January 2013, Vol. 240 No. 1

Features

Pipeline Outlook 2013

Editor’s note: This presentation was prepared for the Pipeliners Association of Houston meeting held Jan. 7.

No matter what you may hear tonight, tomorrow or the next day, the story is going to change.

That’s the state of our industry today and if our industry, government lawmakers and regulators handle development properly, this really can recharge our economic engine for years to come.

Before I get to my slides, I want to talk about my trip to western Pennsylvania last month where I met with companies and universities involved with the Marcellus Shale.

When I asked an executive from Chevron how long they expect to be there, he said 50 to 60 years. That’s why they’ve already invested billions there.

Williams has plans to spend $20 billion in the Marcellus over the next five years. Just outside of Pittsburgh is a growing business park containing more than 60 companies working in the Marcellus with more coming in every week. It’s impossible to find office space in downtown Pittsburgh. Despite all this activity, they’re just barely scratching the surface.

There is talk of building at least five steel plants in the U.S. When was the last time you remember one steel plant built here?

I visited a new pipe coating plant opened in Duquesne in a former steel mill, thanks to the shale. Earlier I visited Elliott Group, a compression company now in the midst of a boom when just a few years ago it nearly shut down which would have cost 1000 jobs.

Industry and government are working together to mitigate problems. We met with officials from the University of Pittsburgh and Carnegie Mellon who are trying to solve issues involving possible environmental and health hazards related to fracking. Then we visited a company that says it can handle wastewater problem by sending portable units directly to the well site within an hour of a call.

While FERC has tried to move pipeline projects forward more quickly, PHMSA has stepped up its regulatory activities. With 60 more inspectors at PHMSA this year and Secretary Lahood’s promise to strictly monitor pipelines, we should see sizable increases in maintenance budgets.

Something to consider is the railroad industry. In some cases the railroads already are supplanting pipelines as a means of oil delivery.

