May 2012, Vol. 239 No. 5

Features

Shale-Related Midstream Infrastructure: Where the Action Is!

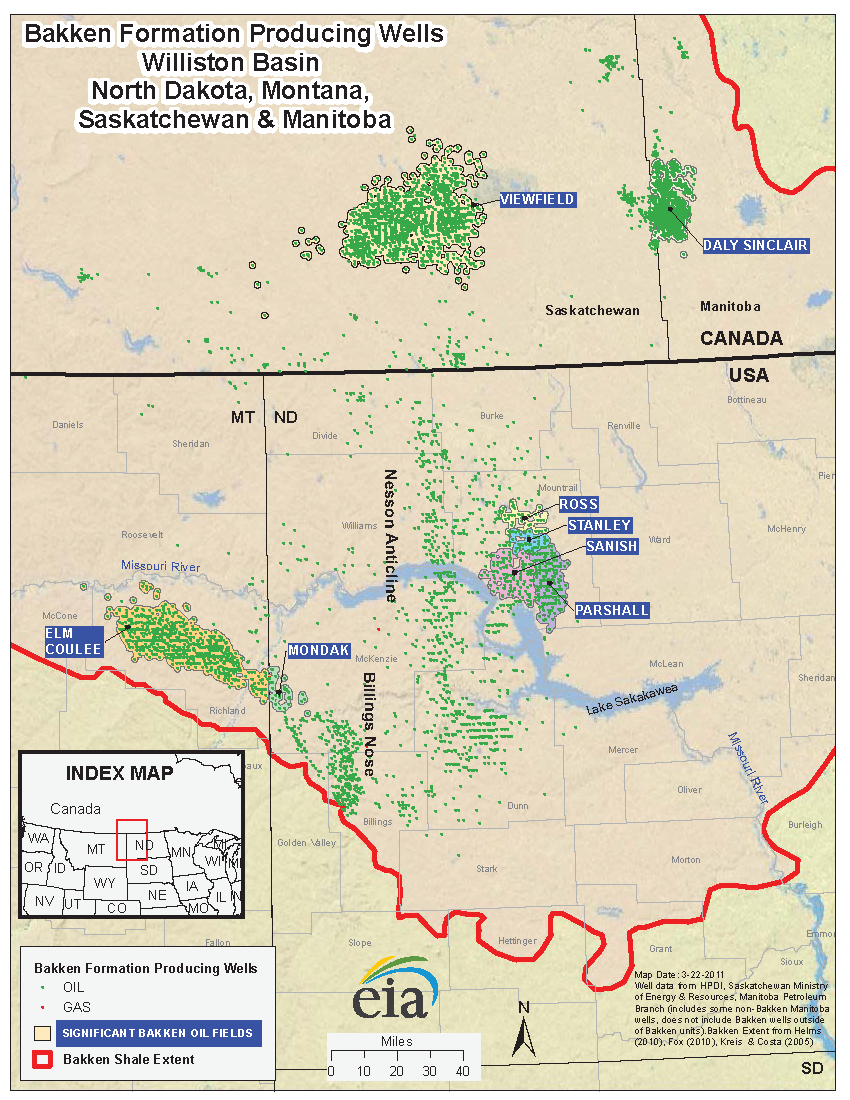

In the winter of 2012 a mostly snowless and relatively warm Bakken Shale play in northwest North Dakota was trucking about 70% of its oil supplies in the gathering and processing phase as production continued at an all-time record clip averaging 546,000 bpd in January. New midstream infrastructure construction was limited to intrastate shipments within an under-developed gathering and processing system.

In various ways this scenario is being repeated in many of the shale plays as production of oil, natural gas liquids and gas continues to outpace the development of midstream infrastructure. As a result, many of the exploration and production (E&P) operators are increasingly getting involved in takeaway infrastructure.

“I think there is a trend, although you will probably get different philosophies on the subject,” said David Lundberg, a New York City-based analyst with Standard & Poor’s Ratings Services (S&P). “It is particularly evident in certain shale plays where the infrastructure is not well built out, such as the Bakken.”

What has been unleashed is an unprecedented midstream infrastructure building boom that recent industry-funded studies have concluded provides the potential for tens of thousands of jobs and a $511 billion cumulative boost to the U.S. economy during the next two decades. The build-out is going to be needed to deliver domestic natural gas, liquids and crude oil in the burgeoning shale plays springing up around the nation.

“In the Bakken, a lot of companies have struggled with meeting production targets because of the lack of infrastructure,” Lundberg said. “Many companies have had to resort to a lot of unconventional means to get the oil out of there. And some have learned their lessons there and are now investing big time in plays like Eagle Ford.”

