May 2011, Vol. 238 No. 5

Features

Shale Gas Is Shaping The Natural Gas Market

While natural gas may not receive the favorable attention renewable energy sources get in federal energy policy, it continues to prove itself as a clean, dependable and abundant domestic energy source.

Its reputation is well-earned, as natural gas is more reliable than some renewable sources, such as solar and wind, yet burns more thoroughly than coal and coal gas, leaving behind fewer pollutants. But its price can be very volatile for reasons that are often unclear. Energy industry experts point to a variety of reasons for changing natural gas prices: higher/lower demand, weather, supply excesses or constraints and the amount of gas in storage, among others.

Until recently, domestic natural gas production growth has been flat as natural gas reserves have continued to be exploited. From about 1995-2005, the U.S. produced approximately 2 trillion cubic feet (Tcf) per month. However, over the last five years, production started moving up to around 2.3 Tcf per month. The vast majority of the increase is because of shale gas, contributing at least 17% of domestic production. This is remarkable, considering that shale gas accounted for an estimated 2% just a few years ago.

Overnight, shale gas has changed the global natural gas and energy narrative from lack to glut, switching the focus from supply to demand. The impact that shale gas is having on the natural gas market is good news for U.S. businesses, both in terms of increased supply and the moderating prices that have resulted.

Natural gas prices peaked in 2005 when Hurricane Katrina ransacked the Gulf of Mexico; since then prices have crashed by 73%. Within the past year and looking forward to 2012, natural gas prices have smoothed out to a relatively constant $3.60-$5.80/Dth at the commonly traded Henry Hub pricing point in Louisiana. The primary reason for this consistency in pricing has been the introduction of significant volumes of shale gas into the North American energy supply.

Hydraulic fracturing (informally termed fracking or fracing) makes shale extraction possible. Until recently, it had not been possible from a technological or economical standpoint to collect natural gas from certain prolific shale formations, as it is less porous and makes extracting the gas from it more difficult than conventional sources. But with breakthroughs such as hydraulic fracing and horizontal drilling, shale gas is now entering the gas supply pool in relatively large amounts.

Fracing is the typical technique used to extract hydrocarbons from shale. With this technique, water, chemicals and sand are pumped into the shale formations. The pressure causes cracks to form in the rock releasing the natural gas, which then flows through the well-bore.

Horizontal drilling is often used in conjunction with fracing. This allows more natural gas to be accessed than would otherwise be possible. The combination of fracing and horizontal drilling make the extraction of gas from shale formations economically feasible. Without these technologies, the gas would flow too slowly.

In the Annual Energy Outlook 2011, the U.S. Energy Information Administration (EIA) states that the U.S. has 2,552 Tcf of potential natural gas resources, the highest level since 1971. Of these resources, 827 Tcf represent natural gas from shale, 474 Tcf above its 2009 projection. With this increased supply along with the depressed economy, natural gas prices have been flat as compared to earlier in the decade.

The shale gas revolution not only offers the power to help the recovering U.S. economy; it is good news for the world, too, especially those countries that rely on imports for most of their natural gas needs.

Shale is changing the global energy landscape. Shale plays have been found all over the world, notably in countries that have not always been thought of as rich in natural resources. Recently, plays have been found in France and Ukraine, while in December Argentina’s President Cristina Fernandez de Kirchner announced a huge shale gas find that could supply the country’s gas needs for 50 years.