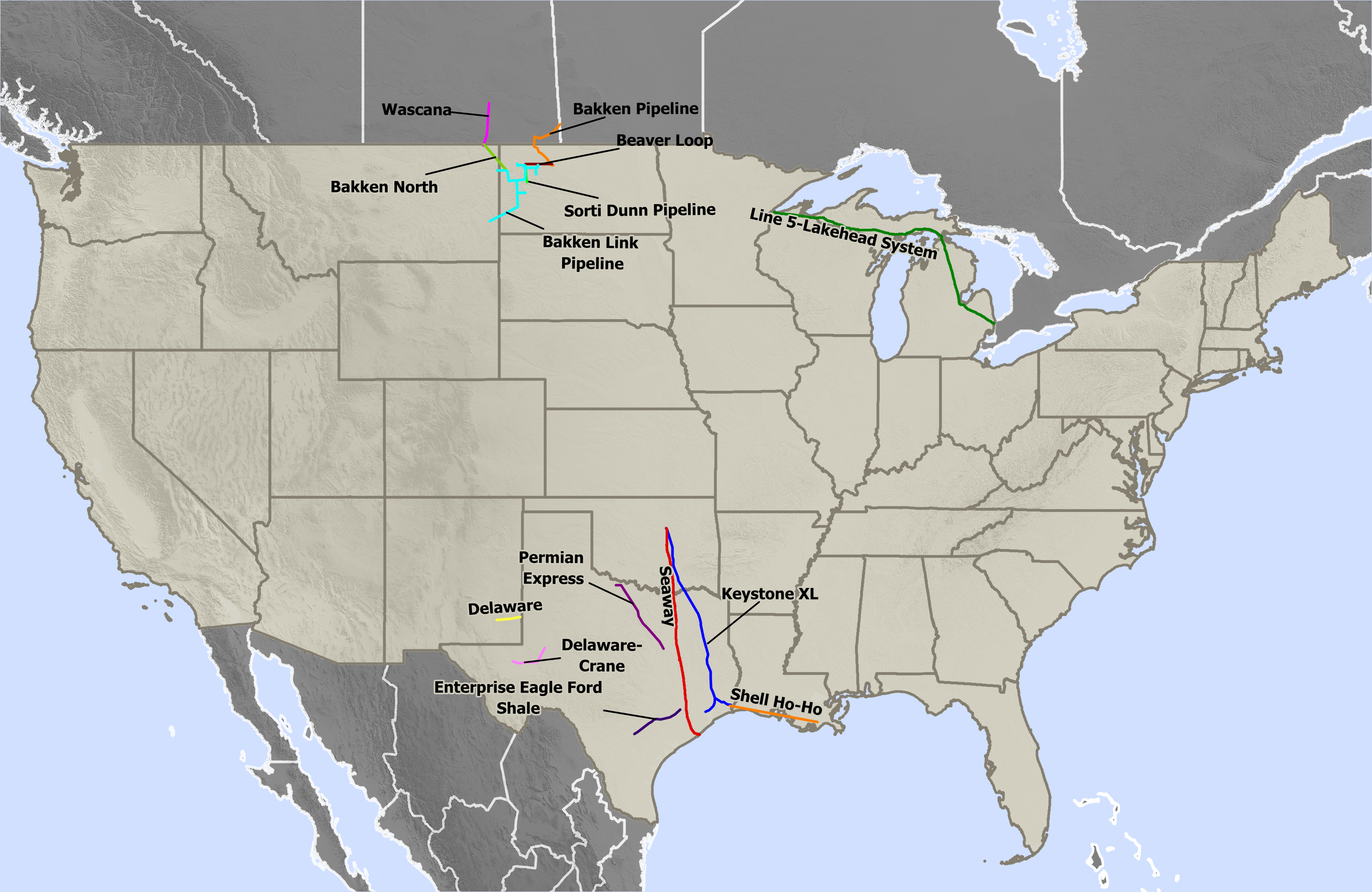

As you know, ONEOK dropped plans for a $2 billion pipeline from the Bakken to Cushing because producers found it was a lot cheaper and convenient to use rail cars and send their oil to Philadelphia. Bakken crude will account for 50,000 barrels a day of the refinery’s output. Even larger volumes of Bakken oil could arrive if the refinery builds a high-speed terminal that can unload two 120-car trains a day, each carrying more than 70,000 barrels.

If you’re a producer, do you make a big investment in a pipeline that can only go to one place and has yet to be built or spend it developing your product?

Here is something to watch and an indication of things to come. Last month Spectra Energy said it was buying the Express-Platte Pipeline System for $1.5 billion. This is a 1,717-mile system stretching from Hardisty, Alberta to Wood River, IL. Express pipeline carries crude oil to refining markets in the Rockies area while the Platte transports crude mostly from the Bakken and Western Canada to the Midwest.

It’s Spectra’s first move into the crude oil business and complements their natural gas midstream assets. They’ll invest more in related crude and refined product infrastructure. Express-Platte System is one of just three major pipelines moving crude from Western Canada to Rockies and Midwest refineries and markets. So this indicative of the opportunities in the North American crude oil pipeline market.

Whether we’ll see new construction or acquisitions followed by expansions or conversions from gas to oil pipelines is anyone’s guess. If the price is right operators rather buy than build.

Some Facts & Figures

Capital expenditures for gas infrastructure development are forecast at $205 Billion through 2035. This would expand the mainline gas transmission system by 35,600 miles and create an additional 589 Bcf of working storage by 2035. Even with the steady growth in pipeline capacity, they estimate the U.S. and Canada will need between roughly 30,000 to 60,000 additional miles of pipeline through 2030.

Taken as a whole, the shale gas revolution has the potential to increase our GDP by 1-2-1.7% per year by 2017.

Natural gas use for power generation is seen increasing 55% from 29 Bcf/d in 2012 to 45 Bcf/d in 2035.

• A projected 37% increase in total natural gas demand in North America to 2035 from 76 Bcf/d in 2012 to 104 Bcf/d in 2035,

• Onshore natural gas resources with shale gas production in North America increasing from 27 Bcf/d in 2012 to 75 Bcf/d in 2035, representing 33% and 63% of total dry production. Shale production is seen rising to 66% in 2035

• A modest revival of the industrial sector – including petrochemical – from 25 Bcf/d in 2012 to 34 Bcf/d in 2035.

• A projected total of 7 Bcfd/ of LNG exports by 2020.

Our 2013 survey figures show 116,000 miles of pipelines planned and under construction worldwidel 84,800 are projects in the planning and design phase and 33,000 are in various stages of construction.

North America – 41,810; South/Central America and Caribbean – 12,285; Africa – 7,999; Asia Pacific – 33,811; Former Soviet Union and Eastern Europe – 10,374 ; Middle East – 7,791; and Western Europe and European Union – 2,767.

Some Specifics

DTE Energy, Enbridge and Spectra Energy plan to develop the NEXUS Gas Transmission system to move Utica shale gas to markets in the Midwest, including Ohio, Michigan, and Ontario. The project will originate in northeastern Ohio, include 250 miles of pipe and transport 1 Bcf/d. Targeted in-service date is November 2015.

The Front Range NGL Pipeline will originate in the Denver-Julesburg Basin in Weld County, CO and extend 435 miles to Skellytown, TX. The plan by Enterprise Products Partners, Anadarko Petroleum and DCP Midstream is will provide takeaway capacity and market access to the Gulf Coast. Initial capacity is 150,000 bpd which can be expanded to 230,000 bpd.

Enterprise is expanding its natural gas and NGL infrastructure in South Texas and Mont Belvieu to accommodate Eagle Ford. They’re building a 350-mile pipeline, a processing plant and an NGL fractionator at Mont Belvieu. Included in the expansion are two additional pipeline segments totaling 168 miles, of which 26 miles of 24-inch pipeline will extend the mainline to the far western reaches of the Eagle Ford. The remaining 142 miles, to be built in two segments, will comprise 30-and 36-inch line in the eastern portion of the Eagle Ford.

Enterprise plans to loop 62 miles of gas pipeline with 24-inch and 30-inch loops. Construction on the expansion is should be ready for operation shortly.

