October 2011, Vol. 238 No. 10

Features

Western Gas Storage--Change Agent Or Soon-To-Change?

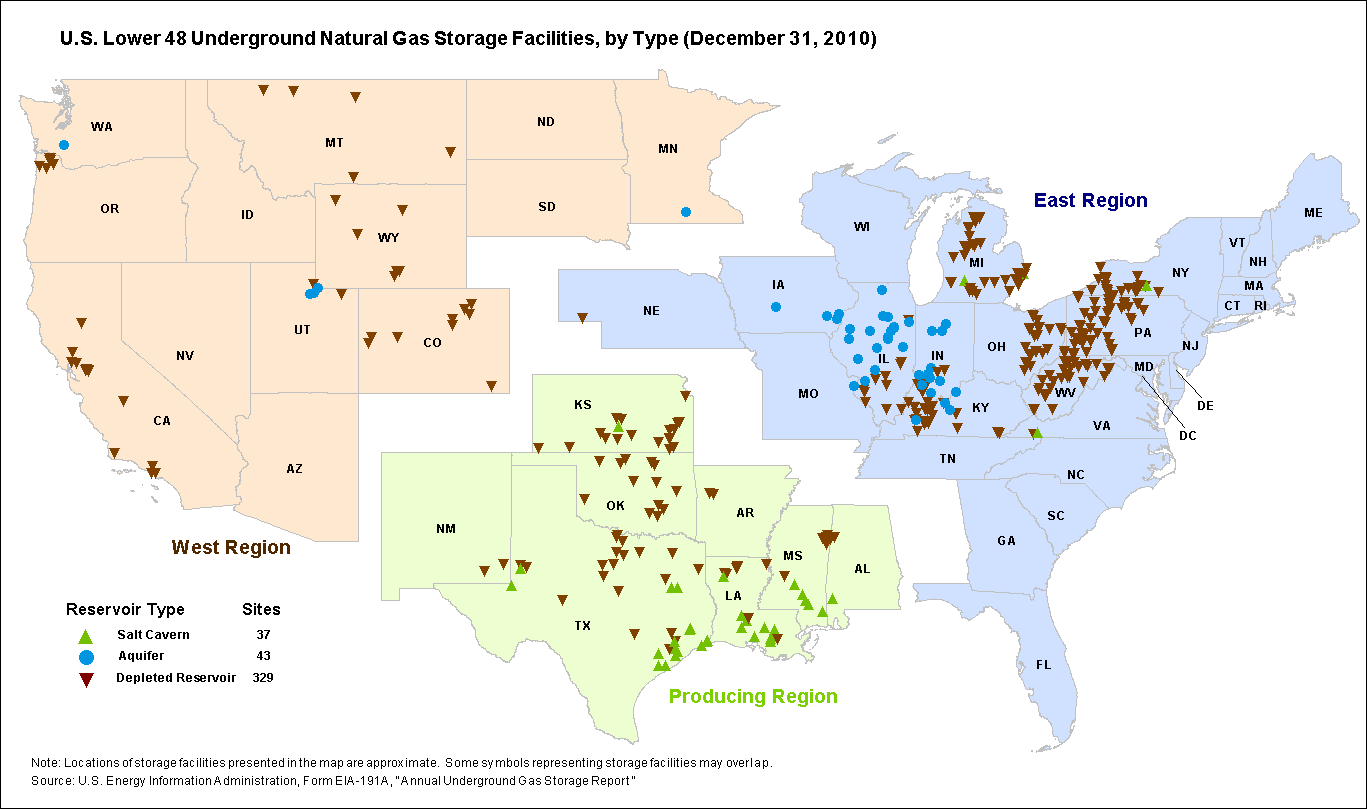

If the North American shale gas boom is a decades-long game-changer as many pundits predict, natural gas pipelines need to stay tuned and the same can be said for the storage operations that have grown up along many of those pipelines. In the West the situation seems ripe for redefinition and reconfiguration of the storage landscape.

