January 2014, Vol. 241 No. 1

Features

Study Finds Shale Boom Drives Maturing Midstream Sector

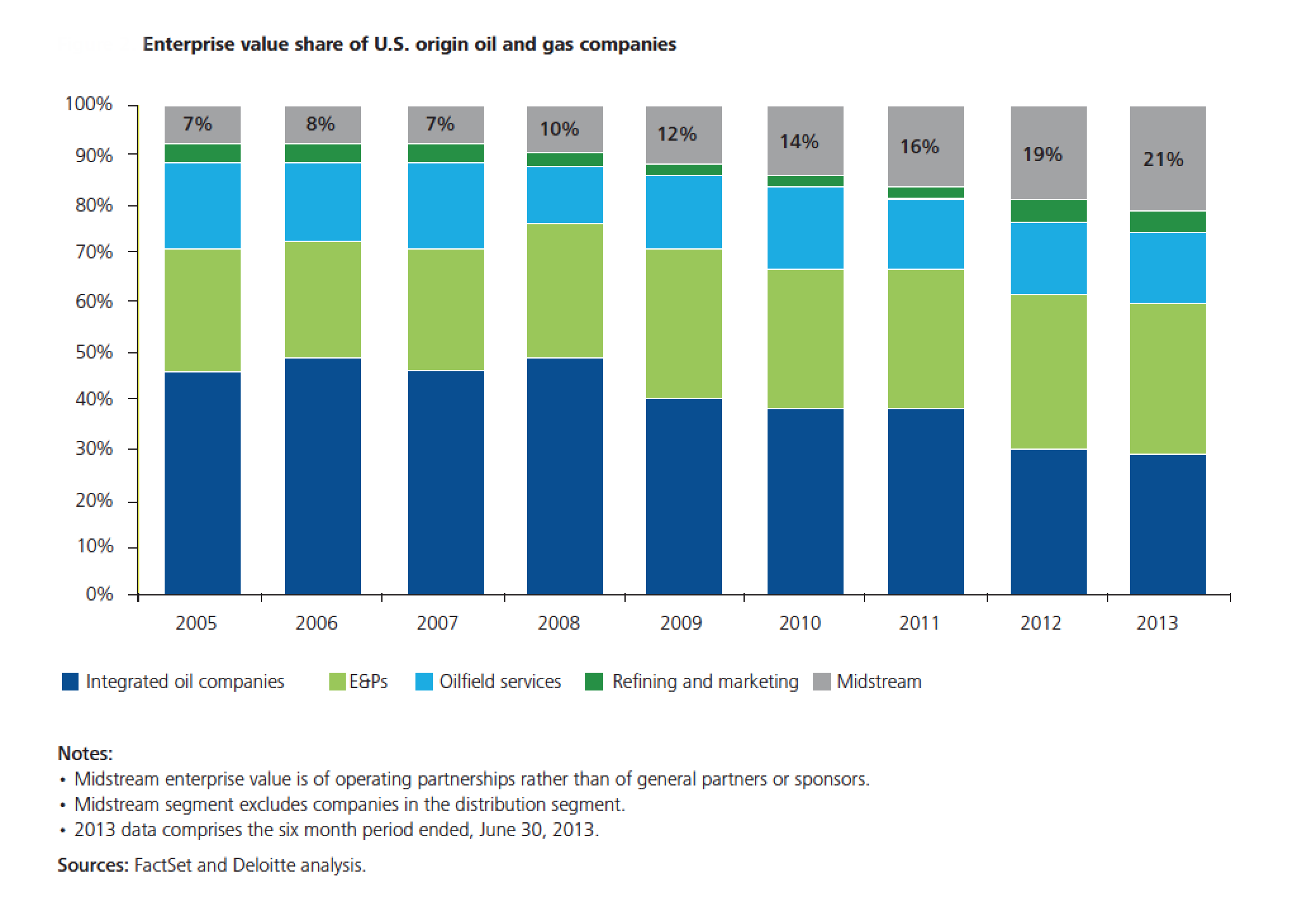

Recent gains in U.S. oil and gas production – along with the need for infrastructure to move it – has “breathed new life” into the midstream sector, which has tripled in value since 2005, according to energy analysts at Deloitte.

Additionally, the study foresees a transformation over the next two decades in which midstream companies will hold assets spanning from the U.S. Gulf of Mexico to Canada, while branching out into export terminal and marine transportation holdings.

