January 2013, Vol. 240 No. 1

Features

Profiles in Courage: Why Shale Oil & Gas Will Lead To Another American Revolution

The transformation potential of shale oil and gas to the American energy, manufacturing, chemical, and pipeline industries is nothing short of revolutionary. As part of this revolution, the U.S. can form a competitive advantage versus other global economies lasting for the next generation… if government leaders and entrepreneurs demonstrate the courage necessary to tread this path.

Today we stand at the precipice of an economic and energy revolution. We can affect its character but not its inevitability as our economy demands both resources and fuel. The U.S. can, with a combination of government leadership and entrepreneurial drive, use the opportunities created by the domestic shale oil and gas finds to start another American Revolution. A revolution that leads to American competitive advantage in energy, manufacturing, chemical, and pipeline industries and that can last a generation or more. Revolution!

Profile in Courage: Large Gas Utility

A U.S. gas distribution and transmission utility announced a system upgrade addressing aging pipeline infrastructure, safety, and reliability concerns. Annual replacement spending in 2010 was less than $100 million. Their 2011 spending rose to $200 million, followed by a further rise in 2012 to nearly $500 million, and in 2013 an expenditure of $1 billion is likely. This work is paid for through the rate base yet customer bill remain steady as the price of natural gas has fallen dramatically offsetting the increasing asset charge.

Shale Oil & Gas Exploration

Technology advances to recover shale oil and gas led to a massive increase in U.S. domestic gas supply to 150 plus years and the potential to retake the mantel of largest global oil producer. Since 2008, increased shale oil and gas supply led to the most dramatic drop in U.S. oil imports in 45 years; reduced the percentage of coal-fired power generation to a level not seen since World War II; shrank carbon dioxide (CO-2) emission to pre-1992 levels, supported the development of intermittent wind and solar renewable power sources; and sparked manufacturing investment and resurgence in the face of the worst economic downturn and slowest economic recovery experienced since the Great Depression; and the list goes on.

We explore how this American Revolution will impact seven industry segments, with an eye toward the implications for pipeline construction activity which will help America rebuild economic competitive advantage for a generation:

• North American Pipeline Construction and Replacement

• Liquefied Natural Gas (LNG) Export

• Natural Gas Liquids (NGL)

• Gas to Liquids (GTL)

• Power Generation

• Natural Gas Vehicles

• Manufacturing Resurgence

In addition, we explore why this phenomena is not solely American and how over 10 years, the rest of the world will catch up.

Implications And Opportunities For Pipeline Construction

North American Pipeline Construction and Replacement:

One consequence of the development of shale gas and oil is the need for new and replacement pipeline construction, including gathering line, transmission mainline, laterals, and distribution pipelines. For instance, the exploration and production that will use the Keystone Pipeline is occurring in Canada, but much of the pipeline construction activity will be in the U.S.

Rising natural gas demand reveals U.S. bottlenecks in transmission and distribution assets. The Interstate Natural Gas Association of America (INGAA) 2011 study forecasts $205 billion in spending over the next 25 years to address bottlenecks. This writer’s experience shows that when utilities replace pipeline infrastructure, a 3 to 5 times increase in spending occurs (Case Study 1).

There are approximately 75 gas utilities and pipeline companies operating in the U.S. of substantial size. We are personally aware of three firms already exhibiting the type of growth rates described in case study 1 and also aware of more than 10 firms with expectations of this type of growth in spending between 2013 and 2016. If one-third of those 75 businesses address safety, integrity, and replacement of their assets, the spending will far outpace the capacity of the industry to undertake the work.

