody Listening?

When QEP Resources Inc. CEO Charles “Chuck” Stanley roams the country giving speeches as the chairman of America’s Natural Gas Alliance (ANGA) he hopes someone is listening because these times for natural gas are full of innovation and opportunity in his mind. A familiar theme for this gas industry veteran is summarized in the question: How do we make the most of this newfound opportunity?

ANGA is made up of the leading U.S. independent gas producers, accounting for about a third of the nation’s gas production in 2013, or 8 Tcf of supplies, Stanley reminded an industry audience at the LDC Gas Forum Rockies & the West in Los Angeles recently. QEP, of course, is one of those independents that is hungry for markets in which to sell its gas and ANGA’s mission is to stir up more U.S. demand for natural gas.

As a geologist by training who first worked in the industry during what he called a period of “impending scarcity,” Stanley noted how profoundly that changed with the advent of marrying two old technologies – hydraulic fracturing (fracking) and horizontal drilling – and the emergence of new gas supplies and new gas plays throughout the United States.

“This is a result of technical innovation combined with the fracking technology that has existed for years, and it has unlocked a tremendous new gas supply throughout the country,” Stanley told the industry forum. In the context ANGA likes to put the future, by 2035 there will be an additional 3.5 million jobs, $475 billion of new economic growth and $2.5 trillion in revenues. Regionally, the corresponding numbers just in the Rockies alone show there will be 600,000 added jobs, $73 billion of economic growth and $416 billion of new revenues, Stanley said.

Stanley said he sees fracking technology continuing to improve and numerous efficiencies still being wrung out of future horizontal drilling. “There is increased sand, increased fracking stages and more concentrated fracturing in the reservoir that have led to increases in individual well productivity,” Stanley said. “More productive drilling and completion activity, better design is allowing us to continue to grow production with fewer rigs.”

In 2009, there were 1,600 rigs drilling for natural gas; in late 2014, there were about 400 rigs drilling for gas, according to Stanley, who noted that the challenge in taking advantage of all these innovations is the need for increased pipeline and related infrastructure. “It is all about reliability, dependability and affordability of various pipeline projects,” he said, citing a number of proposals from the Bakken Shale play in North Dakota and the Marcellus-Utica in Ohio and Pennsylvania.

Natural gas production in the lower 48 United States stayed on a record-breaking pace, averaging 69.1 Bcf/d last September, breaking its previous monthly average high for the ninth consecutive month, according to Bentek Energy, an analytics and forecasting unit of Platts. That production rate was up 4.8 Bcf/d from the same month a year earlier. In October, Bentek analysts suggested the new record wouldn’t stand for long.

“After a month of lower trajectory growth, natural gas production is poised to shatter existing records through the end of 2014,” said Jack Weixel, director of energy analysis for Bentek Energy.

Northeast trunklines finished their scheduled maintenance in early October and the region was expecting 2.2 Bcf/d of incremental pipeline capacity to be in service by Nov. 1, said Weixel, noting this should relieve existing constraints in the field and open up connections to market areas just as the colder weather comes.

As a leader of both an independent oil/gas exploration and production company and the independents’ market-building alliance at ANGA, Stanley’s outlook is probably generally rosier than some of the industry analysts who spoke on various topics at the same industry forum. However, there is one thing they all agree on – the need for new, well-placed infrastructure. All of them agree that takeaway capacity is becoming a bigger strategic issue in all of the most robust shale plays.

John Felmy, chief economist for the American Petroleum Institute (API), shares Stanley’s bullishness, but said he is worried about the possibility of misinformed opposition groups and ill-conceived federal policy decisions setting back the “historic opportunity” today’s natural gas production offers the nation.

Shale oil and gas development will stay concentrated in the United States, Felmy predicted, although he sees a global development taking shape “bit by bit” in Asia and Europe eventually. What will hinder development outside the United States is the fact that there isn’t the concept of private ownership of mineral rights in most other nations. There is a lot more government intervention in these other countries, Felmy said, and thus fewer incentives for landowners to support oil/gas development, particularly fracking.

The task for industry leaders and government policymakers is to get their arms around the enormity of possibilities embodied in plentiful domestic U.S. energy supplies, and to understand objectively all of the challenges as well as opportunities this presents. Stanley seemed inherently locked into the opportunities in increased gas-fired electric generation, a re-industrialization taking place in North America and the real potential of natural gas as a transportation fuel.

