April 2013, Vol. 240 No. 4

Features

World FLNG Market Forecast 2013-2019

Increasing gas demand, coupled with the requirement for short- to medium-term import solutions, has seen the floating regasification sector experience rapid growth in recent years. The industry has grown from the Gulf Gateway unit (2005-2012) to ten operational vessels in 2012. Similarly, the floating liquefaction market is gaining traction with the first base load FLNG liquefaction terminal due onstream in 2016.

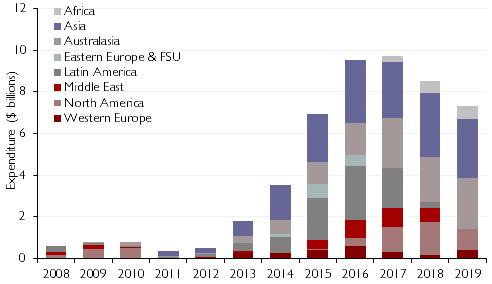

The emergence of floating liquefaction will drive a significant increase in total global capital expenditure (Capex) over the period to 2019. While expenditure is expected to increase in the existing regasification market, the liquefaction sector is forecast to overshadow this as Capex associated with a floating liquefaction terminal is more than triple that of a typical floating import terminal. Douglas-Westwood (DW) in its World FLNG Market Forecast 2013-2019 shows that expenditure is set to total $47.4 billion over the 2013-2019 period with over $28 billion spent on FLNG liquefaction and $19.1 billion on import terminals.

Moreover, economic growth is driving electricity demand in the developing world and Asia will be a focus region for both liquefaction and regasification terminals between 2013-2019, accounting for nearly 35% ($16.3 billion) of global Capex. Australasia will account for 22% ($10.5 billion) of the market, largely due to a number of liquefaction projects. Latin America will represent 17% ($8 billion) of global FLNG expenditure, with projects involving both offshore liquefaction and regasification vessels.

Key Demand Drivers

Five main factors are driving the growth of the FLNG market:

• Monetization of stranded gas reserves

• Security of supply

• Onshore terminal costs

• Environmental

• Increasing long-term gas demand.

Increasing long-term demand is driving the value of gas reserves; however, in some places a lack of infrastructure makes the monetization of reserves challenging. This, coupled with escalating costs of labor and raw materials, as well as tight contractor markets has led to large increases in the cost of new onshore terminals in recent years. This has been evident in Australia with seven projects exceeding forecast expenditure, most recently the Gorgon Project in Barrow Island, Western Australia.

Arguably, FLNG could be a viable option when considering cost; the modular design of FLNG vessels means they can be built in lower cost environments and towed to location. Another advantage is that it acts as a processing platform as well as a liquefaction facility, consequently eliminating costly pipeline and production facilities.

Also, the interruption of gas supplies is a major concern relating to the security of land-based LNG facilities. In some instances, developing new onshore infrastructure can also be difficult due to local opposition. Therefore, the use of offshore regasification facilities, placed in relative proximity to existing gas markets and connected to shore by pipeline, is one method to mitigate such concerns.

Gas is often a waste product of oil production; however; recent market developments have seen companies actively look at gas export and production options that avoid gas flaring and/or unnecessary re-injection. This is driven further by the combination of a desire for gas assets monetization and more stringent legislation.

Increasing economic development, coupled with extensive electrification programs, has caused power generation requirements to increase throughout the developing world, particularly Asia. This has in turn driven a huge interest in floating regasification vessels which are considered cost-effective at medium-sized throughputs (around 3 million tons per annum (mtpa).

Market Forecast

Total global Capex will increase from $3 billion during 2008-2012 to $47 billion during the following seven-year period. Capex should peak at $9.7 billion in 2017; this will be attributed to a large proportion of prospective projects coming onstream. Market trends suggest that FLNG market Capex could continue to rise beyond 2017; however, the operational successes of floating liquefaction projects will be central to market growth.

The Market by Type

Historically the global FLNG market has only consisted of import vessels; however, this is expected to change in the next three/four years with Petronas’ and Shell’s floating liquefaction projects coming onstream. These pioneering projects are likely to instil confidence in the market, thus leading to a number of concepts entering the development stage.

Floating regasification terminal expenditure is expected to increase from $2.8 billion in the 2008-2012 period to $19.1 billion during the following seven years. The lack of project visibility beyond 2016 causes a fall in FLNG import capex; however, market trends indicate this sector is expected to continue growing beyond the forecast period.

Capex on liquefaction vessels will see a dramatic rise beyond 2013 as ground-breaking projects enter the construction phase. Expenditure is expected to rise from $248 million in the 2008-2012 period to $28.3 billion between 2013-2019.