In order to head off or cut into existing bottlenecks, many E&Ps are what Lundberg called “pretty aggressively” building their own midstream infrastructure, attempting to keep their fate in their own hands. “They get greater clarity and confidence that they can meet their growth objectives,” he said.

A lot of companies also are finding that from a cost-of-capital standpoint it is very advantageous to own or partially own infrastructure through Master Limited Partnerships (MLP). Lundberg cited Chesapeake Energy Corp. and Anadarko Petroleum Corp. as examples of this. Here, the public market “places high value on pipelines,” he said. “And at the same time they can control the MLP.”

A study of shale’s economic impacts by the Interstate Natural Gas Association of America (INGAA) Foundation released earlier this year predicts significant near- and long-term benefits that will be spread to all regions of the United States. It concluded the gas, natural gas liquids (NGL) and crude supply-to-markets sector will average 125,000 jobs annually from now through 2035, providing nearly $57 billion in federal, state and local tax revenue during that period. (It was conducted by engineering/consultants Black & Veatch for INGAA Foundation, “Jobs & Economic Benefits of Midstream Infrastructure Development: U.S. Economic Impacts through 2035.”)

“Last winter [2011] was quite hurtful to the industry; we had numerous large storm events that caused wells to be shut in, power lost, and road conditions preventing truck movement,” said Justin Kringstad, director of the North Dakota Pipeline Authority.

“So this really emphasized the importance of the [absence of the] gathering systems. A lot more is being installed because North Dakota winters are generally tough. It is important that crude oil is moving even when road conditions are strained. Last winter really put an exclamation point on that fact,” he said.

This year High Prairie Pipeline has announced an open season for a new major North Dakota pipeline project – Saddle Butte – named for the original company operating in the state.

It is planned for moving from the Bakken southeasterly to Clearbrook, MN. Saddle Butte Pipeline LLC bills itself as an experienced midstream player owned by the New York City-based private equity and venture capital firm, Yorktown Energy Partners.

Balancing oil and gas infrastructure needs is a constant challenge in North Dakota, which has experienced extraordinary oil/gas growth during the past five years, Kringstad said. The state now ranks third in the nation in oil production, trailing only Alaska and Texas and surpassing California. But he ascribed more “urgency” to the gas side where four new plants are under development for the 12-18 months, but it is the pipeline network that needs robust growth.

DCP Midstream Partners LP is one of the nation’s largest gas processors with assets throughout all of the major basins, north-to-south, in the middle of the lower 48. The only two in which it does not have a presence now are Bakken and Marcellus, and its current leaders have said they intend to eventually develop presence in those two as well.

“Call it fortuitous, but DCP happens to have assets in most areas – not all – but most of the big shale plays,” said Bill Waldheim, DCP’s president for gas liquids and crude oil logistics. “As such, we’re finding that the infrastructure in all of these areas needs work. It is either a case where new infrastructure is needed or it needs to be significantly expanded.”

Waldheim is mindful that the way the shale plays are developed with very liquid-rich types of production, the NGLs and the infrastructure to handle the crude oil condensate all has to be built because the wells come on at very high “initial production rates.” And he knows that this first requires expanding pipelines and infrastructure to get the product to market.

DCP has $4 billion of capital projects – pipelines and plants – to be spent over the next several years, Waldheim said, adding that there are at least another $2 billion of projects beyond that. How much industry-wide? That’s anyone’s guess, he said, noting that some consultants estimate that it runs as high as $7-10 billion per year during the next several years.

This sort of robust outlook raises the question of the adequacy of the finances, materials/equipment and human capital in the midstream space. It cannot help but strain the sector in the years ahead, but relatively new players spawned by the shale plays, such as Houston-based Crestwood Midstream Partners LP, contend they don’t see shortages – they see growth.

Founded in 2010 with the purchase of three existing gathering systems in the Barnett Shale from Quicksilver Resources, Crestwood has developed a model in the midstream centered on buying existing assets and adding to them, said Joel Moxley, COO at Crestwood Midstream. Now the company is scrambling to diversify to various basins that have what Moxley characterized as “high-quality producers and good rock.”

In February, Crestwood purchased Denver-based Antero Resources’ gathering

infrastructure in the Marcellus Shale, the company’s first venture in this robust play. In the deal, Moxley said Crestwood bought only the gathering pipelines; the compressor stations are all outsourced to third-party operators. Nevertheless, Crestwood carries the obligation for the future to build or contract for added compression, he said.

“They’re moving 200 MMcf/d in the system now, and eventually that will be 300-500 MMcf/d, so there is a substantial amount of compression that has to be put in to make that happen,” Moxley said. This is the first deal he has seen in which the compression has been out-sourced separately.