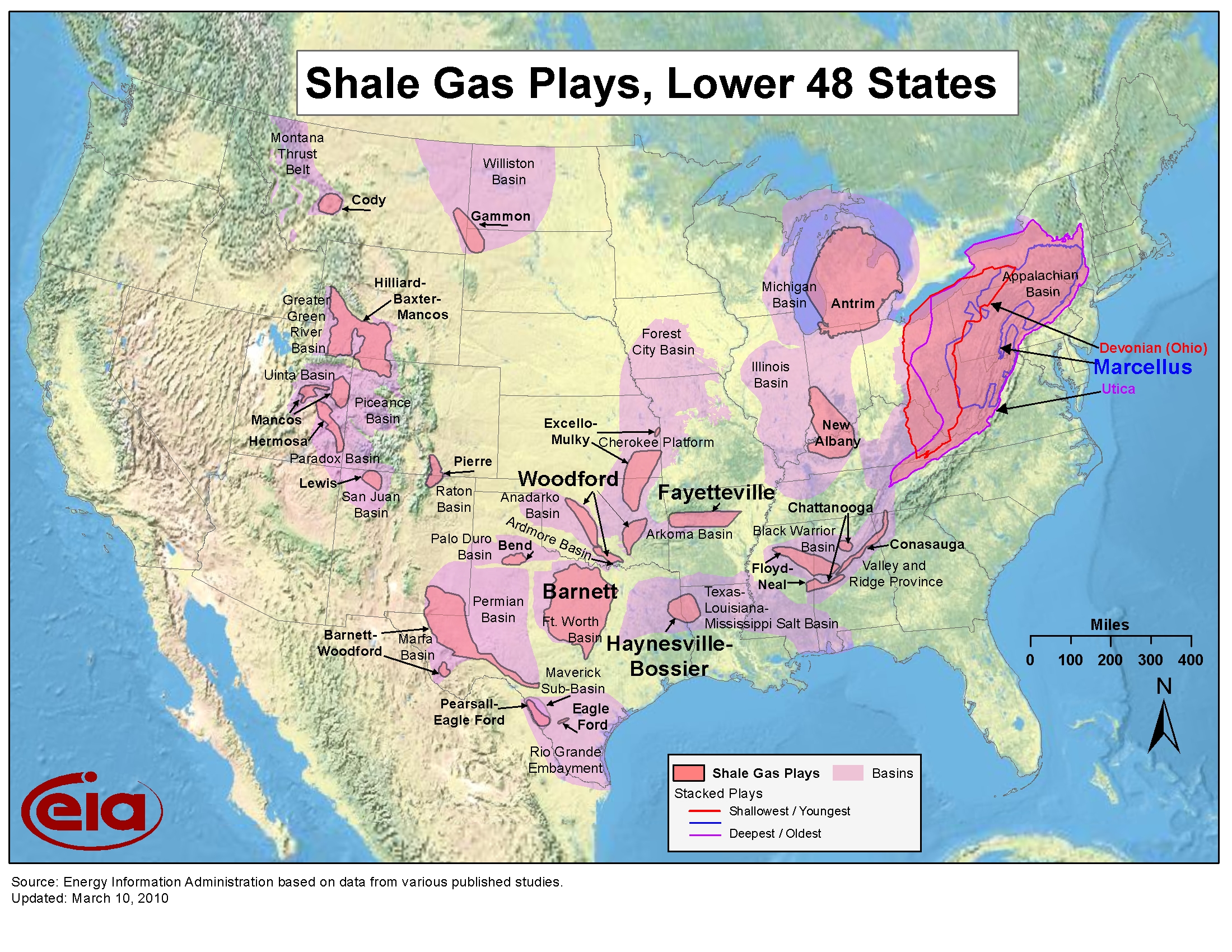

Meanwhile, two of the well-known shale plays in the U.S. are the Marcellus Shale play in the eastern U.S. and the Barnett Shale play in Texas. The Barnett play has been yielding shale gas now for a decade. Other important shale plays are Utica in the east, Haynesville in Louisiana and Fayetteville in Arkansas. Many other shale formations have been identified in Canada, the UK, and China. There is no question that shale gas is having a major impact on the global energy landscape.

Of the natural gas consumed in the U.S. in 2009, 87% was produced domestically; as such, the supply of natural gas is not as dependent on foreign producers as is the supply of crude oil. In addition, the delivery system is less subject to interruption since the product is not shipped long distances. The availability of large quantities of shale gas will further allow the U.S. to consume a predominantly domestic supply of natural gas with a great degree of energy security.

The opportunities for the U.S. and for other countries are touted as very large if the amount of shale gas that is estimated is truly available. However, a topic that doesn’t get a lot of attention is the economic threshold that producers need to reach in order to bring them to invest in the production in the first place. Some experts suggest that natural gas prices need to be at least $2 higher than they are today if the production is to continue to accelerate. Others argue that the technology costs to drill are dropping and that the economic threshold will more easily be met as this reduction in costs continues.

Environmental Concerns

The potential environmental effects of fracing are gaining increasing attention in states where shale gas is produced. Drinking water quality is considered a major concern, due to the wastewater that results from fracing. When the gas is extracted from the well, it must be separated from wastewater, which then requires additional treatment. This wastewater is typically trucked to water treatment facilities, which may not be equipped to do a thorough job of cleaning the wastewater.

Some industry experts also believe that the rise of shale gas will slow the development of renewable energy resources. Why invest the billions of dollars needed for green power, wind and biomass if low-cost shale gas is right in our own backyard? The answer to this is that even shale gas supplies will not last forever, which means that a renewable energy plan should still be part of our national energy strategy.

The political dynamics will change. Prior to the realization of how much shale gas lies within U.S. shores, North American natural gas production appeared to be on the decline. The majority of gas supplies were identified as being located in places like Russia and Iran – the perfect setting for the development of a natural gas cartel. But now, with the rich shale reserves in North America (as well as many countries in Europe and Asia), the likelihood of such an occurrence is mitigated.

Despite the environmental, economic and political concerns that face the U.S. today, the presence of shale gas – and the ability to extract it – is a big plus for America’s energy needs. Vigorous production of natural gas helps make businesses more competitive and the concerns being raised are likely to be resolved over time, leading to continued ample supply of natural gas for U.S. consumers and the world energy markets.

(end)

Author

Bill Bathe is CEO of U.S. Energy Services, Inc., based in Minneapolis, MN. The company is an energy management firm providing a portfolio of energy-related services to industrial, commercial and municipal clients. Contact: 763-543-4600, e-mail: info@usenergyservices.com.

Comments