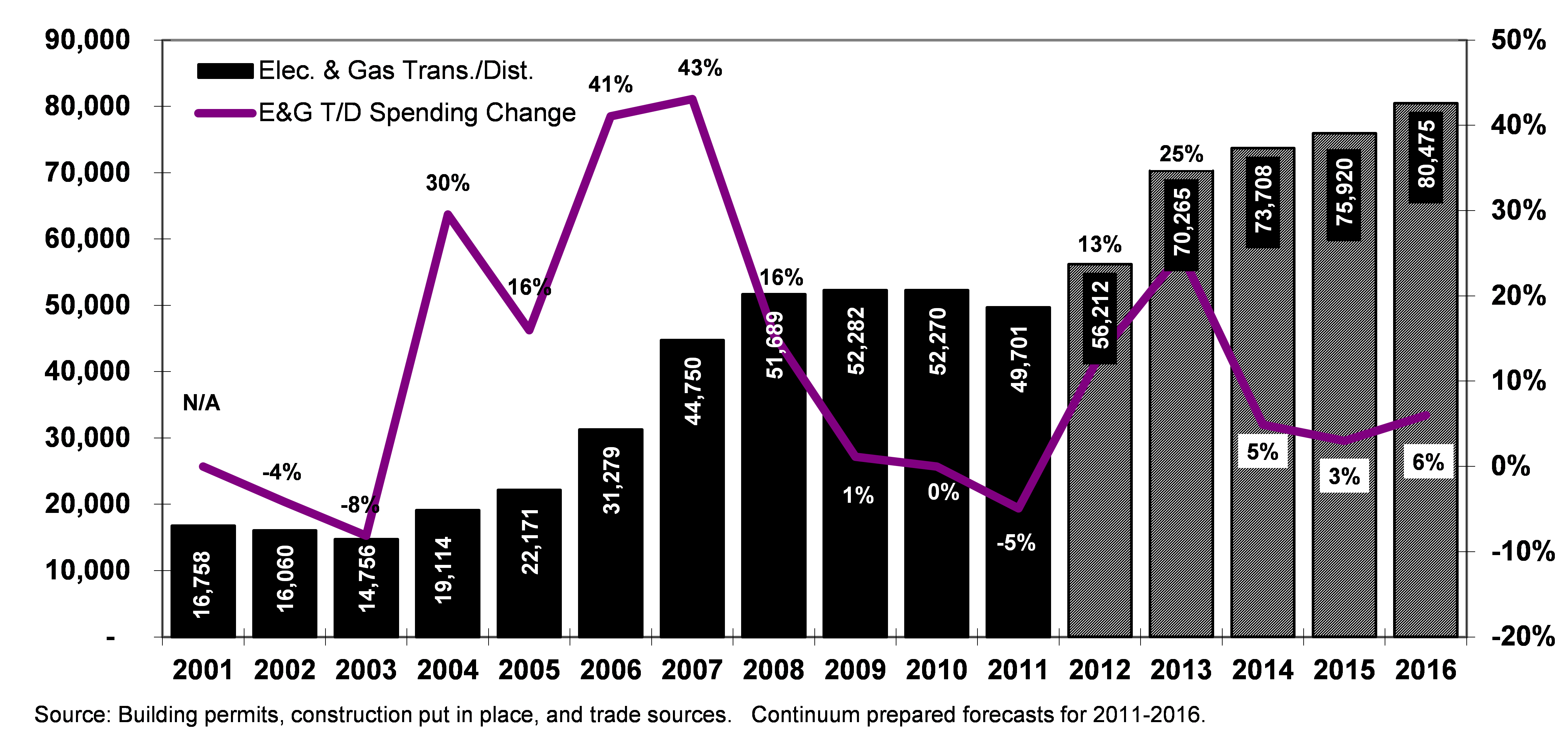

Today, forecasted spending growth in gas transmission and distribution (T&D) construction is driven by a combination of transmission pipeline integrity, distribution pipeline safety, asset replacement, and exploration and production activity (Exhibit 1). The majority of the 2013-2016 growth depicted in Exhibit 1 is related to traditional new and accelerated replacement pipeline construction.

LNG Export: The supply and relatively low cost of natural gas in the U.S. indicates an opportunity to export LNG. The Freeport LNG facility in Texas was originally constructed to import natural gas. However, in July 2012, the facility signed a 20-year contract with two large Japanese power companies to export LNG and is also in export talks with Shell. There are approximately 15 other newly planned or existing facilities seeking Department of Energy approval. On Dec. 5, NERA Economic Consulting released its report on the economic impact and viability of LNG export. The forecasted U.S. economic impact of LNG export is positive in every scenario analyzed.

Profile in Courage: American Electric Power

During 2011, AEP announced a plan to convert the Big Sandy plant in Louisa, KY, the heart of coal country, from burning coal to burning natural gas. In addition, AEP has announced plans to close a host of plants due to retrofit requirements from EPA regulations, and retrofit them with environmental controls, or convert them to burn natural gas. While ultimately the announcement on the Big Sandy plant was reversed, the fact the AEP was willing to convert this facility, in the heart of coal country, to gas is a statement on shale gas’ power.

While some export activity will happen, it is this writer’s belief that this activity will not become a major market for two reasons: 1) Natural gas is too valuable in the U.S. as a feedstock for various chemical processes; 2) much of the cost advantage is lost in the liquefaction and transportation. For pipeline contractors the opportunity associated with LNG export will be limited and specific to a few facilities. Our pipeline construction spending forecast in Exhibit 1 anticipates little pipeline construction activity associated with LNG export during the 2013-2016 forecast period.