Crestwood and a number of shale operators themselves are using the model of first acquiring existing assets and then looking at additional new projects as the shale boom spreads.

In the Marcellus, however, the company reversed that by pursuing a greenfield project that has now been slowed by ever-lower natural gas prices, and then in February buying Antero’s gathering infrastructure.

In the space of 18 months, Crestwood acquired hundreds of millions of dollars of infrastructure that someone else had developed and decided to monetize. Before Antero, Crestwood bought two midstream systems from a unit of Chesapeake Energy in the Fayetteville Shale play in Arkansas. In the Marcellus, there will be what Moxley called a “substantial build-out over the next several years” of the Antero gathering infrastructure.

“At Crestwood, we believe in the shales; we’ve been around them in various locations and it is sort of the foundation of what we’re involved in here,” said Moxley, echoing a strategy now followed by players, large and small, in the U.S. oil/gas patch. “We’re trying to diversify to different basins with high-quality producers and good rock, basically.”

All the activity in the midstream domestically has created more of a logjam for resources and regulators alike. Whether it is new pipe, equipment or a processing plant, the midstream infrastructure providers indicate more detailed planning and longer advance time frames are needed in any of the fast-growing shale plays. Moxley echoed that, and the head of the Gas Processors Association (GPA), Mark Sutton, underscores the situation.

In 2012, Moxley said Crestwood has been factoring extra time on all of its projects. “It probably takes longer than it did a few years ago,” he said, noting a processing plant that once took eight months now takes a year or longer. Part of that is because of the relatively new interest in the liquids-rich areas.

In North Dakota, the state pipeline authority doesn’t “streamline” permitting or make bets on the infrastructure by investing in projects, its director said.

“We have worked on some policy and regulatory issues in the past, but usually our interaction with the industry is on the far-front end,” Kringstad said.

“We want them to have their engineers working on the highest priority going for the right-sized project at the right time. We’re always working on projects a number of years in advance. Once we put those projects together, the permitting process in North Dakota works very smoothly and efficiently,” he said.

From a Tulsa-based energy association’s perspective, GPA’s Sutton said one of his main jobs in 2012 is to help remove regulatory hurdles to badly needed midstream development. He mentioned the U.S. Corps of Engineers as one of the main focuses of his association’s efforts. GPA has met with various political leaders, such as Sen. James Inhofe (R-OK), seeking help.

“Right now we think the Corps of Engineers situation is unique to the Marcellus area, but we’re worried that it may flow to other areas. The Corps regional offices handle different states,” Sutton said. “Everything is a concern from the regulatory standpoint, whether Clean Air Act issues or just the time involved in getting the right approvals to build the infrastructure.

“For the most part, the industry is very willing to build it, but it is becoming pretty hard to get permits for facilities, and you have much longer wait times. Things that used to take a short period of time now take a lot longer. Those are huge issues for us because there needs to be a lot of money spent from the midstream side,” Sutton said.

GPA members are pretty much everywhere in the shale plays, he said.

“Some have existing infrastructure, and a lot of them don’t have it, so they have to build it all and the processing to go along with it. Shale represents a great opportunity for us, and that is what can frustrate us a lot – with great opportunities comes a lot of hurdles to jump through,” Sutton said. “It should be a no-brainer, [shale’s] domestic and it’s clean. It is hard to understand all the struggles we’re having.”

Part of the opportunity is what newly abundant, and in the case of natural gas, low-cost domestic energy supplies, are doing to stimulate a “re-shoring” of some manufacturing sectors, such as the chemicals and automobile manufacturing businesses.

At this year’s IHS CERAWeek energy conference in Houston, Jim Teague, COO of Enterprise Products, and IHS’s chief adviser for chemicals, Gary Adams, emphasized that the economies of the shale plays were providing “opportunities that are wide and very rich” for the petrochemicals industry among others.

With the continuing low gas prices, U.S.-based chemicals are now almost competitive with those produced in the Middle East, which have long been the global leaders in the sector, Adams told attendees at CERAWeek, outlining the positive implications this has for midstream players who are the link in the value chain between domestic oil, NGL and gas producers and revitalized industries.

In pointing out that the United States advantage in ramping up domestic energy and chemicals production comes from its pipeline and processing infrastructure, Enterprise’s Teague told the Houston confab that his company invested $4 billion last year in new infrastructure and plans to add $4 billion next year.

“The United States has an infrastructure advantage that now has been joined with a resource advantage,” said Teague, who classified shale plays as “an unbelievable opportunity” for the midstream sector as well as chemical producers. “The next 10 years are going to be pretty

exciting.”

Author: Richard Nemec is West Coast Correspondent for P&GJ and can be reached at rnemec@ca.rr.com.

Comments