A number of the usual suspects in the gas industry out West will confess this is not the time for clear pronouncements about the direction of natural gas storage. Economic, political and supply-demand metrics are pointing in different directions. It is possible to find some serious plans for expanding and/or streamlining existing storage facilities, but harder to uncover serious proposals for new storage development.

“Development of gas storage in the Pacific Northwest has not kept pace with development elsewhere in North America,” says Bob Braddock, vice president and project manager for the Jordan Cove liquefied natural gas (LNG) project that is proposed for a site along the south-central Oregon coast at Coos Bay. “This is principally due to local geology which is not conducive to the development of underground storage.

“There are limited and very small depleted reservoirs to re-purpose, and — to my knowledge — no significant salt caverns to create storage. I cannot speak with any authority about elsewhere in the West, but it seems to me that the recent additions of pipelines to move gas out of the Rockies to major markets (Rockies Express, Ruby and the Kern River pipeline expansion) have taken pressure off of the need to add storage capacity in the production areas.”

The Northwest historically has lagged the rest of the West and the nation in terms of storage, according to Bellevue, WA-based Puget Sound Energy’s (PSE) Clay Riding, the combination utility’s natural gas resources director. Riding describes the region’s two major storage fields — Jackson Prairie in southwest Washington state; and Mist in northwest Oregon — as critical for the local utilities, but very modest operations relative to the vast storage maintained in California.

In Southern California, Sempra Energy operates the largest gas distribution utility system in the nation with its Southern California Gas Co. (SoCalGas) and San Diego Gas and Electric Co. units. Not surprisingly this includes a vast underground storage system with 134 Bcf of working capacity.

Although the Sempra utilities are not planning to ramp up deliverability in their storage system, SoCalGas this past summer was in the process of expanding its inventory capacity by 5 Bcf at its Honor Rancho storage facility north of Los Angeles, and utility officials were asking state regulators to replace compressors at the 100-Bcf Aliso Canyon storage complex in the north end of Los Angeles’ sprawling San Fernando Valley.

“As a significant amount of new gas storage has been added to the state in recent years, and more may be forthcoming, there are clearly sufficient incentives in California (for) additional gas storage,” said the natural gas staff expert at the California Public Utilities Commission (CPUC). “New projects could be done by local gas distribution utilities or independent storage providers.”

Overall, U.S. gas storage capacity and deliverability have increased markedly in the past five to ten years, and California has been among the leaders, particularly in Northern California where Pacific Gas and Electric Co. (PG&E) is the largest operator. In all, more than 90 Bcf of storage capacity has been added in California during the past decade.

“A significant portion of the storage development in the West has been in Northern California,” says a Sacramento-based PG&E spokesperson. The San Francisco-based combination utility now maintains about 100 Bcf of storage, including a portion of the new 20-Bcf Gill Ranch facility (650 MMcf/d withdrawal) that was opened in late 2010 on a joint venture basis with a unit of Portland, OR-based NW Natural, which also operates the 16-Bcf Mist field in Oregon.

Earlier independent storage was developed at Wild Goose (35 Bcf and 700 MMcf/d withdrawal) and Lodi (34 Bcf and 850 MMcf/d withdrawal). An additional 25 Bcf of capacity has been approved by the CPUC collectively for three separate existing storage facilities (Central Valley, 5 Bcf; Honor Rancho, 5 Bcf; and Wild Goose 15 Bcf). Additionally, a proposed 7.5-Bcf facility is pending at Sacramento Natural Gas Storage adjacent to a residential section of the state capital. Sempra’s Aliso Canyon is proposing to increase its injection rate by 145 MMcf/d, and a 22.5 Bcf federally regulated storage field has been proposed near Bakersfield, Tricor Ten Section.