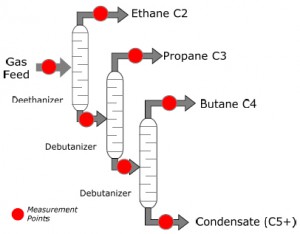

Natural Gas Liquids: Many observers have wondered how it is possible to generate reasonable returns on shale gas when the price is in the $3 Mcf or less range. The answer is natural gas liquids (Exhibit 2). These liquids are associated with shale oil and gas finds and are a feedstock for various industrial processes including the manufacture of paint, fertilizer and plastics, as well as home heating fuel. The domestic “wet” gas finds offer potential to revive the plastics industry in the U.S. Globally, $2-4 billion will be spent annually on facilities in this sector to utilize these liquids. Traditionally, these NGLs have been obtained through the refining of naptha obtained from crude oil. The relatively high price of oil and the ready access to these liquids domestically has created a very significant cost advantage for U.S. firms that use these liquids as a feedstock. Our pipeline construction spending forecast in Exhibit 1 anticipates growing pipeline construction activity associated with natural gas liquids exploration, transportation, and use during the 2014-2016 forecast period.

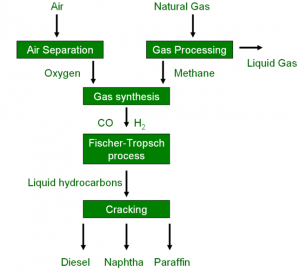

Gas to Liquids (GTL): Given large U.S. gas supplies, there is potential to convert natural gas into a liquid fuel for use in transportation vehicles and other industrial processes. Sasol’s plant described in case study 2 produces a substitute to gasoline or diesel fuels using the Fischer Tropsch (Exhibit 3) or other processes. Development of these various technologies and industries could easily result in $4 billion in annual facility capital construction spending by 2015-2017. The American Chemistry Council estimates that petrochemical companies and other manufacturers will spend upwards of $16 billion over the next five years.

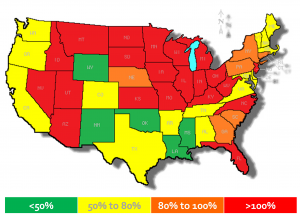

Rapid growth of the GTL industry could offer substantial opportunities for pipeline contractors due to the need to supply these plants with gas feedstock and transport the refined products to market. The first geography likely to see growth in these segments would be along the Gulf Coast where Dow Chemical Co., as an example, is already investing heavily and plans to make use of existing pipeline infrastructure to lessen the need for new large-scale pipeline projects, though significant local infrastructure upgrades would still be needed. A larger opportunity would exist for pipeline work if new facilities are built in PA and OH to make use of the vast gas resources of the Marcellus Shale. This part of the U.S. also has the most significant pipeline capacity issues as pointed out in the Aspen Environmental Group report prepared for the American Public Power Association (Exhibit 4). Our pipeline construction spending forecast in Exhibit 1 anticipates limited pipeline construction due to GTL activity until the 2016 time period.

Power Generation: Power generation is undergoing a revolution driven by regulation and shale gas supply. For the first time since World War II, less than 40% of U.S. power in 2012 will be generated by coal, the bulk being replaced by natural gas. The shift from coal is primarily driven by increasing regulation of coal plants and secondarily by the very low prices of natural gas (Exhibit 5). We expect natural gas prices to remain below $6 Mcf for the long-term which will improve power generation demand for gas.

Cheap and abundant natural gas is replacing coal (Case Study 3) and has also resulted in CO2 emission reductions during the first quarter of 2012 to the lowest level in two decades. While the shift to natural gas from coal has been in the headlines it is not currently a major driver of pipeline construction in our Exhibit 1 forecast due to the fact that all existing gas-fired facilities are already fed by an existing pipeline. Some work will be generated by the conversion of coal fired facilities to gas over the next two to three years but there will be no construction boom in natural gas power plants due to high unused capacity of approximately 70% for existing gas-fired facilities. If existing natural gas-fired facilities were able to operate at 50% of rated capacity this would supply greater than 50% of U.S. power production.

It will take an increase in U.S. power consumption, shuttering of coal fired facilities, or a more robust economic recovery for significant construction growth to occur for gas fired facilities. As the U.S. economy recovers, electric demand will rise and the supply and transmission issues that appeared in the late 2000s will resurface creating more gas demand and ultimately pipeline construction demand.

