April 2014, Vol. 241 No. 4

Features

Natural Gas Price Advantage Creates Opportunities And Benefits For LDCs

A recently released IHS study, Fueling the Future with Natural Gas: Bringing It Home, is intended to serve as a resource for gas LDCs, their customers, regulators, legislators and other policymakers, industry, and the general public to use in adjusting to the new realities of the natural gas market. It describes the unconventional natural gas revolution (also known as the “Shale Gale”) and how it has upended long-held notions of natural gas supply and cost.

The study discusses the actual and potential contributions of natural gas to certain national goals such as energy efficiency, environmental benefits, economic growth and energy security. The study evaluates the potential benefits of natural gas use in residential and commercial sectors that constitute the core markets for gas LDCs.

The study also identifies factors that encourage as well as inhibit greater use of natural gas, with a particular emphasis on gas LDC systems and their core residential and commercial markets. It describes how natural gas usage in the power sector, the industrial sector, and even the transportation sector is evolving and how gas LDCs may be able to participate in such market growth.

Although too lengthy to discuss in detail here, the main focus of this article will be on natural gas prices, public benefits of expanding gas LDC systems and opportunities in core gas LDC markets.

Gas Prices

On the U.S. crude oil and gas price outlook, the report indicates the price of crude oil is expected to remain around $90 bbl (constant 2012 $). On natural gas prices, it shows that the Henry Hub price is expected to remain in the range of $4-5 MMBtu (in constant 2012 $) on an annual average through 2035.

Moreover, about 900 Tcf of unconventional gas resources – nearly one-third of the total recoverable resource base – can be produced economically at a Henry Hub price of $4 per Mcf or less. This means that the North American natural gas resource base can accommodate significant increases in demand without requiring a significantly higher price to elicit new supply.

Tim Gardner, IHS vice president and global head of Power, Gas, Coal and Renewables, said, “The newly abundant natural gas resource base presents an opportunity to rethink our approach to natural gas use. In the past, when natural gas was thought to be a scarce resource, we tried to limit its use. Now that technology has greatly expanded our ability to produce natural gas at relatively low cost, we can look for more ways to capitalize on the economic, efficiency and environmental advantages that natural gas offers.”

IHS also finds that:

- Switching to a natural gas-heated home saves U.S. consumers over $5,700 on average over 15 years.

- Lower prices of natural gas provided an increase in real disposable income per household of approximately $1,200 in 2012. This will steadily increase to $2,000 in 2015 and more than $3,500 by 2025.

- A natural gas vehicle will save an average of $4,500 in fuel costs over five years compared to a gasoline vehicle.

In addition to the potential cost benefits, the report notes that substituting natural gas consumption for other fuels can achieve significant gains in energy efficiency and reductions in greenhouse gas (GHG) emissions.

The study reports that there have already been positive responses to the new natural gas supply and price outlook in the form of accelerated conversion from heating oil to natural gas. New York City, for example, is in the midst of a large-scale conversion from fuel oil use to natural gas use.

LDCs in Maine are expanding their systems to deliver natural gas into sparsely populated areas serving paper mills and using the industrial demand to provide a base level of support for the infrastructure to connect residential and commercial customers along the way.

The study warns, however, that challenges to greater natural gas use remain, such as the upfront costs for natural gas conversion and existing regulatory frameworks that can discourage economic natural gas projects. Upfront capital and installation costs of natural gas appliances may be higher than those of electric appliances.

The natural gas advantage is realized over time as lower fuel costs gradually overcome the higher initial costs. Many potential customers do not have the means to finance a conversion to gas and may be reluctant to do so, especially if their appliances do not need immediate replacement. New policies and regulations may be advisable to ensure that high upfront costs do not deter consumers from making prudent fuel choices.

Public Benefits

The public benefits of using natural gas instead of typical alternative fuel sources may justify measures that go beyond removing economic barriers, and that actually promote the use of natural gas. Active promotion of gas at the expense of alternatives lies beyond the mandates of most PUCs, but state and local governments are entitled to make such policy choices, and can promote gas system expansions as part of an overall energy strategy.

In pursuit of such a strategy, outlined in the report are new measures that may be appropriate for their jurisdiction:

- Authorizing the PUC to allow system expansion costs to be recovered through general tariffs applied to existing as well as new customers;

- Providing explicit subsidies for expansion of gas networks to unserved areas that meet established density criteria. These subsidies could take the form of economic development grants or state-backed bonds; and

- Promoting fuel conversion through information dissemination.

According to the report, several stares are pursing policies of this kind. In Nebraska, for example, the absence of pipe network in rural areas has been identified as an obstacle to economic development. Recent legislation encourages collaboration among stakeholders, including state and local governments, economic development groups and LDCs. It allows funding for new pipes from local sales tax revenues and surcharges to customers.