While there are a number of floating liquefaction vessels due onstream within the forecast, DW believes this sector could continue to gain traction following start-up and operation of projects. Based on this hypothesis, coupled with increasingly remote, offshore and deepwater discoveries, the long-term market is expected to continue to grow.

Regional Outlook

Asia, which is a focus area for both floating liquefaction and regasification vessels, is expected to account for over a third (35%, $16.3 billion) of the forecast. Economic growth and development is driving energy demand in the region; therefore, FLNG provides a short-term solution to rising demand and energy shortages. The region is looking at onshore options in the long term.

Australasia accounts for the second-largest proportion of global capex 22% ($10.6 billion), largely due a number of liquefaction projects. The Prelude and PNG FLNG projects are due onstream in 2017, representing all capex during 2009-2017. Prelude will represent 65% of liquefaction capex. Successful operation of the Prelude facility could lead to increased global interest in floating liquefaction.

Latin America will be the third-largest contributor to global capex (17%) investing $8 billion, driven by both floating import and export facilities. The utilization of floating liquefaction could increase beyond the forecast period with the potential to be used for deepwater production and processing.

North America will halt the majority of its import projects following the production of unconventionals such as shale gas and only account for 9% ($4.2 billion) of global capex, with most spent on floating liquefaction. It will be interesting to see how the U.S. manages the shift from production of shale gas ‘sweet spots’ to formations with increased production difficulty; however, this is not a major feature at present.

The Middle East will see an increase in capex over the forecast period but will only represent 6% ($3 billion) of global expenditure. The region dominates the LNG export market through its onshore liquefaction plants in Qatar and Abu Dhabi. Despite these established onshore facilities, abundant reserves of non-associated and associated gas and security issues have meant some countries (particularly Iraq and Israel) have been suggested as potential locations for FLNG liquefaction vessels.

Western Europe will represent 5% of total global capex ($2.4 billion). The substantial growth in expenditure follows a five-year period without investment in the floating LNG sector. Declining production in the region is placing pressure on countries to increase imports to satisfy energy demand. Floating regasification provides an important solution due to fast track lead times in this industry.

Africa’s spend of $1.5 billion (3%) will be largely attributed to liquefaction expenditure. This could increase as floating liquefaction is considered for significant gas discoveries in countries such as Mozambique and Tanzania. Eastern Europe and the FSU will see some investment over the forecast period; however, this will be minimal at 3% ($1.4 billion) and solely related to import projects.

Conclusions

- The natural gas business has robust long-term drivers. Energy demand is growing as a function of population and economic growth. The drive to develop gas reserves is coming from a substitution effect as a result of high oil prices and a move away from the use of both coal and nuclear energy.

- Unconventional gas will not be a universal solution to increased global gas demand. With the possible exception of China, it is difficult to see how the rapid U.S. unconventional gas development could be replicated elsewhere in the world within the next 10 years. Supply chain constraints, uncertainty over long-term production levels and political issues are the biggest problems.

- Vast offshore conventional reserves exist and continue to be found. Historically, relatively little offshore natural gas exploration has occurred, the industry has instead focussed on oil. Many conventional offshore gas reserves remain untapped and more continue to be found, particularly in frontier areas such as East Africa.

- The FLNG liquefaction business is in its infancy. The success or failure of the first projects will be critical with many operators/observers taking a keen interest in the build, cost and performance. Successful execution and operation will undoubtedly encourage further new projects while failure could see the industry disappear completely.

- The lingering European sovereign debt crisis presents two significant risks to the sector. First, investor caution is already high within the FLNG sector, primarily with regards to floating liquefaction; therefore, the debt crisis could deter investment and diminish potential market growth in the short-medium term. Second, that the crisis will bring further economic downturns and depress oil demand and prices – in turn impacting new E&P activity.

- Political and security-related risks are an ongoing issue in the E&P business. Boundary disputes, threats of civil unrest and war and terrorism are all ever-present challenges that the oil and gas industry is used to encountering. However, by siting infrastructure offshore, FLNG could help mitigate some proportion of risk in regions where these issues are apparent.

- For more than 30 years FLNG export has been an ambition of the offshore industry. It is now well on the way to reality. Last year was a real milestone for the industry with steel cut on the first project. The sector is now buoyant with the prospect of over $47 billion to be spent 2013-2019.

- While there remains considerable uncertainty at a project-by-project level and caution is required in assessing longer-term markets, it is clear that the inherent complexity in future natural gas developments will be a key growth opportunity for equipment, engineering and service providers worldwide.

For information or to purchase the World FLNG Market Forecast 2013-2019, contact: Phone: +44 1227 780999 Email: research@douglaswestwood.com or visit Website: www.douglaswestwood.com.

Comments