At this time of energy fulfillment and the chance to be self-sufficient and more secure, the United States as evidenced by the Obama administration’s ongoing approaches is attempting to promote more integration of the nation’s energy sources and systems. That means market-based plans for more U.S.-produced oil and gas also have to be aware of what is happening regarding coal, nuclear and renewables – not to mention even within oil/gas the distinction between natural gas and natural gas liquids (NGL) in terms of their market and infrastructure developments.

A special advisor at the U.S. Department of Energy (DOE) told an energy audience last fall that natural gas “is a success story,” but that success needs to be better coordinated with the larger domestic energy network. And the integration needs to be aimed at the three national energy goals that DOE has articulated: economic competitiveness, environmental responsibility and energy security.

DOE’s Greg Singleton emphasized that Energy Secretary Ernest Moniz is a nuclear physicist and professor at the Massachusetts Institute of Technology so he has a new push to ensure there is a “strong analytical base” for all of the federal energy programs. In addition, programs need to address fundamental support for the national well-being, and that is the basis by which the Obama administration is looking at energy infrastructure. Added pipeline and processing infrastructure in the Bakken or Marcellus Shale plays are needed for both economic and energy security reasons, and those certainly contribute to the nation’s well-being, Singleton contended.

“What this does is facilitate commerce and economic activity, so all of that infrastructure contributes to the nation’s bottom line,” said Singleton, observing that DOE is trying to look nationally at where infrastructure is working well and other areas where that isn’t the case. It is the latter, he said, where the federal government might provide help and incentives to the industry.

“Natural gas touches so many elements of our nation’s economy,” Singleton said, in explaining why the current DOE “quadrennial review” of the nation’s energy policies has to include gas along with all of the other major energy sources and sectors – coal, nuclear, power generation and renewables. “Natural gas is everywhere,” he said.

This wide reach for natural gas these days leads back to the questions about infrastructure, more than half of which is 40 years old or older, having been built in the 1940s, ’50s and ’60s. “What this tells us is the old standards for safety and maintenance aren’t good enough anymore,” Singleton said. DOE has already estimated that gas infrastructure investment needs to be close to $20 billion annually until 2020.

“Natural gas [midstream players] needs to come to the table with the producers to solve this infrastructure challenge,” said Stanley, noting that his preference is for the marketplace – not DOE – to address immediate, if not also long-range, problems. “Both INGAA [Interstate Natural Gas Association of America] and a number of the ANGA member companies are working with specific producers to look at some solutions tied to long-term supply contracts. We’re also cooperating with a number of these entities to support additional gas infrastructure projects.”

Stanley said those in the industry are now learning from each other, and the distributors and producers are offering pipelines ideas and more new commercial ways to address some of the same issues that DOE has identified.

There are also macro-economic issues surrounding the U.S. energy sector as supply and demand have gotten out of balance with the hearty production increases in both domestic oil and gas and the aforementioned infrastructure challenges.

Many of the analysts take a more somber view of the situation nationally than Stanley. They see demand increasingly lagging production, as analysts Reza Haidari, a North American gas market trading manager at Thomson Reuters, and Luke Jackson, a Bentek energy analyst, point to regional and national price and infrastructure considerations that dampen gas outlooks, even with substantial new exports to Mexico (via pipelines) and as liquefied natural gas (LNG).

“Market mechanisms have worked, and the market has rebalanced itself [following a record cold winter in 2013-14],” Haidari told an industry meeting last fall. He made the point that because production levels have ramped up so much, even with last winter’s large drawdown of gas storage nationally, inventories starting 2015 will be around normal and even with a normal winter, storage levels likely will be higher than normal coming out of the winter season in April.

“Some estimates are predicting increases in production of 1 Bcf/d over the winter as new pipeline takeaway capacity comes online in the Northeast,” Haidari said.

Bentek’s Jackson predicted the Northeast will be where the action is for natural gas, given that he has estimated there are up to 2,000 wells drilled and ready to go, but not producing because of a lack of infrastructure in the region that includes parts of the Marcellus and Utica Shale plays. Those “backlog,” or inventory wells amount to up to 8-10 Bcf/d of added production by 2020, Jackson said.