Core Gas LDC Markets

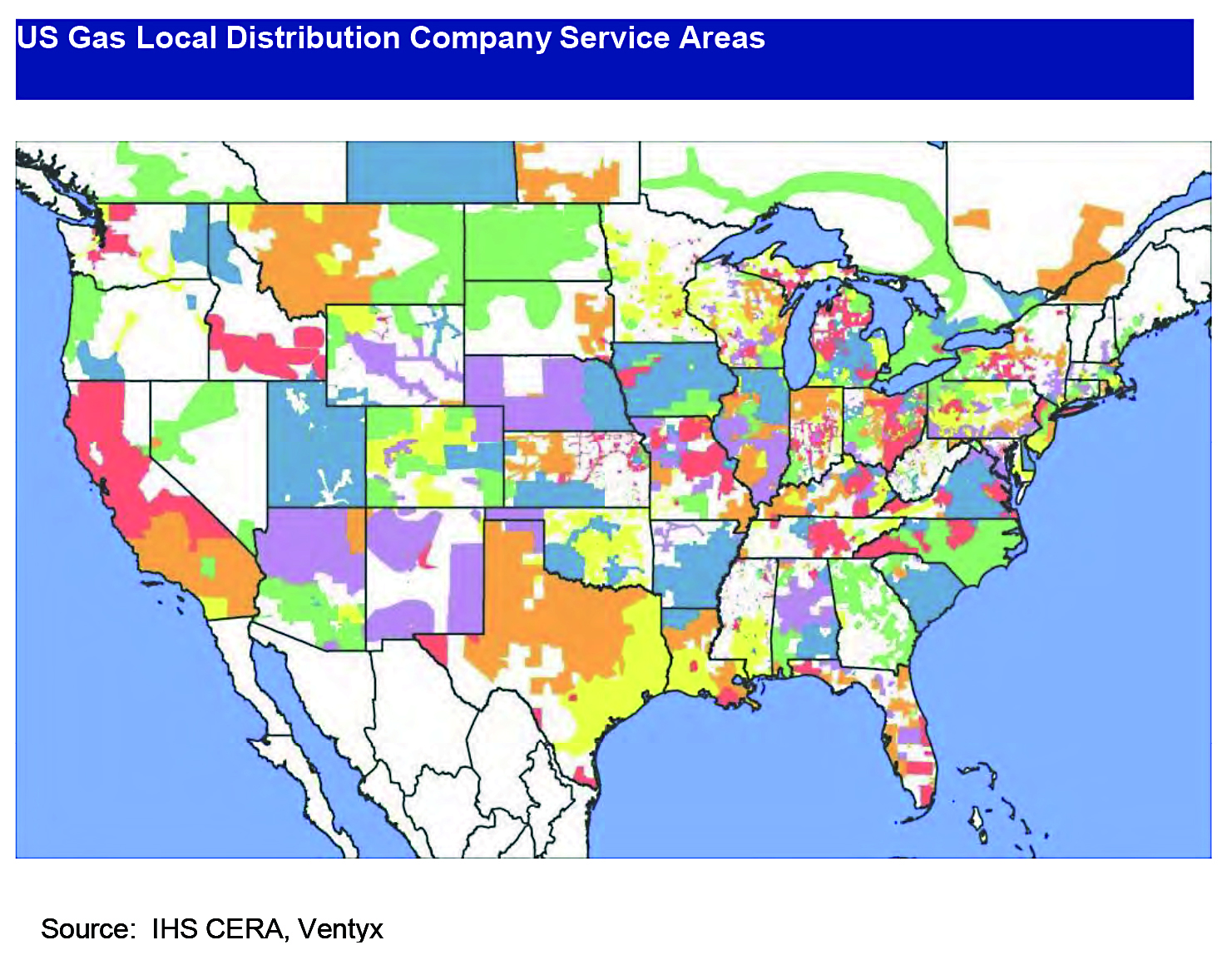

The report finds a clear opportunity exists to expand natural gas service to more residential and commercial customers who constitute the core markets for LDCs. The possibilities include:

• A near-term and ongoing opportunity to displace heating oil in the Northeast.

• An opportunity to increase gas market share in space heating and other uses, taking advantage of a growing divergence between gas and electricity prices and a greater full fuel-cycle efficiency of gas appliances in some regions.

• An opportunity to work within LDC service areas to use natural gas to promote economic development, attract industrial, power, or large commercial gas-using facilities to serve as anchor tenants around which a gas distribution system can be extended to smaller residential and commercial customers in the area.

• Over a longer time frame, developing and improving natural gas technologies, including lower-cost high-efficiency appliances, natural gas heat pumps, small-scale generation, cogeneration applications, and fueling facilities for natural gas vehicles, whether commercial or home-based.

Ideally, LDCs may be able to expand their networks to serve a variety of customers, balancing complementary load profiles and optimizing distribution costs across the customer base.

Growth In Other Sectors

As noted in the report, the 5% of industrial gas users that were not connected to LDC systems used almost half of industrial gas volumes in 2011, and the 31% of power sector customers that were not served by LDCs accounted for nearly 75% of power sector gas consumption. Nevertheless, prospects exist for higher gas demand from these sectors and expansions of LDC systems may be required to facilitate their growth.

Gas-using industrial and power facilities can also serve as anchor tenants for LDC system expansions and as engines for local economic development. Natural gas is poised to increase its share of a heretofore minuscule market—transportation. LDCs may also play a role in building and supplying residential and commercial refueling stations.

Editor’s Note: The IHS study, Fueling the Future with Natural Gas: Bringing It Home, was supported by the American Gas Foundation. IHS Inc. is exclusively responsible for the analysis, content, and perspectives provided. To download the complete report, Fueling the Future with Natural Gas: Bringing It Home, visit www.ihs.com/fuelingthefuturewithng.

Comments