Natural Gas Vehicles: The high cost of oil and gasoline versus low-cost natural gas make compressed natural gas (CNG) and LNG-fueled vehicles of interest. T. Boone Pickens recently provided $150 million to Clean Energy Fuels (he sits on their board) to build 150 LNG-fueling stations at Pilot/Flying J location across the country. There are just 900 CNG-fueling locations in the U.S. with 43% in CA, UT and OK, compared to 120,000 gasoline stations. The cost to replicate the gasoline infrastructure exceeds $50 billion.

A massive conversion of passenger vehicles to CNG or LNG is unlikely but what is already happening is the conversion of local fleet operations. Waste Management and UPS are aggressively making use of CNG by installing refueling stations in their local facilities where they can build one pipeline, one station, and fuel their vehicles centrally. Supporting this trend, Cummins, GM, Ford and Chrysler all have or are developing natural gas engines. The construction impacts in total dollars for these types of users are significant but they are separated by time and distance around the country, equating to a series of small to medium sized pipeline and fueling station projects. Our Exhibit 1 forecast anticipates a modestly rising amount of pipeline construction activity in 2013-2016 related to the pipeline and fueling station construction anticipated.

Manufacturing Resurgence: Since the 1970s the U.S. has lost manufacturing jobs at an accelerating rate (Exhibit 6). Shale oil and gas create an opportunity to reverse this trend. PA and OH shale gas fields are helping to revitalize the steel business, pipeline manufacturing, and equipment manufacturing sectors. Republic Steel in Lorain, OH is investing $85.2 million in a new furnace. V&M Star is building a $650 million rolling mill next to its Youngstown operation that is the largest private investment in the area since GM built the Lordstown assembly plant nearly four decades ago. Vermeer continues to add staff and manufacturing capacity for equipment used to support shale gas exploration.

Two other examples are a United States Steel collaborating with a Japan-based partner, Kobe Steel, to build a $400 million, 454,000-square-foot addition to what is known as the Pro-Tec plant in Leipsic, south of Toledo and the Timken site where a $200 million, 83,000-square-foot addition is taking place. In the past, the building of U.S. steel mills and petrochemical facilities, like the proposed Shell owned Monaca, PA site , would have been laughable. Today, thousands of construction jobs and hundreds of long-term jobs are on the horizon.

In 2011 shale gas exploration and production created $12.8 billion in economic activity and 156,000 jobs in Pennsylvania. By 2020, 256,000 new jobs, directly related to shale gas are projected. Nationally, shale gas is projected to create 870,000 jobs and $118 billion in economic growth through 2015. According to the U.S. Bureau of Labor Statistics, the average annual wage in the pipeline transportation industry was $64,820, or more than $20,000 higher than the U.S. average for all jobs ($44,410). Individual courage by both politicians and entrepreneurs can unleash a job creation engine in the U.S. Our Exhibit 1 forecast anticipates a rising amount of pipeline construction activity for 2013-2016 related to expanding manufacturing capacity in the U.S.

Worldwide Shale Oil and Gas: The U.S. is not unique in its availability of shale formations. Massive formations with large potential amounts of shale gas and oil exist on every continent. The U.S. is 10 years ahead of much of the rest of the globe. Despite the head start the opportunities afforded the U.S. by this competitive advantage, it will not last indefinitely. Poland is just one example. Royal Dutch Shell, Total SA and ConocoPhillips have acquired exploration rights in Poland, where estimated reserves equal 35-65 years of the country’s demand for natural gas, according to the Polish Geological Institute. At least part of the region’s motivation in embracing these partners is obvious: to get out from under Russia’s thumb. According to a May study by consultancy KPMG, 69% of the gas consumed in Central and Eastern Europe is imported, nearly all of it from Russia.

Conclusion

As noted, the U.S. has approximately a 10 year head start on the rest of the world in technology and experience to economically extract shale oil and gas resources. It is up to the entrepreneurs, business leaders and government officials to exercise the wisdom, skill, compassion, innovation and courage to capitalize on these opportunities. For the pipeline industry, shale oil and gas is creating a broad range of short- and long-term construction opportunities that should provide the industry a steady stream of work through the next decade.

For the larger economy the U.S. can regain manufacturing jobs and competitive advantage in a more challenging global business environment. In combination, shale oil and gas can transform the U.S. and lead to a new American Revolution… if government leaders and entrepreneurs demonstrate the courage necessary to tread this path!

Authors

Mark Bridgers and Nate Scott are consultants with Continuum Advisory Group, which provides management consulting, training, and investment banking services to the worldwide utility and infrastructure construction industry. They can be reached at (919) 345-0403 or MBridgers@ContinuumAG.com or followed on twitter at @MarkBridgers. For more information on Continuum, visit www.ContinuumAG.com.

Comments