“We don’t expect this trend to change as over the next five years we see the Northeast accounting for the bulk of the production growth,” said Jackson, who noted that the Northeast in 2010 accounted for only 5% of U.S. gas production; by 2019 that will be 30%. That’s basically another 10 Bcf/d of growth between 2014 and the end of 2019.”

These kinds of assessments underscore Stanley’s contention that “supply is here for the long haul” and U.S. gas production is on track to double during the next 25 years.

“We’re the world’s leading producer,” he said, adding that all of the indicators point to the U.S. gas abundance carrying on for a long time, and prices remaining relatively stable, compared to what officials were projecting just a few years ago.

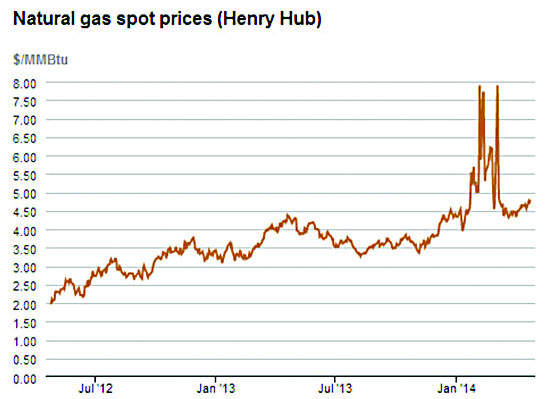

In 2009, the DOE forecasts were calling for $13 natural gas by 2035, but this was at the early stages of the shale boom that has transformed the U.S. energy sector. “Forecasts now show a much different picture with a sub-$4 natural gas price in 2035,” Stanley noted. “This is a dramatic change in forecasted prices over a short period of time, and that shows how technical innovations have driven an abundance of supplies in this country.”

As an example, in 2014 the most productive well in the Marcellus Shale play in Pennsylvania was producing five times more gas than the most productive wells 10 years ago. And what is driving that are longer laterals, more fracking stages, and more efficient completion techniques, explained Stanley, bearing witness to untold advances being made by the industry’s operators in U.S. oilfields.

There is just a lot more productive and precise drilling ongoing, according to Stanley. Looking ahead, these innovations in production technology will have to be matched in completing the enhancements to the U.S. energy infrastructure to ensure what Stanley called the “reliability, dependability and affordability of our products.”

Some industry pundits are also championing many of the positives that Stanley articulates, in some cases going even further in their exuberance. They see producers as expanding margins even in a low-price environment through continually lowering production costs with enhanced materials, technology and systems.

One prediction emerging late last year is that in 2015 operating cash flow could exceed capital spending in the E&P sector for the first time since 2008. That in itself is a gateway for future growth, but then these same pundits also see gas demand taking off with exports, re-industrialization and natural gas vehicles.

Stanley’s relatively modest projections for demand growth are whipped up much higher by others, calling for up to 12-15 Bcf/d of LNG exports, Mexico exports jumping threefold, shutdown of up to 25% of current U.S. coal-fired electricity and a major surge in industrial natural gas consumption centered on the Gulf Coast.

The prospect of growing coal-fired plant retirements has Stanley and others salivating at what gas can do to boost demand in the power generation sector. He said gas is destined to play a significant role, but he also noted that after gas eventually eclipses coal as the primary energy source for power, there will still be large amounts of electricity coming from coal, nuclear and renewables.

In 2040, his crystal ball shows natural gas generating 35% of the nation’s power, coal still providing nearly a third at 32% and renewables and nuclear each having a 16% share of the pie.

“There will still be a substantial mix of diverse power sources,” Stanley predicted. “The notion that we’re taking a dash to all-gas power is wrong. We’re going to need a diverse mix of power generation.”

And with that, Stanley surprised even himself with the most modest and conservative outlook he could find to describe natural gas in the electricity sector and the nation’s energy future. He also added the thought that the industry still has a way to go in convincing generators that gas can be as reliable as coal has proven to be for decades. The industry’s chief marketing cheerleader proved he can mix his unabashed enthusiasm with some practical reality, too.

Richard Nemec is a Los Angeles-based West Coast correspondent for P&GJ and can be reached at rnemec@ca.rr.com.

Comments