TransCanada remains fully committed to construction of its 1,179-mile Keystone XL Pipeline from Hardisty, Alberta to Steele City, NB. Last week the Nebraska Department of Environmental Quality gave its go-ahead though opponents are still riled because a part of it would cross the Ogallala aquifer. Most expect the President to issue the presidential permit during the first quarter.

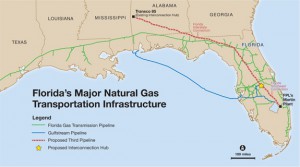

Florida Power & Light last month issued an RFP for a third major natural gas pipeline into Florida.

With its two existing major gas pipelines nearing full capacity, the state needs new infrastructure by 2017 to meet the growing need for natural gas power. Other than those two pipelines, they have practically no gas production or no storage capacity, yet use more natural gas for electricity than any other state except Texas, with about 60% of its power generating by natural gas.

The third pipeline system would be 700 miles and include a hub to interconnect all three pipeline systems in Central Florida.

The proposed new “Southeast Pipeline” will provide 400 MMcf/d beginning in 2017, increasing in capacity later on. It will have two segments:

- The “Florida Interstate Connection” and “Central Florida Hub” comprise the upstream pipeline project, starting at an existing hub in western Alabama, running east and then south, ending at a new hub to be built in Central Florida that will allow the new pipeline to interconnect with Florida’s existing pipeline systems.

- From there the “Florida Southeast Connection” will connect with FPL’s system in Martin County.

Piedmont Natural Gas, Williams Partners and Cabot Oil & Gas have a joint venture to build the 121-mile, 30-inch Constitution Pipeline at $180 million. The pipeline will transport 650,000 Dth/d of gas from northern Pennsylvania. Construction is expected to begin in April 2014 with an in-service date of March 2015.

Enbridge plans a $1.8 billion expansion of its mainline system between Edmonton and Hardisty, Alberta. It includes a 36-inch, 110-mile crude pipeline with capacity of 570,000 bpd with expansion potential to 800,000 bpd. In-service date is mid-2015.

Southern Star Central Gas Pipeline held an open season for its Straight Blackwell Expansion to provide western Oklahoma producers more access to markets in Oklahoma, Kansas and Missouri as well as to other intrastate and interstate pipelines. The expansion should begin service by Oct. 1.

Enterprise Mid-America Pipeline plans to start construction of its Western Expansion Pipeline III in April. This includes 7 loops starting near Farmington, NM and ending near Hobbs It would have 246 miles of 16-inch pipeline and would carry increased NGL production to Hobbs and ultimately to Mont Belvieu. Construction is scheduled for completion before year-end.

Magellan Midstream Partners and Occidental Petroleum plan to build the BridgeTex Pipeline to transport Permian Basin crude oil from Colorado City, TX, to the Houston Gulf Coast area. The pipeline will be capable of transport 300,000 bpd of crude.

Spectra Energy along with Phillips 66 and DCP Midstream are planning the NGL Sand Hills and Southern Hills pipelines which I believe is on the order of $2 billion.

The Sand Hills pipeline will carry liquids from the Permian Basin and Eagle Ford to the Gulf Coast. Sand Hills will have initial capacity of 200,000 bpd, expandable to 350,000 and is being phased into service with the first phase now online providing service from the Eagle Ford. Direct connection to Mont Belvieu is expected by year end. The timing of Sand Hills’ second phase – the Permian portion – is due to be in service in mid-2013.

Southern Hills will provide 150,000 bpd, expandable to 175,000, of NGLs from the midcontinent to Mt. Belvieu and has targeted in-service date of midyear.

In Mexico, El Paso Natural Gas owned by Kinder Morgan Energy Partners, L.P. and Kinder Morgan, Inc., has a 25-year transportation agreement in connection with plans to build a pipeline to serve customers in Mexico. EPNG, acting through its affiliate Sasabe Pipeline Co., would initially provide 200 MMcf/d of firm transportation capacity via a 60-mile, 36-inch lateral pipeline extending from Tucson to the U.S.-Mexico border, terminating at Sasabe, AZ where it would connect with a pipeline in Mexico.

Several possible routes are being evaluated. If it goes, construction could begin in 2014 with anticipated in-service that September.

Also in Mexico, Sempra International’s Mexican business unit Sempra Mexico was awarded two contracts to build and operate a 500-mile, $1 billion pipeline network connecting the northwestern states of Sonora and Sinaloa. It will be comprised of two segments interconnecting to the U.S. interstate pipeline system in Arizona and provide natural gas to new and existing Mexican power plants that now use fuel oil.

The capacity for each segment is fully contracted under two 25-year firm capacity contracts. The first segment, a 36-inch, 310-mile pipeline, will run from Sasabe, south of Tucson, to Guaymas, Sonora, and will have capacity of 770 MMcf/d of natural gas. It could begin operation in late 2014.

The second segment from Guaymas to El Oro, Sinaloa, is a 30-inch, 200-mile pipeline with a capacity of 510 Mcf/d. The pipeline is planned to begin operations in mid-2016.

Comments