Looking ahead in today’s shale-changed environment, PG&E officials indicate they expect a “pause” in storage development “for at least the next several years” until what they consider current low storage spreads start to recover.

Ironically, in these economically troubled times, no one else thinks there are any financial hurdles to developing more storage. The more troublesome barriers are market demand and corresponding pipeline and other infrastructure needs.

Market conditions, the magnitude and length of the continuing recessionary economy, and gas supply-demand are all unknowns heading into the end of 2011. The industry’s now mostly indefinite plans for new storage projects reflect this uncertainty.

NW Natural senior executives this past summer reported only modest results from the company’s Gill Ranch facility in California, noting that a dive in second quarter earnings year over year was mostly attributable to extra start-up costs at the 20-Bcf storage facility, which is located about 25 miles west of Fresno in mid-central California.

CFO David Anderson indicated that operating expenses were 7% higher in the second quarter this year, primarily because of the Gill Ranch project. “Storage values remain weak, and those conditions created less-than-ideal conditions for the start of our Gill Ranch facility,” according to NW Natural CEO Gregg Kantor, speaking to financial analysts in early August.

Unlike the exploration/production sector that is robust and frenetic, there is no corresponding buzz surrounding gas storage in 2011, according to stakeholders contacted for this report. No one sees any direct new technological breakthroughs that might radically change storage prospects.

At SoCalGas, engineers do not see any technological breakthroughs for storage beyond the horizontal drilling in shale gas E&P. “We have been using horizontal drilling for some time and that has reduced the number of wells that are needed to achieve various injection and/or withdrawal rates, and that, of course, lowers the cost of developing storage fields,” a SoCalGas spokesperson says.

“In addition, there have been incremental technology improvements in compressors, control technology and other aspects of gas storage. These technology improvements and resulting cost reductions have had an effect on storage development, but not of the magnitude that has occurred in the gas production business.”

NW Natural’s Randy Friedman echoes these thoughts that both E&P and storage have lowered costs considerably through horizontal drilling techniques.

While recognizing the wealth of storage in California, PSE’s Riding suggested that NW Natural was looking beyond Gill Ranch to another new nonutility storage venture. Friedman, gas supply director at NW Natural, says the possibility of growth in the long-term could result in an added storage project. Short-term, he sees little happening.

“With the current (summer 2011) low spreads and low growth rates, it is unlikely that anything new of any significant size will be built in the near term,” Friedman says. “Long term, there is large potential for new storage driven by electric utilities needing to add gas generation to balance the supply profile of renewable sources, especially wind power.”

A Houston-based spokesperson for TransCanada U.S. gas pipeline system noted that as one of the largest gas storage operators across North America his company provides 380 Bcf of capacity, a lot of it in Michigan, but he has little involvement with that part of the business. TransCanada has its electricity division run gas storage, which underscores Friedman’s statement on the power sector being a major driver for future storage development and upgrades.

In the summer, PSE’s Riding was actively looking for a new batch of gas storage to allocate to his utility’s electric generation operations. “We’re actively looking at that, and I know Portland General Electric is, too. On the public power side, I am watching closely to see if (the federal) Bonneville (Power Administration) steps out (in the storage arena).”

SoCalGas officials point out that throughout North America “energy players always have looked for the best places to add storage.” And they emphasize that in the late 1990s, Canadian investors helped in the development of California’s first nonutility storage project, Wild Goose, in a depleted dry gas field north of Sacramento.

Elsewhere in the West there is storage either in existence or proposed facilities in Utah, Wyoming and Montana. Private interests centered in Houston-based Peregrine Midstream Partners LLC envision a 35-Bcf-capacity storage field at the Opal hub in southwest Wyoming in the proposed Ryckman Creek project.

With a 70% interest in Peregrine purchased by the UK-based EQT Infrastructure last August, it is not clear if this will accelerate the storage project’s development that has been slated to start operating in 2013. Under Peregrine’s timetable Ryckman was to begin operating with 18 Bcf of working gas capacity, building up to the 35 Bcf level in a strategic location near five interstate pipelines, including the most recent to come online, El Paso Corp.’s Ruby Pipeline running from Wyoming to southeast Oregon.