To that end, Deloitte advises that midstream companies play a bigger part in production management as that process becomes more highly automated and uses more efficient forecasting analytics.

In its latest study, “The Rise of the Midstream: Shale Reinvigorates Midstream Growth,” Deloitte also predicts an emergence of “market-dominating” midstream companies that have the size and influence to rival major upstream companies.

“A handful of the largest midstream players will become an essential part of the infrastructure and enjoy a significant market share,” the study said, adding these midstream majors would benefit from buying up “fragmented and lucrative” gathering and processing assets, covering both liquids and natural gas.

However, the report also sees niche opportunities continuing for “innovative and opportunistic” smaller players interested in developing gathering and processing, storage and certain pipeline assets.

“I think that in the newer areas there’s going to be nice opportunities for smaller companies to move in quick,” said John England, Deloitte vice chairman for U.S. oil and gas. “Then, over time, we project there will be continued consolidation by companies with bigger balance sheets and lower cost of capital.”

Midstream transactions rose in first the half of 2013, compared with first half of 2012 – from $18.7 billion to $25.1 billion.

The Deloitte study found that despite increasing capital intensity, the infrastructure needs in areas such as North Dakota’s Bakken shale region are just beginning to be met with the federal Energy Information Administration (EIA) reporting as much as 35% of natural gas in the region being flared or not marketed.

“Growth of shale gas was led by independents, which gave rise to the midstream growth,” said England, who added there has been a “big shift toward oil or liquids-rich plays” due to pricing with some traditional gas midstream players moving to the oil space as well.

Enbridge’s proposed Sandpiper Pipeline is an example of a project designed to address this dearth of infrastructure, shipping 375,000 bopd 610 miles from the Bakken to Superior, WI. However, its startup isn’t expected until early 2016.

In reaction to the need for additional transportation farther south, NuStar Energy began the second phase of a $135 million pipeline to ship Eagle Ford crude to the Corpus Christi port. If all goes as planned, the project will boost capacity by 65,000 bopd in early 2015.

Cash And MLPs

Midstream companies, which are dependent on external cash because much of their cash is distributed to investors, have funded their total capex and acquisitions through equity and debt since 2008, the study said.

Master limited partnerships (MLPs) alleviate much of the financial concern, Deloitte found, by enabling midstream operators to monetize assets, realizing a higher valuation premium. As a result, MLPs have given the sector access to ample low-cost capital.

“We think there is still a fair amount of fragmentation in the industry, so there will be a steady flow of acquisition activity through the end of the decade and possibly beyond,” England said. “We think the trend will be toward consolidation, but we don’t know that it will happen very quickly. I think it will be more of steady flow of M&A activity.”

With 14 deals raising $4.9 billion through initial public offerings in 2012, “the MLP remains the bedrock of the midstream sector’s capital structure,” the study said. “That could change, though, if interest rates rise significantly.”

Among other findings in the study:

• Current growth driven by crude will diminish, being overtaken by NGLs and LNG exports by 2016.

• As the industry matures and price competition increases, returns will narrow and the lowest-cost operators will prevail, paving the way for consolidation in a highly fragmented industry.

• The shale boom – initially the domain of small, independent upstream companies – is increasingly drawing attention from supermajors, which are being drawn back to the U.S. after decades abroad. The study cites ExxonMobil’s purchase of XTO Energy and Anadarko’s sale of a portion of its Mozambique holdings to illustrate that trend.

• The depletion of oil’s “sweet spots” will likely coincide with reigniting of gas growth. LNG exports and more demand from gas-powered energy sectors will drive the growth of the midstream sector. Additionally, new petrochemical plants will cause NGLs, mostly propane, to become the fastest growing commodity.

With more than 25 midstream companies valued at more than $5 billion, Deloitte predicts an additional $200 billion capital investment into the sector over the next two decades. Midstream IPOs have raised $4.9 billion through 14 deals since 2012, the largest proceeds in three years.

Even if the Keystone XL fails to gain approval, England said, he would not see that as an indication of a “larger slowdown” within the industry, adding that cross-border issues present unusual circumstances and other growth projects would still move forward.

“Certainly I think there is reason for optimism both around the growth and reserves and production,” he said.

Midstream is now the third-largest sector of the oil and gas industry, behind supermajors and large independents. With an enterprise value of $110 billion, Kinder Morgan is the third-largest energy company in North America.

Comments