Bismarck, ND-based MDU Resources Group operates three natural gas storage fields including the largest storage field in North America located near the Montana town of Baker. The company told financial analysts in the summer that it continues to seek interest in its storage services and is pursuing a project to increase its firm deliverability from the Baker Storage field by 125 MMcf /d.

“The company has received commitments on approximately 30% of the total potential project and is moving forward on this phase with a projected in-service date in November this year, a spokesperson says.

From MDU’s second quarter conference call in early August, CEO Terry Hildestad said the Baker Storage enhancement project will add 35 MMcf/d of firm deliverability when placed into service later this year.

“We’ll continue to look for pipeline expansion opportunities, building on infrastructure we already have in place and exploring other areas and services where we have the expertise to add value,” Hildestad told analysts at the time, talking particularly about the Upper Midwest and its heavy involvement in the Bakken shale oil/gas play in North Dakota.

Back in the Northwest, the underground storage at both Mist and Jackson Prairie has had multiple expansions during the past decade. A new expansion at Mist for both capacity and deliverability is now under development, according to NW Natural’s Friedman.

In recent years, Peter Hansen, the CEO of a second LNG project, Oregon LNG focused along the mouth of the Columbia River, credits both Mist and Jackson Prairie, along with a small amount of storage on the Oregon coast in Newport, for keeping the region’s peak gas-demand days from becoming problematic.

Mist has only modest deliverability at 515 MMcf/d, while the 23 Bcf Jackson Prairie facility can deliver up to 1.15 Bcf/d. Mist, however, also provides some daily gas production of up to 4,000 Dth/d.

“The Pacific Northwest is an extremely ‘peaky’ market with the majority of the peak being caused by heavy demands for space heating whenever a short-term cold snap hits,” Hansen says. “So, while there is plenty of pipeline capacity on a normal day, the regional load center in the I-5 corridor ((Seattle, Tacoma, Olympia, Vancouver (WA), Portland, Salem and Eugene (OR)) west of the Cascades runs out of pipeline capacity on a peak day.”

Hansen assumes the need to expand both Northwest storage fields is a given, but he says the continuing “anemic economy” makes it hard to envision any new facility being developed. “The feasibility of a (new) storage project is really dependent on pipeline constraints staying in place,” he says.

He also says that the current ongoing gas boom in North America further dampens the need and prospects for new natural gas storage. “There clearly is plenty of gas available at all times now,” Hansen says.

His LNG competitor, Jordan Cove’s Bob Braddock, agrees: “I don’t think it will become clear whether and where new gas storage is needed until the natural gas grid equilibrates to the new production patterns that have been created by the various new shale gas plays.”

Another source of indirect storage might come if a West Coast LNG terminal were ever built, but stakeholders interviewed in this report think the prospects of that happening are very dim.

Nevertheless, Hansen said if his project at the mouth of the Columbia River comes to fruition, it could provide another 10 Bcf of above-ground storage in the three tanks proposed for the LNG receiving and regasification terminal.

“The tanks would obviously be available from an import project and could also be made available from an export facility, if there was enough commercial interest to pay for the relatively marginal additional facilities needed for vaporization,” he says.

In the future, PSE’s Riding sees the two major Northwest gas distributors sitting in a strong position regarding both the onslaught of more intermittent wind power and gas storage that should follow a wind/gas-fired generation build out. Smaller gas utilities operating in the West, however, may find the future environment tougher to deal with.

The song for now seems to be, “think storage” even if there are no shovels in the ground or contracts to sign. Eventually, it will be needed and economically expedient.

Author:

Richard Nemec is P&GJ’s West Coast Correspondent. He can be reached at: rnemec@ca.rr.com.

Comments